對于一家全球性企業(yè)來說,,目睹人類的苦難乃至戰(zhàn)爭,往往也是其工作的常態(tài),。不過在2022年2月26日這一天,,雅苒國際公司(Yara International)的首席執(zhí)行官斯韋恩·托雷·霍爾塞瑟根本沒有預(yù)料到,局勢竟然會發(fā)展成后來的樣子,。

雅苒國際是一家擁有117年歷史的挪威化肥公司,,其業(yè)務(wù)遍及全球60多個(gè)國家。幾十年來,,雅苒國際在烏克蘭和俄羅斯都有大量卓有成效的業(yè)務(wù),。烏克蘭是一個(gè)重要的小麥出口國,而俄羅斯則向雅苒國際供應(yīng)了大量鉀肥和磷肥原料,。而就在俄烏沖突爆發(fā)的第三天,,一枚俄羅斯的導(dǎo)彈擊中了雅苒國際在基輔的分公司總部。

由于空襲時(shí)間是清晨,,因而這枚導(dǎo)彈并未造成人員傷亡,。不過在數(shù)日后接受《財(cái)富》雜志采訪時(shí),霍爾塞瑟仍然心有余悸,。他說:“當(dāng)你看見掛著雅苒國際標(biāo)志的辦公樓被炸出一個(gè)大洞時(shí),,你就會發(fā)現(xiàn),戰(zhàn)爭突然變得離你很近了,。這種感覺真的很可怕,。”

像很多其他行業(yè)一樣,,雅苒國際也從另外一個(gè)方面感受到了俄烏戰(zhàn)爭的影響——那就是不斷攀升的能源價(jià)格,。今年3月初的時(shí)候,隨著烏克蘭滿目瘡痍的景象連續(xù)霸占媒體頭條,,世界各國一片嘩然,,全球能源市場也陷入恐慌之中。歐盟(European Union)在2021年花了1080億歐元(約1190億美元)進(jìn)口俄羅斯能源,。但在戰(zhàn)爭爆發(fā)后,,歐盟也表示在今年年底前將把對俄羅斯化石燃料的依賴度降低三分之二。

雖然歐盟最終沒有完全禁止從俄羅斯進(jìn)口能源,,但隨著英國石油(BP),、殼牌(Shell),、道達(dá)爾能源(TotalEnergies)和埃克森美孚(Exxon Mobil)等石油巨頭相繼宣布撤出俄羅斯,,西方實(shí)際上已經(jīng)實(shí)施了抵制俄羅斯能源的政策,。國際能源署(International Energy Agency)警告稱,從今年4月開始,,“隨著制裁生效和買家停止進(jìn)口,,俄羅斯每天可能都要砍掉300萬桶的石油產(chǎn)量?!?/p>

受俄烏沖突影響,,世界各地的石油和天然氣價(jià)格全線上漲。由于能源成本飆升,,3月初的時(shí)候,,全歐洲的企業(yè)(包括雅苒國際在內(nèi))基本上都關(guān)閉了生產(chǎn)線。歐洲的天然氣基準(zhǔn)期貨Title Transfer Facility的價(jià)格在3月7日創(chuàng)下了超過每兆瓦227歐元的紀(jì)錄,?;魻柸忉尩溃骸斑@相當(dāng)于石油價(jià)格漲到每桶600美元。我們實(shí)際上是在背著巨大的負(fù)利潤在生產(chǎn),?!彼€指出,氨肥的生產(chǎn)成本幾乎上漲到了俄烏沖突前的20倍,。

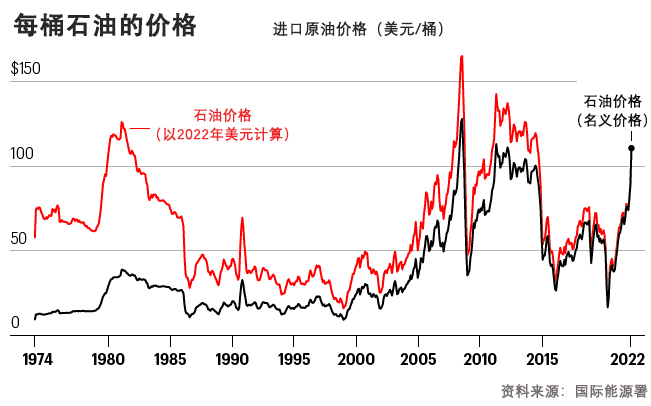

高盛集團(tuán)(Goldman Sachs)的大宗商品研究主管杰夫·柯里指出:“這是1973年也就是歐佩克(OPEC)石油禁運(yùn)那年以來,大宗商品市場漲幅最大的一次,?!?/p>

*****

俄烏沖突也造成了歐洲自二戰(zhàn)以來最嚴(yán)重的人道主義危機(jī),目前戰(zhàn)爭已經(jīng)造成了數(shù)千人死亡,。馬里烏波爾和哈爾科夫等城市已經(jīng)成了一片廢墟,,超過1000萬名的烏克蘭難民被迫離開家園。人類在這場戰(zhàn)爭中遭受的苦難是無法用數(shù)字衡量的,。

這場戰(zhàn)爭也將對全球經(jīng)濟(jì)產(chǎn)生廣泛而深遠(yuǎn)的影響,。石油和天然氣價(jià)格的上漲只是一個(gè)開始,后續(xù)可能還會有一系列連鎖反應(yīng),,比如所有大宗商品價(jià)格的上漲,,到時(shí)候,從面包到電動汽車,,各種門類的商品可能都會漲價(jià),。

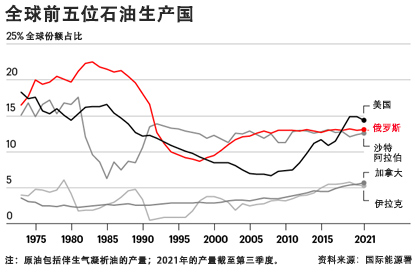

很多經(jīng)濟(jì)學(xué)家、政策制定者和商業(yè)領(lǐng)袖都警告稱,,如果俄烏戰(zhàn)爭繼續(xù)打下去,,全世界的企業(yè)和老百姓就都會受到影響,。俄羅斯是全世界最大的天然氣出口國,也是第二原油出口國和第三大煤炭出口國,。據(jù)經(jīng)合組織(OECD)預(yù)測,,這場戰(zhàn)爭有可能會使今年的全球GDP增長增長率下降整整一個(gè)百分點(diǎn),并將全球通脹率進(jìn)一步推高2.5%,。高盛集團(tuán)也表示,,油價(jià)每上漲10美元,就會抵消幾十億美元的經(jīng)濟(jì)增長,。高盛的分析師指出,,俄烏沖突有40%的可能性會讓美國陷入衰退,而歐洲的情況就更糟了,。

*****

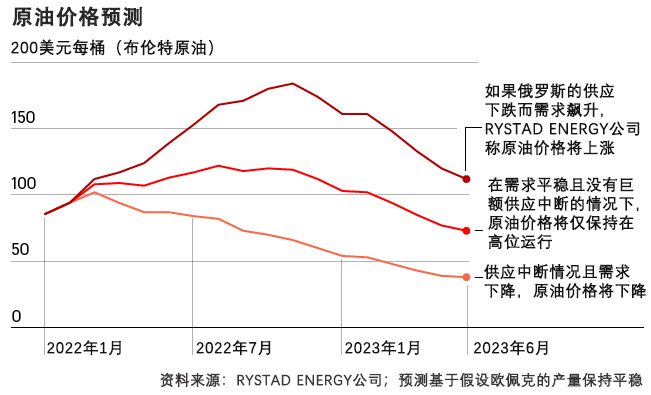

隨著夏季駕車旺季即將到來,,關(guān)于油價(jià)的預(yù)測也是五花八門。巴克萊銀行(Barclays),、美銀證券(BofA Securities)和挪威的能源咨詢與研究機(jī)構(gòu)Rystad Energy均表示,,一旦出現(xiàn)最壞情況,也就是北約(NATO)也卷入了沖突,,那么作為全球石油基準(zhǔn)的布倫特原油價(jià)格將逼近200美元,。Rystad 公司的石油市場部門負(fù)責(zé)人比約納爾·通豪根認(rèn)為,這一預(yù)測“是可能的……但可能性并不是特別高”,,理由是“俄羅斯的石油出口基本上已經(jīng)到了‘大而不能倒’的地步”,。

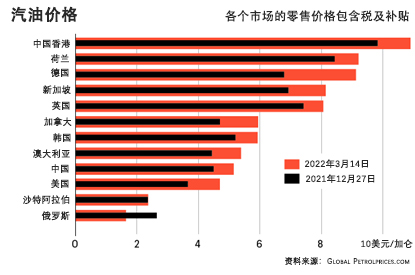

不過這一事實(shí)并不能夠讓全球能源市場放心。從今年年初到現(xiàn)在,,布倫特原油價(jià)格已經(jīng)上漲了50%以上,,美國普通汽油的價(jià)格也上漲了將近30%。與此同時(shí),,石油交易員們還在密切關(guān)注未來幾周的兩大動向:一是俄羅斯日均出口的500萬桶石油能否找到新買家——例如中國和印度,。二是其他出口商,比如中東國家,,會不會掉頭將產(chǎn)能賣給歐洲和北美,?但愿這種全球供應(yīng)鏈的重新洗牌,可以讓全世界避免重現(xiàn)20世紀(jì)70年代的那種供應(yīng)鏈震蕩,。

有一件事情是肯定的:每次重大能源危機(jī)都會催生出新的經(jīng)濟(jì)贏家和輸家,。以下是我們總結(jié)的專家們的看法。

輸家:

能源進(jìn)口國

中東問題專家,、倫敦經(jīng)濟(jì)學(xué)院(London School of Economics)的比較政治學(xué)教授斯特芬·赫爾托格指出:“所有主要的能源進(jìn)口國都是輸家,。”其中首當(dāng)其沖的就是歐盟。歐盟與俄羅斯能源脫鉤的過程將是相當(dāng)坎坷的,,短期內(nèi)必然導(dǎo)致電力和汽油價(jià)格的上漲,,以及經(jīng)濟(jì)增長的放緩。美銀證券預(yù)計(jì),,這將使歐盟今年經(jīng)濟(jì)增長率下降7%,。

節(jié)假日出行者

2008年的石油危機(jī)已經(jīng)考驗(yàn)過一次美國人的自駕游熱情了。當(dāng)時(shí),,布倫特原油價(jià)格最高漲到了146美元/桶,。由于燃油價(jià)格居高不下,加上經(jīng)濟(jì)停滯,,美國人的駕車?yán)锍踢B續(xù)下降了五年,。通豪根說:“我們不得不接受一個(gè)事實(shí),那就是今年暑假,,我們可能不會像以前那樣經(jīng)常開車了,。”不過環(huán)保分子可能會覺得這是一件好事情——畢竟能夠減少排放,。

全球窮人

2021年秋天,,在聯(lián)合國第26屆氣候大會(COP26)期間,雅苒國際的首席執(zhí)行官霍爾塞瑟曾經(jīng)警告道,,能源價(jià)格的飆升有可能導(dǎo)致全球糧食危機(jī)?,F(xiàn)在俄烏戰(zhàn)爭剛剛打了一個(gè)月,局勢就已經(jīng)超出了他的預(yù)期,,小麥,、玉米和大麥價(jià)格全線飆升?;魻柸硎?,俄烏戰(zhàn)爭及其對全球能源價(jià)格的影響,很可能會讓全世界在幫助數(shù)億人脫貧和擺脫饑餓上的努力化為烏有,。他和聯(lián)合國世界糧食計(jì)劃署(United Nations World Food Programme)的執(zhí)行主任大衛(wèi)·比斯利的看法一樣,認(rèn)為現(xiàn)在的局勢簡直是“災(zāi)上加災(zāi)”,。

贏家:

少數(shù)出口國

新時(shí)期的石油地緣政治可以用“他人看跌我看漲”來形容,。委內(nèi)瑞拉的總統(tǒng)尼古拉斯·馬杜羅等人應(yīng)該就是這么想的。馬杜羅并未放棄對普京的支持,。但是在俄烏戰(zhàn)爭開打后,,馬杜羅這么多年來頭一次會見了一個(gè)美國代表團(tuán),要談的自然是能源問題,。中東問題專家,、倫敦經(jīng)濟(jì)學(xué)院比較政治學(xué)教授斯蒂芬·赫爾托格認(rèn)為:“從短期來看,這對石油出口國是一個(gè)利好消息,包括伊朗和委內(nèi)瑞拉,,都有可能通過由美國軟化或取消制裁的方式,,向市場投放更多的石油?!薄渡程毓尽罚⊿audi, Inc.)一書的作者艾倫·沃爾德也認(rèn)為,,隨著油價(jià)高漲,“伊朗也比過去多賺了很多錢,?!币晾蔬€可以利用目前的經(jīng)濟(jì)形勢,在談判中采取強(qiáng)硬態(tài)度,,以爭取暫緩制裁,,并且全面重返石油出口市場。

煤炭,、頁巖氣與液化天然氣

德國等歐洲國家對高污染的煤炭的態(tài)度也有了180度的轉(zhuǎn)變,。今年3月,作為歐元區(qū)最大經(jīng)濟(jì)體的德國呼吁歐洲應(yīng)該建立煤炭儲備以解決電力問題,。未來幾年,,歐洲的另一個(gè)贏家很可能將是液化天然氣。美銀證券認(rèn)為,,隨著歐洲推動進(jìn)口液化天然氣作為俄羅斯天然氣的替代品,,歐盟很可能將成為全球增長最快的液化天然氣市場。而在大西洋對岸的美國,,頁巖氣將再次稱王,。拜登政府希望美國頁巖氣生產(chǎn)商提高產(chǎn)量,以頂上日均70萬桶的俄羅斯原油的缺口,。而今年3月,,美國的頁巖氣生產(chǎn)商也確實(shí)加大了鉆井力度,只不過開采活動仍然低于新冠疫情前的水平,。

可再生能源

在短期內(nèi),,一些國家大干快上煤炭和頁巖油的做法,或許會讓一些社會責(zé)任投資者感到恐慌,。但從長期看來,,情況還是樂觀的。俄烏戰(zhàn)爭導(dǎo)致的化石燃料價(jià)格上漲,,只會進(jìn)一步碳捕獲與存儲(CCS)和綠色氫能等凈零排放技術(shù)的價(jià)值,。據(jù)Rystad Energy公司預(yù)測,CCS技術(shù)的投資額將在未來三年翻四番,,達(dá)到500億美元,。歐盟也制訂了一個(gè)雄心勃勃的計(jì)劃,,要在2030年前用清潔氫能取代近半數(shù)俄羅斯天然氣。拜登政府也承諾10年內(nèi)將投入95億美元以促進(jìn)氫能發(fā)展,。

在家辦公一族

今年3月,,國際能源署發(fā)布了一份關(guān)于如何將全球日均石油消費(fèi)量迅速降低270萬桶的十點(diǎn)計(jì)劃。第一點(diǎn)就是每周在家辦公三天,,對于視頻會議能夠搞定的事情,,盡量不要出差。新冠疫情發(fā)展到現(xiàn)在,,我們對這一套流程應(yīng)該都很熟悉了,。(財(cái)富中文網(wǎng))

本文另一版本登載于《財(cái)富》雜志2022年4/5月刊,標(biāo)題為《石油的國際新秩序》(Oil's New World Order),。

譯者:樸成奎

對于一家全球性企業(yè)來說,,目睹人類的苦難乃至戰(zhàn)爭,往往也是其工作的常態(tài),。不過在2022年2月26日這一天,,雅苒國際公司(Yara International)的首席執(zhí)行官斯韋恩·托雷·霍爾塞瑟根本沒有預(yù)料到,局勢竟然會發(fā)展成后來的樣子,。

雅苒國際是一家擁有117年歷史的挪威化肥公司,,其業(yè)務(wù)遍及全球60多個(gè)國家。幾十年來,,雅苒國際在烏克蘭和俄羅斯都有大量卓有成效的業(yè)務(wù),。烏克蘭是一個(gè)重要的小麥出口國,而俄羅斯則向雅苒國際供應(yīng)了大量鉀肥和磷肥原料,。而就在俄烏沖突爆發(fā)的第三天,,一枚俄羅斯的導(dǎo)彈擊中了雅苒國際在基輔的分公司總部。

由于空襲時(shí)間是清晨,,因而這枚導(dǎo)彈并未造成人員傷亡,。不過在數(shù)日后接受《財(cái)富》雜志采訪時(shí),霍爾塞瑟仍然心有余悸,。他說:“當(dāng)你看見掛著雅苒國際標(biāo)志的辦公樓被炸出一個(gè)大洞時(shí),,你就會發(fā)現(xiàn),戰(zhàn)爭突然變得離你很近了,。這種感覺真的很可怕,。”

像很多其他行業(yè)一樣,,雅苒國際也從另外一個(gè)方面感受到了俄烏戰(zhàn)爭的影響——那就是不斷攀升的能源價(jià)格。今年3月初的時(shí)候,,隨著烏克蘭滿目瘡痍的景象連續(xù)霸占媒體頭條,,世界各國一片嘩然,全球能源市場也陷入恐慌之中。歐盟(European Union)在2021年花了1080億歐元(約1190億美元)進(jìn)口俄羅斯能源,。但在戰(zhàn)爭爆發(fā)后,,歐盟也表示在今年年底前將把對俄羅斯化石燃料的依賴度降低三分之二。

雖然歐盟最終沒有完全禁止從俄羅斯進(jìn)口能源,,但隨著英國石油(BP),、殼牌(Shell)、道達(dá)爾能源(TotalEnergies)和??松梨冢‥xxon Mobil)等石油巨頭相繼宣布撤出俄羅斯,,西方實(shí)際上已經(jīng)實(shí)施了抵制俄羅斯能源的政策。國際能源署(International Energy Agency)警告稱,,從今年4月開始,,“隨著制裁生效和買家停止進(jìn)口,俄羅斯每天可能都要砍掉300萬桶的石油產(chǎn)量,?!?/p>

受俄烏沖突影響,世界各地的石油和天然氣價(jià)格全線上漲,。由于能源成本飆升,,3月初的時(shí)候,全歐洲的企業(yè)(包括雅苒國際在內(nèi))基本上都關(guān)閉了生產(chǎn)線,。歐洲的天然氣基準(zhǔn)期貨Title Transfer Facility的價(jià)格在3月7日創(chuàng)下了超過每兆瓦227歐元的紀(jì)錄,。霍爾塞瑟解釋道:“這相當(dāng)于石油價(jià)格漲到每桶600美元,。我們實(shí)際上是在背著巨大的負(fù)利潤在生產(chǎn),。”他還指出,,氨肥的生產(chǎn)成本幾乎上漲到了俄烏沖突前的20倍,。

高盛集團(tuán)(Goldman Sachs)的大宗商品研究主管杰夫·柯里指出:“這是1973年也就是歐佩克(OPEC)石油禁運(yùn)那年以來,大宗商品市場漲幅最大的一次,?!?/p>

*****

俄烏沖突也造成了歐洲自二戰(zhàn)以來最嚴(yán)重的人道主義危機(jī),目前戰(zhàn)爭已經(jīng)造成了數(shù)千人死亡,。馬里烏波爾和哈爾科夫等城市已經(jīng)成了一片廢墟,,超過1000萬名的烏克蘭難民被迫離開家園。人類在這場戰(zhàn)爭中遭受的苦難是無法用數(shù)字衡量的,。

這場戰(zhàn)爭也將對全球經(jīng)濟(jì)產(chǎn)生廣泛而深遠(yuǎn)的影響,。石油和天然氣價(jià)格的上漲只是一個(gè)開始,后續(xù)可能還會有一系列連鎖反應(yīng),,比如所有大宗商品價(jià)格的上漲,,到時(shí)候,,從面包到電動汽車,各種門類的商品可能都會漲價(jià),。

很多經(jīng)濟(jì)學(xué)家,、政策制定者和商業(yè)領(lǐng)袖都警告稱,如果俄烏戰(zhàn)爭繼續(xù)打下去,,全世界的企業(yè)和老百姓就都會受到影響,。俄羅斯是全世界最大的天然氣出口國,也是第二原油出口國和第三大煤炭出口國,。據(jù)經(jīng)合組織(OECD)預(yù)測,,這場戰(zhàn)爭有可能會使今年的全球GDP增長增長率下降整整一個(gè)百分點(diǎn),并將全球通脹率進(jìn)一步推高2.5%,。高盛集團(tuán)也表示,,油價(jià)每上漲10美元,就會抵消幾十億美元的經(jīng)濟(jì)增長,。高盛的分析師指出,,俄烏沖突有40%的可能性會讓美國陷入衰退,而歐洲的情況就更糟了,。

*****

隨著夏季駕車旺季即將到來,,關(guān)于油價(jià)的預(yù)測也是五花八門。巴克萊銀行(Barclays),、美銀證券(BofA Securities)和挪威的能源咨詢與研究機(jī)構(gòu)Rystad Energy均表示,,一旦出現(xiàn)最壞情況,也就是北約(NATO)也卷入了沖突,,那么作為全球石油基準(zhǔn)的布倫特原油價(jià)格將逼近200美元,。Rystad 公司的石油市場部門負(fù)責(zé)人比約納爾·通豪根認(rèn)為,這一預(yù)測“是可能的……但可能性并不是特別高”,,理由是“俄羅斯的石油出口基本上已經(jīng)到了‘大而不能倒’的地步”,。

不過這一事實(shí)并不能夠讓全球能源市場放心。從今年年初到現(xiàn)在,,布倫特原油價(jià)格已經(jīng)上漲了50%以上,,美國普通汽油的價(jià)格也上漲了將近30%。與此同時(shí),,石油交易員們還在密切關(guān)注未來幾周的兩大動向:一是俄羅斯日均出口的500萬桶石油能否找到新買家——例如中國和印度,。二是其他出口商,比如中東國家,,會不會掉頭將產(chǎn)能賣給歐洲和北美,?但愿這種全球供應(yīng)鏈的重新洗牌,可以讓全世界避免重現(xiàn)20世紀(jì)70年代的那種供應(yīng)鏈震蕩,。

有一件事情是肯定的:每次重大能源危機(jī)都會催生出新的經(jīng)濟(jì)贏家和輸家,。以下是我們總結(jié)的專家們的看法,。

輸家:

能源進(jìn)口國

中東問題專家、倫敦經(jīng)濟(jì)學(xué)院(London School of Economics)的比較政治學(xué)教授斯特芬·赫爾托格指出:“所有主要的能源進(jìn)口國都是輸家,。”其中首當(dāng)其沖的就是歐盟,。歐盟與俄羅斯能源脫鉤的過程將是相當(dāng)坎坷的,,短期內(nèi)必然導(dǎo)致電力和汽油價(jià)格的上漲,以及經(jīng)濟(jì)增長的放緩,。美銀證券預(yù)計(jì),,這將使歐盟今年經(jīng)濟(jì)增長率下降7%。

節(jié)假日出行者

2008年的石油危機(jī)已經(jīng)考驗(yàn)過一次美國人的自駕游熱情了,。當(dāng)時(shí),,布倫特原油價(jià)格最高漲到了146美元/桶。由于燃油價(jià)格居高不下,,加上經(jīng)濟(jì)停滯,,美國人的駕車?yán)锍踢B續(xù)下降了五年。通豪根說:“我們不得不接受一個(gè)事實(shí),,那就是今年暑假,,我們可能不會像以前那樣經(jīng)常開車了?!辈贿^環(huán)保分子可能會覺得這是一件好事情——畢竟能夠減少排放,。

全球窮人

2021年秋天,在聯(lián)合國第26屆氣候大會(COP26)期間,,雅苒國際的首席執(zhí)行官霍爾塞瑟曾經(jīng)警告道,,能源價(jià)格的飆升有可能導(dǎo)致全球糧食危機(jī)。現(xiàn)在俄烏戰(zhàn)爭剛剛打了一個(gè)月,,局勢就已經(jīng)超出了他的預(yù)期,,小麥、玉米和大麥價(jià)格全線飆升,?;魻柸硎荆頌鯌?zhàn)爭及其對全球能源價(jià)格的影響,,很可能會讓全世界在幫助數(shù)億人脫貧和擺脫饑餓上的努力化為烏有,。他和聯(lián)合國世界糧食計(jì)劃署(United Nations World Food Programme)的執(zhí)行主任大衛(wèi)·比斯利的看法一樣,認(rèn)為現(xiàn)在的局勢簡直是“災(zāi)上加災(zāi)”,。

贏家:

少數(shù)出口國

新時(shí)期的石油地緣政治可以用“他人看跌我看漲”來形容,。委內(nèi)瑞拉的總統(tǒng)尼古拉斯·馬杜羅等人應(yīng)該就是這么想的。馬杜羅并未放棄對普京的支持,。但是在俄烏戰(zhàn)爭開打后,,馬杜羅這么多年來頭一次會見了一個(gè)美國代表團(tuán),,要談的自然是能源問題。中東問題專家,、倫敦經(jīng)濟(jì)學(xué)院比較政治學(xué)教授斯蒂芬·赫爾托格認(rèn)為:“從短期來看,,這對石油出口國是一個(gè)利好消息,包括伊朗和委內(nèi)瑞拉,,都有可能通過由美國軟化或取消制裁的方式,,向市場投放更多的石油?!薄渡程毓尽罚⊿audi, Inc.)一書的作者艾倫·沃爾德也認(rèn)為,,隨著油價(jià)高漲,“伊朗也比過去多賺了很多錢,?!币晾蔬€可以利用目前的經(jīng)濟(jì)形勢,在談判中采取強(qiáng)硬態(tài)度,,以爭取暫緩制裁,,并且全面重返石油出口市場。

煤炭,、頁巖氣與液化天然氣

德國等歐洲國家對高污染的煤炭的態(tài)度也有了180度的轉(zhuǎn)變,。今年3月,作為歐元區(qū)最大經(jīng)濟(jì)體的德國呼吁歐洲應(yīng)該建立煤炭儲備以解決電力問題,。未來幾年,,歐洲的另一個(gè)贏家很可能將是液化天然氣。美銀證券認(rèn)為,,隨著歐洲推動進(jìn)口液化天然氣作為俄羅斯天然氣的替代品,,歐盟很可能將成為全球增長最快的液化天然氣市場。而在大西洋對岸的美國,,頁巖氣將再次稱王,。拜登政府希望美國頁巖氣生產(chǎn)商提高產(chǎn)量,以頂上日均70萬桶的俄羅斯原油的缺口,。而今年3月,,美國的頁巖氣生產(chǎn)商也確實(shí)加大了鉆井力度,只不過開采活動仍然低于新冠疫情前的水平,。

可再生能源

在短期內(nèi),,一些國家大干快上煤炭和頁巖油的做法,或許會讓一些社會責(zé)任投資者感到恐慌,。但從長期看來,,情況還是樂觀的。俄烏戰(zhàn)爭導(dǎo)致的化石燃料價(jià)格上漲,只會進(jìn)一步碳捕獲與存儲(CCS)和綠色氫能等凈零排放技術(shù)的價(jià)值,。據(jù)Rystad Energy公司預(yù)測,,CCS技術(shù)的投資額將在未來三年翻四番,達(dá)到500億美元,。歐盟也制訂了一個(gè)雄心勃勃的計(jì)劃,,要在2030年前用清潔氫能取代近半數(shù)俄羅斯天然氣。拜登政府也承諾10年內(nèi)將投入95億美元以促進(jìn)氫能發(fā)展,。

在家辦公一族

今年3月,,國際能源署發(fā)布了一份關(guān)于如何將全球日均石油消費(fèi)量迅速降低270萬桶的十點(diǎn)計(jì)劃。第一點(diǎn)就是每周在家辦公三天,,對于視頻會議能夠搞定的事情,盡量不要出差,。新冠疫情發(fā)展到現(xiàn)在,,我們對這一套流程應(yīng)該都很熟悉了。(財(cái)富中文網(wǎng))

本文另一版本登載于《財(cái)富》雜志2022年4/5月刊,,標(biāo)題為《石油的國際新秩序》(Oil's New World Order),。

譯者:樸成奎

For a global business that works with miners and farmers, witnessing the ravages of human suffering and even war is too often part of the job. Still, nothing could quite prepare Yara International CEO Svein Tore Holsether for what he woke to on Feb. 26—or, for that matter, what would come next.

Yara, a 117-year-old Norwegian fertilizer giant, operates in more than 60 countries. For decades, Yara has had a large and fruitful presence in both Ukraine, a major wheat exporter, and in Russia, a key supplier of the potash and phosphate needed in Yara’s fertilizer production. On day three of Russia’s invasion of Ukraine, a Russian missile blasted into the headquarters of Yara Ukraine in Kyiv.

No Yara employees were injured in the early-morning air strike, but Holsether was still shaken days later when he spoke to Fortune. War, he said, “becomes quite close when you see the office building, with the Yara sign on it, and a big hole. That’s really scary.”

Like companies in a wide range of industries, Yara felt the impact of the invasion in another way, too: rising energy prices. As Russian missiles flattened Ukrainian apartment blocks, hospitals, and businesses in early March, shock gripped the world’s capitals and panic tore through global energy markets. Incensed, the European Union, which spent €108 billion ($119 billion) on Russian energy imports last year, vowed to slash by two-thirds its dependence on Russian fossil fuels by year-end.

Plans for an outright EU ban on Russian oil eventually stalled. But oil giants BP, Shell, TotalEnergies, and Exxon Mobil effectively created an embargo anyhow when they announced plans to pull out of Russia, ending decades of investment. The International Energy Agency (IEA) now warns that, beginning in April, “3 [million barrels per day] of Russian oil output could be shut in as sanctions take hold and buyers shun exports.”

These tectonic shifts are creating a supply crunch, pushing up the price of oil and natural gas everywhere. Businesses across Europe, Yara included, shut down operations in early March to save money as energy bills skyrocketed: Europe’s natural gas benchmark, the Title Transfer Facility, spiked to a record high above €227 per megawatt on March 7 before correcting. “That’s an oil price equivalent of $600 per barrel. We were running at huge negative margins,” Holsether explains, adding production costs for ammonia rose nearly 20-fold on prewar levels.

Says Jeff Currie, head of commodity research at Goldman Sachs: “This is the biggest upheaval for commodities markets since 1973”—the year of the OPEC oil embargo.

*****

The Russian invasion of Ukraine has precipitated Europe’s worst humanitarian crisis since World War II. Thousands are dead already. Cities like Mariupol and Kharkiv lie in ruins. More than 10 million Ukrainian refugees have been forced from their homes. The scale of human suffering is incalculable.

Vladimir Putin’s war will also have a wide-ranging and long-lasting impact on the global economy. And the surge in oil and gas prices is just the start. The ripple effects are likely to push up the cost of all commodities, making products ranging from bread to electric vehicles more expensive.

Economists, policymakers, and business leaders warn that as long as Russia—the world’s biggest natural gas exporter, as well as its No. 2 crude and No. 3 coal exporter—keeps bombing Ukraine, businesses and homeowners the world over will feel it. The war could whack a full percentage point off global GDP growth this year, the OECD calculates, and push the global inflation rate up by a further 2.5%. Goldman Sachs, meanwhile, says every $10 hike in oil prices wipes out billions in economic growth. Its analysts say there’s a 40% chance the Ukraine invasion will sink the U.S. into recession. The odds are even worse for Europe.

*****

Heading into the summer driving season, forecasts for oil prices are all over the place. Barclays, BofA Securities, and Rystad Energy, the Oslo-based energy consultancy and research firm, all say their worst-case scenario—think NATO being drawn into the bloody conflict—is Brent crude, the global benchmark, nearing $200. That upper-range assessment is in the “possible?…?but not particularly likely” category, says Bj?rnar Tonhaugen, head of oil markets at Rystad. The reason: “Russia’s oil exports are basically too big to fail,” he says.

That fact is hardly reassuring the global energy markets. Brent is up more than 50% so far in 2022, and the price of regular gasoline in the U.S. has risen nearly 30%. Oil traders, meanwhile, are watching for two big developments in the coming weeks: Will Russia’s daily exports of 5 million barrels find new buyers in, say, India and China? And, if so, will other exporters—the Middle East, maybe—turn around and begin to sell to Europe and North America? Such a global recalibration of supplies, it’s hoped, would stabilize prices and save the planet from a 1970s-style supply shock.

One thing is for sure: Every major energy crisis yields new economic winners and losers. Here’s what the experts we surveyed are expecting.

The losers:

Importing nations

“All major energy importers are losers,” says Steffen Hertog, a Middle East expert and professor of comparative politics at the London School of Economics. For Exhibit A, look no further than the EU. Its commitment to weaning itself off Russian energy will be a rocky process that in the short term will mean higher electricity and petrol prices, and lower growth. Count on a 0.7% hit this year to growth, says BofA.

Holiday travelers

The 2008 oil crisis, in which Brent hit a high of $146 per barrel, tested Americans’ love affair with the automobile. As fuel prices remained elevated and the economy sputtered, the number of miles Americans drove in their cars fell for five straight years. “We just have to accept the fact that we won’t be driving as much in our cars, on vacation, this summer,” Tonhaugen figures. On the flip side: Climate hawks would cheer the reduced emissions.

The global poor

Last autumn, on the sidelines of the COP26 climate summit, Yara CEO Holsether warned the world that spiking energy prices could lead to a global food crisis. One month into Russia’s invasion of Ukraine, the situation is beyond his worst fears with wheat, corn, and barley prices soaring. The war, and its impact on global energy prices, could undo the progress the world’s made in lifting hundreds of millions out of hunger and poverty, Holsether warns. He calls it the “catastrophe on top of the catastrophe,” echoing the words of David Beasley, executive director of the United Nations World Food Programme.

The winners:

Rogue exporting nations

The new geopolitics of oil can best be described as “down-is-up,” a policy shift happily welcomed by the likes of Venezuela’s President Nicolás Maduro. He hasn’t backed down in his support of Putin. Still, for the first time in years, Maduro met with a U.S. delegation in the early days of the war to talk, yes, energy. “It is definitely good news in the short run for oil exporters, including ones that might be able to put additional oil on to the market through softened or abrogated U.S. sanctions like Iran and Venezuela,” Hertog reckons. As for Iran, at these oil prices, “it’s making a lot more money than it was before,” points out Ellen Wald, an energy consultant and author of Saudi, Inc. Iran could use the current economics to play hardball as it negotiates to win a reprieve from sanctions, and fully return to the export market.

Coal, shale, and LNG

Germany, among others in Europe, has pulled an about-face on dirty coal. In March, the eurozone’s biggest economy called for the creation of strategic coal reserves to keep the lights on. Another winner in Europe in the coming years: liquefied natural gas. Europe’s push to import LNG as a Russian gas substitute will make the EU the world’s fastest-growing LNG market, BofA Securities calculates. Across the Atlantic, fracking could once again be king. The Biden administration wants U.S. shale producers to boost production to meet the shortfall of the 700,000 barrels per day of Russian crude that’s now banned. In March, shale producers responded by drilling more wells, though rig activity remains below pre-pandemic levels.

Renewables

In the short run, ESG investors will look in horror on governments cozying up to shale and coal. But longer term, things are looking sunnier. The war, and the resulting surge in fossil fuel prices, is already proving to be an accelerator for such net-zero technologies as carbon capture and storage (CCS) and green hydrogen. Rystad forecasts CCS investments will quadruple over the next three years to top $50 billion. And the EU has set an ambitious 2030 target to replace nearly half of Russian gas with clean hydrogen. The Biden administration, meanwhile, has committed $9.5 billion to boost hydrogen power this decade.

WFH warriors

In March, the IEA published a 10-point plan to spell out how the world could quickly cut 2.7 million barrels of oil from its daily consumption. Top of the list? Work from home three days a week, and forgo business travel when a Zoom call will do. That’s something we all know how to do by now.

This article appears in the April/May 2022 issue of Fortune with the headline, “Oil's New World Order.”