從主權(quán)債券到加密貨幣再到科技股,,剛剛結(jié)束的這個(gè)季度對(duì)投資者來(lái)說(shuō)都很艱難。

事實(shí)上,,根據(jù)德意志銀行的數(shù)據(jù),,這是自2020年第一季度(新冠肺炎疫情封鎖季度,投資收益慘淡)以來(lái)股票和固定收益資產(chǎn)表現(xiàn)最糟糕的一個(gè)季度,。不過(guò),,這一次,不僅僅是因?yàn)樾鹿诜窝滓咔?,而且還因?yàn)樵诖似陂g一眾金融騙子壓低風(fēng)險(xiǎn)資產(chǎn),。

德意志銀行主題研究團(tuán)隊(duì)的吉姆·里德(Jim Reid)和亨利·艾倫(Henry Allen)在周五的投資者綜述中寫(xiě)道:“第一季度的金融市場(chǎng)經(jīng)歷了戲劇性時(shí)期,這一時(shí)期,,俄烏沖突爆發(fā),,通貨膨脹加速,美聯(lián)儲(chǔ)開(kāi)始新一輪加息周期,,此外,,2年期和10年期美國(guó)國(guó)債收益率曲線倒掛。這種動(dòng)蕩意味著我們樣本中的大多數(shù)資產(chǎn)在本季度都出現(xiàn)了下跌,,38種非貨幣資產(chǎn)中只有9種處于正值區(qū)域,。”

所謂實(shí)現(xiàn)盈利的九種資產(chǎn)包括大宗商品和萬(wàn)能的美元,。布倫特原油在本季度飆升38%,,推高了各地的通貨膨脹率,并給世界上最大的央行施加了加息壓力,。與此同時(shí),,美元指數(shù)上漲2.8%,這是美元連續(xù)第三個(gè)季度的上漲,。強(qiáng)勢(shì)美元通常會(huì)嚴(yán)重削弱美國(guó)跨國(guó)公司盈利,。

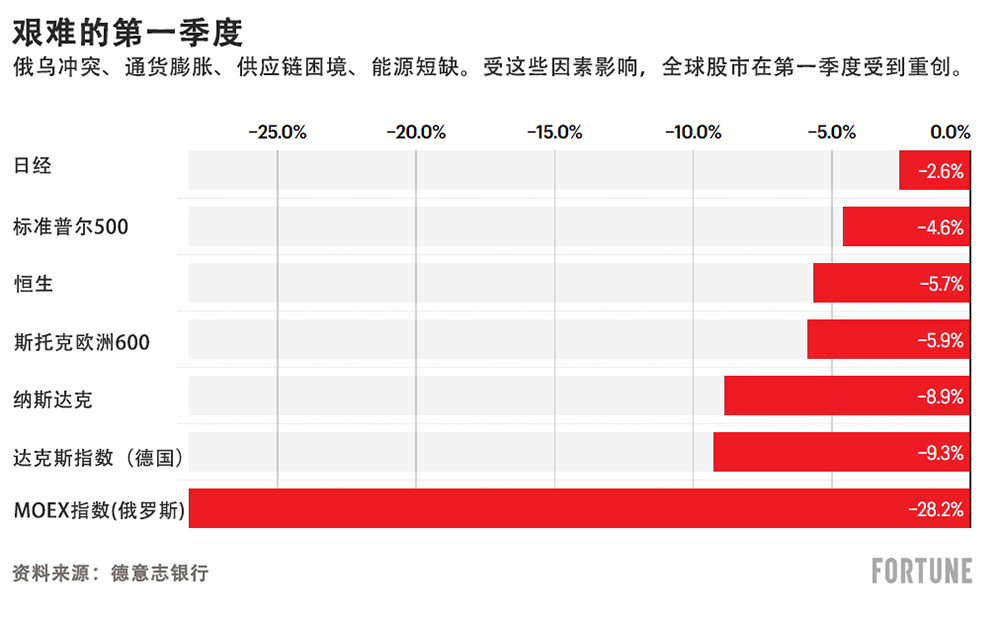

如圖所示,,科技股在上個(gè)季度受到重創(chuàng)。由于美聯(lián)儲(chǔ)開(kāi)始提高利率以抑制通脹,,納斯達(dá)克指數(shù)下跌8.9%,。情況本來(lái)會(huì)更糟,但科技股指數(shù)在3月份實(shí)際上漲了3.5%,。俄羅斯的主要交易所MOEX情況最糟糕,。盡管MOEX在3月的大部分時(shí)間都處于關(guān)閉狀態(tài),但它還是下跌了28.2%,。

標(biāo)準(zhǔn)普爾500指數(shù)情況最差,,該指數(shù)在美國(guó)資產(chǎn)中表現(xiàn)最好或者說(shuō)是“差中最優(yōu)”,總回報(bào)率為-4.6%,。

該圖表沒(méi)有顯示主權(quán)債券的糟糕狀況,。10年期美國(guó)國(guó)債在本季度下跌5.5%,吉姆·里德和亨利·艾倫寫(xiě)道:“這是自1999年以來(lái)最糟糕的季度表現(xiàn),?!迸c此同時(shí),德國(guó)國(guó)債下跌5.1%,。債券暴跌表明投資者對(duì)未來(lái)幾年的經(jīng)濟(jì)增長(zhǎng)越來(lái)越擔(dān)心,。

該圖表也沒(méi)有顯示比特幣的狀況。加密貨幣之王比特幣2022年開(kāi)盤(pán)時(shí)的交易價(jià)格為47,300美元,。今天早上它的交易價(jià)格為45,100美元,,年初至今下跌了2.7%。(財(cái)富中文網(wǎng))

譯者:ZHY

從主權(quán)債券到加密貨幣再到科技股,,剛剛結(jié)束的這個(gè)季度對(duì)投資者來(lái)說(shuō)都很艱難,。

事實(shí)上,根據(jù)德意志銀行的數(shù)據(jù),,這是自2020年第一季度(新冠肺炎疫情封鎖季度,,投資收益慘淡)以來(lái)股票和固定收益資產(chǎn)表現(xiàn)最糟糕的一個(gè)季度。不過(guò),,這一次,,不僅僅是因?yàn)樾鹿诜窝滓咔椋疫€因?yàn)樵诖似陂g一眾金融騙子壓低風(fēng)險(xiǎn)資產(chǎn),。

德意志銀行主題研究團(tuán)隊(duì)的吉姆·里德(Jim Reid)和亨利·艾倫(Henry Allen)在周五的投資者綜述中寫(xiě)道:“第一季度的金融市場(chǎng)經(jīng)歷了戲劇性時(shí)期,,這一時(shí)期,俄烏沖突爆發(fā),,通貨膨脹加速,,美聯(lián)儲(chǔ)開(kāi)始新一輪加息周期,此外,,2年期和10年期美國(guó)國(guó)債收益率曲線倒掛,。這種動(dòng)蕩意味著我們樣本中的大多數(shù)資產(chǎn)在本季度都出現(xiàn)了下跌,,38種非貨幣資產(chǎn)中只有9種處于正值區(qū)域?!?/p>

所謂實(shí)現(xiàn)盈利的九種資產(chǎn)包括大宗商品和萬(wàn)能的美元,。布倫特原油在本季度飆升38%,推高了各地的通貨膨脹率,,并給世界上最大的央行施加了加息壓力,。與此同時(shí),美元指數(shù)上漲2.8%,,這是美元連續(xù)第三個(gè)季度的上漲,。強(qiáng)勢(shì)美元通常會(huì)嚴(yán)重削弱美國(guó)跨國(guó)公司盈利。

科技股在上個(gè)季度受到重創(chuàng),。由于美聯(lián)儲(chǔ)開(kāi)始提高利率以抑制通脹,,納斯達(dá)克指數(shù)下跌8.9%,。情況本來(lái)會(huì)更糟,,但科技股指數(shù)在3月份實(shí)際上漲了3.5%。俄羅斯的主要交易所MOEX情況最糟糕,。盡管MOEX在3月的大部分時(shí)間都處于關(guān)閉狀態(tài),,但它還是下跌了28.2%。

標(biāo)準(zhǔn)普爾500指數(shù)情況最差,,該指數(shù)在美國(guó)資產(chǎn)中表現(xiàn)最好或者說(shuō)是“差中最優(yōu)”,,總回報(bào)率為-4.6%。

該圖表沒(méi)有顯示主權(quán)債券的糟糕狀況,。10年期美國(guó)國(guó)債在本季度下跌5.5%,,吉姆·里德和亨利·艾倫寫(xiě)道:“這是自1999年以來(lái)最糟糕的季度表現(xiàn)?!迸c此同時(shí),,德國(guó)國(guó)債下跌5.1%。債券暴跌表明投資者對(duì)未來(lái)幾年的經(jīng)濟(jì)增長(zhǎng)越來(lái)越擔(dān)心,。

該圖表也沒(méi)有顯示比特幣的狀況,。加密貨幣之王比特幣2022年開(kāi)盤(pán)時(shí)的交易價(jià)格為47,300美元。今天早上它的交易價(jià)格為45,100美元,,年初至今下跌了2.7%,。(財(cái)富中文網(wǎng))

譯者:ZHY

From sovereign bonds to crypto to tech stocks, the quarter that just ended was a rough one for investors.

In fact, it was the worst quarter for stocks and fixed-income assets since Q1 2020, the infamous COVID lockdown quarter, according to Deutsche Bank. This time, though, it wasn't just COVID, but a rogues' gallery of miscreants pushing down risk assets in the period.

"Q1 was a dramatic time in financial markets, featuring Russia’s invasion of Ukraine, accelerating inflation, the start of another hiking cycle from the Federal Reserve, as well as an inversion of the 2s10s yield curve. That turbulence meant that the majority of assets in our sample have lost ground over the quarter, with just nine of the 38 non-currency assets in positive territory," writes Jim Reid and Henry Allen of Deutsche Bank's thematic research team, in an investor roundup note on Friday.

The so-called winning nine included commodities and the almighty dollar. Brent crude soared 38% in the quarter, pushing up inflation everywhere and putting pressure on the world's biggest central banks to begin raising interest rates. The dollar was up 2.8%, meanwhile, its third straight quarter of gains. A strong dollar typically hits the bottom line of U.S. multinationals hard.

As the chart shows, tech bulls got clobbered last quarter. The Nasdaq fell 8.9% as the Federal Reserve began raising interest rates to put the brakes on inflation. It could have been worse. The tech-heavy index actually climbed 3.5% in March. The worst of the bunch? Russia's principal exchange, the MOEX. It fell 28.2% even though it was shut down for most of March.

The booby prize goes to the S&P 500, which turned in the best—or "least worst"—performance for U.S. assets, with a total return of -4.6%.

Not pictured in the chart is the rotten performance of sovereign bonds. Ten-year U.S. Treasuries notes fell 5.5% in the quarter, "their worst quarterly performance since it begins in 1999," Reid and Allen write. German bunds, meanwhile, fell 5.1%. The rout in bonds shows investors are growing increasingly wary about economic growth in the years ahead.

Also not pictured in the chart is Bitcoin. The king of crypto opened 2022 trading at $47,300. This morning it was trading at $45,100, a year-to-date decline of 2.7%.