2011年開始的房地產(chǎn)上升周期已經(jīng)正式結束。簡而言之:房地產(chǎn)進入衰退期,。

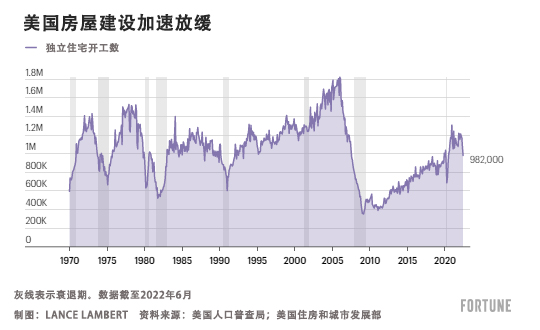

7月19日,我們得知,,6月房屋建筑商獨立住宅開工數(shù)為98.2萬套,。自今年2月以來下降了19%,與2021年6月相比下降了16%,。雖然算不上“泡沫破裂”,,但很明顯,建筑商正在收縮業(yè)務,。從歷史經(jīng)驗看,,這說明房地產(chǎn)周期發(fā)生反轉。建筑商向來要與存量房競爭,,隨著庫存激增,,房屋建筑商就會開始減少開工,。

“巔峰時期的歡快已經(jīng)離我們遠去。曾經(jīng)席卷各大房地產(chǎn)市場的(房屋)高價紅利逐漸回吐,?!奔s翰·伯恩斯房地產(chǎn)咨詢公司(John Burns Real Estate Consulting)的研究主管小里克·帕拉西奧斯表示。

房屋庫存將繼續(xù)增加,,新房建設將繼續(xù)放緩,。至少約翰·伯恩斯房地產(chǎn)咨詢公司如此認為,該公司主要向建筑商和投資者提供咨詢服務,。在這一過程中,,房地產(chǎn)持續(xù)衰退(即房地產(chǎn)市場萎縮)可能拉低泡沫存在地區(qū)的房價。帕拉西奧斯稱,,2023年和2024年很多泡沫市場都會大幅降價,,其中包括菲尼克斯、納什維爾,、西棕櫚灘,、拉斯維加斯和奧斯汀等地。帕拉西奧斯指出,,在愛達荷州博伊西,,房價最早可能在今年12月就會同比下跌。

“某些地方的建筑商已經(jīng)(決定)停止?jié)仓前?,澆筑樓板是房屋開工的明確標志,。在某些市場上,感覺像是(房地產(chǎn)泡沫破滅),?!迸晾鲓W斯說。

今年春天抵押貸款利率飆升后不久,,住房市場就陷入了“調整期”,。很容易發(fā)現(xiàn),利率提升如何讓諸多潛在買家望而卻步,。如果借款人在12月以3.1%的利率獲得50萬美元抵押貸款,,每月就要償還2135美元的本金和利息。如果借款人以現(xiàn)在的30年期固定利率抵押貸款平均利率(5.51%)獲得50萬美元抵押貸款,,每月就要還2839美元,。

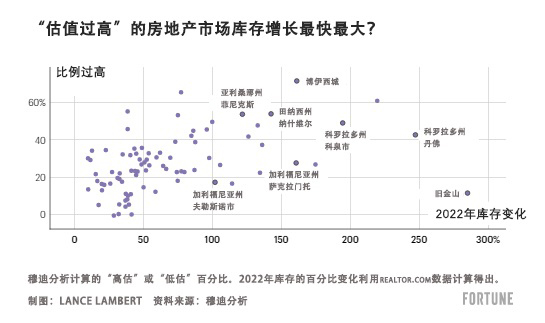

房地產(chǎn)衰退對市場造成了嚴重沖擊,不過各個市場受到的影響并不均衡,。西部山區(qū),、西海岸和西南部房地產(chǎn)市場受到的打擊格外沉重??纯磶齑孀兓湍軌虬l(fā)現(xiàn):過去六個月,,丹佛的庫存激增了247%,,而匹茲堡只有18%。緊隨丹佛之后的是奧斯?。?20%),;科羅拉多斯普林斯(195%);加利福尼亞州斯托克頓(175%),;還有博伊西(161%),。

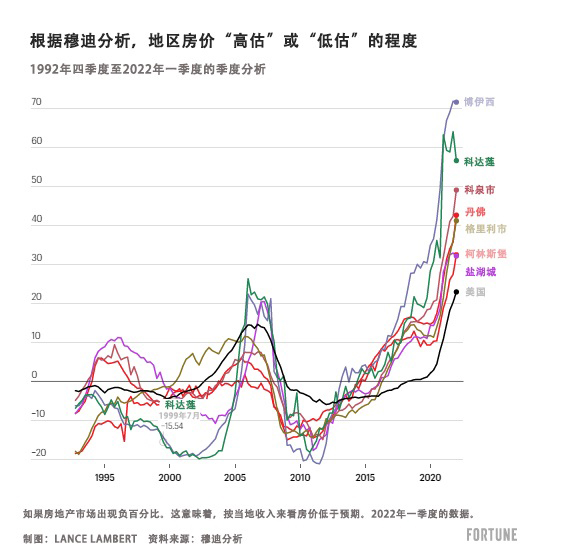

實際情況到底怎樣?西部房地產(chǎn)市場恰好也是美國最“高估”的市場之一,。隨著過去兩年房地產(chǎn)大規(guī)模繁榮,,很多供應更緊張的市場上房價漲勢驚人。過去兩年,,博伊西的房價上漲了53%,,也導致當?shù)氐姆績r遠遠超過了歷史上市場基本面可以支撐的水平。事實上,,穆迪分析(Moody's Analytics)認為博伊西是美國房價最“高估”的市場,。

穆迪分析預計,未來一年在博伊西和奧斯汀等被嚴重“高估”的房地產(chǎn)市場,,房價將下跌5%至10%,。穆迪分析預計全美房價同比增長為0%。然而如果經(jīng)濟衰退來襲,,穆迪分析預測被嚴重“高估”的市場中房價可能跌去15%至20%,,而全美房價將下跌約5%。

奧斯汀和菲尼克斯等泡沫市場收縮更快還有另一個原因:投資者,。

過去兩年,,投資者紛紛涌入美國房地產(chǎn)市場。愛彼迎(Airbnb)房東和夫妻房東等小玩家加入,。炒房客返回市場,。有像黑石(Blackstone)一樣的機構,還有Zillow之類的網(wǎng)絡平臺,。最受歡迎的地點在哪,?正是遍及西部山區(qū)、西南和東南部火熱的房地產(chǎn)市場,。

然而,隨著新興城市房地產(chǎn)市場開始收縮,,第一批逃離的也是投資者,。

“投資者有時喜歡組團行動。如果2022年的菲尼克斯房地產(chǎn)不再是人們眼中很酷的投資,,那就可能迅速對房屋銷售產(chǎn)生巨大影響,。如果很多投資者決定賣出……那就不妙了,。”菲尼克斯的獨立房地產(chǎn)分析師約翰·韋克告訴《財富》雜志,。

當然,,本輪房地產(chǎn)衰退其實是有意為之。

今年早些時候,,美聯(lián)儲(Federal Reserve)從量化寬松(即購買債券)轉向量化緊縮(即出售債券),。金融市場上的10年期國債和抵押貸款利率立刻走高。這正是美聯(lián)儲想要的結果:如果抵押貸款利率上升,,就能夠讓疫情中推高通脹的火熱房地產(chǎn)市場降溫,。

“要我說的話,如果你是購房者,,或者是想買房的年輕人,,就需要做點調整。我們要恢復到供需正常,、通脹重新降至低位,、抵押貸款利率也降至低位的狀態(tài)?!泵缆?lián)儲主席杰羅姆·鮑威爾在6月向記者表示,。

帕拉西奧斯認為,美聯(lián)儲住房“調整”實際意思是“房價下跌”,。雖然美聯(lián)儲沒有直接表態(tài),,但帕拉西奧斯表示,業(yè)內很多人預計這正是下一步要面臨的情況,。

帕拉西奧斯說,,房地產(chǎn)持續(xù)收縮加上態(tài)度堅定的美聯(lián)儲,意味著衰退注定到來,。從歷史上看,,美聯(lián)儲引發(fā)的衰退始于房地產(chǎn)等利率敏感行業(yè)。通常情況過程如此:抵押貸款利率飆升迅速導致房屋銷售減少,。然后庫存急劇上升,,房屋建筑商收縮。隨后,,大宗商品和耐用品需求均下降,。當然,房地產(chǎn)衰退也會造成裁員,。

“閱讀保羅·沃爾克文章后學到的教訓是,,20世紀70年代美聯(lián)儲就是這么把事情搞砸的。如果面對通脹問題有紅燈、綠燈的心態(tài),,就永遠也無法擺脫通脹思維……如果過去一個月認真聽美聯(lián)儲的表態(tài)就可以發(fā)現(xiàn),,他們自己也非常害怕會這樣?!迸晾鲓W斯說,。(財富中文網(wǎng))

譯者:梁宇

審校:夏林

2011年開始的房地產(chǎn)上升周期已經(jīng)正式結束。簡而言之:房地產(chǎn)進入衰退期,。

7月19日,,我們得知,6月房屋建筑商獨立住宅開工數(shù)為98.2萬套,。自今年2月以來下降了19%,,與2021年6月相比下降了16%。雖然算不上“泡沫破裂”,,但很明顯,,建筑商正在收縮業(yè)務。從歷史經(jīng)驗看,,這說明房地產(chǎn)周期發(fā)生反轉,。建筑商向來要與存量房競爭,隨著庫存激增,,房屋建筑商就會開始減少開工,。

“巔峰時期的歡快已經(jīng)離我們遠去。曾經(jīng)席卷各大房地產(chǎn)市場的(房屋)高價紅利逐漸回吐,?!奔s翰·伯恩斯房地產(chǎn)咨詢公司(John Burns Real Estate Consulting)的研究主管小里克·帕拉西奧斯表示。

房屋庫存將繼續(xù)增加,,新房建設將繼續(xù)放緩,。至少約翰·伯恩斯房地產(chǎn)咨詢公司如此認為,該公司主要向建筑商和投資者提供咨詢服務,。在這一過程中,,房地產(chǎn)持續(xù)衰退(即房地產(chǎn)市場萎縮)可能拉低泡沫存在地區(qū)的房價。帕拉西奧斯稱,,2023年和2024年很多泡沫市場都會大幅降價,,其中包括菲尼克斯、納什維爾,、西棕櫚灘,、拉斯維加斯和奧斯汀等地。帕拉西奧斯指出,,在愛達荷州博伊西,,房價最早可能在今年12月就會同比下跌,。

“某些地方的建筑商已經(jīng)(決定)停止?jié)仓前澹瑵仓前迨欠课蓍_工的明確標志,。在某些市場上,感覺像是(房地產(chǎn)泡沫破滅),?!迸晾鲓W斯說。

今年春天抵押貸款利率飆升后不久,,住房市場就陷入了“調整期”,。很容易發(fā)現(xiàn),利率提升如何讓諸多潛在買家望而卻步,。如果借款人在12月以3.1%的利率獲得50萬美元抵押貸款,,每月就要償還2135美元的本金和利息。如果借款人以現(xiàn)在的30年期固定利率抵押貸款平均利率(5.51%)獲得50萬美元抵押貸款,,每月就要還2839美元,。

房地產(chǎn)衰退對市場造成了嚴重沖擊,不過各個市場受到的影響并不均衡,。西部山區(qū),、西海岸和西南部房地產(chǎn)市場受到的打擊格外沉重??纯磶齑孀兓湍軌虬l(fā)現(xiàn):過去六個月,,丹佛的庫存激增了247%,而匹茲堡只有18%,。緊隨丹佛之后的是奧斯?。?20%);科羅拉多斯普林斯(195%),;加利福尼亞州斯托克頓(175%),;還有博伊西(161%)。

實際情況到底怎樣,?西部房地產(chǎn)市場恰好也是美國最“高估”的市場之一,。隨著過去兩年房地產(chǎn)大規(guī)模繁榮,很多供應更緊張的市場上房價漲勢驚人,。過去兩年,,博伊西的房價上漲了53%,也導致當?shù)氐姆績r遠遠超過了歷史上市場基本面可以支撐的水平,。事實上,,穆迪分析(Moody's Analytics)認為博伊西是美國房價最“高估”的市場。

穆迪分析預計,,未來一年在博伊西和奧斯汀等被嚴重“高估”的房地產(chǎn)市場,,房價將下跌5%至10%。穆迪分析預計全美房價同比增長為0%。然而如果經(jīng)濟衰退來襲,,穆迪分析預測被嚴重“高估”的市場中房價可能跌去15%至20%,,而全美房價將下跌約5%。

奧斯汀和菲尼克斯等泡沫市場收縮更快還有另一個原因:投資者,。

過去兩年,,投資者紛紛涌入美國房地產(chǎn)市場。愛彼迎(Airbnb)房東和夫妻房東等小玩家加入,。炒房客返回市場,。有像黑石(Blackstone)一樣的機構,還有Zillow之類的網(wǎng)絡平臺,。最受歡迎的地點在哪,?正是遍及西部山區(qū)、西南和東南部火熱的房地產(chǎn)市場,。

然而,,隨著新興城市房地產(chǎn)市場開始收縮,第一批逃離的也是投資者,。

“投資者有時喜歡組團行動,。如果2022年的菲尼克斯房地產(chǎn)不再是人們眼中很酷的投資,那就可能迅速對房屋銷售產(chǎn)生巨大影響,。如果很多投資者決定賣出……那就不妙了,。”菲尼克斯的獨立房地產(chǎn)分析師約翰·韋克告訴《財富》雜志,。

當然,,本輪房地產(chǎn)衰退其實是有意為之。

今年早些時候,,美聯(lián)儲(Federal Reserve)從量化寬松(即購買債券)轉向量化緊縮(即出售債券),。金融市場上的10年期國債和抵押貸款利率立刻走高。這正是美聯(lián)儲想要的結果:如果抵押貸款利率上升,,就能夠讓疫情中推高通脹的火熱房地產(chǎn)市場降溫,。

“要我說的話,如果你是購房者,,或者是想買房的年輕人,,就需要做點調整。我們要恢復到供需正常,、通脹重新降至低位,、抵押貸款利率也降至低位的狀態(tài)?!泵缆?lián)儲主席杰羅姆·鮑威爾在6月向記者表示,。

帕拉西奧斯認為,,美聯(lián)儲住房“調整”實際意思是“房價下跌”。雖然美聯(lián)儲沒有直接表態(tài),,但帕拉西奧斯表示,,業(yè)內很多人預計這正是下一步要面臨的情況。

帕拉西奧斯說,,房地產(chǎn)持續(xù)收縮加上態(tài)度堅定的美聯(lián)儲,,意味著衰退注定到來。從歷史上看,,美聯(lián)儲引發(fā)的衰退始于房地產(chǎn)等利率敏感行業(yè)。通常情況過程如此:抵押貸款利率飆升迅速導致房屋銷售減少,。然后庫存急劇上升,,房屋建筑商收縮。隨后,,大宗商品和耐用品需求均下降,。當然,房地產(chǎn)衰退也會造成裁員,。

“閱讀保羅·沃爾克文章后學到的教訓是,,20世紀70年代美聯(lián)儲就是這么把事情搞砸的。如果面對通脹問題有紅燈,、綠燈的心態(tài),,就永遠也無法擺脫通脹思維……如果過去一個月認真聽美聯(lián)儲的表態(tài)就可以發(fā)現(xiàn),他們自己也非常害怕會這樣,?!迸晾鲓W斯說。(財富中文網(wǎng))

譯者:梁宇

審校:夏林

The housing cycle—which began its upward climb in 2011—has officially turned over. Simply put: We've moved into a housing recession.

On July 19, we learned that homebuilders broke ground on 982,000 single-family homes in June. That's down 19% since February, and down 16% from the same month in 2021. While it's hardly a "blow out," it's clear builders are cutting back. Historically speaking, that's exactly what happens when a housing cycle turns over: As existing home inventory—which builders compete against—begins to spike, homebuilders start to cut back.

"Peak euphoria is behind us. We are giving back some of the euphoria [home] pricing that was rolling over every housing market," says Rick Palacios Jr., head of research at John Burns Real Estate Consulting.

Existing home inventory will continue to rise, and homebuilding will continue to slow. At least that's the view at John Burns Real Estate Consulting, which does consulting work for both builders and investors. As it does, the ongoing housing recession (i.e. a contracting housing market) could push home prices lower in bubbly regional housing markets. Indeed, many bubbly markets, Palacios says, are barreling toward price cuts in both 2023 and 2024. That includes markets like Phoenix, Nashville, West Palm Beach, Las Vegas, and Austin. In Boise, Palacios says, home prices could go negative on a year-over-year basis as soon as December.

"Builders are already [deciding] to not pour slabs in certain markets. Which is the technical trigger for a start for a home. In certain markets it will feel like [a housing bust]," Palacios says.

Soon after mortgage rates spiked this spring, the housing market slipped into a "housing correction." It's easy to see how those higher rates priced out many would-be buyers. If a borrower in December took out a $500,000 mortgage at a 3.1% rate, they'd owe a monthly principal and interest payment of $2,135. If a borrower took out a $500,000 mortgage at today's average 30-year fixed mortgage rate (5.51%), they'd get a $2,839 payment.

While this housing recession has hit markets coast to coast, it's hardly even. It's delivering a particularly hard blow to housing markets in the Mountain West, West Coast, and Southwest. Just look at the shift in inventory levels: Over the past six months, housing inventory has spiked 247% in Denver compared to just 18% in Pittsburgh. Not too far behind Denver are Austin (220%); Colorado Springs (195%); Stockton, Calif. (175%); and Boise (161%).

What's going on? These Western housing markets also happen to be among the most "overvalued" markets in the country. As the pandemic housing boom raged over the past two years, many of those markets—which were more constrained supply-wise—saw staggering home price appreciation. In Boise, home prices jumped 53% over the past two years. That took home prices there well beyond what economic fundamentals in the market would historically support. In fact, Moody's Analytics deems it the most "overvalued" market in the country.

Over the coming year, Moody's Analytics expects significantly "overvalued" housing markets like Boise and Austin to see home prices fall 5% to 10%. Nationally, Moody's Analytics expects year-over-year home price growth to be at 0%. However, if a recession hits, Moody's Analytics predicts significantly "overvalued" housing markets could see home prices drop by 15% to 20% while national home prices would fall by around 5%.

There's another reason bubbly markets like Austin and Phoenix are contracting faster: investors.

Investors poured into the U.S. housing market over the past two years. There were small players like Airbnb hosts and mom-and-pop landlords. Home flippers returned. There were also institutional types like Blackstone and iBuyer players like Zillow. Their favorite locales? Hot housing markets throughout the Mountain West, Southwest, and Southeast.

However, as housing markets in those boomtowns begin to contract, investors are the first ones who run for the exits.

"Investors sometimes move in a herd. If Phoenix real estate isn’t the cool investment anymore in 2022, it could have a big and quick impact on home sales. If a lot of investors decide to sell…yikes," John Wake, an independent real estate analyst based in Phoenix, told Fortune.

This housing recession, of course, is all by design.

Earlier this year, the Federal Reserve flipped from quantitative easing (i.e. buying bonds) to quantitative tightening (i.e. selling bonds). Immediately, financial markets pushed up both the 10-year Treasury and mortgage rates. That's exactly what the Fed wanted: If mortgage rates rose, it would cause the pandemic housing boom—which helped fuel higher inflation—to fizzle out.

"I'd say if you are a homebuyer, somebody or a young person looking to buy a home, you need a bit of a reset. We need to get back to a place where supply and demand are back together and where inflation is down low again, and mortgage rates are low again," Fed Chair Jerome Powell told reporters in June.

According to Palacios, that Fed housing "reset" actually means "falling home prices." While the Fed didn't directly say it, Palacios says many in the industry believe that's exactly what's coming next.

That ongoing housing contraction coupled with a determined Fed, Palacios says, is the perfect recipe for a recession. Historically speaking, Fed-induced recessions begin in rate-sensitive sectors like housing. It usually goes something like this: Spiking mortgage rates quickly translate into fewer home sales. Then inventory rises sharply and homebuilders scale back. Next, demand for both commodities and durable goods falls. Of course, a housing recession also brings with it layoffs.

"The lesson learned in reading [Paul] Volcker's piece, that’s where [the Fed] messed up [in the 1970s]. If you have this red-light, green-light mentality around inflation, then you’re going to allow the psychology of inflation to get out in front of you…If you listen to the Fed over the last month or so, that's what they’re so freaked out about," Palacios says.