一份最新報(bào)告顯示,,2022年,,由于股市暴跌和強(qiáng)勢(shì)美元對(duì)國(guó)際資產(chǎn)價(jià)格的影響,全球財(cái)富自全球金融危機(jī)以來(lái)首次縮水,。

由瑞銀集團(tuán)(UBS)和瑞士信貸(Credit Suisse)周二發(fā)布的《2023年全球財(cái)富報(bào)告》發(fā)現(xiàn),,去年私人財(cái)富總額減少2.4%或11.3萬(wàn)億美元,減少至454.4萬(wàn)億美元,,成年人人均財(cái)富縮水3.6%,,減少3,198美元至84,718美元。

假設(shè)匯率維持在2021年的水平不變,2022年財(cái)富總額實(shí)際上增長(zhǎng)了3.4%,。但作者認(rèn)為,,這依舊是“自2008年以來(lái)假設(shè)匯率不變的情況下最慢的財(cái)富增長(zhǎng)速度”。該報(bào)告調(diào)查了全球54億成年人的財(cái)富狀況,。

2022年,,全球經(jīng)濟(jì)從新冠疫情中艱難復(fù)蘇。高通脹迫使多國(guó)央行加息,,再加上俄烏沖突對(duì)經(jīng)濟(jì)增長(zhǎng)的影響,,消費(fèi)者和企業(yè)的借款成本增加。

去年,,隨著股價(jià)和債券價(jià)格暴跌,,發(fā)達(dá)地區(qū)受到的影響最為嚴(yán)重。去年,,北美和歐洲的財(cái)富共縮水10.9萬(wàn)億美元,,亞太地區(qū)財(cái)富縮水2.1萬(wàn)億美元。

而非洲和印度在2022年財(cái)富分別增長(zhǎng)了1.5%(850億美元)和4.6%(6,750億美元),。瑞銀集團(tuán)和瑞士信貸表示,,拉丁美洲是去年的“例外”。由于美國(guó)制造業(yè)轉(zhuǎn)為近岸外包,,并且當(dāng)?shù)刎泿艃睹涝骄?%,,因此該地區(qū)的財(cái)富總額增長(zhǎng)了18.6%(2.4萬(wàn)億美元)。

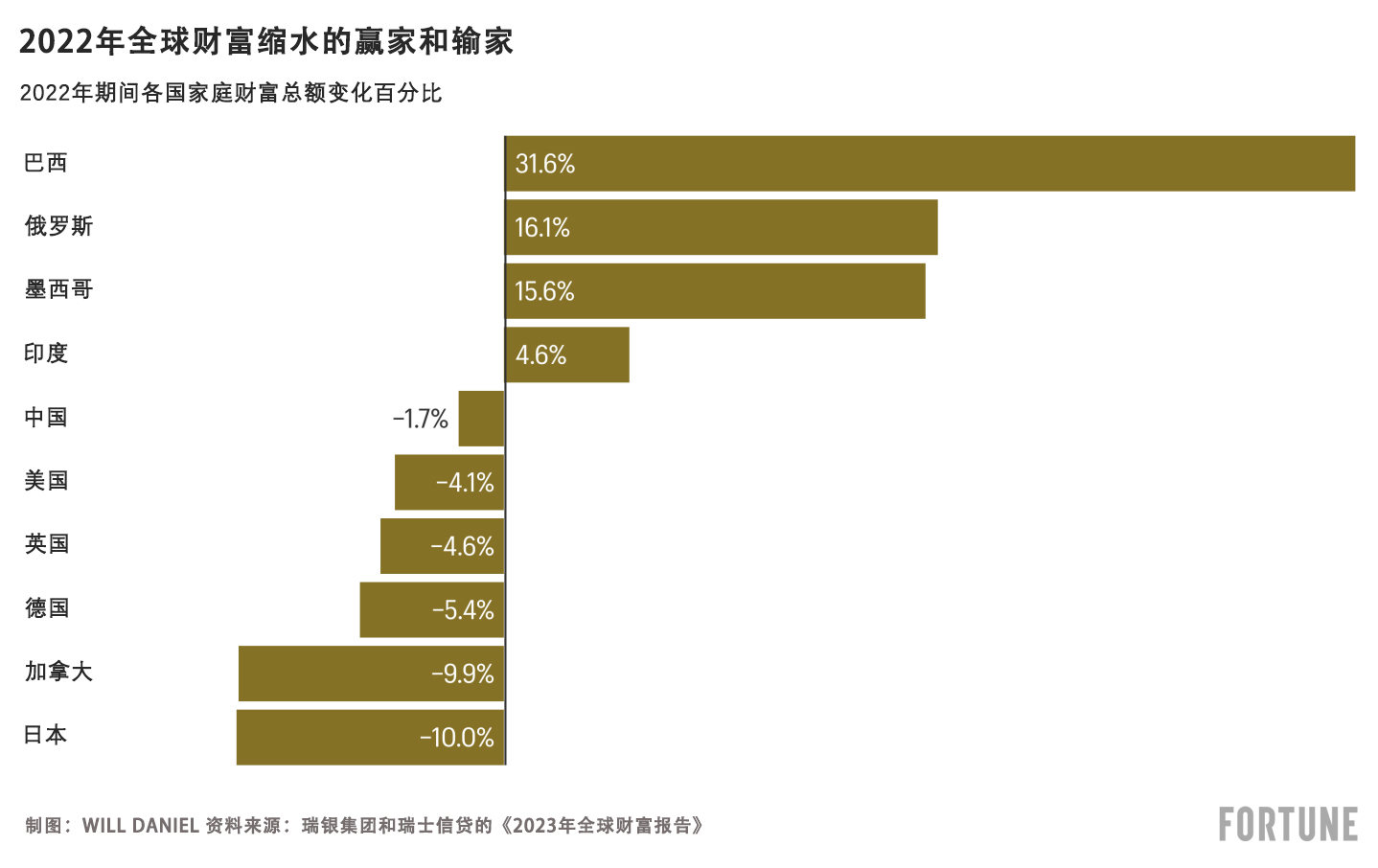

在國(guó)家層面,,美國(guó)名義財(cái)富金額減少5.9萬(wàn)億美元,,降幅最大,但同比僅減少了4.1%,。從降幅來(lái)看,,埃及財(cái)富降幅最大,由于通脹暴漲和埃及磅貶值37%,,平均家庭財(cái)富縮水22.7%,。

2022年的最大贏家是巴西。巴西平均家庭財(cái)富暴漲31.6%(1.1萬(wàn)億美元),,部分原因是相對(duì)強(qiáng)勁的GDP增長(zhǎng)(2.9%),,以及巴西雷亞爾兌美元升值。俄羅斯和墨西哥的財(cái)富分別增長(zhǎng)了16.1%和15.4%,。墨西哥貨幣兌美元升值,,且GDP增長(zhǎng)3.1%。而在俄羅斯,,由于利率下降和俄羅斯盧布升值5.6%,,導(dǎo)致其房?jī)r(jià)大幅上漲,。

雖然2022年全球財(cái)富縮水,但瑞銀集團(tuán)和瑞士信貸預(yù)計(jì)未來(lái)幾年會(huì)有所好轉(zhuǎn),。瑞士信貸歐洲,、中東、非洲地區(qū)首席投資官兼全球經(jīng)濟(jì)與研究負(fù)責(zé)人納內(nèi)特·赫克勒-法伊德赫比表示,,到2027年,,隨著中等收入國(guó)家持續(xù)發(fā)展,全球財(cái)富將增長(zhǎng)38%,,達(dá)到627萬(wàn)億美元,,因此他認(rèn)為“前景更加光明”。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

一份最新報(bào)告顯示,,2022年,,由于股市暴跌和強(qiáng)勢(shì)美元對(duì)國(guó)際資產(chǎn)價(jià)格的影響,全球財(cái)富自全球金融危機(jī)以來(lái)首次縮水,。

由瑞銀集團(tuán)(UBS)和瑞士信貸(Credit Suisse)周二發(fā)布的《2023年全球財(cái)富報(bào)告》發(fā)現(xiàn),,去年私人財(cái)富總額減少2.4%或11.3萬(wàn)億美元,減少至454.4萬(wàn)億美元,,成年人人均財(cái)富縮水3.6%,,減少3,198美元至84,718美元。

假設(shè)匯率維持在2021年的水平不變,,2022年財(cái)富總額實(shí)際上增長(zhǎng)了3.4%,。但作者認(rèn)為,這依舊是“自2008年以來(lái)假設(shè)匯率不變的情況下最慢的財(cái)富增長(zhǎng)速度”,。該報(bào)告調(diào)查了全球54億成年人的財(cái)富狀況,。

2022年,全球經(jīng)濟(jì)從新冠疫情中艱難復(fù)蘇,。高通脹迫使多國(guó)央行加息,再加上俄烏沖突對(duì)經(jīng)濟(jì)增長(zhǎng)的影響,,消費(fèi)者和企業(yè)的借款成本增加,。

去年,隨著股價(jià)和債券價(jià)格暴跌,,發(fā)達(dá)地區(qū)受到的影響最為嚴(yán)重,。去年,北美和歐洲的財(cái)富共縮水10.9萬(wàn)億美元,,亞太地區(qū)財(cái)富縮水2.1萬(wàn)億美元,。

而非洲和印度在2022年財(cái)富分別增長(zhǎng)了1.5%(850億美元)和4.6%(6,750億美元)。瑞銀集團(tuán)和瑞士信貸表示,,拉丁美洲是去年的“例外”,。由于美國(guó)制造業(yè)轉(zhuǎn)為近岸外包,,并且當(dāng)?shù)刎泿艃睹涝骄?%,因此該地區(qū)的財(cái)富總額增長(zhǎng)了18.6%(2.4萬(wàn)億美元),。

在國(guó)家層面,,美國(guó)名義財(cái)富金額減少5.9萬(wàn)億美元,降幅最大,,但同比僅減少了4.1%,。從降幅來(lái)看,埃及財(cái)富降幅最大,,由于通脹暴漲和埃及磅貶值37%,,平均家庭財(cái)富縮水22.7%。

2022年的最大贏家是巴西,。巴西平均家庭財(cái)富暴漲31.6%(1.1萬(wàn)億美元),,部分原因是相對(duì)強(qiáng)勁的GDP增長(zhǎng)(2.9%),以及巴西雷亞爾兌美元升值,。俄羅斯和墨西哥的財(cái)富分別增長(zhǎng)了16.1%和15.4%,。墨西哥貨幣兌美元升值,且GDP增長(zhǎng)3.1%,。而在俄羅斯,,由于利率下降和俄羅斯盧布升值5.6%,導(dǎo)致其房?jī)r(jià)大幅上漲,。

雖然2022年全球財(cái)富縮水,,但瑞銀集團(tuán)和瑞士信貸預(yù)計(jì)未來(lái)幾年會(huì)有所好轉(zhuǎn)。瑞士信貸歐洲,、中東,、非洲地區(qū)首席投資官兼全球經(jīng)濟(jì)與研究負(fù)責(zé)人納內(nèi)特·赫克勒-法伊德赫比表示,到2027年,,隨著中等收入國(guó)家持續(xù)發(fā)展,,全球財(cái)富將增長(zhǎng)38%,達(dá)到627萬(wàn)億美元,,因此他認(rèn)為“前景更加光明”,。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

In 2022, worldwide wealth declined for the first time since the Global Financial Crisis, as stock markets tumbled and the strong dollar weighed on asset prices internationally, according to a new report.

The Global Wealth Report 2023, published Tuesday by UBS and Credit Suisse, found that total private wealth fell 2.4% or $11.3 trillion last year to $454.4 trillion, and wealth per adult sank 3.6% or $3,198 to $84,718.

Keeping exchange rates constant at 2021 levels, total wealth actually increased 3.4% during 2022. But that still amounts to the “slowest increase of wealth at constant exchange rates since 2008,” according to the authors of the report, which covers the holdings of 5.4 billion adults worldwide.

The global economy struggled to recover from the COVID era in 2022. High inflation forced many central banks to raise interest, increasing the cost of borrowing for consumers and businesses as the war in Ukraine weighed on growth.

Developed regions were the hardest hit as stock and bond prices fell throughout the year. North America and Europe lost $10.9 trillion of wealth combined last year, while the Asia-Pacific region lost $2.1 trillion.

Africa and India, on the other hand, managed to increase their wealth by 1.5% ($85 billion) and 4.6% ($675 billion), respectively, in 2022. And Latin America was an “outlier” last year, according to UBS and Credit Suisse. The region’s total wealth increased 18.6% ($2.4 trillion) amid U.S. near-shoring of manufacturing and a 6% average currency appreciation compared with the dollar.

At the country level, the United States saw the largest nominal wealth drop at $5.9 trillion, but that represented just a 4.1% decline from a year ago. In percentage terms, Egypt had the worst year, with its average household wealth dropping 22.7% owing to soaring inflation and 37% depreciation in the Egyptian pound.

The big winner in 2022 was Brazil. The country’s average household wealth surged 31.6% ($1.1 trillion) owing in part to relatively strong 2.9% GDP growth and the Brazilian real’s appreciation compared with the dollar. Russia and Mexico also increased their wealth by 16.1% and 15.4%, respectively. Mexico saw its currency appreciate versus the dollar, and its GDP grew 3.1%. Russia, meanwhile, saw its home prices rise significantly amid lower interest rates and the Russian ruble appreciated by 5.6% on the year.

Despite the downturn in global wealth in 2022, UBS and Credit Suisse expect a turnaround in coming years. Nannette Hechler-Fayd’herbe, CIO for the EMEA region and global head of economics and research at Credit Suisse, said global wealth should increase 38% to $627 trillion by 2027 as middle-income countries continue to develop, calling it a “brighter outlook.”