今年3月,,摩根大通(JPMorgan Chase)的科技分析師姚橙和他的研究團(tuán)隊(duì)發(fā)表了一份報(bào)告,宣稱中國(guó)互聯(lián)網(wǎng)股票“不可投資”,,此舉讓他意外地成了名人,。這一尖銳的評(píng)級(jí)認(rèn)定引發(fā)了2000億美元的中國(guó)股票拋售,并促使一家中國(guó)科技公司后來(lái)取消了摩根大通作為其計(jì)劃中的股票發(fā)行高級(jí)承銷商資格,。

今年5月,,姚橙再次登上新聞?lì)^條,這次他看好中國(guó)股票,。他將七家中國(guó)主要互聯(lián)網(wǎng)公司的評(píng)級(jí)從此前的“減持”上調(diào)至“增持”,并將另外幾家公司的評(píng)級(jí)上調(diào)至“中性”,。姚橙并不是唯一一個(gè)重新評(píng)估中國(guó)股市的人,。最近幾周,高盛集團(tuán)(Goldman Sachs),、美國(guó)銀行(Bank of America),、杰富瑞金融集團(tuán)(Jefferies Financial Group)、東方匯理資產(chǎn)管理公司(Amundi)和花旗銀行(Citi)等20家主要投資機(jī)構(gòu)的分析師都看好中國(guó),,此前這個(gè)全球第二大經(jīng)濟(jì)體的股市前景黯淡,。市場(chǎng)情緒的轉(zhuǎn)變推動(dòng)摩根士丹利資本國(guó)際公司中國(guó)指數(shù)(MSCI China Index)自3月15日以來(lái)上漲逾20%,該指數(shù)是衡量中國(guó)內(nèi)地和離岸市場(chǎng)中國(guó)股票的最廣泛指標(biāo),。

其他主要的中國(guó)股指也有所上漲,。滬深300指數(shù)是滬深兩市上市公司的主要基準(zhǔn)指數(shù),同期上漲近12%,。追蹤在香港上市的中國(guó)股票的恒生中國(guó)企業(yè)指數(shù)(Hang Seng China Enterprises Index)上漲了23%,,而以在納斯達(dá)克(Nasdaq)上市的成功中國(guó)企業(yè)為主的金龍指數(shù)(Golden Dragon Index)飆升了近52%。一些分析師現(xiàn)在將中國(guó)吹捧為美國(guó)和歐洲股市近期暴跌的“避風(fēng)港”,。

2020年11月,,中國(guó)叫停了螞蟻集團(tuán)370億美元的首次公開(kāi)募股計(jì)劃,沒(méi)有人預(yù)測(cè)中國(guó)科技公司令人眼花繚亂的估值會(huì)回歸——至少不會(huì)很快回歸,。但高盛集團(tuán)的中國(guó)策略師劉勁津如今表示,,中國(guó)股市最糟糕的時(shí)期可能已經(jīng)過(guò)去,。在6月13日的一份報(bào)告中,他認(rèn)為最近的復(fù)蘇與中國(guó)市場(chǎng)早先的調(diào)整“持平”,,而且可能還有持續(xù)的上升空間,。劉勁津的樂(lè)觀態(tài)度引人注目,因?yàn)樗屯碌倌鳌つ潦亲钤缡褂谩安豢赏顿Y”來(lái)形容中國(guó)股票的分析師之一,。在2021年7月的一份研究報(bào)告中,,他們注意到,“我們最近與客戶就投資中國(guó)股票進(jìn)行的許多對(duì)話中都提到了‘不可投資’,?!?/p>

杰富瑞的全球股票策略師肖恩·達(dá)比也認(rèn)為,中國(guó)股市已經(jīng)渡過(guò)難關(guān),?!皽?00指數(shù)已經(jīng)觸底?!彼?月13日給客戶的報(bào)告中寫道,。“我們從‘適度看漲’轉(zhuǎn)為‘看漲’,?!?/p>

這樣的評(píng)論與3月14日投資者普遍的悲觀情緒相去甚遠(yuǎn),當(dāng)時(shí)姚橙將包括阿里巴巴集團(tuán),、騰訊控股有限公司和美團(tuán)在內(nèi)的28只中國(guó)互聯(lián)網(wǎng)股票評(píng)級(jí)下調(diào)至“減持”,,認(rèn)為由于地緣政治和宏觀經(jīng)濟(jì)風(fēng)險(xiǎn)不斷上升,這些股票在未來(lái)6個(gè)月到12個(gè)月內(nèi)“不可投資”,,調(diào)低力度異常之大,。例如,姚橙將阿里巴巴集團(tuán)的目標(biāo)價(jià)從180美元下調(diào)至65美元,,是彭博社(Bloomberg)調(diào)查的分析師中最低的,。

姚橙對(duì)中國(guó)互聯(lián)網(wǎng)股票的嚴(yán)重警告,引發(fā)了全球?qū)χ袊?guó)股票幾乎所有板塊的瘋狂拋售,。數(shù)小時(shí)內(nèi),,香港恒生指數(shù)(Hang Seng Index)暴跌6%,至10年來(lái)最低水平,。當(dāng)時(shí),,中國(guó)政府正在多個(gè)城市抗擊新冠肺炎疫情,科技中心深圳已經(jīng)封城,,外交政策專家警告稱,,如果中國(guó)政府在俄烏沖突中支持俄方,美國(guó)可能會(huì)對(duì)中國(guó)實(shí)施嚴(yán)厲的經(jīng)濟(jì)制裁。在監(jiān)管部門為期近兩年的打擊行動(dòng)之后,,中國(guó)一度充滿活力的互聯(lián)網(wǎng)巨頭仍然籠罩在不確定性的陰云之中,。

而在4月,情況變得更糟,。上海和北京爆發(fā)疫情,,促使政府在全市范圍內(nèi)實(shí)施嚴(yán)厲的疫情管控措施,全球供應(yīng)鏈?zhǔn)艿接绊?,持續(xù)了兩個(gè)月之久,。5月6日,五一黃金周后滬深兩市復(fù)市,,滬深300指數(shù)跌至兩年來(lái)最低水平,。

但姚橙和他的團(tuán)隊(duì)看到了看漲的希望。5月16日,,他們以中國(guó)政府強(qiáng)有力的政策支持為由,,對(duì)阿里巴巴集團(tuán)、騰訊控股有限公司,、美團(tuán)和拼多多等主要中國(guó)科技公司的評(píng)級(jí)進(jìn)行了上調(diào),。

在一份宣布突然逆轉(zhuǎn)的報(bào)告中,摩根大通團(tuán)隊(duì)提到了3月16日由政府的經(jīng)濟(jì)政策負(fù)責(zé)人劉鶴領(lǐng)導(dǎo)的中國(guó)最高金融政策委員會(huì)(國(guó)務(wù)院金融穩(wěn)定發(fā)展委員會(huì))在北京召開(kāi)的一次會(huì)議,。媒體報(bào)道稱,,在那次會(huì)議上,劉鶴表示政府將實(shí)施新措施來(lái)提振經(jīng)濟(jì),,并應(yīng)“積極出臺(tái)對(duì)市場(chǎng)有利的政策”,。該委員會(huì)還決定,應(yīng)“盡快”完成對(duì)中國(guó)互聯(lián)網(wǎng)公司的“整頓”,。

當(dāng)時(shí),全球投資者對(duì)劉鶴的評(píng)論反響不一,。一些人稱贊這是一個(gè)積極信號(hào),,表明政府對(duì)資本市場(chǎng)的重視。但其他人認(rèn)為這些話似乎不足以支持股市反彈,。

姚橙和他的團(tuán)隊(duì)認(rèn)為,,劉鶴3月16日的聲明是中國(guó)科技股的關(guān)鍵轉(zhuǎn)折點(diǎn)。他們總結(jié)道:“在近期監(jiān)管公告的背景下,,該行業(yè)面臨的重大不確定性應(yīng)該會(huì)開(kāi)始減弱,。”

5月初,,彭博社援引摩根大通匿名消息人士的話稱,,一項(xiàng)內(nèi)部調(diào)查得出結(jié)論,姚橙使用“不可投資”是編輯失誤的結(jié)果,本不應(yīng)該發(fā)生,。摩根大通拒絕對(duì)彭博社的報(bào)道置評(píng),,但在發(fā)給通訊社的一封電子郵件中,該公司強(qiáng)調(diào):“我們堅(jiān)持發(fā)布的研究成果和分析師對(duì)該行業(yè)的獨(dú)立分析,?!?/p>

進(jìn)入6月的時(shí)候,姚橙觀點(diǎn)的徹底轉(zhuǎn)變看起來(lái)越來(lái)越高明,。上海和北京憑借史無(wú)前例的核酸檢測(cè)和監(jiān)測(cè)措施,,成功控制了新冠肺炎疫情并解除了封鎖。包括阿里巴巴集團(tuán),、騰訊控股有限公司,、美團(tuán)和百度在內(nèi)的多家中國(guó)互聯(lián)網(wǎng)巨頭公布的季度財(cái)報(bào)超出預(yù)期,并上調(diào)了對(duì)今年剩余時(shí)間收益的預(yù)期,。6月8日,,中國(guó)政府宣布批準(zhǔn)60個(gè)新的網(wǎng)絡(luò)游戲牌照,給科技股帶來(lái)了利好,。

最近幾周,,媒體廣泛報(bào)道稱,監(jiān)管機(jī)構(gòu)對(duì)網(wǎng)約車巨頭滴滴出行的數(shù)據(jù)安全違規(guī)行為的調(diào)查即將結(jié)束,,此舉將使該公司在中國(guó)恢復(fù)正常業(yè)務(wù)運(yùn)營(yíng),,并可能推進(jìn)其在香港上市的計(jì)劃。

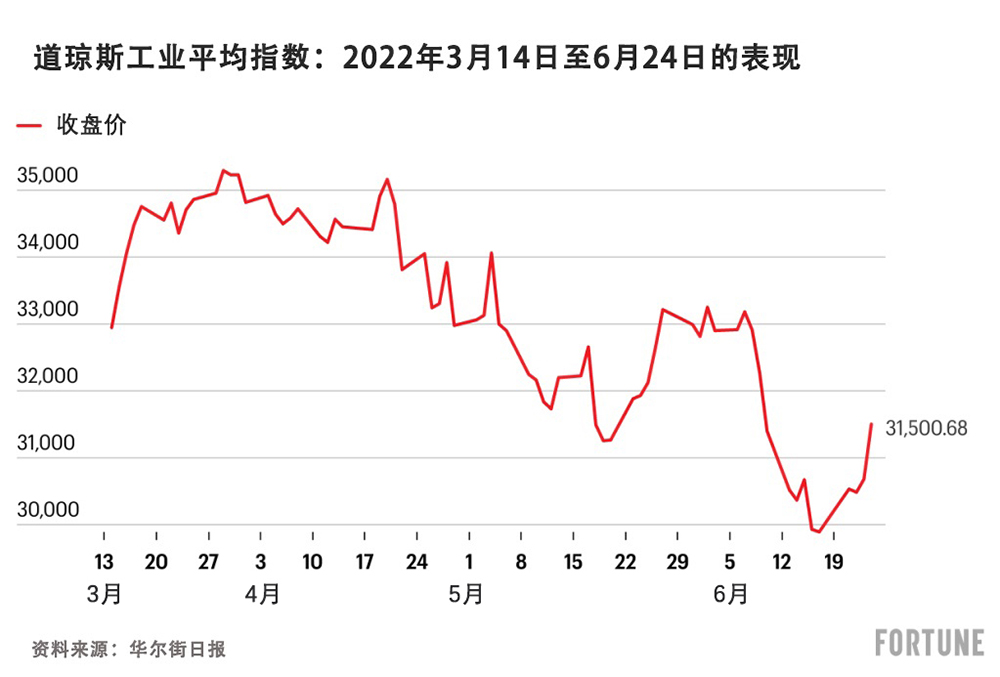

相比之下,,由于油價(jià)上漲以及美聯(lián)儲(chǔ)(Federal Reserve)和歐洲央行為對(duì)抗通脹而宣布大幅加息,,美國(guó)和歐洲股市均下跌。過(guò)去三個(gè)月,,道瓊斯工業(yè)平均指數(shù)(Dow Jones Industrial Average)下跌了12%,,而標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)下跌了16%?!叭缃駵p持中國(guó)股票是有風(fēng)險(xiǎn)的,。”東方匯理資產(chǎn)管理公司的首席投資官文森特·莫蒂爾在5月接受彭博社采訪時(shí)表示,。

目前,,有一些全球投資者正在悄悄重返中國(guó)股市。摩根士丹利(Morgan Stanley)的首席中國(guó)股票策略師王瀅一直是對(duì)中國(guó)股市反彈持最大懷疑態(tài)度的人之一,,她表示,,她目前還不建議客戶增持中國(guó)股票。但在今年6月的早些時(shí)候接受彭博電視臺(tái)(Bloomberg TV)采訪時(shí),,她承認(rèn)中國(guó)股市看起來(lái)更有吸引力,,可能正處于長(zhǎng)期熊市的“最后一站”,。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

今年3月,摩根大通(JPMorgan Chase)的科技分析師姚橙和他的研究團(tuán)隊(duì)發(fā)表了一份報(bào)告,,宣稱中國(guó)互聯(lián)網(wǎng)股票“不可投資”,,此舉讓他意外地成了名人。這一尖銳的評(píng)級(jí)認(rèn)定引發(fā)了2000億美元的中國(guó)股票拋售,,并促使一家中國(guó)科技公司后來(lái)取消了摩根大通作為其計(jì)劃中的股票發(fā)行高級(jí)承銷商資格,。

今年5月,姚橙再次登上新聞?lì)^條,,這次他看好中國(guó)股票,。他將七家中國(guó)主要互聯(lián)網(wǎng)公司的評(píng)級(jí)從此前的“減持”上調(diào)至“增持”,并將另外幾家公司的評(píng)級(jí)上調(diào)至“中性”,。姚橙并不是唯一一個(gè)重新評(píng)估中國(guó)股市的人,。最近幾周,高盛集團(tuán)(Goldman Sachs),、美國(guó)銀行(Bank of America),、杰富瑞金融集團(tuán)(Jefferies Financial Group)、東方匯理資產(chǎn)管理公司(Amundi)和花旗銀行(Citi)等20家主要投資機(jī)構(gòu)的分析師都看好中國(guó),,此前這個(gè)全球第二大經(jīng)濟(jì)體的股市前景黯淡,。市場(chǎng)情緒的轉(zhuǎn)變推動(dòng)摩根士丹利資本國(guó)際公司中國(guó)指數(shù)(MSCI China Index)自3月15日以來(lái)上漲逾20%,該指數(shù)是衡量中國(guó)內(nèi)地和離岸市場(chǎng)中國(guó)股票的最廣泛指標(biāo),。

其他主要的中國(guó)股指也有所上漲,。滬深300指數(shù)是滬深兩市上市公司的主要基準(zhǔn)指數(shù),同期上漲近12%,。追蹤在香港上市的中國(guó)股票的恒生中國(guó)企業(yè)指數(shù)(Hang Seng China Enterprises Index)上漲了23%,,而以在納斯達(dá)克(Nasdaq)上市的成功中國(guó)企業(yè)為主的金龍指數(shù)(Golden Dragon Index)飆升了近52%。一些分析師現(xiàn)在將中國(guó)吹捧為美國(guó)和歐洲股市近期暴跌的“避風(fēng)港”,。

2020年11月,,中國(guó)叫停了螞蟻集團(tuán)370億美元的首次公開(kāi)募股計(jì)劃,沒(méi)有人預(yù)測(cè)中國(guó)科技公司令人眼花繚亂的估值會(huì)回歸——至少不會(huì)很快回歸,。但高盛集團(tuán)的中國(guó)策略師劉勁津如今表示,,中國(guó)股市最糟糕的時(shí)期可能已經(jīng)過(guò)去。在6月13日的一份報(bào)告中,,他認(rèn)為最近的復(fù)蘇與中國(guó)市場(chǎng)早先的調(diào)整“持平”,,而且可能還有持續(xù)的上升空間,。劉勁津的樂(lè)觀態(tài)度引人注目,,因?yàn)樗屯碌倌鳌つ潦亲钤缡褂谩安豢赏顿Y”來(lái)形容中國(guó)股票的分析師之一。在2021年7月的一份研究報(bào)告中,,他們注意到,,“我們最近與客戶就投資中國(guó)股票進(jìn)行的許多對(duì)話中都提到了‘不可投資’。”

杰富瑞的全球股票策略師肖恩·達(dá)比也認(rèn)為,,中國(guó)股市已經(jīng)渡過(guò)難關(guān),。“滬深300指數(shù)已經(jīng)觸底,?!彼?月13日給客戶的報(bào)告中寫道?!拔覀儚摹m度看漲’轉(zhuǎn)為‘看漲’,。”

這樣的評(píng)論與3月14日投資者普遍的悲觀情緒相去甚遠(yuǎn),,當(dāng)時(shí)姚橙將包括阿里巴巴集團(tuán),、騰訊控股有限公司和美團(tuán)在內(nèi)的28只中國(guó)互聯(lián)網(wǎng)股票評(píng)級(jí)下調(diào)至“減持”,認(rèn)為由于地緣政治和宏觀經(jīng)濟(jì)風(fēng)險(xiǎn)不斷上升,,這些股票在未來(lái)6個(gè)月到12個(gè)月內(nèi)“不可投資”,,調(diào)低力度異常之大。例如,,姚橙將阿里巴巴集團(tuán)的目標(biāo)價(jià)從180美元下調(diào)至65美元,,是彭博社(Bloomberg)調(diào)查的分析師中最低的。

姚橙對(duì)中國(guó)互聯(lián)網(wǎng)股票的嚴(yán)重警告,,引發(fā)了全球?qū)χ袊?guó)股票幾乎所有板塊的瘋狂拋售,。數(shù)小時(shí)內(nèi),香港恒生指數(shù)(Hang Seng Index)暴跌6%,,至10年來(lái)最低水平,。當(dāng)時(shí),中國(guó)政府正在多個(gè)城市抗擊新冠肺炎疫情,,科技中心深圳已經(jīng)封城,,外交政策專家警告稱,如果中國(guó)政府在俄烏沖突中支持俄方,,美國(guó)可能會(huì)對(duì)中國(guó)實(shí)施嚴(yán)厲的經(jīng)濟(jì)制裁,。在監(jiān)管部門為期近兩年的打擊行動(dòng)之后,中國(guó)一度充滿活力的互聯(lián)網(wǎng)巨頭仍然籠罩在不確定性的陰云之中,。

而在4月,,情況變得更糟。上海和北京爆發(fā)疫情,,促使政府在全市范圍內(nèi)實(shí)施嚴(yán)厲的疫情管控措施,,全球供應(yīng)鏈?zhǔn)艿接绊懀掷m(xù)了兩個(gè)月之久,。5月6日,,五一黃金周后滬深兩市復(fù)市,,滬深300指數(shù)跌至兩年來(lái)最低水平。

但姚橙和他的團(tuán)隊(duì)看到了看漲的希望,。5月16日,,他們以中國(guó)政府強(qiáng)有力的政策支持為由,對(duì)阿里巴巴集團(tuán),、騰訊控股有限公司,、美團(tuán)和拼多多等主要中國(guó)科技公司的評(píng)級(jí)進(jìn)行了上調(diào)。

在一份宣布突然逆轉(zhuǎn)的報(bào)告中,,摩根大通團(tuán)隊(duì)提到了3月16日由政府的經(jīng)濟(jì)政策負(fù)責(zé)人劉鶴領(lǐng)導(dǎo)的中國(guó)最高金融政策委員會(huì)(國(guó)務(wù)院金融穩(wěn)定發(fā)展委員會(huì))在北京召開(kāi)的一次會(huì)議,。媒體報(bào)道稱,在那次會(huì)議上,,劉鶴表示政府將實(shí)施新措施來(lái)提振經(jīng)濟(jì),,并應(yīng)“積極出臺(tái)對(duì)市場(chǎng)有利的政策”。該委員會(huì)還決定,,應(yīng)“盡快”完成對(duì)中國(guó)互聯(lián)網(wǎng)公司的“整頓”,。

當(dāng)時(shí),全球投資者對(duì)劉鶴的評(píng)論反響不一,。一些人稱贊這是一個(gè)積極信號(hào),,表明政府對(duì)資本市場(chǎng)的重視。但其他人認(rèn)為這些話似乎不足以支持股市反彈,。

姚橙和他的團(tuán)隊(duì)認(rèn)為,,劉鶴3月16日的聲明是中國(guó)科技股的關(guān)鍵轉(zhuǎn)折點(diǎn)。他們總結(jié)道:“在近期監(jiān)管公告的背景下,,該行業(yè)面臨的重大不確定性應(yīng)該會(huì)開(kāi)始減弱,。”

5月初,,彭博社援引摩根大通匿名消息人士的話稱,,一項(xiàng)內(nèi)部調(diào)查得出結(jié)論,姚橙使用“不可投資”是編輯失誤的結(jié)果,,本不應(yīng)該發(fā)生。摩根大通拒絕對(duì)彭博社的報(bào)道置評(píng),,但在發(fā)給通訊社的一封電子郵件中,,該公司強(qiáng)調(diào):“我們堅(jiān)持發(fā)布的研究成果和分析師對(duì)該行業(yè)的獨(dú)立分析?!?/p>

進(jìn)入6月的時(shí)候,,姚橙觀點(diǎn)的徹底轉(zhuǎn)變看起來(lái)越來(lái)越高明。上海和北京憑借史無(wú)前例的核酸檢測(cè)和監(jiān)測(cè)措施,,成功控制了新冠肺炎疫情并解除了封鎖,。包括阿里巴巴集團(tuán)、騰訊控股有限公司,、美團(tuán)和百度在內(nèi)的多家中國(guó)互聯(lián)網(wǎng)巨頭公布的季度財(cái)報(bào)超出預(yù)期,,并上調(diào)了對(duì)今年剩余時(shí)間收益的預(yù)期。6月8日,,中國(guó)政府宣布批準(zhǔn)60個(gè)新的網(wǎng)絡(luò)游戲牌照,,給科技股帶來(lái)了利好。

最近幾周,,媒體廣泛報(bào)道稱,,監(jiān)管機(jī)構(gòu)對(duì)網(wǎng)約車巨頭滴滴出行的數(shù)據(jù)安全違規(guī)行為的調(diào)查即將結(jié)束,此舉將使該公司在中國(guó)恢復(fù)正常業(yè)務(wù)運(yùn)營(yíng),,并可能推進(jìn)其在香港上市的計(jì)劃,。

相比之下,由于油價(jià)上漲以及美聯(lián)儲(chǔ)(Federal Reserve)和歐洲央行為對(duì)抗通脹而宣布大幅加息,,美國(guó)和歐洲股市均下跌,。過(guò)去三個(gè)月,道瓊斯工業(yè)平均指數(shù)(Dow Jones Industrial Average)下跌了12%,,而標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)下跌了16%,。“如今減持中國(guó)股票是有風(fēng)險(xiǎn)的,?!睎|方匯理資產(chǎn)管理公司的首席投資官文森特·莫蒂爾在5月接受彭博社采訪時(shí)表示。

目前,,有一些全球投資者正在悄悄重返中國(guó)股市,。摩根士丹利(Morgan Stanley)的首席中國(guó)股票策略師王瀅一直是對(duì)中國(guó)股市反彈持最大懷疑態(tài)度的人之一,她表示,,她目前還不建議客戶增持中國(guó)股票。但在今年6月的早些時(shí)候接受彭博電視臺(tái)(Bloomberg TV)采訪時(shí),,她承認(rèn)中國(guó)股市看起來(lái)更有吸引力,,可能正處于長(zhǎng)期熊市的“最后一站”,。(財(cái)富中文網(wǎng))

譯者:中慧言-王芳

JPMorgan Chase technology analyst Alex Yao earned unwanted celebrity in March when he and his research team published a report declaring Chinese internet stocks “uninvestable.” That scathing designation ignited a $200 billion selloff of China shares—and prompted one Chinese technology company to later remove JPMorgan as the senior underwriter for a planned stock offering.

In May, Yao made headlines again, this time as a China bull. He revised his rating of seven leading Chinese internet firms to “overweight,” up from an earlier “underweight” rating, and bumped up several more to “neutral.” Yao isn’t alone in his reassessment of China shares. In recent weeks analysts at a score of leading investment houses—Goldman Sachs, Bank of America, Jefferies Financial Group, Amundi, and Citi—have brightened formerly dim outlooks for equities in the world’s second-largest economy. The shift in sentiment has helped to drive the MSCI China Index, the broadest measure of China stocks on mainland and offshore markets, up more than 20% since March 15.

Other key China stock indexes have gained as well. The CSI 300, the leading benchmark of companies listed on exchanges in Shanghai and Shenzhen, has risen nearly 12% during that same interval. The Hang Seng China Enterprises Index, which tracks Chinese shares traded in Hong Kong, is up 23%, while the Golden Dragon Index, dominated by high-flying Chinese companies listed on the Nasdaq, has soared nearly 52%. Some analysts now tout China as a “safe haven” from recent carnage in U.S. and Europe markets.

No one is predicting a return—at least not anytime soon—to the dizzying valuations commanded by Chinese tech companies before November 2020, when Chinese government squelched a $37 billion initial public offering planned by Ant Group, the sprawling mobile payments company controlled by billionaire Jack Ma. But Goldman Sachs China strategist Kinger Lau now says the worst may be over for China shares. In a June 13 report, he argued that the recent recovery is “on par” with earlier China market corrections and may yet have room to run. Lau’s upbeat take is notable because he and colleague Timothy Moe were among the first analysts to use the “u-word” in connection with China. In a July 2021 research note they observed that “’uninvestable’ has featured in many of our recent conversations with clients regarding investing in Chinese stocks.”

Sean Darby, global equity strategist at Jefferies, also believes China shares have turned the corner. “A bottom has been made in the CSI 300,” he wrote in June 13 note to clients. “We upgrade to Bullish from Modestly Bullish.”

Such comments are a far cry from the gloom that prevailed among investors on March 14, when Yao downgraded 28 Chinese internet stocks including Alibaba Group Holding, Tencent Holdings, and Meituan to “underweight,” deeming them “uninvestable” for the next six to 12 months owing to rising geopolitical and macroeconomic risks. The write-downs were unusually aggressive. For example, Yao slashed his price target for Alibaba to $65, down from $180, making it the lowest among analysts surveyed by Bloomberg.

Yao’s dire warning about Chinese internet stocks prompted a global stampede out of China stocks in nearly every sector. In hours, Hong Kong’s Hang Seng Index plunged 6% to its lowest level in 10 years. At the time, Chinese authorities were battling COVID-19 outbreaks in multiple cities, the tech hub of Shenzhen already was in COVID lockdown, and foreign policy experts warned that the U.S. might hit China with harsh economic sanctions if Beijing backed Russia’s invasion of Ukraine. China’s once-dynamic internet giants remained shrouded in a cloud of uncertainty in the wake of a nearly two-year regulatory crackdown.

And in April, things got worse. The virus flared in Shanghai and Beijing, prompting authorities to impose harsh citywide lockdowns that dampened Chinese consumption, snarled global supply chains, and dragged on for two months. On May 6, when exchanges in Shanghai and Shenzhen reopened after the nation’s “Golden Week” holiday, the CSI 300 index tumbled to its lowest level in two years.

But Yao and his team saw reasons for optimism. On May 16, they upgraded a passel of leading Chinese tech companies including Alibaba, Tencent, Meituan, and Pinduoduo citing strong policy support from Beijing.

In a report announcing the abrupt reversal, the JPMorgan team referenced a March 16 meeting in Beijing of China’s top financial policy committee led by Liu He, the government’s economic policy czar. In that meeting, according to accounts in China’s state-controlled press, Liu vowed the government would implement new measures to boost the economy and should “actively introduce policies that benefit markets.” The committee also resolved that measures to “rectify” China’s internet companies should be completed “as soon as possible.”

Liu’s comments had drawn mixed reviews from global investors at the time. Some hailed them as a signal that China’s leaders, who had long seemed oblivious to the worldwide selloff in China stocks, now recognized they needed to do something to reverse it. But others dismissed the remarks as empty rhetoric.

Yao and his team deemed Liu’s March 16 pronouncements a key turning point for Chinese tech shares. “Significant uncertainties facing the sector should begin to abate on the back of recent regulatory announcements,” they concluded.

In early May, Bloomberg, citing anonymous JPMorgan sources, reported that an internal investigation had concluded that Yao’s use of the “u-word” was the result of an editorial screwup and should never have happened. JPMorgan declined to comment on the Bloomberg report, but in an e-mail sent to the news service the firm stressed that “we stand by our published research and the analyst’s independent analysis of the sector.”

As May gave way to June, Yao’s volte-face looked increasingly shrewd. Shanghai and Beijing, by dint of unprecedented testing and surveillance measures, managed to contain their COVID outbreaks and were exiting lockdown. A parade of Chinese internet giants, including Alibaba, Tencent, Meituan, and Baidu, announced better-than-expected quarterly financial results and raised their estimates for earnings for the rest of the year. On June 8, Beijing gave tech stocks a positive jolt by announcing the approval of 60 new online game licenses.

In recent weeks, there have been widespread media reports that regulators are on the verge of concluding their probe into data security violations at ride-hailing giant Didi Chuxing, a move that would allow the company to resume normal business operations in China—and potentially move forward with plans to float shares in Hong Kong.

Meanwhile, declines in U.S. and Europe markets in response to higher oil prices and aggressive interest rate hikes announced by the Federal Reserve and European central banks to combat inflation have helped China shares regain at least part of their lost luster. The Dow Jones industrial average has fallen 12% over the past three months, while the S&P 500 has slumped 16%. “To be underweight Chinese equities today is risky,” Vincent Mortier, Amundi’s chief investment officer declared in a May interview with Bloomberg.

For now, though, it seems clear that at least some global investors are tiptoeing back to Chinese equities. Morgan Stanley chief China equity strategist Laura Wang, who has been among the biggest skeptics of the idea of a China rally, says she’s not recommending clients load up on China shares yet. But in an interview with Bloomberg TV earlier June, she conceded that China stocks are looking more attractive and may be on the “l(fā)ast leg” of an extended bear market.