埃隆·馬斯克收購?fù)铺毓荆═witter)本身便是一個(gè)巨大的商業(yè)故事,,但它隱藏了一個(gè)更大的商業(yè)故事,。

此次競(jìng)購讓媒體對(duì)馬斯克收購目標(biāo)計(jì)劃議論紛紛。這位大亨希望將這家社交媒體平臺(tái)轉(zhuǎn)變?yōu)橐粋€(gè)言論自由的城市廣場(chǎng),,這可能意味著恢復(fù)美國前總統(tǒng)唐納德·特朗普的社交媒體賬號(hào),,讓推特成為他的傳聲筒。專家們想知道,,這位特立獨(dú)行的人是否真的能夠像他承諾的那樣,,可以在五年內(nèi)將這家深陷困境的公司的收入翻五倍。

到目前為止,,馬斯克搖擺不定,、競(jìng)購后宣布暫停,對(duì)推特公司的運(yùn)營(yíng)和股東來說是一場(chǎng)災(zāi)難,。在今年4月同意以每股54.20美元的價(jià)格將推特公司變成一家私人控股公司后,,馬斯克在幾周后開始拖延時(shí)間,聲稱該平臺(tái)上“機(jī)器人”和虛假賬戶的數(shù)量遠(yuǎn)遠(yuǎn)高于推特公司聲稱的數(shù)量。許多人認(rèn)為馬斯克的這一舉動(dòng)是為了以更低的價(jià)格達(dá)成交易——甚至完全放棄交易,。這個(gè)問題在本報(bào)道發(fā)表時(shí)仍未解決,,但到那時(shí),推特公司的管理層已經(jīng)陷入混亂,,其股價(jià)也已經(jīng)暴跌,。

不過,盡管推特公司遭受重創(chuàng),,但迄今為止,,這筆交易最大的輸家是特斯拉公司(Tesla)的股東,而電動(dòng)汽車巨頭特斯拉公司讓馬斯克成為偶像,。如果馬斯克如愿以償,,成為推特公司的主理人和首席執(zhí)行官,那么這些投資者就將遭受更大的損失,。

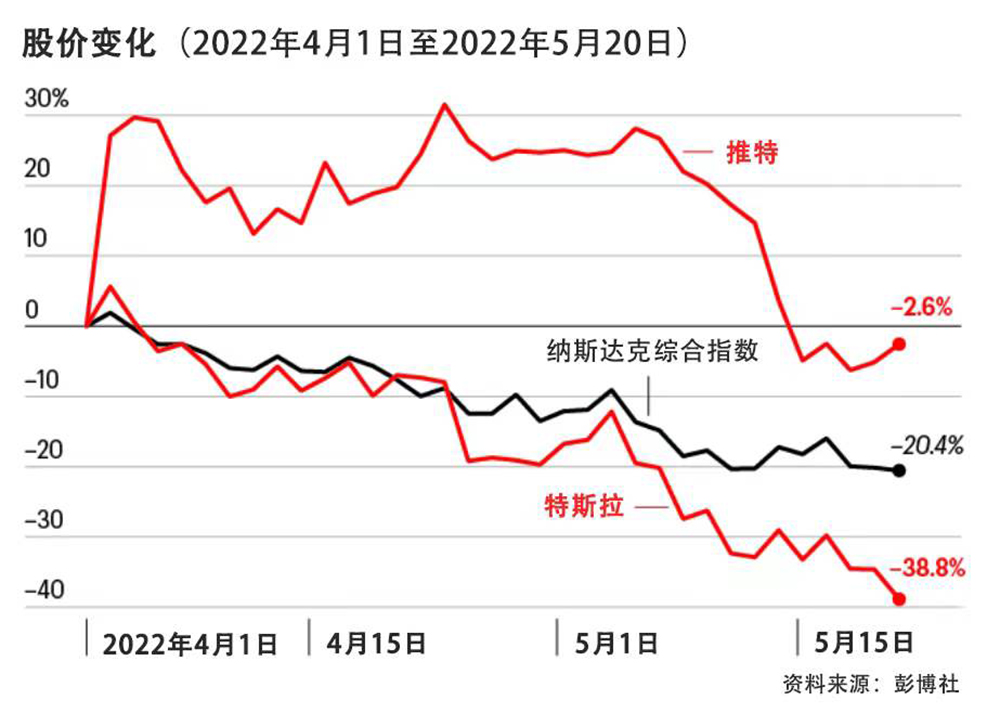

盡管特斯拉公司最大的長(zhǎng)期投資者都沒有公開批評(píng)馬斯克收購?fù)铺毓局e,,但從其股票的大幅拋售中能夠明顯看出,許多投資者對(duì)該交易嗤之以鼻,。從4月1日收盤,,即馬斯克披露其推特公司初始股份之前,到5月20日,,特斯拉的股價(jià)下跌了39%,。股價(jià)下跌抹去了特斯拉公司4330億美元的市值,這是有史以來在如此短的時(shí)間內(nèi)最大的損失之一,。換一種說法:特斯拉公司的市值下跌帶來的損失是馬斯克收購?fù)铺毓咎嶙h的440億美元的近10倍,。

收購?fù)铺毓镜慕灰撞⒉皇翘厮估竟蓛r(jià)下跌的唯一原因(經(jīng)濟(jì)衰退帶來的威脅必然是另一個(gè)原因),。但很容易看出為什么收購?fù)铺毓镜慕灰讜?huì)讓股東們心驚肉跳,。在特斯拉公司自身面臨重大挑戰(zhàn)之際,重振推特公司(一家在低利潤(rùn)行業(yè)中存在嚴(yán)重現(xiàn)金流問題的公司)所面臨的挑戰(zhàn)和成本將極大地分散馬斯克的注意力,。這些挑戰(zhàn),,包括其上海超級(jí)工廠的關(guān)閉、市場(chǎng)份額的下降以及來自全球電動(dòng)汽車新進(jìn)入者的激烈競(jìng)爭(zhēng),,都需要馬斯克全力以赴來應(yīng)對(duì),。突然間,被馬斯克打動(dòng)而相信特斯拉的追隨者開始質(zhì)疑他們的英雄怎么可能為另一家公司展開瘋狂的改革行動(dòng),。

特斯拉迷們并不是唯一一群涉及到金錢得失問題的人,。作為標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)中市值最大的公司之一,特斯拉公司在5月底的市值為6870億美元,,是大盤股指數(shù)基金的主力,。這使其成為數(shù)千萬美國人401(k)s計(jì)劃(養(yǎng)老基金——譯注)和儲(chǔ)備金的一部分。例如,截至4月30日,,特斯拉在先鋒標(biāo)準(zhǔn)普爾500指數(shù)ETF基金(Vanguard S&P 500 ETF)中排名第五位,,占2.1%,高于伯克希爾-哈撒韋公司(Berkshire Hathaway),、聯(lián)合健康集團(tuán)(UnitedHealth Group)和強(qiáng)生公司(Johnson & Johnson),。

當(dāng)然,即使沒有收購?fù)铺毓镜慕灰?,特斯拉的股價(jià)暴跌也可以說是不可避免的,。根據(jù)特斯拉公司在未來幾年內(nèi)能夠?qū)嶋H產(chǎn)生的銷售額和利潤(rùn),其股票被嚴(yán)重高估了,。證券研究公司New Constructs的負(fù)責(zé)人戴維·特雷納說:“馬斯克是個(gè)天才,,但也是個(gè)狡猾的經(jīng)營(yíng)者,他通過炒作的方式讓特斯拉公司坐上了火箭飛船,?!睙o論結(jié)果如何,收購?fù)铺毓镜倪@場(chǎng)鬧劇都可以證明泡沫破滅,。

以下是推特公司收購案對(duì)特斯拉公司未來構(gòu)成的五大威脅——除了高管分心之外,。

治理推特公司的費(fèi)用。在向貸方和投資者的介紹中,,馬斯克為推特公司設(shè)定了幾乎不可能實(shí)現(xiàn)的目標(biāo),。最值得注意的是,他的目標(biāo)是將用戶群從2021年的2.17億增加到2028年的近10億,。投行Jefferies的分析師布倫特·蒂爾指出,,他所了解的任何社交媒體平臺(tái)——包括Facebook——都沒有這么快的擴(kuò)張,而且推特在年輕用戶中缺乏人氣,,無法實(shí)現(xiàn)快速增長(zhǎng),。

但更大的問題是,用戶群增長(zhǎng)需要資金,,而這一成本可能會(huì)以犧牲特斯拉公司的投資者為代價(jià),。為了達(dá)成這筆交易的融資,馬斯克已經(jīng)出售了他所持有的大約6%的特斯拉股份,,價(jià)值85億美元,。一位內(nèi)部人士告訴《財(cái)富》雜志,如果交易完成,,馬斯克可能會(huì)持有超過50%的推特公司股份,。但這筆交易還要求推特公司承擔(dān)130億美元的巨額新債,每年的利息約為6.5億美元,。

長(zhǎng)話短說:這些利息可能會(huì)耗盡推特公司所有的運(yùn)營(yíng)現(xiàn)金,,因此,,沒有任何資本支出能夠用于建設(shè)技術(shù)基礎(chǔ)設(shè)施以支持更大的用戶群。如果推特公司的業(yè)績(jī)沒有改善,,馬斯克就將面臨壓力,,需要彌補(bǔ)任何損失,甚至需要提供數(shù)十億美元的新資本,。而這反過來又加劇了馬斯克需要出售更多特斯拉股票的風(fēng)險(xiǎn),,可能會(huì)持續(xù)引發(fā)股票下跌。

保證金貸款的危險(xiǎn),。馬斯克的融資藍(lán)圖包括質(zhì)押他自己的312.5億美元特斯拉股票——按當(dāng)前價(jià)格計(jì)算約為4400萬股——為收購?fù)铺毓精@得62.5億美元的貸款,。根據(jù)特斯拉公司最近披露的財(cái)務(wù)信息,馬斯克此前已經(jīng)將8800萬股股票質(zhì)押用于其他借款,,但目前尚不清楚他使用了多少信貸,。因此,如果他真的動(dòng)用了這62.5億美元,,他就將總共質(zhì)押他完全擁有的特斯拉股份的80%左右,。

但內(nèi)部人士的巨額保證金貸款給所有股東帶來了巨大的危險(xiǎn)。如果特斯拉的股價(jià)因?yàn)槿魏卧蚣眲∠碌热?,因?yàn)樗チ耸袌?chǎng)份額——馬斯克的貸方就可以要求他提供更多現(xiàn)金作為抵押,。而這反過來又可能迫使他出售更多股票,從而將股票帶入死亡陷阱,。能夠肯定的是,,價(jià)格急劇下跌才會(huì)引發(fā)追加保證金。但由于特斯拉的價(jià)格相對(duì)于它的業(yè)績(jī)來說是如此之高——它的市盈率仍然接近90——這種下跌的可能性比一家擁有更大,、更安全現(xiàn)金流的老牌公司要大得多,。

中國難題。馬斯克非常依賴中國的電動(dòng)汽車銷售和生產(chǎn)來推動(dòng)特斯拉的增長(zhǎng),。去年,,中國的銷售額約占特斯拉總收入的四分之一。盡管短缺問題阻礙了上海工廠的發(fā)展,,馬斯克仍然實(shí)現(xiàn)將其產(chǎn)能翻一番,,達(dá)到每年100萬輛的巨大規(guī)模,。

開放平臺(tái)的危險(xiǎn),。通過收購?fù)铺毓荆R斯克將進(jìn)入并駕馭一個(gè)高度政治化的領(lǐng)域,。他冒著失去特斯拉客戶的風(fēng)險(xiǎn),。美國證券交易委員會(huì)(Securities and Exchange Commission)的前高級(jí)審判律師、律師事務(wù)所Moses & Singer的合伙人霍華德·費(fèi)舍爾說:“他說他會(huì)讓特朗普回歸推特,,這個(gè)網(wǎng)站可能會(huì)成為右翼巨頭的游樂場(chǎng),。本來會(huì)購買特斯拉汽車的人,,會(huì)被拒之門外,轉(zhuǎn)而購買雪佛蘭(Chevrolet)的Bolt電動(dòng)汽車或其他車型,。將你的品牌與50%的美國人不贊成的觀點(diǎn)聯(lián)系起來可能是一個(gè)錯(cuò)誤,。”

馬斯克對(duì)美國證券交易委員會(huì),。美國證券交易委員會(huì)和馬斯克不是朋友關(guān)系——馬斯克收購?fù)铺毓究赡軙?huì)讓雙方的關(guān)系變得更糟,。監(jiān)管機(jī)構(gòu)指控馬斯克犯有證券欺詐罪,因?yàn)樗?018年的推文中聲稱,,他已經(jīng)獲得了將特斯拉私有化的融資,。馬斯克支付了2000萬美元的罰款,并同意在三年內(nèi)不再擔(dān)任這家電動(dòng)汽車制造商的董事長(zhǎng),。

現(xiàn)在,,馬斯克面臨來自推特公司股東的訴訟,指控他在規(guī)定日期后數(shù)周才披露他對(duì)該公司的初始投資,,違反了證券法規(guī),。這個(gè)問題可能會(huì)引發(fā)美國證券交易委員會(huì)的另一次調(diào)查。馬斯克越是激怒美國證券交易委員會(huì),,該機(jī)構(gòu)就越有可能仔細(xì)審查他關(guān)于特斯拉前景的陳述,。特斯拉驚人的估值部分取決于對(duì)未來多年巨大增長(zhǎng)的信心。讓美國證券交易委員會(huì)不斷質(zhì)疑馬斯克在開空頭支票可能會(huì)打破這種說法,。

特斯拉泡沫,。當(dāng)特斯拉公司股價(jià)達(dá)到1100美元,公司估值達(dá)到1萬億美元時(shí),,New Constructs的特雷納整理了一些數(shù)據(jù)來回答一個(gè)亟待解決的問題:特斯拉需要發(fā)展到什么程度才可以證明這個(gè)價(jià)格是合理的,?結(jié)論:特斯拉公司需要實(shí)現(xiàn)極大的發(fā)展,比現(xiàn)實(shí)中能夠?qū)崿F(xiàn)的發(fā)展的規(guī)模大的多,。根據(jù)特雷納的說法,,到2030年,特斯拉每年需要銷售1500萬輛汽車,,高于去年的93.1萬輛,;根據(jù)國際能源署(International Energy Agency)的銷售預(yù)測(cè),這意味著占據(jù)全球電動(dòng)汽車市場(chǎng)57%的份額,。

回到此時(shí)此地,,越來越多的競(jìng)爭(zhēng)對(duì)手正在電動(dòng)汽車領(lǐng)域站穩(wěn)腳跟,而特斯拉公司的主導(dǎo)地位已經(jīng)在下滑,。根據(jù)New Constructs和EV-volumes.com的數(shù)據(jù),,其全球電動(dòng)汽車市場(chǎng)份額從2019年的16%下滑至去年的14%,2021年其在美國的市場(chǎng)份額為70%,,同比下降9個(gè)百分點(diǎn),。

特雷納認(rèn)為特斯拉公司的合理估值是多少,?他最樂觀的預(yù)測(cè)是,特斯拉公司將在2030年售出700萬輛汽車,,占全球交付量的27%(與今天相比有很大的增長(zhǎng)),,利潤(rùn)率為9%,這將與豐田汽車(Toyota)近年來公布的行業(yè)領(lǐng)先數(shù)字持平,。在這種情況下,,特斯拉股票如今的真實(shí)價(jià)值是200美元——僅僅是當(dāng)前價(jià)格的四分之一。特雷納補(bǔ)充說:“如果特斯拉公司未能達(dá)到這些預(yù)期,,那么該公司的估值就將比如今的估值低,。”

總之:無論馬斯克做什么,,特斯拉公司的估值都注定會(huì)大幅下跌,。他可以保持其作為世界上最有價(jià)值——甚至是最重要的——汽車制造商的地位,但前提是他必須聚焦汽車領(lǐng)域,,放棄執(zhí)掌推特公司,。特斯拉股價(jià)進(jìn)一步下跌帶來的震驚,可能說服馬斯克結(jié)束他的推特公司收購案,。在經(jīng)歷了資本主義史上最快的超級(jí)明星崛起之后,,他大概不希望出現(xiàn)同樣戲劇性的下跌。(財(cái)富中文網(wǎng))

本文另一版本登載于《財(cái)富》雜志2022年6/7月刊,,標(biāo)題為《馬斯克收購?fù)铺刂凶畲蟮妮敿遥禾厮估耐顿Y者》(The big losers in Musk’s Twitter bid: Tesla investors),。

譯者:中慧言-王芳

埃隆·馬斯克收購?fù)铺毓荆═witter)本身便是一個(gè)巨大的商業(yè)故事,但它隱藏了一個(gè)更大的商業(yè)故事,。

此次競(jìng)購讓媒體對(duì)馬斯克收購目標(biāo)計(jì)劃議論紛紛,。這位大亨希望將這家社交媒體平臺(tái)轉(zhuǎn)變?yōu)橐粋€(gè)言論自由的城市廣場(chǎng),這可能意味著恢復(fù)美國前總統(tǒng)唐納德·特朗普的社交媒體賬號(hào),,讓推特成為他的傳聲筒,。專家們想知道,這位特立獨(dú)行的人是否真的能夠像他承諾的那樣,,可以在五年內(nèi)將這家深陷困境的公司的收入翻五倍,。

到目前為止,馬斯克搖擺不定,、競(jìng)購后宣布暫停,,對(duì)推特公司的運(yùn)營(yíng)和股東來說是一場(chǎng)災(zāi)難。在今年4月同意以每股54.20美元的價(jià)格將推特公司變成一家私人控股公司后,,馬斯克在幾周后開始拖延時(shí)間,,聲稱該平臺(tái)上“機(jī)器人”和虛假賬戶的數(shù)量遠(yuǎn)遠(yuǎn)高于推特公司聲稱的數(shù)量。許多人認(rèn)為馬斯克的這一舉動(dòng)是為了以更低的價(jià)格達(dá)成交易——甚至完全放棄交易,。這個(gè)問題在本報(bào)道發(fā)表時(shí)仍未解決,,但到那時(shí),推特公司的管理層已經(jīng)陷入混亂,,其股價(jià)也已經(jīng)暴跌,。

不過,盡管推特公司遭受重創(chuàng),,但迄今為止,,這筆交易最大的輸家是特斯拉公司(Tesla)的股東,而電動(dòng)汽車巨頭特斯拉公司讓馬斯克成為偶像,。如果馬斯克如愿以償,,成為推特公司的主理人和首席執(zhí)行官,那么這些投資者就將遭受更大的損失,。

盡管特斯拉公司最大的長(zhǎng)期投資者都沒有公開批評(píng)馬斯克收購?fù)铺毓局e,,但從其股票的大幅拋售中能夠明顯看出,許多投資者對(duì)該交易嗤之以鼻,。從4月1日收盤,,即馬斯克披露其推特公司初始股份之前,到5月20日,,特斯拉的股價(jià)下跌了39%,。股價(jià)下跌抹去了特斯拉公司4330億美元的市值,這是有史以來在如此短的時(shí)間內(nèi)最大的損失之一,。換一種說法:特斯拉公司的市值下跌帶來的損失是馬斯克收購?fù)铺毓咎嶙h的440億美元的近10倍,。

收購?fù)铺毓镜慕灰撞⒉皇翘厮估竟蓛r(jià)下跌的唯一原因(經(jīng)濟(jì)衰退帶來的威脅必然是另一個(gè)原因)。但很容易看出為什么收購?fù)铺毓镜慕灰讜?huì)讓股東們心驚肉跳,。在特斯拉公司自身面臨重大挑戰(zhàn)之際,,重振推特公司(一家在低利潤(rùn)行業(yè)中存在嚴(yán)重現(xiàn)金流問題的公司)所面臨的挑戰(zhàn)和成本將極大地分散馬斯克的注意力。這些挑戰(zhàn),,包括其上海超級(jí)工廠的關(guān)閉,、市場(chǎng)份額的下降以及來自全球電動(dòng)汽車新進(jìn)入者的激烈競(jìng)爭(zhēng),都需要馬斯克全力以赴來應(yīng)對(duì),。突然間,,被馬斯克打動(dòng)而相信特斯拉的追隨者開始質(zhì)疑他們的英雄怎么可能為另一家公司展開瘋狂的改革行動(dòng)。

特斯拉迷們并不是唯一一群涉及到金錢得失問題的人,。作為標(biāo)準(zhǔn)普爾500指數(shù)(S&P 500)中市值最大的公司之一,,特斯拉公司在5月底的市值為6870億美元,是大盤股指數(shù)基金的主力,。這使其成為數(shù)千萬美國人401(k)s計(jì)劃(養(yǎng)老基金——譯注)和儲(chǔ)備金的一部分,。例如,截至4月30日,,特斯拉在先鋒標(biāo)準(zhǔn)普爾500指數(shù)ETF基金(Vanguard S&P 500 ETF)中排名第五位,,占2.1%,,高于伯克希爾-哈撒韋公司(Berkshire Hathaway)、聯(lián)合健康集團(tuán)(UnitedHealth Group)和強(qiáng)生公司(Johnson & Johnson),。

當(dāng)然,,即使沒有收購?fù)铺毓镜慕灰祝厮估墓蓛r(jià)暴跌也可以說是不可避免的,。根據(jù)特斯拉公司在未來幾年內(nèi)能夠?qū)嶋H產(chǎn)生的銷售額和利潤(rùn),,其股票被嚴(yán)重高估了。證券研究公司New Constructs的負(fù)責(zé)人戴維·特雷納說:“馬斯克是個(gè)天才,,但也是個(gè)狡猾的經(jīng)營(yíng)者,,他通過炒作的方式讓特斯拉公司坐上了火箭飛船?!睙o論結(jié)果如何,,收購?fù)铺毓镜倪@場(chǎng)鬧劇都可以證明泡沫破滅。

以下是推特公司收購案對(duì)特斯拉公司未來構(gòu)成的五大威脅——除了高管分心之外,。

治理推特公司的費(fèi)用,。在向貸方和投資者的介紹中,馬斯克為推特公司設(shè)定了幾乎不可能實(shí)現(xiàn)的目標(biāo),。最值得注意的是,,他的目標(biāo)是將用戶群從2021年的2.17億增加到2028年的近10億。投行Jefferies的分析師布倫特·蒂爾指出,,他所了解的任何社交媒體平臺(tái)——包括Facebook——都沒有這么快的擴(kuò)張,,而且推特在年輕用戶中缺乏人氣,無法實(shí)現(xiàn)快速增長(zhǎng),。

但更大的問題是,,用戶群增長(zhǎng)需要資金,而這一成本可能會(huì)以犧牲特斯拉公司的投資者為代價(jià),。為了達(dá)成這筆交易的融資,,馬斯克已經(jīng)出售了他所持有的大約6%的特斯拉股份,價(jià)值85億美元,。一位內(nèi)部人士告訴《財(cái)富》雜志,,如果交易完成,馬斯克可能會(huì)持有超過50%的推特公司股份,。但這筆交易還要求推特公司承擔(dān)130億美元的巨額新債,,每年的利息約為6.5億美元。

長(zhǎng)話短說:這些利息可能會(huì)耗盡推特公司所有的運(yùn)營(yíng)現(xiàn)金,,因此,,沒有任何資本支出能夠用于建設(shè)技術(shù)基礎(chǔ)設(shè)施以支持更大的用戶群。如果推特公司的業(yè)績(jī)沒有改善,馬斯克就將面臨壓力,,需要彌補(bǔ)任何損失,,甚至需要提供數(shù)十億美元的新資本。而這反過來又加劇了馬斯克需要出售更多特斯拉股票的風(fēng)險(xiǎn),,可能會(huì)持續(xù)引發(fā)股票下跌,。

保證金貸款的危險(xiǎn),。馬斯克的融資藍(lán)圖包括質(zhì)押他自己的312.5億美元特斯拉股票——按當(dāng)前價(jià)格計(jì)算約為4400萬股——為收購?fù)铺毓精@得62.5億美元的貸款,。根據(jù)特斯拉公司最近披露的財(cái)務(wù)信息,馬斯克此前已經(jīng)將8800萬股股票質(zhì)押用于其他借款,,但目前尚不清楚他使用了多少信貸,。因此,如果他真的動(dòng)用了這62.5億美元,,他就將總共質(zhì)押他完全擁有的特斯拉股份的80%左右,。

但內(nèi)部人士的巨額保證金貸款給所有股東帶來了巨大的危險(xiǎn)。如果特斯拉的股價(jià)因?yàn)槿魏卧蚣眲∠碌热?,因?yàn)樗チ耸袌?chǎng)份額——馬斯克的貸方就可以要求他提供更多現(xiàn)金作為抵押,。而這反過來又可能迫使他出售更多股票,從而將股票帶入死亡陷阱,。能夠肯定的是,,價(jià)格急劇下跌才會(huì)引發(fā)追加保證金。但由于特斯拉的價(jià)格相對(duì)于它的業(yè)績(jī)來說是如此之高——它的市盈率仍然接近90——這種下跌的可能性比一家擁有更大,、更安全現(xiàn)金流的老牌公司要大得多,。

中國難題。馬斯克非常依賴中國的電動(dòng)汽車銷售和生產(chǎn)來推動(dòng)特斯拉的增長(zhǎng),。去年,,中國的銷售額約占特斯拉總收入的四分之一。盡管短缺問題阻礙了上海工廠的發(fā)展,,馬斯克仍然實(shí)現(xiàn)將其產(chǎn)能翻一番,,達(dá)到每年100萬輛的巨大規(guī)模。

開放平臺(tái)的危險(xiǎn),。通過收購?fù)铺毓?,馬斯克將進(jìn)入并駕馭一個(gè)高度政治化的領(lǐng)域。他冒著失去特斯拉客戶的風(fēng)險(xiǎn),。美國證券交易委員會(huì)(Securities and Exchange Commission)的前高級(jí)審判律師,、律師事務(wù)所Moses & Singer的合伙人霍華德·費(fèi)舍爾說:“他說他會(huì)讓特朗普回歸推特,這個(gè)網(wǎng)站可能會(huì)成為右翼巨頭的游樂場(chǎng),。本來會(huì)購買特斯拉汽車的人,,會(huì)被拒之門外,轉(zhuǎn)而購買雪佛蘭(Chevrolet)的Bolt電動(dòng)汽車或其他車型。將你的品牌與50%的美國人不贊成的觀點(diǎn)聯(lián)系起來可能是一個(gè)錯(cuò)誤,?!?/p>

馬斯克對(duì)美國證券交易委員會(huì)。美國證券交易委員會(huì)和馬斯克不是朋友關(guān)系——馬斯克收購?fù)铺毓究赡軙?huì)讓雙方的關(guān)系變得更糟,。監(jiān)管機(jī)構(gòu)指控馬斯克犯有證券欺詐罪,,因?yàn)樗?018年的推文中聲稱,他已經(jīng)獲得了將特斯拉私有化的融資,。馬斯克支付了2000萬美元的罰款,,并同意在三年內(nèi)不再擔(dān)任這家電動(dòng)汽車制造商的董事長(zhǎng)。

現(xiàn)在,,馬斯克面臨來自推特公司股東的訴訟,,指控他在規(guī)定日期后數(shù)周才披露他對(duì)該公司的初始投資,違反了證券法規(guī),。這個(gè)問題可能會(huì)引發(fā)美國證券交易委員會(huì)的另一次調(diào)查,。馬斯克越是激怒美國證券交易委員會(huì),該機(jī)構(gòu)就越有可能仔細(xì)審查他關(guān)于特斯拉前景的陳述,。特斯拉驚人的估值部分取決于對(duì)未來多年巨大增長(zhǎng)的信心,。讓美國證券交易委員會(huì)不斷質(zhì)疑馬斯克在開空頭支票可能會(huì)打破這種說法。

特斯拉泡沫,。當(dāng)特斯拉公司股價(jià)達(dá)到1100美元,,公司估值達(dá)到1萬億美元時(shí),New Constructs的特雷納整理了一些數(shù)據(jù)來回答一個(gè)亟待解決的問題:特斯拉需要發(fā)展到什么程度才可以證明這個(gè)價(jià)格是合理的,?結(jié)論:特斯拉公司需要實(shí)現(xiàn)極大的發(fā)展,比現(xiàn)實(shí)中能夠?qū)崿F(xiàn)的發(fā)展的規(guī)模大的多,。根據(jù)特雷納的說法,,到2030年,特斯拉每年需要銷售1500萬輛汽車,,高于去年的93.1萬輛,;根據(jù)國際能源署(International Energy Agency)的銷售預(yù)測(cè),這意味著占據(jù)全球電動(dòng)汽車市場(chǎng)57%的份額,。

回到此時(shí)此地,,越來越多的競(jìng)爭(zhēng)對(duì)手正在電動(dòng)汽車領(lǐng)域站穩(wěn)腳跟,而特斯拉公司的主導(dǎo)地位已經(jīng)在下滑,。根據(jù)New Constructs和EV-volumes.com的數(shù)據(jù),,其全球電動(dòng)汽車市場(chǎng)份額從2019年的16%下滑至去年的14%,2021年其在美國的市場(chǎng)份額為70%,,同比下降9個(gè)百分點(diǎn),。

特雷納認(rèn)為特斯拉公司的合理估值是多少,?他最樂觀的預(yù)測(cè)是,特斯拉公司將在2030年售出700萬輛汽車,,占全球交付量的27%(與今天相比有很大的增長(zhǎng)),,利潤(rùn)率為9%,這將與豐田汽車(Toyota)近年來公布的行業(yè)領(lǐng)先數(shù)字持平,。在這種情況下,,特斯拉股票如今的真實(shí)價(jià)值是200美元——僅僅是當(dāng)前價(jià)格的四分之一。特雷納補(bǔ)充說:“如果特斯拉公司未能達(dá)到這些預(yù)期,,那么該公司的估值就將比如今的估值低,。”

總之:無論馬斯克做什么,,特斯拉公司的估值都注定會(huì)大幅下跌,。他可以保持其作為世界上最有價(jià)值——甚至是最重要的——汽車制造商的地位,,但前提是他必須聚焦汽車領(lǐng)域,,放棄執(zhí)掌推特公司,。特斯拉股價(jià)進(jìn)一步下跌帶來的震驚,,可能說服馬斯克結(jié)束他的推特公司收購案。在經(jīng)歷了資本主義史上最快的超級(jí)明星崛起之后,,他大概不希望出現(xiàn)同樣戲劇性的下跌。(財(cái)富中文網(wǎng))

本文另一版本登載于《財(cái)富》雜志2022年6/7月刊,,標(biāo)題為《馬斯克收購?fù)铺刂凶畲蟮妮敿遥禾厮估耐顿Y者》(The big losers in Musk’s Twitter bid: Tesla investors)。

譯者:中慧言-王芳

Elon Musk’s campaign to buy Twitter is a big business story that’s masking an even bigger one.

The bid has had the media buzzing about Musk’s plans for his takeover target. The mogul wants to transform the social media platform into an anything-goes town square, which might mean restoring Donald Trump’s megaphone. And pundits wonder whether the maverick can really quintuple the ailing company’s revenues in five years, as he’s been promising.

So far, Musk’s vacillating, race-then-retreat pursuit has been a disaster for Twitter’s operations and stockholders. After agreeing in April to take Twitter private at $54.20 a share, Musk began stalling a few weeks later, alleging that the number of “bots” and fake accounts on the platform was far higher than Twitter claimed. Many have seen that gambit as an effort by Musk to recast the deal at a far lower price—or even walk away entirely. That issue was unresolved as this story went to press, but by then Twitter’s management ranks were in turmoil, and its shares had cratered.

Still, despite the pummeling that Twitter has taken, the deal’s biggest losers thus far are shareholders at the company that made Musk an icon: Tesla, the electric-car juggernaut. And those investors stand to lose far more if Musk gets his wish and becomes Twitter’s principal owner and CEO.

Though none of the biggest, long-standing Tesla investors have publicly criticized Musk’s Twitter play, it’s obvious from the sharp selloff in its shares that many investors despise the deal. Between the market closes on April 1, just before Musk disclosed his initial Twitter stake, and May 20, Tesla’s stock crumbled 39%. The nosedive erased $433 billion in value, one of the largest wipeouts ever over such a short span. To frame it differently: Tesla’s market cap fell by almost 10 times the $44 billion Musk offered for Twitter.

The Twitter deal isn’t the only reason Tesla is down (the threat of recession is certainly another). But it’s easy to see why it makes shareholders squeamish. The challenge and the cost of fixing Twitter—a company with big cash-flow problems in a low-margin industry—would create a huge distraction for Musk at a time when Tesla faces major challenges of its own. Those challenges, including shutdowns at its gigafactory in Shanghai, falling market share, and burgeoning competition from new EV entrants worldwide, demand Musk’s full commitment. Suddenly, the followers whom Musk has moved to believe in Tesla are questioning how their hero could embark on a crazy crusade for another company.

Fanboys and girls aren’t the only ones with money at stake. As one of the biggest companies in the S&P 500 by market cap, at $687 billion in late May, Tesla is a staple in large-cap index funds. That makes it part of the 401(k)s and nest eggs of tens of millions of Americans. For example, as of April 30, Tesla ranked as the fifth-largest holding in the Vanguard S&P 500 ETF at 2.1%, above Berkshire Hathaway, UnitedHealth Group, and Johnson & Johnson.

Of course, Tesla’s share price tumble was arguably inevitable even without the Twitter deal. Tesla’s stock is hugely overvalued based on the sales and profits it can realistically generate in the years to come. “Musk is a genius, but also a slick operator who’s able to keep Tesla on a rocket-ship ride by using hype,” says David Trainer, chief of equity research firm New Constructs. The Twitter sideshow, whichever way it turns out, could prove the bubble-buster.

Here are the five biggest threats—beyond executive distraction—that the Twitter takeover drama poses to Tesla’s future.

*****

The cost of a fixer-upper. In presentations to lenders and investors, Musk has set nearly impossible goals for Twitter. Most notably, he aims to grow the user base from 217 million in 2021 to almost 1 billion by 2028. Analyst Brent Thill of Jefferies notes that no social media platform he covers—including Facebook—has ever expanded remotely that fast, and that Twitter lacks the popularity among young users to achieve rapid growth.

But the bigger problem is that growth costs money, and that cost might come at Tesla investors’ expense. To help finance the deal, Musk has already sold around 6% of his Tesla holdings, for $8.5 billion. An insider tells Fortune that the deal, if consummated, is likely to leave Musk holding over 50% of Twitter’s shares. But the deal also calls for Twitter to assume a gigantic $13 billion in new debt, costing around $650 million a year in interest.

Long story short: That interest is likely to absorb all of Twitter’s cash from operations, leaving nothing for the kind of capital expenditures that will be needed to build the tech infrastructure to support a bigger user base. If Twitter’s performance doesn’t improve, Musk will be under pressure to cover any losses or even contribute billions in new capital. And that, in turn, heightens the risk that Musk will need to sell far more Tesla shares, potentially triggering a downward cascade.

*****

Margin-loan danger. Musk’s financing blueprint involves pledging $31.25 billion of his own Tesla stock—about 44 million shares, at current prices—to secure a $6.25 billion loan for the Twitter takeover. According to Tesla’s most recent financial disclosures, Musk has previously margined 88 million shares for other borrowings, though it’s unclear how much of that credit he’s used. Hence, if indeed he taps the $6.25 billion, he’ll have pledged in total around 80% of the Tesla shares he owns outright.

But huge margin loans for insiders pose big dangers for all shareholders. If Tesla’s share price falls steeply, for any reason—because it loses market share, say—Musk’s lenders can require more cash from him as collateral. And that in turn could force him to sell more shares, creating a death spiral for the stock. To be sure, it would take a sharp price decrease to trigger margin calls. But because Tesla’s price is so high relative to its performance—its P/E is still almost 90—the odds of such a decline are much greater than they would be for an established company with bigger, safer cash flows.

*****

The China conundrum. Musk is counting heavily on China for sales and production of EVs to drive Tesla’s growth. Last year, sales in China accounted for around one-quarter of Tesla’s total revenues. And though shortages are hobbling his Shanghai factory, Musk is still doubling its capacity to a gigantic 1 million cars a year.

*****

Open-platform perils. By purchasing Twitter, Musk would be entering and navigating a highly politicized sphere. He’d hazard losing natural Tesla customers. “He says he’ll put Trump back on Twitter, and the site could become a playground for right-wing trolls,” says Howard Fischer, a former senior trial counsel for the Securities and Exchange Commission and a partner at law firm Moses & Singer. “People who would otherwise buy a Tesla car would get turned off and purchase a ChevyBolt or another model instead. It could be a mistake to associate your brand with ideas that 50% of Americans don’t like.”

*****

Musk vs. the SEC. The SEC and Musk are not pals—and Musk buying Twitter could make the relationship worse. The regulator charged Musk with securities fraud over his 2018 tweets claiming that he’d secured the financing to take Tesla private. He paid a fine of $20 million and agreed to step down as the EV-maker’s chairman for three years.

Now Musk faces a lawsuit from Twitter shareholders charging that he violated securities regulations by disclosing his initial investment in the company weeks after the required date. That issue could trigger still another SEC probe. The more Musk riles up the SEC, the more probable the agency will scrutinize his statements on Tesla’s prospects. Tesla’s awesome valuation hinges in part on faith that years of giant growth lie ahead. Having the SEC constantly question the claims of its pied piper could puncture the narrative.

*****

The Tesla bubble. When Tesla stock stood at $1,100, and the company had a $1 trillion valuation, Trainer of New Constructs ran some numbers to answer a burning question: How much would Tesla have to grow to justify that price? The conclusion: much bigger that it can realistically get. According to Trainer, Tesla would need to sell 15 million vehicles a year by 2030, up from 931,000 deliveries last year; that would mean holding 57% of the global EV market, based on sales projections from the International Energy Agency.

Back in the here and now, more competitors are establishing themselves in EVs, and Tesla’s dominance is already slipping. Its worldwide EV market share slid from 16% in 2019 to 14% last year, and its U.S. position was 70% in 2021, down nine points in a year, according to data from New Constructs and EV-volumes.com.

What does Trainer see as a reasonable valuation for Tesla? His most optimistic forecast posits that Tesla will sell 7 million cars in 2030, capturing 27% of global deliveries (a big increase from today), at a 9% profit margin, which would equal the industry-leading numbers posted in recent years by Toyota. In that scenario, the true value of Tesla stock today is $200—barely one-quarter of its current price. “If Tesla fails to meet those expectations,” Trainer adds, “it’s worth less today.”

The bottom line: Tesla’s valuation is destined to fall big-time, whatever Musk does. He can preserve its status as the world’s most valuable—and even most important—automaker, but only if he keeps his eye on the automotive ball and scraps the Twitter lark. And a further drop in Tesla’s shares could be the jolt that persuades Musk to end his quest. After what’s arguably the fastest rise to superstardom in the annals of capitalism, he presumably doesn’t want an equally dramatic fall.

This article appears in the June/July 2022 issue of Fortune with the headline, "The big losers in Musk’s Twitter bid: Tesla investors."