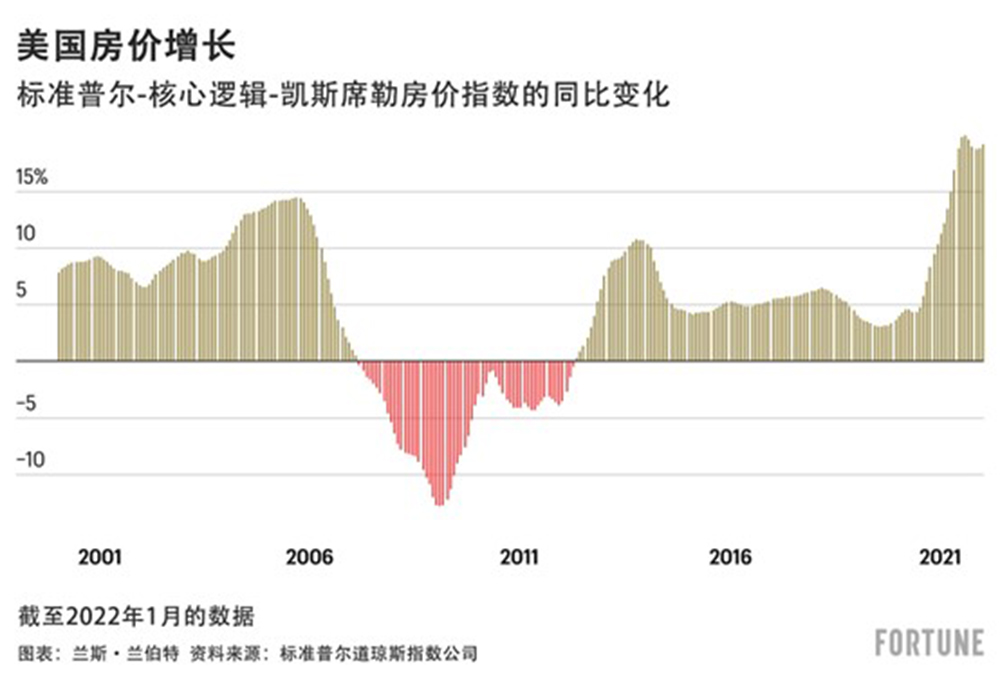

購房者去年暫停找房,,期望2022年房價更友好,,但是現(xiàn)在他們感覺很糟糕。我們周二獲悉,,1月份美國房價同比增長高達(dá)19.2%,,這比去年同期公布的11.3%的漲幅要高。最新的漲幅也遠(yuǎn)高于2008年房地產(chǎn)泡沫前的峰值年增長率(14.5%),。

持續(xù)火熱的房地產(chǎn)市場開始引起更多關(guān)注,。只要看看本周達(dá)拉斯聯(lián)邦儲備銀行發(fā)表的一篇題為“實時市場監(jiān)測發(fā)現(xiàn)美國房地產(chǎn)泡沫正在醞釀的跡象”的論文就知道了。達(dá)拉斯聯(lián)邦儲備銀行研究人員在比較了美國房價與基礎(chǔ)經(jīng)濟(jì)數(shù)據(jù)后得出了這一結(jié)論,。

達(dá)拉斯聯(lián)邦儲備銀行研究人員寫道:“我們的證據(jù)表明,,自21世紀(jì)初的繁榮以來,美國房地產(chǎn)市場行為首次出現(xiàn)異常,。我們擔(dān)憂的原因可以從某些經(jīng)濟(jì)指標(biāo)上看出來……房價似乎越來越與基本面脫節(jié),。”

在新冠肺炎疫情期間,,史上最低的抵押貸款利率和首次購房的千禧一代人口浪潮有助于促進(jìn)房地產(chǎn)市場持續(xù)繁榮,。然而,僅憑這一點并不能解釋房價的暴漲,。研究人員認(rèn)為,,另一個因素可能是“錯失恐懼癥”——或者購房者認(rèn)為如果他們不立馬涌入房地產(chǎn)市場,他們可能會被甩在后面,??紤]到因錯失恐懼癥而購房是上一次房地產(chǎn)泡沫的關(guān)鍵因素,所以這一現(xiàn)象是令人擔(dān)憂的,。

好消息是什么,?盡管達(dá)拉斯聯(lián)邦儲備銀行的研究人員看到了泡沫化的房地產(chǎn)市場,但他們認(rèn)為我們不會走向2008年式的崩盤,。首先,,現(xiàn)今的家庭狀況要好得多,。早在2007年,美國7%的個人可支配收入用于償還抵押貸款債務(wù),。在去年的最新數(shù)據(jù)中,這一數(shù)字僅為3.8%,。

研究人員寫道:“根據(jù)目前的證據(jù),,從規(guī)模或宏觀經(jīng)濟(jì)嚴(yán)重性來看,,預(yù)計住房調(diào)整帶來的影響不可能和2007-2009年全球金融危機(jī)相提并論,。至于其他事項,家庭資產(chǎn)負(fù)債表狀況似乎更好,,過度借貸似乎并沒有助長房地產(chǎn)市場的繁榮,。”

業(yè)內(nèi)人士希望,,飆升的抵押貸款利率——過去12周30年期固定抵押貸款平均利率從3.11%攀升至4.42%——有助于在房價過高導(dǎo)致泡沫破裂之前抑制房價的失控增長,。

本周早些時候,約翰·伯恩斯房地產(chǎn)咨詢公司(John Burns Real Estate Consulting)研究副總裁德文·巴赫曼(Devyn Bachman)告訴《財富》雜志:“如果利率上升到5%以上,,買家就會被擠出市場……更高的利率還可能阻礙投資者活動,,而投資者活動在現(xiàn)今的房屋銷售中占很大比例?!?/p>

早在2006年,,抵押貸款利率迅速飆升。這些更高的利率——當(dāng)時許多家庭的抵押貸款利率是可以調(diào)節(jié)的——最終加速了無數(shù)次級抵押貸款的消亡,,并為不可避免的2008年金融危機(jī)埋下了伏筆,。這一次,至少在理論上,,抵押貸款利率的上升應(yīng)該會帶來不同的結(jié)果,。雖然它肯定會阻止一些潛在買家進(jìn)入市場,但對房主的影響不大,。如今,,約99%的抵押貸款有固定利率。(財富中文網(wǎng))

譯者:ZHY

購房者去年暫停找房,,期望2022年房價更友好,,但是現(xiàn)在他們感覺很糟糕。我們周二獲悉,,1月份美國房價同比增長高達(dá)19.2%,,這比去年同期公布的11.3%的漲幅要高。最新的漲幅也遠(yuǎn)高于2008年房地產(chǎn)泡沫前的峰值年增長率(14.5%),。

持續(xù)火熱的房地產(chǎn)市場開始引起更多關(guān)注,。只要看看本周達(dá)拉斯聯(lián)邦儲備銀行發(fā)表的一篇題為“實時市場監(jiān)測發(fā)現(xiàn)美國房地產(chǎn)泡沫正在醞釀的跡象”的論文就知道了,。達(dá)拉斯聯(lián)邦儲備銀行研究人員在比較了美國房價與基礎(chǔ)經(jīng)濟(jì)數(shù)據(jù)后得出了這一結(jié)論。

達(dá)拉斯聯(lián)邦儲備銀行研究人員寫道:“我們的證據(jù)表明,,自21世紀(jì)初的繁榮以來,,美國房地產(chǎn)市場行為首次出現(xiàn)異常。我們擔(dān)憂的原因可以從某些經(jīng)濟(jì)指標(biāo)上看出來……房價似乎越來越與基本面脫節(jié),?!?/p>

在新冠肺炎疫情期間,史上最低的抵押貸款利率和首次購房的千禧一代人口浪潮有助于促進(jìn)房地產(chǎn)市場持續(xù)繁榮,。然而,,僅憑這一點并不能解釋房價的暴漲。研究人員認(rèn)為,,另一個因素可能是“錯失恐懼癥”——或者購房者認(rèn)為如果他們不立馬涌入房地產(chǎn)市場,,他們可能會被甩在后面??紤]到因錯失恐懼癥而購房是上一次房地產(chǎn)泡沫的關(guān)鍵因素,,所以這一現(xiàn)象是令人擔(dān)憂的。

好消息是什么,?盡管達(dá)拉斯聯(lián)邦儲備銀行的研究人員看到了泡沫化的房地產(chǎn)市場,,但他們認(rèn)為我們不會走向2008年式的崩盤。首先,,現(xiàn)今的家庭狀況要好得多,。早在2007年,美國7%的個人可支配收入用于償還抵押貸款債務(wù),。在去年的最新數(shù)據(jù)中,,這一數(shù)字僅為3.8%。

研究人員寫道:“根據(jù)目前的證據(jù),,從規(guī)?;蚝暧^經(jīng)濟(jì)嚴(yán)重性來看,預(yù)計住房調(diào)整帶來的影響不可能和2007-2009年全球金融危機(jī)相提并論,。至于其他事項,,家庭資產(chǎn)負(fù)債表狀況似乎更好,過度借貸似乎并沒有助長房地產(chǎn)市場的繁榮,?!?/p>

業(yè)內(nèi)人士希望,飆升的抵押貸款利率——過去12周30年期固定抵押貸款平均利率從3.11%攀升至4.42%——有助于在房價過高導(dǎo)致泡沫破裂之前抑制房價的失控增長,。

本周早些時候,,約翰·伯恩斯房地產(chǎn)咨詢公司(John Burns Real Estate Consulting)研究副總裁德文·巴赫曼(Devyn Bachman)告訴《財富》雜志:“如果利率上升到5%以上,買家就會被擠出市場……更高的利率還可能阻礙投資者活動,,而投資者活動在現(xiàn)今的房屋銷售中占很大比例,?!?/p>

早在2006年,抵押貸款利率迅速飆升,。這些更高的利率——當(dāng)時許多家庭的抵押貸款利率是可以調(diào)節(jié)的——最終加速了無數(shù)次級抵押貸款的消亡,,并為不可避免的2008年金融危機(jī)埋下了伏筆。這一次,,至少在理論上,,抵押貸款利率的上升應(yīng)該會帶來不同的結(jié)果。雖然它肯定會阻止一些潛在買家進(jìn)入市場,,但對房主的影響不大。如今,,約99%的抵押貸款有固定利率,。(財富中文網(wǎng))

譯者:ZHY

Home shoppers who paused their search last year, in hopes that 2022 would be friendlier, aren't feeling great: We learned on Tuesday that year-over-year U.S. home price growth accelerated to 19.2% in January. That's up from the 11.3% uptick posted at the same time last year. The latest jump is also well above the peak annual rate (14.5%) posted in the lead-up to the 2008 housing bubble.

That stubbornly hot housing market is beginning to raise more eyebrows. Look no further than a paper published this week by the Federal Reserve Bank of Dallas titled "Real-time market monitoring finds signs of brewing U.S. housing bubble." The Dallas Fed researchers came to that conclusion after comparing U.S. home prices to underlying economic data.

"Our evidence points to abnormal U.S. housing market behavior for the first time since the boom of the early 2000s. Reasons for concern are clear in certain economic indicators...house prices appear increasingly out of step with fundamentals," wrote the Dallas Fed researchers.

Amid the pandemic, historically low mortgage rates and a demographic wave of first-time millennial homebuyers helped to spur the ongoing housing boom. However, that alone can't explain the explosion in home prices. Another factor, argues the researchers, could be "fear-of-missing-out"—or home shoppers who think they could be left behind if they don't rush into the market. That's concerning, considering that FOMO home buying was a key ingredient in the last housing bubble.

The good news? While researchers at the Dallas Fed see a bubbly housing market, they don't think we're headed for a 2008-style crash. For starters, households are in much better shape today. Back in 2007, 7% of U.S. disposable personal income was going towards mortgage debt service payments. At its latest reading last year, that figure was just 3.8%.

"Based on present evidence, there is no expectation that fallout from a housing correction would be comparable to the 2007–09 global financial crisis in terms of magnitude or macroeconomic gravity. Among other things, household balance sheets appear in better shape, and excessive borrowing doesn’t appear to be fueling the housing market boom," writes the researchers.

Industry insiders are hoping that spiking mortgage rates—with the average 30-year fixed mortgage rate climbing from 3.11% to 4.42% over the past 12 weeks—can help to tame runaway home price growth before prices get so high it leads to a bursting bubble.

"If rates rise above 5% you will price buyers out of the market... The higher rates could also discourage investor activity, which accounts for a large portion of home sales today," Devyn Bachman, vice president of research at John Burns Real Estate Consulting, told Fortune earlier this week.

Back in 2006, mortgage rates quickly shot up. Those higher rates—at a time when many households had variable mortgage rates—ultimately sped up the demise of countless subprime mortgages and set the stage for the inevitable 2008 financial crisis. This time, in theory at least, rising mortgage rates should play out differently. While it will certainly deter some would-be buyers from entering the market, it would have little impact on homeowners. These days, around 99% of mortgages have fixed rates.