2005年的時(shí)候,美聯(lián)儲(chǔ)主席格林斯潘曾對(duì)國(guó)會(huì)表示:“美國(guó)整體上不太可能出現(xiàn)房?jī)r(jià)泡沫,?!钡鞘聦?shí)上,當(dāng)時(shí)房地產(chǎn)泡沫不但已經(jīng)形成了,,而且就在格林斯潘在國(guó)會(huì)傳達(dá)這一信息時(shí),,泡沫已接近了頂峰。

時(shí)間快進(jìn)到2022年,,正是因?yàn)榇蠹覍?duì)上次泡沫心有余悸,,所以這一次,經(jīng)濟(jì)學(xué)家們并不害怕承認(rèn)泡沫的存在——即便他們覺(jué)得這次泡沫或許沒(méi)有上一次那么危險(xiǎn),。

上周二,,全世界最有影響力的經(jīng)濟(jì)學(xué)家就是這樣做的——美聯(lián)儲(chǔ)主席杰羅姆·鮑威爾在布魯金斯學(xué)會(huì)的一次活動(dòng)中表示,美國(guó)在疫情期間的房?jī)r(jià)上漲就符合“房地產(chǎn)泡沫”的定義,。

“由于疫情的緣故,,當(dāng)時(shí)的抵押貸款利率非常低,人們都想買房,而且是想離開(kāi)城市,,在郊區(qū)買房,,所以美國(guó)確實(shí)出現(xiàn)了房地產(chǎn)泡沫,房?jī)r(jià)上漲到了非常不可持續(xù)的水平,,出現(xiàn)了過(guò)熱等問(wèn)題,。所以,現(xiàn)在的房地產(chǎn)市場(chǎng)將迎來(lái)泡沫的另一階段,,希望它的供需關(guān)系能達(dá)到一個(gè)更好的狀態(tài),。”鮑威爾說(shuō),。

結(jié)合鮑威爾以往的發(fā)言,,美國(guó)房地產(chǎn)的“平衡”進(jìn)程應(yīng)該已經(jīng)開(kāi)始了。今年6月份,,鮑威爾曾表示,,抵押貸款利率的大幅上漲將有助于“重置”美國(guó)的房地產(chǎn)市場(chǎng)。9月份鮑威爾曾對(duì)記者表示,,美國(guó)已經(jīng)正式進(jìn)入了一個(gè)“艱難的房地產(chǎn)市場(chǎng)調(diào)整期”,,它將恢復(fù)市場(chǎng)的“平衡”,。

在鮑威爾承認(rèn)有“泡沫”之前,,達(dá)拉斯聯(lián)儲(chǔ)銀行在11月份發(fā)表了一篇題為《消除美國(guó)房地產(chǎn)泡沫是一項(xiàng)微妙而艱巨的任務(wù)》的文章。文章認(rèn)為,,美國(guó)的政策制定者應(yīng)該努力讓泡沫縮水,,而不是戳破它。

達(dá)拉斯聯(lián)儲(chǔ)銀行的馬丁內(nèi)斯·加西亞在文中指出:“在當(dāng)前的環(huán)境下,,當(dāng)住房需求出現(xiàn)疲軟跡象時(shí),,貨幣政策需要很小心地起到穿針引線的作用,既要下調(diào)通脹,,同時(shí)也不能引發(fā)房?jī)r(jià)的螺旋式下跌——也就是不能引起住房市場(chǎng)的大拋售,,那將加劇經(jīng)濟(jì)下行?!奔游鱽嗊€表示:“雖然形式充滿挑戰(zhàn),,但是災(zāi)難性的崩盤(pán)并非不可避免,在縮小房市泡沫的同時(shí)實(shí)現(xiàn)美聯(lián)儲(chǔ)軟著陸目標(biāo)的機(jī)會(huì)窗口仍然是存在的,?!?/p>

為了更好地理解下一步房地產(chǎn)市場(chǎng)下一步將何去何從,我們可以深入研究一下鮑威爾關(guān)于房地產(chǎn)市場(chǎng)的言論,。

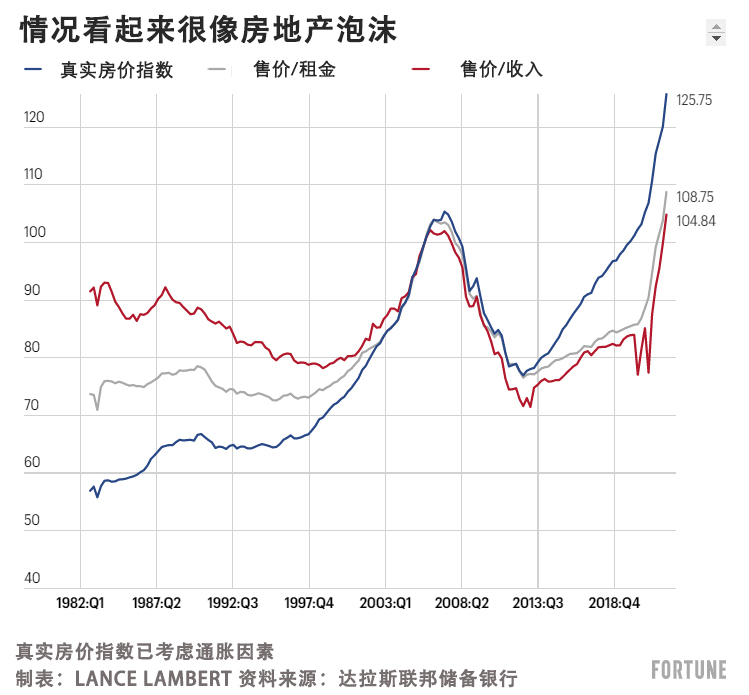

客觀地說(shuō),,美國(guó)房地產(chǎn)市場(chǎng)在疫情期間的確出現(xiàn)了泡沫。達(dá)拉斯聯(lián)儲(chǔ)銀行的數(shù)據(jù)顯示,,2022年的美國(guó)房?jī)r(jià)實(shí)陸上比2005年和2008年更加脫離基本面,。

未來(lái)一年內(nèi),,房?jī)r(jià)與基本面的撕裂應(yīng)該會(huì)有所愈合,這也是摩根士丹利,、Zonda,、畢馬威、約翰伯恩斯房地產(chǎn)咨詢,、穆迪分析,、高盛、富國(guó),、房利美和澤爾曼聯(lián)合公司等多家業(yè)內(nèi)分析機(jī)構(gòu)的共同意見(jiàn),。這些公司認(rèn)為,隨著消費(fèi)者的負(fù)擔(dān)壓力變大(在美國(guó)房?jī)r(jià)飆升40%之后,,美國(guó)的抵押貸款利率也大幅上漲3%),,美國(guó)的房?jī)r(jià)將在2023年進(jìn)一步下跌。如果美國(guó)房?jī)r(jià)(目前已從2022年6月的最高點(diǎn)下跌2.2%)繼續(xù)下跌,,而收入繼續(xù)上漲,,則基本面將確實(shí)開(kāi)始回歸現(xiàn)實(shí)。

不過(guò),,美聯(lián)儲(chǔ)的官員們并不認(rèn)為目前的樓市調(diào)整是2008年的重演,。

“從金融穩(wěn)定性的角度來(lái)看,我們?cè)谶@個(gè)周期內(nèi)并未看到上次金融危機(jī)前的那種大規(guī)模的不良信貸?,F(xiàn)在的貸款機(jī)構(gòu)對(duì)住房信貸的管理要謹(jǐn)慎得多,。所以2022年的情況是完全不同的,目前看來(lái)不存在金融穩(wěn)定性的問(wèn)題,。但是我們也確實(shí)明白,,房地產(chǎn)是影響我們政策的一個(gè)很大的方面?!滨U威爾在11月初對(duì)記者表示,。

而上一次房地產(chǎn)泡沫則是另一幅景象。在上次房地產(chǎn)泡沫期間,,貪婪的借貸機(jī)構(gòu)會(huì)向有不良信貸記錄的借款人發(fā)放抵押貸款(更確切地說(shuō),,是次級(jí)抵押貸款)。貸款的涌入促進(jìn)了房地產(chǎn)市場(chǎng)的繁榮和房?jī)r(jià)上漲,。但是隨著美聯(lián)儲(chǔ)收緊貸幣政策,,美國(guó)在2006年出現(xiàn)了市場(chǎng)調(diào)整,房地產(chǎn)市場(chǎng)迅速出現(xiàn)供應(yīng)過(guò)剩的局面,,大量不良貸款無(wú)法償還,,很多房子只能法拍了事。這種供給過(guò)剩和大量法拍房并存的局面,導(dǎo)致美國(guó)房?jī)r(jià)在2007年至2012年期間足足下跌了26%,。

雖然美聯(lián)儲(chǔ)官員承認(rèn),,美國(guó)房?jī)r(jià)有可能出現(xiàn)“實(shí)質(zhì)性調(diào)整”,但他們并不認(rèn)為這輪調(diào)整的破壞性會(huì)達(dá)到2008年的規(guī)模,。原因是美聯(lián)儲(chǔ)認(rèn)為未來(lái)幾年,,我們不必?fù)?dān)心出現(xiàn)大規(guī)模的法拍房危機(jī)或者大規(guī)模的供給過(guò)剩。

由于房地產(chǎn)市場(chǎng)的高銷量和供應(yīng)鏈問(wèn)題疊加,,導(dǎo)致疫情期間美國(guó)有大量住房項(xiàng)目未能按時(shí)交付,。一方面,由于房地產(chǎn)商急于交房,,這可能會(huì)加劇2023年的房?jī)r(jià)下行壓力,。另一方面,這些房子尚不足以解決美國(guó)的住房短缺問(wèn)題,。鮑威爾也在上周三的講話中承認(rèn)了這一點(diǎn),。

鮑威爾表示:“這些(批進(jìn)行中的住房調(diào)整)都不會(huì)帶來(lái)影響長(zhǎng)期的問(wèn)題,因?yàn)槊绹?guó)是一個(gè)發(fā)達(dá)國(guó)家,,建設(shè)中的住房數(shù)量是難以滿足公眾的需求的,,所以住房短缺的情況長(zhǎng)期看來(lái)仍然存在?!?/p>

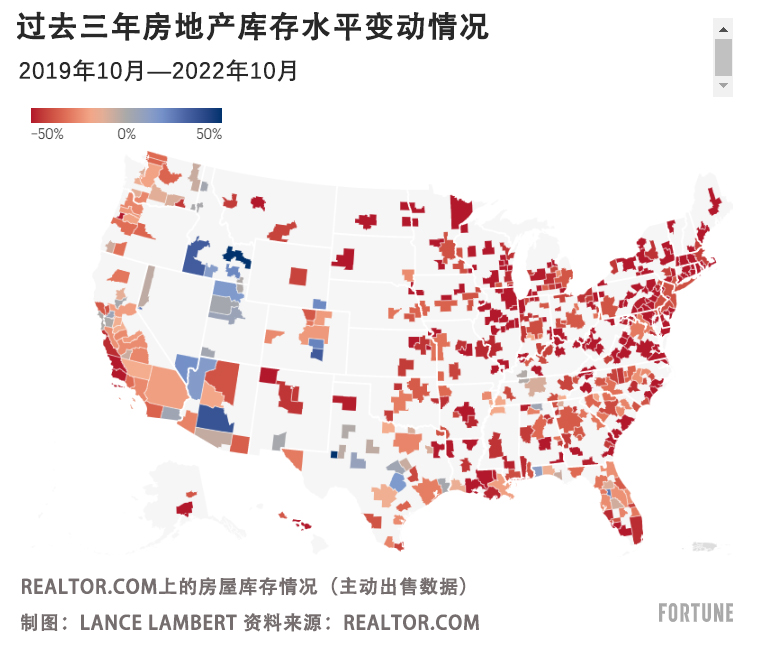

因此,,盡管抵押貸款利率的大幅上漲,有可能通過(guò)壓低房?jī)r(jià)的方式,,給房地產(chǎn)市場(chǎng)帶來(lái)“平衡”,,并且給進(jìn)一步增長(zhǎng)帶來(lái)一些去庫(kù)的空間,,但是從長(zhǎng)期看來(lái),,市場(chǎng)的軌跡可能仍然不利于買方。

我們還要明確一點(diǎn)——沒(méi)有人知道所謂的“房地產(chǎn)市場(chǎng)調(diào)整”將如何展開(kāi),。需要解答的問(wèn)題太多了,。比如美國(guó)的通脹是否會(huì)快速下降,并且同時(shí)拉低抵押貸款利率,?抑或通脹具有相當(dāng)?shù)恼承?,因此還需要在更長(zhǎng)的時(shí)間內(nèi)維持較高的利率?

但有一點(diǎn)可以肯定,,那就是根據(jù)歷史經(jīng)驗(yàn),,下一步的走向肯定是因地而異的。

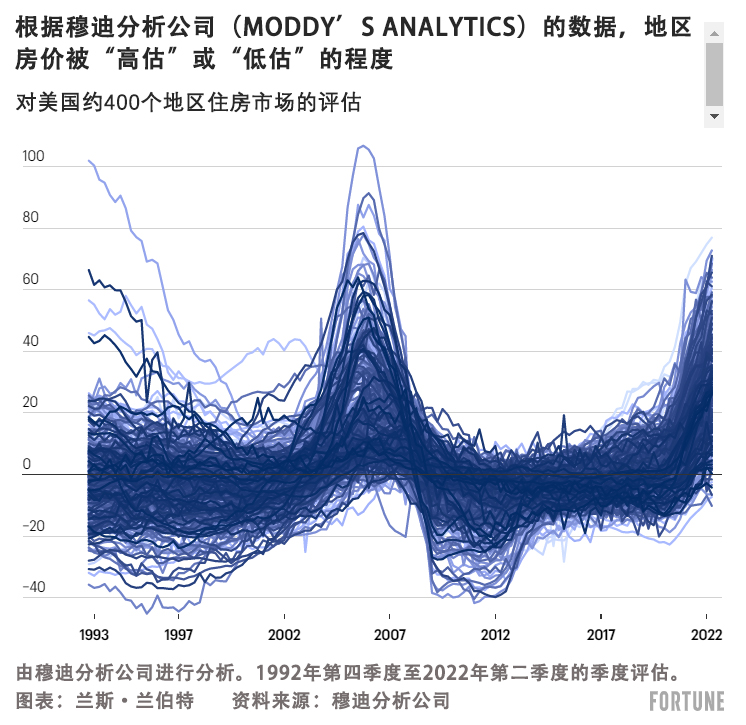

這樣說(shuō)的一個(gè)重要原因是,,不同地區(qū)的基本面差異很大,。以克利夫蘭和奧斯汀為例,前者在疫情期間出現(xiàn)了房地產(chǎn)繁榮,后者的房?jī)r(jià)更是飆升了70%以上,。當(dāng)然現(xiàn)在兩地的房地產(chǎn)市場(chǎng)已經(jīng)發(fā)生了變化,,奧斯汀已經(jīng)出現(xiàn)了大幅回調(diào)(穆迪分析認(rèn)為該地房?jī)r(jià)被“高估”了61%),而克里夫蘭只是房?jī)r(jià)增速略有放緩(穆迪分析認(rèn)為該地房?jī)r(jià)被高估了15%),。

簡(jiǎn)單地說(shuō)就是,,房地產(chǎn)市場(chǎng)的基本面仍然是很重要的。(財(cái)富中文網(wǎng))

譯者:樸成奎

2005年的時(shí)候,,美聯(lián)儲(chǔ)主席格林斯潘曾對(duì)國(guó)會(huì)表示:“美國(guó)整體上不太可能出現(xiàn)房?jī)r(jià)泡沫,。”但是事實(shí)上,,當(dāng)時(shí)房地產(chǎn)泡沫不但已經(jīng)形成了,,而且就在格林斯潘在國(guó)會(huì)傳達(dá)這一信息時(shí),泡沫已接近了頂峰,。

時(shí)間快進(jìn)到2022年,,正是因?yàn)榇蠹覍?duì)上次泡沫心有余悸,所以這一次,,經(jīng)濟(jì)學(xué)家們并不害怕承認(rèn)泡沫的存在——即便他們覺(jué)得這次泡沫或許沒(méi)有上一次那么危險(xiǎn),。

上周二,全世界最有影響力的經(jīng)濟(jì)學(xué)家就是這樣做的——美聯(lián)儲(chǔ)主席杰羅姆·鮑威爾在布魯金斯學(xué)會(huì)的一次活動(dòng)中表示,,美國(guó)在疫情期間的房?jī)r(jià)上漲就符合“房地產(chǎn)泡沫”的定義,。

“由于疫情的緣故,當(dāng)時(shí)的抵押貸款利率非常低,,人們都想買房,,而且是想離開(kāi)城市,在郊區(qū)買房,,所以美國(guó)確實(shí)出現(xiàn)了房地產(chǎn)泡沫,,房?jī)r(jià)上漲到了非常不可持續(xù)的水平,出現(xiàn)了過(guò)熱等問(wèn)題,。所以,,現(xiàn)在的房地產(chǎn)市場(chǎng)將迎來(lái)泡沫的另一階段,希望它的供需關(guān)系能達(dá)到一個(gè)更好的狀態(tài),?!滨U威爾說(shuō)。

結(jié)合鮑威爾以往的發(fā)言,,美國(guó)房地產(chǎn)的“平衡”進(jìn)程應(yīng)該已經(jīng)開(kāi)始了,。今年6月份,鮑威爾曾表示,,抵押貸款利率的大幅上漲將有助于“重置”美國(guó)的房地產(chǎn)市場(chǎng),。9月份鮑威爾曾對(duì)記者表示,,美國(guó)已經(jīng)正式進(jìn)入了一個(gè)“艱難的房地產(chǎn)市場(chǎng)調(diào)整期”,它將恢復(fù)市場(chǎng)的“平衡”,。

在鮑威爾承認(rèn)有“泡沫”之前,,達(dá)拉斯聯(lián)儲(chǔ)銀行在11月份發(fā)表了一篇題為《消除美國(guó)房地產(chǎn)泡沫是一項(xiàng)微妙而艱巨的任務(wù)》的文章。文章認(rèn)為,,美國(guó)的政策制定者應(yīng)該努力讓泡沫縮水,,而不是戳破它。

達(dá)拉斯聯(lián)儲(chǔ)銀行的馬丁內(nèi)斯·加西亞在文中指出:“在當(dāng)前的環(huán)境下,,當(dāng)住房需求出現(xiàn)疲軟跡象時(shí),,貨幣政策需要很小心地起到穿針引線的作用,既要下調(diào)通脹,,同時(shí)也不能引發(fā)房?jī)r(jià)的螺旋式下跌——也就是不能引起住房市場(chǎng)的大拋售,,那將加劇經(jīng)濟(jì)下行?!奔游鱽嗊€表示:“雖然形式充滿挑戰(zhàn),,但是災(zāi)難性的崩盤(pán)并非不可避免,在縮小房市泡沫的同時(shí)實(shí)現(xiàn)美聯(lián)儲(chǔ)軟著陸目標(biāo)的機(jī)會(huì)窗口仍然是存在的,?!?/p>

為了更好地理解下一步房地產(chǎn)市場(chǎng)下一步將何去何從,我們可以深入研究一下鮑威爾關(guān)于房地產(chǎn)市場(chǎng)的言論,。

客觀地說(shuō),,美國(guó)房地產(chǎn)市場(chǎng)在疫情期間的確出現(xiàn)了泡沫。達(dá)拉斯聯(lián)儲(chǔ)銀行的數(shù)據(jù)顯示,,2022年的美國(guó)房?jī)r(jià)實(shí)陸上比2005年和2008年更加脫離基本面,。

未來(lái)一年內(nèi),房?jī)r(jià)與基本面的撕裂應(yīng)該會(huì)有所愈合,,這也是摩根士丹利,、Zonda、畢馬威,、約翰伯恩斯房地產(chǎn)咨詢,、穆迪分析,、高盛,、富國(guó)、房利美和澤爾曼聯(lián)合公司等多家業(yè)內(nèi)分析機(jī)構(gòu)的共同意見(jiàn),。這些公司認(rèn)為,,隨著消費(fèi)者的負(fù)擔(dān)壓力變大(在美國(guó)房?jī)r(jià)飆升40%之后,美國(guó)的抵押貸款利率也大幅上漲3%),,美國(guó)的房?jī)r(jià)將在2023年進(jìn)一步下跌,。如果美國(guó)房?jī)r(jià)(目前已從2022年6月的最高點(diǎn)下跌2.2%)繼續(xù)下跌,,而收入繼續(xù)上漲,則基本面將確實(shí)開(kāi)始回歸現(xiàn)實(shí),。

不過(guò),,美聯(lián)儲(chǔ)的官員們并不認(rèn)為目前的樓市調(diào)整是2008年的重演。

“從金融穩(wěn)定性的角度來(lái)看,,我們?cè)谶@個(gè)周期內(nèi)并未看到上次金融危機(jī)前的那種大規(guī)模的不良信貸?,F(xiàn)在的貸款機(jī)構(gòu)對(duì)住房信貸的管理要謹(jǐn)慎得多。所以2022年的情況是完全不同的,,目前看來(lái)不存在金融穩(wěn)定性的問(wèn)題,。但是我們也確實(shí)明白,房地產(chǎn)是影響我們政策的一個(gè)很大的方面,?!滨U威爾在11月初對(duì)記者表示。

而上一次房地產(chǎn)泡沫則是另一幅景象,。在上次房地產(chǎn)泡沫期間,,貪婪的借貸機(jī)構(gòu)會(huì)向有不良信貸記錄的借款人發(fā)放抵押貸款(更確切地說(shuō),是次級(jí)抵押貸款),。貸款的涌入促進(jìn)了房地產(chǎn)市場(chǎng)的繁榮和房?jī)r(jià)上漲,。但是隨著美聯(lián)儲(chǔ)收緊貸幣政策,美國(guó)在2006年出現(xiàn)了市場(chǎng)調(diào)整,,房地產(chǎn)市場(chǎng)迅速出現(xiàn)供應(yīng)過(guò)剩的局面,,大量不良貸款無(wú)法償還,很多房子只能法拍了事,。這種供給過(guò)剩和大量法拍房并存的局面,,導(dǎo)致美國(guó)房?jī)r(jià)在2007年至2012年期間足足下跌了26%。

雖然美聯(lián)儲(chǔ)官員承認(rèn),,美國(guó)房?jī)r(jià)有可能出現(xiàn)“實(shí)質(zhì)性調(diào)整”,,但他們并不認(rèn)為這輪調(diào)整的破壞性會(huì)達(dá)到2008年的規(guī)模。原因是美聯(lián)儲(chǔ)認(rèn)為未來(lái)幾年,,我們不必?fù)?dān)心出現(xiàn)大規(guī)模的法拍房危機(jī)或者大規(guī)模的供給過(guò)剩,。

由于房地產(chǎn)市場(chǎng)的高銷量和供應(yīng)鏈問(wèn)題疊加,導(dǎo)致疫情期間美國(guó)有大量住房項(xiàng)目未能按時(shí)交付,。一方面,,由于房地產(chǎn)商急于交房,這可能會(huì)加劇2023年的房?jī)r(jià)下行壓力,。另一方面,,這些房子尚不足以解決美國(guó)的住房短缺問(wèn)題。鮑威爾也在上周三的講話中承認(rèn)了這一點(diǎn),。

鮑威爾表示:“這些(批進(jìn)行中的住房調(diào)整)都不會(huì)帶來(lái)影響長(zhǎng)期的問(wèn)題,,因?yàn)槊绹?guó)是一個(gè)發(fā)達(dá)國(guó)家,,建設(shè)中的住房數(shù)量是難以滿足公眾的需求的,所以住房短缺的情況長(zhǎng)期看來(lái)仍然存在,?!?/p>

因此,盡管抵押貸款利率的大幅上漲,,有可能通過(guò)壓低房?jī)r(jià)的方式,,給房地產(chǎn)市場(chǎng)帶來(lái)“平衡”,并且給進(jìn)一步增長(zhǎng)帶來(lái)一些去庫(kù)的空間,,但是從長(zhǎng)期看來(lái),,市場(chǎng)的軌跡可能仍然不利于買方。

我們還要明確一點(diǎn)——沒(méi)有人知道所謂的“房地產(chǎn)市場(chǎng)調(diào)整”將如何展開(kāi),。需要解答的問(wèn)題太多了,。比如美國(guó)的通脹是否會(huì)快速下降,并且同時(shí)拉低抵押貸款利率,?抑或通脹具有相當(dāng)?shù)恼承?,因此還需要在更長(zhǎng)的時(shí)間內(nèi)維持較高的利率?

但有一點(diǎn)可以肯定,,那就是根據(jù)歷史經(jīng)驗(yàn),,下一步的走向肯定是因地而異的。

這樣說(shuō)的一個(gè)重要原因是,,不同地區(qū)的基本面差異很大,。以克利夫蘭和奧斯汀為例,前者在疫情期間出現(xiàn)了房地產(chǎn)繁榮,,后者的房?jī)r(jià)更是飆升了70%以上,。當(dāng)然現(xiàn)在兩地的房地產(chǎn)市場(chǎng)已經(jīng)發(fā)生了變化,奧斯汀已經(jīng)出現(xiàn)了大幅回調(diào)(穆迪分析認(rèn)為該地房?jī)r(jià)被“高估”了61%),,而克里夫蘭只是房?jī)r(jià)增速略有放緩(穆迪分析認(rèn)為該地房?jī)r(jià)被高估了15%),。

簡(jiǎn)單地說(shuō)就是,房地產(chǎn)市場(chǎng)的基本面仍然是很重要的,。(財(cái)富中文網(wǎng))

譯者:樸成奎

In 2005, Fed Chair Alan Greenspan told Congress that a “bubble in home prices for the nation as a whole does not appear likely.” Of course, not only had a housing bubble formed, it was nearing its peak just as Greenspan delivered that message on Capitol Hill.

Fast forward to 2022, and the scars of the last bubble have clearly made economists less afraid to acknowledge a housing bubble—even if they believe the bubble could be less dangerous than the one that formed in the early 2000s.

On Tuesday, the most powerful economist in the world did just that: Speaking at a Brookings Institute event, Fed Chair Jerome Powell told the audience that the run-up in home prices during the Pandemic Housing Boom qualifies a “housing bubble.”

“Coming out of the pandemic, [mortgage] rates were very low, people wanted to buy houses, they wanted to get out of the cities and buy houses in the suburbs because of COVID. So you really had a housing bubble, you had housing prices going up [at] very unsustainable levels and overheating and that kind of thing. So, now the housing market will go through the other side of that and hopefully come out in a better place between supply and demand,” Powell said.

According to past statements by Powell, that process of bringing “balance” to the U.S. housing market has already begun. In June, Powell said spiked mortgage rates would help to “reset” the U.S. housing market. Then in September, Powell told reporters that we had officially entered into a “difficult [housing] correction” that would restore “balance” to the market.

That “bubble” acknowledgment by Powell comes on the heels of an article published in November by the Federal Reserve Bank of Dallas with the title “Skimming U.S. Housing Froth a Delicate, Daunting Task.” The article argued that policymakers should try to deflate the bubble rather than burst it.

“In the current environment, when housing demand is showing signs of softening, monetary policy needs to carefully thread the needle of bringing inflation down without setting off a downward house-price spiral—a significant housing sell-off—that could aggravate an economic downturn,” writes Martínez-García at the Dallas Fed. “A severe housing bust from the frothy pandemic run-up isn’t inevitable. Although the situation is challenging, there remains a window of opportunity to deflate the housing bubble while achieving the Fed’s preferred outcome of a soft landing.”

To better understand where we might head next, let’s take a deeper examination of Powell’s housing comments.

The U.S. housing market got objectively bubbly during the pandemic. In fact, data produced by the Dallas Fed (see chart above) finds that home prices in 2022 are actually more detached from underlying fundamentals than they were 2005 and 2008.

Over the coming year, those detached fundamentals should begin to heal a bit. That's a view held by firms like Morgan Stanley, Zonda, KPMG, John Burns Real Estate Consulting, Moody's Analytics, Goldman Sachs, Wells Fargo, Fannie Mae, and Zelman & Associates. Those firms believe that "pressurized" affordability (i.e. mortgage rates spiking 3 percentage points just after U.S. home prices soared 40%) will see home prices fall further in 2023. If U.S. home prices—which are already down 2.2% from their June 2022 peak—continue to fall and incomes continue to rise, fundamentals would indeed begin to come back down to earth.

That said, Fed officials don't think the ongoing housing correction is a 2008 repeat.

"From a financial stability standpoint, we didn't see in this cycle the kinds of poor underwriting credit that we saw before the Great Financial Crisis. Housing credit was much more carefully managed by the lenders. It's a very different situation [in 2022], it doesn't present potential, [well] it doesn't appear to present financial stability issues. But we do understand that [housing] is where a very big effect of our policies is," Powell told reporters earlier in November.

See, the last housing bubble was fundamentally a different story. Back in the aughts, zealous lenders were giving out mortgages (or better put, subprime mortgages) to folks who historically wouldn’t have qualified. As that credit rushed in, it helped to drive both a building boom and a home price boom. However, once Fed tightening set off a housing market correction in 2006, that building boom turned into a supply glut and those bad loans turned into a foreclosure crisis. That combination of oversupply and "forced selling" saw U.S. home prices fall a staggering 26% between 2007 and 2012.

While Fed officials acknowledge that we could see a "material correction" in home prices, they don't believe it'd be as damaging as the 2008 crash. The reason? In the years ahead, the Fed believes we shouldn't have to worry about a foreclosure crisis nor a massive supply glut.

A combination of high sales and supply chain issues saw home builders build-up quite a backlog of unfinished projects during the pandemic. On one hand, as homebuilders rush to offload these homes that could put downward pressure on home prices in 2023. On the other hand, this simply isn't enough homes to solve the nation's housing shortage. Powell acknowledged as much on Wednesday.

"None of this [the ongoing housing correction] affects the longer run issue, which is that we got a built-up country and it's hard to get zoning and hard to get housing built in sufficient quantities to meet the public's demand," Powell. "There's a longer run housing shortage."

So while spiked mortgage rates may help to bring "balance" to the housing market by pushing home prices lower and giving inventory (see chart above) breathing room to grow, the trajectory of the market might not favor buyers for long.

Let's be clear: No one really knows how the ongoing housing correction will actually unfold. There are simply too many question marks. Does inflation come down quickly and bring mortgage rates down with it? Or does inflation prove sticky, and thus require higher rates for longer?

But we can say, based on past history, whatever comes next will surely vary by housing market.

One big reason that it'll vary is that fundamentals vary so much by market. Look no further than Cleveland and Austin. The former saw a modest housing boom during the pandemic, while the latter saw home prices soar over 70%. Of course, now that the housing market has shifted, Austin (which Moody's Analytics estimates is "overvalued" by 61%) has already slipped into a sharp correction while Cleveland (which is "overvalued" by 15%) has simply slowed down.

Simply put: Housing fundamentals still matter.