2020年新冠疫情導致全球交通封鎖,使航空和郵輪出行幾乎停滯,,日常辦公通勤頻次大減,,導致全球對石油的需求幾近降至冰點。雖然此后原油供應增加,,但儲存場所卻十分缺乏,,最終導致美國國內原油期貨價格于2020年4月陡然跌為負數。油價最低時,,西得克薩斯中質油(WTI)合約價為負,,即每賣一桶油,,賣家還得倒找37美元給買家。

然而最近的情況卻開始倒轉,,油價不僅出現了反彈,,而且漲得比疫情爆發(fā)前還高。隨著史無前例的快速經濟復蘇,,對石油的需求迅速回升,,比預期還要強勁。去年油價暴跌,,產油國除減產外別無他法,,因而庫存稀少,被暴增的需求迅速耗盡,。截至上周五,,WTI合約價格為每桶69.62美元,較2020年12月上漲了52%,。這也導致了汽油價格的上漲,。美國汽油常規(guī)均價為每加侖3.34美元,自2020年12月以來上漲了55%,。

2022年的燃料價格走勢將會是怎樣的,?為了找到答案,,《財富》雜志對幾個權威的預測模型進行了盤點,。

主要結論:盡管美國政府預測,2022年石油和天然氣價格都將下降,,但相關私營領域的多個預測都顯示,,燃料價格會繼續(xù)上升。

高盛(Goldman Sachs)認同巴克萊銀行的看法,。高盛的石油分析師認為油價存在“上行風險”,目前歐洲海岸開采的布倫特原油合約價格為每桶73美元,2023年可能會攀升至85美元,。

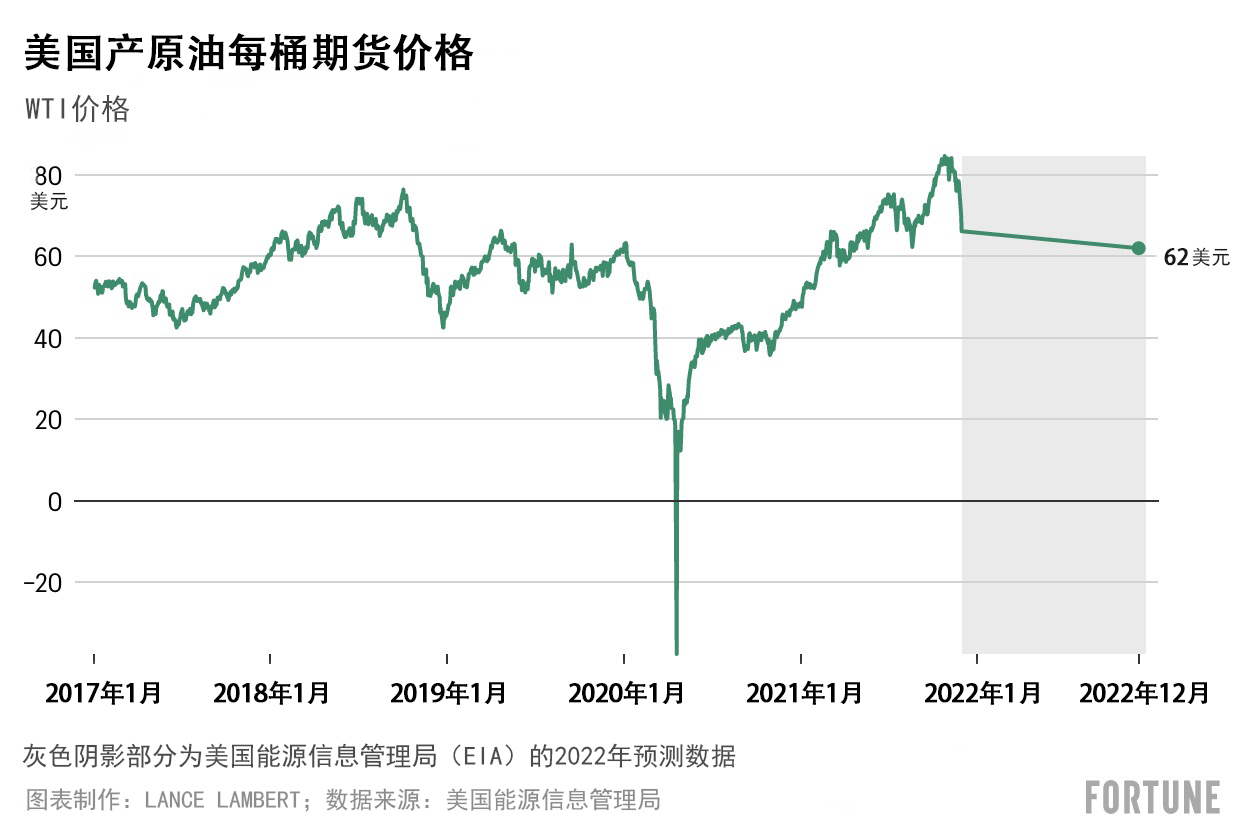

但美國能源信息管理局(EIA)并不同意這一觀點,,并持相反態(tài)度(見上圖)。其預測,,到2022年底,,WTI和布倫特原油合約價將分別降至每桶62美元和66美元,原因在于原油供需不匹配的狀況將在明年得到緩解,。

EIA的研究人員在2022年的展望報告中寫道:“我們預測,,2022年歐佩克+和美國的原油產量上升,全球液態(tài)燃料庫存增加,,原油價格隨之下跌,。”“全球范圍內,、美國國內的原油庫存近期相對較低,,使原油合約價格面對上漲的壓力。然而,,長期原油合約價格較低,,這可能反映出,市場將會更加平衡,?!?/p>

當然,,所有預測模型都是建立在假設的基礎上的,,而這些假設很容易出現錯誤。如果明年歐佩克及其盟友國不按原計劃擴大石油生產,,才會產生最大的風險,。(財富中文網)

譯者:Transn

2020年新冠疫情導致全球交通封鎖,使航空和郵輪出行幾乎停滯,,日常辦公通勤頻次大減,,導致全球對石油的需求幾近降至冰點。雖然此后原油供應增加,,但儲存場所卻十分缺乏,,最終導致美國國內原油期貨價格于2020年4月陡然跌為負數,。油價最低時,西得克薩斯中質油(WTI)合約價為負,,即每賣一桶油,,賣家還得倒找37美元給買家。

然而最近的情況卻開始倒轉,,油價不僅出現了反彈,,而且漲得比疫情爆發(fā)前還高。隨著史無前例的快速經濟復蘇,,對石油的需求迅速回升,,比預期還要強勁。去年油價暴跌,,產油國除減產外別無他法,,因而庫存稀少,被暴增的需求迅速耗盡,。截至上周五,,WTI合約價格為每桶69.62美元,較2020年12月上漲了52%,。這也導致了汽油價格的上漲,。美國汽油常規(guī)均價為每加侖3.34美元,自2020年12月以來上漲了55%,。

2022年的燃料價格走勢將會是怎樣的,?為了找到答案,《財富》雜志對幾個權威的預測模型進行了盤點,。

主要結論:盡管美國政府預測,,2022年石油和天然氣價格都將下降,,但相關私營領域的多個預測都顯示,,燃料價格會繼續(xù)上升。

巴克萊銀行(Barclays)預測,, 2022年,,WTI合約價格將從目前的每桶69.62美元上漲到77美元。該銀行表示,,拜登政府最近動用石油戰(zhàn)略儲備來降低油價,,這并不是一種可持續(xù)發(fā)展的方式,而且最近幾周的油價回落“只是暫時的”,。世界銀行表示,,如果新冠疫情產生的影響達到最小化,石油需求的增長會超過預期,,那么油價也可能會高于預期,。簡單地說:如果明年疫情逐漸平息,,油價就可能會遭受更大的上漲壓力。

高盛(Goldman Sachs)認同巴克萊銀行的看法,。高盛的石油分析師認為油價存在“上行風險”,,目前歐洲海岸開采的布倫特原油合約價格為每桶73美元,2023年可能會攀升至85美元,。

但美國能源信息管理局(EIA)并不同意這一觀點,,并持相反態(tài)度(見上圖)。其預測,,到2022年底,,WTI和布倫特原油合約價將分別降至每桶62美元和66美元,原因在于原油供需不匹配的狀況將在明年得到緩解,。

EIA的研究人員在2022年的展望報告中寫道:“我們預測,,2022年歐佩克+和美國的原油產量上升,全球液態(tài)燃料庫存增加,,原油價格隨之下跌,。”“全球范圍內,、美國國內的原油庫存近期相對較低,,使原油合約價格面對上漲的壓力。然而,,長期原油合約價格較低,,這可能反映出,市場將會更加平衡,?!?/p>

根據EIA的預測,如果原油價格大幅下跌,,加油站的汽油價格也會隨之下降,。預計到明年1月,汽油均價(現每加侖3.34美元)將降至3.01美元,。EIA預計,,2022年美國常規(guī)汽油和柴油均價分別為每加侖2.88美元和3.19美元。

當然,,所有預測模型都是建立在假設的基礎上的,,而這些假設很容易出現錯誤。如果明年歐佩克及其盟友國不按原計劃擴大石油生產,,才會產生最大的風險,。(財富中文網)

譯者:Transn

Demand for petroleum absolutely crashed at the onset of the 2020 lockdowns as air travel, cruise trips, and daily office commutes evaporated. The ensuing buildup in crude oil supply—and the lack of places to store it—culminated in the futures price of domestically produced crude briefly going negative in April 2020. At the bottom of the crash, sellers of West Texas Intermediate (WTI) contracts were paying buyers $37 per barrel to take their oil.

Lately we've had the opposite problem: Not only did oil prices rebound, they're higher now than prior to the pandemic. When oil prices crashed last year, producers had no choice but to cut production. That reduced supply was quickly outmatched as the historic economic recovery saw demand roar back sooner—and stronger—than expected. As of Friday, that WTI contract price stands at $69.62 per barrel—up 52% from December 2020. That has also translated into higher prices at the pump. The average U.S. regular price of $3.34 per gallon is up 55% since December 2020.

But where are oil and gas prices headed in 2022? To get an indication, Fortune reviewed several leading forecast models.

The big takeaway: While U.S. government forecasts predict both oil and gas prices will see a decline in 2022, many private sector forecasts show the opposite occurring.

When it comes to domestically produced crude, Barclays predicts that the WTI contract price will increase from the current rate of $69.62 to an average price of $77 in 2022. The bank says the Biden administration's recent release of oil from the Strategic Petroleum Reserve isn't a sustainable way to bring down prices, and the dip we've seen in recent weeks "would only be temporary." Prices could go even higher than forecast, the bank says, if COVID-19 outbreaks are minimized and thus allow demand to grow by more than expected. Simply put: If the pandemic winds down next year, that could put more upward pressure on prices.

That assessment is shared by Goldman Sachs. Oil analysts at the investment bank see "upside risks" that contract prices for Brent crude—oil drilled off the shore of Europe—could climb from the current price of $73 to $85 per barrel by 2023.

But the U.S. Energy Information Administration (EIA) doesn't agree. Instead, the government agency is predicting (see chart above) that the WTI price per barrel will drop to $62 by the end of 2022, and Brent oil contracts will fall to $66 per barrel. The reason? EIA says the supply and demand mismatch for crude will ease in 2022.

"We forecast that rising production from OPEC+ countries and the United States will lead to global liquid fuels inventories increasing and crude oil prices falling in 2022," wrote EIA researchers in their 2022 outlook. "Low crude oil inventories, both globally and in the United States, have put upward price pressure on near-dated crude oil contracts, whereas longer-dated crude oil contract prices are lower, likely reflecting expectations of a more balanced market."

If crude prices do fall significantly, it would translate into lower gasoline costs at the pump. That's exactly what EIA is predicting. By January, it forecasts that average gasoline prices (currently at $3.34) will drop to $3.01 per gallon. For the 2022 calendar year, it expects regular U.S. gasoline prices to average $2.88 and diesel to average $3.19 per gallon.

Of course, all of these models are built on assumptions that could easily go astray. The biggest risk? That OPEC and its allies don't follow through on their 2022 plan to up production.