布拉德·懷特有胃酸反流的老毛病,,所以需要長(zhǎng)年服用埃索美拉唑,這種藥物是阿斯利康公司的專利藥物耐信的非專利版本,。懷特是得克薩斯州南湖市的一名退休的學(xué)校行政人員,,可以享受醫(yī)保。不過(guò)今年年初,,他開(kāi)車到當(dāng)?shù)氐腃VS藥店取藥時(shí),,還是被嚇了一跳——藥店的工作人員告訴他,要想購(gòu)買(mǎi)三個(gè)月的藥量,,他還得自付490美元,。

他也不記得自己以前在買(mǎi)藥上花了多少錢(qián)——以前的處方藥都是郵寄來(lái)的,買(mǎi)藥的錢(qián)都是通過(guò)自動(dòng)扣款。不過(guò)他知道,,在達(dá)到3000美元的自付額之前,,他自己還是得在買(mǎi)藥上多花不少錢(qián)。一想到吃幾個(gè)月的非專利藥,,就得花將近500美元的高價(jià),,他實(shí)在難以接受。所以他沒(méi)有拿藥就走了,,打算“重新部署”一下自己的用藥計(jì)劃,。

回到家后,,懷特開(kāi)始在谷歌上搜索“低藥價(jià)”等關(guān)鍵詞,。很快,他發(fā)現(xiàn)了一家名叫GoodRx的藥品折扣公司,。憑借該公司贈(zèng)送給他的優(yōu)惠券,,他能夠在不動(dòng)用醫(yī)保的前提下,以17美元的超低價(jià),,從附近的一家克羅格藥店拿到一個(gè)月的藥量,。

他說(shuō):“我當(dāng)時(shí)覺(jué)得:‘這肯定不可行!’但沒(méi)有想到,,它竟然真的可行,。”

他最近又利用這款應(yīng)用程序購(gòu)買(mǎi)了另外一種處方藥,。如果使用醫(yī)保的話,,購(gòu)買(mǎi)一個(gè)月的藥量,需要自付36美元,。而在GoodRx上,,只需要花費(fèi)16.6美元。所以他當(dāng)然選擇了這個(gè)花錢(qián)更少的渠道,。懷特也知道,,買(mǎi)藥不用醫(yī)保,相當(dāng)于有便宜不占,,但他并不介意,。

“當(dāng)藥價(jià)存在這么大的差距時(shí),只要做個(gè)簡(jiǎn)單的計(jì)算,,你就會(huì)知道,,最好不使用醫(yī)保。老實(shí)說(shuō),,我也覺(jué)得這很奇怪,。”

在和藥店的藥劑師聊天時(shí),懷特驚訝地發(fā)現(xiàn),,藥店不僅接受GoodRx的優(yōu)惠券,,連這位藥劑師自己,也會(huì)使用GoodRx的優(yōu)惠券,,以更低的價(jià)格購(gòu)買(mǎi)他的哮喘藥,。

今年早些時(shí)候,我跟懷特談到這件事情時(shí),,他還處在一種既開(kāi)心又將信將疑的狀態(tài),,因?yàn)樗X(jué)得這里似乎有一個(gè)“悖論”。

“我疑惑的是,,這種情況到底可以持續(xù)多久,?因?yàn)槿绻腥嗽谫嶅X(qián)的話,就肯定有人在虧錢(qián),,只不過(guò)我不知道誰(shuí)虧誰(shuí)賺,。”

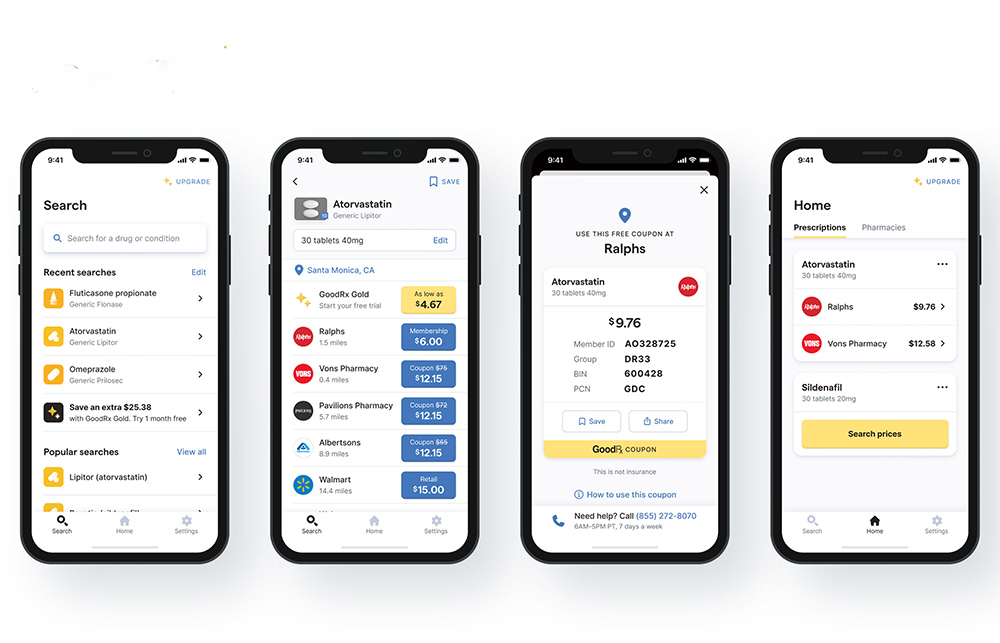

你大概也能夠理解懷特的困惑吧,?如今在美國(guó),,每個(gè)月都有560萬(wàn)人通過(guò)GoodRx購(gòu)買(mǎi)打折的處方藥。GoodRx有一個(gè)免費(fèi)的應(yīng)用程序,,它會(huì)顯示多家零售藥店的處方藥價(jià)格,,并且提供相應(yīng)的優(yōu)惠券。

目前,,它已經(jīng)是蘋(píng)果的iTunes和谷歌的GooglePlay上下載次數(shù)最多的醫(yī)療類應(yīng)用程序之一,。該公司官網(wǎng)的月訪問(wèn)量達(dá)到了1800萬(wàn)次以上。該公司的服務(wù)深受消費(fèi)者的喜愛(ài),,并且也被醫(yī)生們大力推薦,。

ProPublica、《紐約時(shí)報(bào)》和《財(cái)富》等媒體也對(duì)它贊譽(yù)有加,。

《財(cái)富》雜志甚至將它列入2019年的“改變世界”排行榜,。該公司的“凈推廣分?jǐn)?shù)”——或者說(shuō)忠誠(chéng)度評(píng)分,幾乎超過(guò)了90分,。相比之下,,蘋(píng)果最新的忠誠(chéng)度得分只有47分,沃爾格林(Walgreens)是25分,,F(xiàn)acebook是負(fù)21分,。

GoodRx何以受到熱捧?理由很明顯:該公司稱,,從2011年以來(lái),,它已經(jīng)為廣大消費(fèi)者節(jié)省了合計(jì)超過(guò)250億美元的買(mǎi)藥成本,。而從2019年以來(lái),它幾乎每天都可以為消費(fèi)者節(jié)省2000萬(wàn)美元的買(mǎi)藥支出,??紤]到美國(guó)有5800萬(wàn)人存在買(mǎi)不起藥的問(wèn)題,每個(gè)月估計(jì)有上萬(wàn)人因?yàn)橘I(mǎi)不起藥物而死亡,,它已經(jīng)堪稱是一款英雄的應(yīng)用程序了,。

當(dāng)然,GoodRx是一家商業(yè)企業(yè),,不是慈善機(jī)構(gòu),。事實(shí)證明,幫助大家節(jié)省買(mǎi)藥錢(qián),,這本身就是一筆好生意,。

去年該公司的營(yíng)收為5.507億美元,較2019年增長(zhǎng)42%,。要知道,,受新冠疫情影響,去年美國(guó)醫(yī)療保健服務(wù)的消費(fèi)量實(shí)際上是受到抑制的,,醫(yī)生開(kāi)出的處方數(shù)也要低于往年。(根據(jù)醫(yī)療數(shù)據(jù)公司IQVIA的數(shù)據(jù),,2010年美國(guó)開(kāi)具的處方量下降了3%,。)另外,GoodRx已經(jīng)實(shí)現(xiàn)了盈利,。2020年上半年,,它的凈利潤(rùn)同比增長(zhǎng)了75%,達(dá)到5500萬(wàn)美元,。(不過(guò)由于IPO的相關(guān)成本,,GoodRx的全年虧損額仍然達(dá)到2.94億美元。)

華爾街也看好GoodRx這種貌似違反直覺(jué)的商業(yè)模式,。去年9月,,GoodRx通過(guò)IPO實(shí)現(xiàn)上市,這也是去年規(guī)模最大的20宗IPO之一,,其交易規(guī)模達(dá)到11.4億美元,。目前該公司的市值約為158億美元。

GoodRx常說(shuō),,有了GoodRx,,所有人都成為了贏家。消費(fèi)者買(mǎi)得起藥,、存得下錢(qián),,從而提高了健康水平。醫(yī)療服務(wù)供應(yīng)商和醫(yī)保公司也是贏家,因?yàn)椴∪烁心芰Π凑仗幏接盟幜?。制藥商,、藥店和藥品福利管理公司(主要?fù)責(zé)為醫(yī)保公司管理用藥需求)同樣也是贏家,因?yàn)橛行└邇r(jià)藥本來(lái)有可能一直在藥店里被放到過(guò)期,,但現(xiàn)在卻通過(guò)打折的方式處理了出去,。(另外,由于客流量提高了,,藥店也會(huì)帶來(lái)更高的非藥物銷量,。)當(dāng)然,最大的贏家還是GoodRx,。只用了短短10年時(shí)間,,它就把自己打造成了一個(gè)英雄的形象,在盤(pán)根錯(cuò)節(jié)的美國(guó)醫(yī)療保健行業(yè)里站穩(wěn)了腳根——雖然其本質(zhì)還是一家中間商,。

****

如果美國(guó)的藥價(jià)體系不是如此復(fù)雜的話,,GoodRx可能根本不會(huì)存在。約翰斯·霍普金斯大學(xué)(Johns Hopkins University)的流行病學(xué)和醫(yī)學(xué)教授凱萊布·亞歷山大說(shuō):“美國(guó)的藥品定價(jià)體系可以說(shuō)是不正常的,,而它們找到了在這樣一個(gè)體系里做生意的好方法,。”

亞當(dāng)·費(fèi)恩是一名藥品經(jīng)濟(jì)學(xué)家和藥品分銷專家,,也是藥物渠道研究所的首席執(zhí)行官,。他在推特上這樣評(píng)價(jià)GoodRx去年的驚人業(yè)績(jī):“哇,藥品福利公司的格局被打破了,?!?/p>

對(duì)此,GoodRx的聯(lián)合創(chuàng)始人,、聯(lián)合首席執(zhí)行官道格·赫希也并不否認(rèn),。去年秋天,他告訴我:“我們的成功,,恰恰說(shuō)明美國(guó)的醫(yī)療體系已經(jīng)爛到了什么樣子,。”

GoodRx的聯(lián)合創(chuàng)始人,、聯(lián)合首席執(zhí)行官道格·赫希,。圖片來(lái)源:Courtesy of GoodRx

GoodRx的聯(lián)合創(chuàng)始人,、聯(lián)合首席執(zhí)行官道格·赫希,。圖片來(lái)源:Courtesy of GoodRx

正是這種市場(chǎng)失靈,才造就了最初的GoodRx,。

2010年的一天,,赫希到當(dāng)?shù)氐囊患宜幍耆ベI(mǎi)一種藥,結(jié)果發(fā)現(xiàn)他要自付500美元的藥費(fèi),。赫希也是有醫(yī)保的,,他本來(lái)以為藥費(fèi)只是這個(gè)數(shù)字的一個(gè)零頭,。于是他又去了馬路對(duì)面的另一家藥店,結(jié)果發(fā)現(xiàn),,同樣的藥品,,這里只需要300美元。而到另一個(gè)地區(qū),,用藥成本變成了400美元,。赫希憤然離開(kāi)了藥店,但藥劑師卻追了上來(lái),,表示愿意跟赫希談判,。

談到這次經(jīng)歷時(shí),赫?;貞浀溃骸拔业哪X子有點(diǎn)崩潰,。”赫希曾經(jīng)是雅虎和Facebook的員工,,他也是照片標(biāo)簽功能的創(chuàng)造者之一,。作為一名科技從業(yè)者,他親自見(jiàn)證了數(shù)字化革命給航空業(yè)和房地產(chǎn)等行業(yè)帶來(lái)的透明度和便利性,。而處方藥市場(chǎng)的水既渾且深,,有中間商層層盤(pán)剝,價(jià)格極不統(tǒng)一,,這也恰恰是一個(gè)能夠顛覆的市場(chǎng),。因此,他和GoodRx的另一位創(chuàng)始人特雷弗·貝茲德克啟動(dòng)了這個(gè)耗時(shí)10年的創(chuàng)業(yè)項(xiàng)目,。

赫希表示,這個(gè)創(chuàng)業(yè)項(xiàng)目起初純粹是出于好奇,,只是想弄清楚藥價(jià)背后的貓膩,。

“坦率地說(shuō),剛開(kāi)始創(chuàng)業(yè)的時(shí)候,,我并不知道藥品福利管理公司是干什么的,。”他和其他幾位創(chuàng)始人開(kāi)始收集藥價(jià)信息,。

開(kāi)市客會(huì)在其官網(wǎng)上發(fā)布藥品價(jià)格,,沃爾瑪會(huì)以最低4美元的價(jià)格銷售部分處方藥,還有一些州制定了法律,,要求藥價(jià)必須在網(wǎng)上或在藥店里公示,。這些措施都旨在提高藥價(jià)的透明度,但它們并未起到應(yīng)有的效果,。

去年秋天他對(duì)我說(shuō):“這簡(jiǎn)直是一團(tuán)糟,?!?/p>

于是赫希和他的團(tuán)隊(duì)開(kāi)始打電話給各個(gè)藥店的藥劑師,并且面向整個(gè)醫(yī)療界尋求幫助,。

在《平價(jià)醫(yī)療法案》剛出臺(tái)的日子里,,很多人都覺(jué)得他們的努力是劃不來(lái)的。大家要么認(rèn)為美國(guó)醫(yī)療體系的漏洞已經(jīng)被彌補(bǔ)了,,要么認(rèn)為現(xiàn)有體系不可能被顛覆,。不過(guò)還是有足夠的人支持他們,包括藥品福利管理公司MedImpact的一名員工,。MedImpact最終也成了GoodRx的首批合作伙伴之一,。赫希稱:“大門(mén)總是向我們敞開(kāi)的?!?/p>

隨著時(shí)間的累積,,赫希的團(tuán)隊(duì)已經(jīng)收集了足夠的藥價(jià)信息,足以讓該公司的數(shù)據(jù)團(tuán)隊(duì)發(fā)現(xiàn)藥品福利管理公司與藥店之間無(wú)比復(fù)雜的合同里隱藏的貓膩,。他們發(fā)現(xiàn),,不同地方的藥價(jià),往往相差巨大,,特別是那些低成本的常用非專利藥品,。要想理解處方藥市場(chǎng)的運(yùn)行機(jī)制,首先要解決一個(gè)巨大且復(fù)雜的數(shù)據(jù)工程問(wèn)題,。不過(guò)GoodRx已經(jīng)解決了這個(gè)問(wèn)題,。

到2011年,該公司已經(jīng)建立了一個(gè)網(wǎng)站和一個(gè)產(chǎn)品——這是一個(gè)簡(jiǎn)單的數(shù)字化工具,,它可以清晰地展示不同銷售點(diǎn)的處方藥價(jià)格,,然而引導(dǎo)消費(fèi)者到價(jià)格最低的地方去購(gòu)買(mǎi)。隨著時(shí)間的推移,,該公司的數(shù)據(jù)庫(kù)也變得愈發(fā)復(fù)雜和完整,。

赫希表示,GoodRx現(xiàn)在幾乎能夠從所有的藥品福利管理公司渠道獲得藥價(jià)信息,,此外它還有其他的信息來(lái)源,,所以它的系統(tǒng)每天都可以收集2000多億條價(jià)格信息。

德意志銀行的醫(yī)療保健技術(shù)與服務(wù)證券研究部總經(jīng)理喬治·希爾認(rèn)為,,雖然GoodRx只是簡(jiǎn)單地對(duì)藥價(jià)進(jìn)行了比較,讓消費(fèi)者可以去低價(jià)的地方買(mǎi)藥,,但這已經(jīng)是行業(yè)一個(gè)了不起的突破了,。他指出,一個(gè)美國(guó)人平均每年要購(gòu)買(mǎi)11種處方藥,?!癎oodRx確實(shí)是醫(yī)療保健行業(yè)第一個(gè)被廣泛接受和采用的價(jià)格透明度工具,。”

****

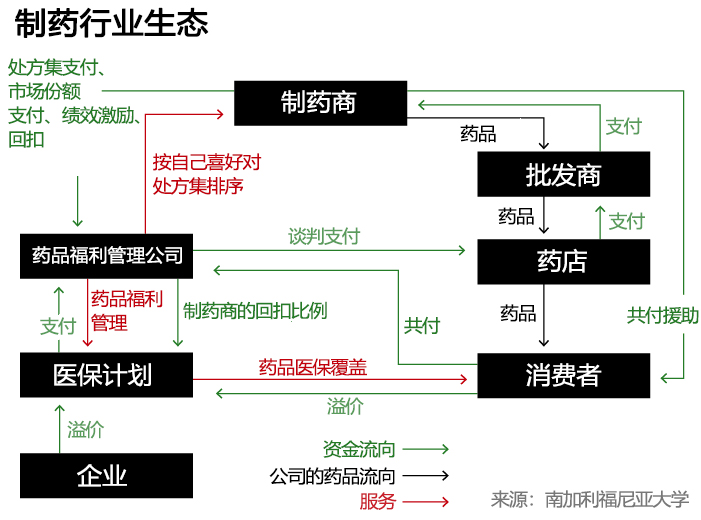

那么,,GoodRx的運(yùn)行機(jī)制到底是什么,?或者更準(zhǔn)確地說(shuō),它到底是怎樣賺錢(qián)的,?要理解它錯(cuò)綜復(fù)雜的商業(yè)模式,,你必須首先了解藥店行業(yè)的經(jīng)濟(jì)生態(tài)。不過(guò)就像美國(guó)醫(yī)療行業(yè)的許多其他角落一樣,,藥店這個(gè)行業(yè)的業(yè)態(tài),,是很難三言兩語(yǔ)解釋得清的。

這個(gè)行業(yè)有很多參與者,,都在爭(zhēng)搶這個(gè)5090億美元的大蛋糕,,其中大多數(shù)人都是中間商。大家都在通過(guò)各種復(fù)雜操作試圖分一杯羹,,比如所謂的回扣,、返點(diǎn)、共付等等,。對(duì)于外行來(lái)說(shuō),,要想知道你用來(lái)買(mǎi)藥的錢(qián)都流向了哪里,其難度簡(jiǎn)直復(fù)雜到無(wú)法想象,。

在這些參與者中,,對(duì)GoodRx的成功影響最大的,就是所謂的藥品福利管理公司(簡(jiǎn)稱PBM),。PBM最早出現(xiàn)在20世紀(jì)60年代,,它主要扮演了一個(gè)為醫(yī)保公司管理消費(fèi)者的處方藥需求的角色。這現(xiàn)在仍然是它們的主要業(yè)務(wù),,不過(guò)隨著時(shí)間的推移,,PBM在美國(guó)處方藥市場(chǎng)上的地位越來(lái)越強(qiáng)大,成了一個(gè)攫取了大量利益的中間商群體,。

PBM是醫(yī)保公司、制藥公司和藥店之間的中間商,,它可以通過(guò)談判來(lái)決定醫(yī)保公司要向制藥公司支付多少錢(qián),、消費(fèi)者要付給藥店多少錢(qián),以及藥店能夠報(bào)銷多少錢(qián),。它們還可以制定處方集,,它直接決定了你的醫(yī)保能夠報(bào)銷哪些藥品。它們還可以部署所謂的“醫(yī)療服務(wù)使用管理工具”,,比如預(yù)授權(quán)機(jī)制,,以確保你的處方藥在醫(yī)療上確實(shí)具有必要性,。有的PBM公司還經(jīng)營(yíng)著自己的藥店,能夠通過(guò)郵寄方式來(lái)向消費(fèi)者配送藥物,,等等,。所有這些活動(dòng)的目的,以及PBM公司自我標(biāo)榜的目標(biāo),,表面上就是為了控制購(gòu)買(mǎi)藥品的醫(yī)保支出,。

至于這些PBM公司到底起了多大的作用,這是一個(gè)非常有爭(zhēng)議的問(wèn)題,。近年來(lái),,這個(gè)規(guī)模高達(dá)4020億美元的龐大產(chǎn)業(yè)經(jīng)常因?yàn)椴煌该鞯闹虚g商行為而受到詬病。

在過(guò)去的10年里,,美國(guó)最大的三家PBM公司都被大型保險(xiǎn)公司吞并,,比如信諾旗下的Express Scripts、CVS旗下的Caremark,、聯(lián)合健康旗下的Optum,,而且創(chuàng)造了相當(dāng)可觀的收益??梢哉f(shuō),,它們賺的每一分錢(qián),都是消費(fèi)者在藥店花出去的錢(qián),。而GoodRx瞄準(zhǔn)的就是這個(gè)問(wèn)題,。

在本文中,我們主要探討低成本的非專利藥市場(chǎng),,因?yàn)樗荊oodRx為消費(fèi)者節(jié)省最多,、同時(shí)也是該公司盈利最多的地方。

一般來(lái)說(shuō),,當(dāng)你去藥店購(gòu)買(mǎi)處方藥的時(shí)候,,你要付給藥店多少錢(qián),取決于以下幾個(gè)因素:一是你醫(yī)保計(jì)劃,;二是你的醫(yī)保公司請(qǐng)來(lái)管理藥品成本的PBM公司,;三是你去買(mǎi)藥的那家藥店。你支付給藥店多少錢(qián),,取決于你的藥店與PBM公司之間的協(xié)議價(jià),。如果你沒(méi)有醫(yī)保,就要按照藥店的零售價(jià)用現(xiàn)金購(gòu)買(mǎi),,而這個(gè)價(jià)格通常是非常昂貴的,。

這就是為什么同一款藥品,不同的人去買(mǎi),,或者在不同的藥店購(gòu)買(mǎi),,價(jià)格相差會(huì)如此巨大,。

佐治亞州埃爾伯頓的獨(dú)立藥店Madden’s的老板兼藥劑師小唐恩·皮拉說(shuō):“如果有10個(gè)人在麥當(dāng)勞排隊(duì)買(mǎi)同樣的快樂(lè)兒童餐,那么所有人支付的金額都是一樣的,,不管你是用現(xiàn)金還是刷信用卡,,也不管你是什么人。但是在醫(yī)療行業(yè),,特別是在藥品行業(yè),,如果有10個(gè)人排隊(duì),想購(gòu)買(mǎi)30片降壓藥,,那么10個(gè)人掏的錢(qián)都不一樣,,或者說(shuō)他們的醫(yī)保支付的錢(qián)都不一樣?!彼舱J(rèn)為這個(gè)體系“很荒唐”,,更糟糕的是“沒(méi)有透明度”。

GoodRx的應(yīng)用程序正是圍繞醫(yī)藥行業(yè)的這一漏洞打造的,。它展示了PBM公司和各大藥店談判達(dá)成的所有價(jià)格,,而消費(fèi)者可以持GoodRx提供的優(yōu)惠券,到任意一家藥店去購(gòu)買(mǎi),。

不過(guò),,具有諷刺意味的是,通過(guò)與多家PBM公司的合作,,這種優(yōu)惠本身也成了一種賺錢(qián)的門(mén)路,。

例如據(jù)赫希介紹,當(dāng)一名消費(fèi)者拿著GoodRx的優(yōu)惠券,,在當(dāng)?shù)氐哪臣宜幍曩?gòu)買(mǎi)了某種低價(jià)藥品時(shí),,PBM公司也會(huì)給GoodRx一筆“介紹費(fèi)”。(這筆費(fèi)用貢獻(xiàn)了GoodRx收入的90%,。)這種交易對(duì)PBM公司來(lái)說(shuō)也是很劃算的,,因?yàn)樗鼈冇纱诉M(jìn)入了一個(gè)全新的收入領(lǐng)域。

南加利福尼亞大學(xué)謝弗中心的醫(yī)療政策主任,、醫(yī)療經(jīng)濟(jì)學(xué)家杰弗里·喬伊斯稱:“對(duì)那些沒(méi)有醫(yī)保的消費(fèi)者來(lái)說(shuō),,他們相當(dāng)于扮演了一個(gè)PBM公司的角色?!边@一部分利潤(rùn)是相當(dāng)可觀的,。“沒(méi)有醫(yī)保的消費(fèi)者是藥店的現(xiàn)金大戶,。他們?yōu)榉菍@幹Ц读烁叩秒x譜的價(jià)格?!?/p>

GoodRx并不是第一家奉行這個(gè)戰(zhàn)略的公司,。在美國(guó),,藥品折扣卡這個(gè)東西已經(jīng)存在幾十年了,它能夠讓消費(fèi)者以更便宜的價(jià)格,,從PBM公司指定的藥店網(wǎng)絡(luò)購(gòu)買(mǎi)處方藥,。只不過(guò)GoodRx的網(wǎng)絡(luò)更加復(fù)雜和強(qiáng)大,它的PBM合作伙伴已經(jīng)超過(guò)了12家,,所以它不僅掌握了他們所有藥店網(wǎng)絡(luò)的零售價(jià),,也可以提供更大范圍的折扣。(另外,,GoodRx還開(kāi)發(fā)了一個(gè)先進(jìn)的技術(shù)網(wǎng)絡(luò),,用來(lái)幫消費(fèi)者省錢(qián)。同時(shí)它在市場(chǎng)推廣上也不惜血本,。)

“所以通常情況下,,他們會(huì)有一個(gè)很好的價(jià)格?!钡乱庵俱y行網(wǎng)絡(luò)證券研究部的總經(jīng)理勞埃德·沃姆斯利說(shuō),。

凱蒂·雷·艾利森是懷俄明州吉列市的一家珠寶店的經(jīng)理兼設(shè)計(jì)師。她從小就患有甲狀腺疾病,,每天都需要服藥控制,,否則健康就會(huì)受到影響。她工作的地方并不提供醫(yī)保,。所以今年年初,,她第一次接觸到GoodRx的應(yīng)用程序時(shí),她既感到如釋重負(fù),,但也抱有幾分懷疑,。

她對(duì)我說(shuō):“它好得簡(jiǎn)直難以置信?!彼换?5美元,,就買(mǎi)到了90天的藥量。而如果沒(méi)有GoodRx的優(yōu)惠券的話,,她一個(gè)月的藥費(fèi)就得達(dá)到32美元,。“現(xiàn)在,,三個(gè)月的藥量只花了不到以前一個(gè)月的錢(qián),。按照一年來(lái)計(jì)算的話,它會(huì)給我省下很多錢(qián),?!?/p>

不過(guò),在GoodRx的用戶中,像艾利森這樣沒(méi)有醫(yī)療保險(xiǎn)的只是少數(shù),。據(jù)該公司介紹,,它75%的用戶都有某種形式的醫(yī)療保險(xiǎn)(包括Medicare等政府醫(yī)保)。

當(dāng)這些消費(fèi)者使用GoodRx的優(yōu)惠券在一家藥店低價(jià)購(gòu)買(mǎi)處方藥時(shí),,他們就不會(huì)動(dòng)用醫(yī)保,。這樣一來(lái),得利就是GoodRx和在那家藥店擁有最低協(xié)議價(jià)格的PBM公司,,而不是消費(fèi)者的醫(yī)保公司指定的PBM公司,。

為什么這么多人寧愿通過(guò)GoodRx自付藥費(fèi),也不動(dòng)用辛辛苦苦工作換來(lái)的醫(yī)療保險(xiǎn)呢,?很多人是出于跟上文的布拉德·懷特相同的考慮——即便我動(dòng)用了醫(yī)保,,我也得自付一部分高額藥費(fèi)。這也是因?yàn)榻陙?lái),,很多雇主選擇了高自付額度的醫(yī)保方案,。在這種醫(yī)保方案下,用戶至少要先自付1400美元,,之后才能夠啟動(dòng)醫(yī)保報(bào)銷,。

根據(jù)凱撒家族基金會(huì)的數(shù)據(jù),過(guò)去10年間,,美國(guó)人的平均自付金額從917美元上漲至1644美元,,增長(zhǎng)率達(dá)到111%。雇主的初衷是想讓雇員提高醫(yī)療保險(xiǎn)的成本意識(shí),,但在實(shí)際上,,它并沒(méi)有起到預(yù)期的效果。很多人反而因此而付不起高額的醫(yī)療賬單,。研究表明,,在高自付額醫(yī)保計(jì)劃下,人們會(huì)更傾向于推遲或放棄治療,。

GoodRx可以減輕醫(yī)保用戶的短期經(jīng)濟(jì)壓力,,但這也是有代價(jià)的。由于是通過(guò)現(xiàn)金支付的,,消費(fèi)者相當(dāng)于沒(méi)有動(dòng)用自己的醫(yī)保自付額度,,這樣一來(lái),也就延遲了他們享受醫(yī)保福利的機(jī)會(huì)——要知道,,消費(fèi)者和他們的雇主每月可是要在醫(yī)保上繳納不少錢(qián)的,。(根據(jù)凱撒家庭基金會(huì)的數(shù)據(jù),2020年,,美國(guó)個(gè)人的人均保費(fèi)是7470美元,,家庭的平均保費(fèi)是21342美元,。)

哈佛商學(xué)院的教授利莫爾·達(dá)芙尼也擔(dān)心,由于GoodRx的支出不計(jì)入自付額度,,一些醫(yī)保消費(fèi)者最終花出去的錢(qián)有可能會(huì)更多,。(GoodRx在其官網(wǎng)上提供了醫(yī)保消費(fèi)指引,比如如何提交收據(jù)和填寫(xiě)保險(xiǎn)報(bào)銷單等,以便讓消費(fèi)者在GoodRx上的消費(fèi)能夠被計(jì)入醫(yī)保自付額度,。不過(guò)該公司并沒(méi)有做出太多承諾,。該公司的一位發(fā)言人表示:“你很可能得不到報(bào)銷,,但你總是可以嘗試一下的,?!保?/p>

不過(guò),一些有醫(yī)保的消費(fèi)者之所以使用GoodRx,,往往不僅僅是為了省錢(qián),,而是因?yàn)獒t(yī)保系統(tǒng)的官僚主義嚴(yán)重影響了治療,而不得不求助于GoodRx,。比如馬薩諸塞州伍斯特市的中學(xué)數(shù)學(xué)老師亞伊拉·帕金斯。

今年33歲的帕金斯是兩個(gè)孩子的母親,,她一直過(guò)著充實(shí)而積極的生活,。但2019年年末,她開(kāi)始出現(xiàn)了系統(tǒng)性硬皮病的奇怪癥狀,,身體日漸衰弱,。2020年年初,她才確診患有這種罕見(jiàn)的自體免疫性疾病,。雖然這種病并不危及生命,但像其他自體免疫性疾病一樣,,它的致病機(jī)理尚不為人所知,,也無(wú)法徹底治愈。

對(duì)這種自體免疫性疾病,,醫(yī)生會(huì)給他們開(kāi)一些原本用來(lái)治療其他疾病的藥物,這些藥物有時(shí)候會(huì)有效,。帕金斯的病每天都會(huì)發(fā)作幾次,,醫(yī)生給了她開(kāi)了幾種免疫抑制劑,幾種治療高血壓和痤瘡的藥物,,還有一些面霜、肉毒桿菌素,,甚至還有非專利版的偉哥(西地那非),,希望這些能夠控制住她的病情。

起初,,帕金斯的保險(xiǎn)公司拒絕報(bào)銷其中的很多藥物,,理由是這些藥物并不是針對(duì)她的病情的指定療法。為此她和她的醫(yī)生花了幾周甚至幾個(gè)月的時(shí)間去申訴,。比如西地那非可以緩解她雙手血液循環(huán)不暢的問(wèn)題,,而90天的西地那非的費(fèi)用就高達(dá)1363.89美元。不過(guò)在用了醫(yī)生給她的GoodRx優(yōu)惠券后,,她實(shí)際只支付了19.37美元,。

帕金斯的故事并非個(gè)例。美國(guó)國(guó)家公共電臺(tái),、羅伯特·伍德·約翰遜基金會(huì)和哈佛公共衛(wèi)生學(xué)院去年的一項(xiàng)聯(lián)合調(diào)查顯示,,美國(guó)有超過(guò)三分之一的成年人和將近一半的低收入家庭,都曾經(jīng)被告知,,他們的醫(yī)保計(jì)劃無(wú)法報(bào)銷醫(yī)生開(kāi)具給他們的某一款處方藥,。

雖然帕金斯很感激GoodRx讓她終于負(fù)擔(dān)得起這些藥物,但她的心情依然五味雜陳,。今年2月,,她對(duì)我說(shuō):“整個(gè)體系都出了問(wèn)題,這些公司——我不知道它們是如何盈利的,,但我非常確定,,如果你深入研究的話,你會(huì)發(fā)現(xiàn),,不僅它們?cè)诰鹑±?,整個(gè)私營(yíng)保險(xiǎn)行業(yè)也在攫取利益,。”

從她和很多人的遭遇看,,她說(shuō)的一點(diǎn)不錯(cuò),。帕金斯的醫(yī)保公司(以及該醫(yī)保公司指定的PBM公司)雖然收了她繳納的保費(fèi),但她卻還要自己掏錢(qián)給GoodRx和另一家PBM公司,。

****

那么,,我們應(yīng)該如何看待GoodRx,以及它在美國(guó)醫(yī)療體系中扮演的角色呢,?這是一個(gè)很復(fù)雜的問(wèn)題,。

約翰斯·霍普金斯大學(xué)的卡萊布·亞歷山大深入研究了“藥價(jià)抵消”的問(wèn)題——比如GoodRx的優(yōu)惠券。他發(fā)現(xiàn),,消費(fèi)者節(jié)省下來(lái)的錢(qián),,主要集中在相對(duì)少量的非專利藥上。抵消的費(fèi)用相對(duì)來(lái)說(shuō)也并不高——大約是每筆交易16美元,,但它平均為用戶節(jié)省了約40%的自付費(fèi)用,。雖然他擔(dān)心這種價(jià)格采購(gòu)可能會(huì)營(yíng)造一種碎片化的環(huán)境,讓慢性病患者難以持續(xù),、穩(wěn)定地獲得藥品,,但還是要肯定它的優(yōu)點(diǎn)。

他表示:“這些類型的折扣,,最終會(huì)給消費(fèi)者帶來(lái)很大的轉(zhuǎn)變,。”

就連密歇根大學(xué)的價(jià)值型保險(xiǎn)設(shè)計(jì)中心的主任,、內(nèi)科醫(yī)生馬克·芬德里克,,也在自己辦公室的電腦旁邊放了一疊GoodRx的優(yōu)惠券,以便那些付不起基本藥品費(fèi)用的病人使用,。他對(duì)美國(guó)的醫(yī)保體系有清醒的認(rèn)識(shí),,他指出,GoodRx“是一個(gè)證明了整個(gè)定價(jià),、報(bào)銷,、分配系統(tǒng)有多混亂的經(jīng)典案例?!痹谶@個(gè)體系得到修正前,,他支持病人通過(guò)GoodRx或其他形式的輔助手段(例如眾籌捐款等等)獲得必需的藥物。

最近,,他就通過(guò)這款應(yīng)用程序?yàn)樗〉膶櫸锶惱?gòu)買(mǎi)了60片西地那非,,GoodRx讓省下了整整720美元,他自己只支付了33美元——折扣高達(dá)95%,。他還表示,,如果他肯去城市另一邊的另一家藥店,,他還可以再省一些錢(qián)。

南加州大學(xué)的喬伊斯也認(rèn)為,,GoodRx為那些負(fù)擔(dān)不起基本藥品的人提供了一條活路,。不過(guò)對(duì)于那些已經(jīng)購(gòu)買(mǎi)了醫(yī)保的消費(fèi)者,GoodRx的作用比較難以評(píng)估,,它對(duì)美國(guó)消費(fèi)者總體醫(yī)療出支出的影響也同樣難以評(píng)估,。

喬伊斯說(shuō):“它們不是圣人,它們這樣做是為了賺錢(qián),,而且它們的生意也是非常有利可圖的,。”

雖然GoodRx為人們提供了大量的藥價(jià)數(shù)據(jù),,但喬伊斯認(rèn)為,,GoodRx并未讓整個(gè)醫(yī)療體系變得更加透明?!八鼈儧](méi)有帶來(lái)更高的透明度,,它們的價(jià)格仍然高于采購(gòu)成本,它們并沒(méi)有把價(jià)格壓低到邊際成本,。”

此外,,喬伊斯等人也不相信GoodRx真的像它聲稱的那樣為消費(fèi)者節(jié)省了那么多錢(qián),。

馬里蘭大學(xué)藥學(xué)院的副教授喬伊·馬丁利認(rèn)為,在宣傳替消費(fèi)者省錢(qián)上,,GoodRx用了和PBM公司相同的數(shù)學(xué)花招——即假定一名消費(fèi)者如果沒(méi)有使用GoodRx的優(yōu)惠券,,他就會(huì)按照最高的價(jià)格買(mǎi)藥。(從GoodRx公司對(duì)相關(guān)數(shù)據(jù)的解釋看,,馬丁利的懷疑很有可能是正確的,。)

盡管如此,馬丁利還是認(rèn)為,,GoodRx能夠給消費(fèi)者帶來(lái)很有意義的轉(zhuǎn)變,,尤其是對(duì)那些沒(méi)有醫(yī)保的人。

不過(guò)站在GoodRx的角度,,赫希認(rèn)為,,為消費(fèi)者節(jié)省250億美元還是一種保守的說(shuō)法。

“我認(rèn)為在確保病人按時(shí)用藥,、使病人盡量少去急診等方面,,我們的實(shí)際影響還要大得多。有了GoodRx,,消費(fèi)者可以支付全部的處方藥費(fèi)用,,所以保險(xiǎn)公司,、付款人和政府的負(fù)擔(dān)都會(huì)有所減輕?!备鶕?jù)該公司的分析,,它已經(jīng)讓2200多萬(wàn)美國(guó)人買(mǎi)得起藥了,。

喬伊斯并未把“不透明”的帽子扣在GoodRx頭上。他說(shuō):“它突顯了藥品供應(yīng)鏈的浪費(fèi)和低效,以及藥價(jià)的低透明度,。而PBM公司才是真正的罪魁禍?zhǔn)住,!?/p>

2018年,,《美國(guó)醫(yī)學(xué)會(huì)雜志》發(fā)表了喬伊斯和他的同事的一篇研究。研究發(fā)現(xiàn),,在22%的情況下,,消費(fèi)者對(duì)處方藥的共付費(fèi)用超過(guò)了藥品本身的成本。換句話說(shuō),,患者并非是“共付”,,而是“過(guò)度支付”了藥價(jià)。從中得利的恰恰是PBM和保險(xiǎn)公司,。

更過(guò)分的是,,直到最近,很多藥店還在以合同的形式,,禁止藥劑師提醒醫(yī)保病人他們支付的金額可能超過(guò)了藥品的現(xiàn)金價(jià)格(也就是沒(méi)有醫(yī)保的病人支付的價(jià)格),。

從一些獨(dú)立藥劑師(比如獨(dú)立藥店Madden’s的老板小唐恩·皮拉)的角度看,GoodRx的優(yōu)惠券,,只是PBM公司從藥店割肉的另一種方式,。

他表示,Madden’s藥店的現(xiàn)金價(jià)格往往比GoodRx上的價(jià)格更加優(yōu)惠,,不過(guò)它不會(huì)出現(xiàn)在GoodRx的應(yīng)用程序上,。但當(dāng)消費(fèi)者使用優(yōu)惠券時(shí),PBM公司會(huì)收取一筆“高額費(fèi)用”,,然后向藥店報(bào)銷一個(gè)較低的金額,,有時(shí)甚至?xí)陀谒幤返某杀尽2贿^(guò)即使賠錢(qián)賣藥,,它也必須兌換GoodRx的優(yōu)惠券,,因?yàn)樗嚓P(guān)的PBM公司有協(xié)議。

作為一家小藥店,,和其他獨(dú)立藥房一樣,當(dāng)與強(qiáng)大的PBM公司談判的時(shí)候,Madden’s是沒(méi)有什么話語(yǔ)權(quán)的,。而不與PBM打交道則根本不現(xiàn)實(shí),。

皮拉也認(rèn)為,GoodRx提供的折扣,,確實(shí)可以幫助消費(fèi)者買(mǎi)得起他們所需的藥品,。只不過(guò),GoodRx提供給消費(fèi)者的只是一個(gè)“更好”的價(jià)格,,而并非“最好”的價(jià)格,。(不過(guò)赫希表示,GoodRx“專注于為消費(fèi)者提供最好的價(jià)格,?!保?/p>

皮拉說(shuō):“它們其實(shí)什么也沒(méi)有做。它們沒(méi)有實(shí)際銷售一種產(chǎn)品,,也沒(méi)有給病人打電話,,給他們提供咨詢服務(wù),也沒(méi)有告訴病人如何用藥,。它只是做了一個(gè)算法,,就能夠凈賺幾億美元,這意味著什么,?”

赫希認(rèn)為,,GoodRx不僅僅是一種算法——該公司也一直在擴(kuò)展其他業(yè)務(wù),包括遠(yuǎn)程醫(yī)療,,和所謂的“制藥商解決方案”,。這也是一項(xiàng)高增長(zhǎng)、高利潤(rùn)的業(yè)務(wù),。GoodRx會(huì)讓各大藥物品牌的制藥商與在其平臺(tái)上搜索藥品的消費(fèi)者建立聯(lián)系。該公司還提供了GoodRx Gold和Kroger Rx省錢(qián)俱樂(lè)部等會(huì)員服務(wù),,會(huì)員可以享受到比應(yīng)用程序更優(yōu)惠的藥價(jià),。該公司還發(fā)布了藥品價(jià)格研究報(bào)告,并就改善藥品行業(yè)生態(tài),,提供了一些最清晰的,、最有利于消費(fèi)者的見(jiàn)解。

去年11月,,在亞馬遜宣布啟動(dòng)自己的藥品優(yōu)惠計(jì)劃后,,GoodRx的股價(jià)出現(xiàn)了短暫的下跌。不過(guò)GoodRx的高管表示,,從業(yè)務(wù)上看,,GoodRx對(duì)亞馬遜的進(jìn)入并沒(méi)有什么可以擔(dān)憂的。(另外,消費(fèi)者還能夠在亞馬遜的藥店使用GoodRx的優(yōu)惠券,。)

德意志銀行網(wǎng)絡(luò)證券研究部的總經(jīng)理勞埃德·沃姆斯利和瑞士信貸的分析師杰倫德拉·辛格等分析師也認(rèn)為,,GoodRx的業(yè)務(wù)當(dāng)前面臨的威脅是被夸大了的。

赫希表示,,他認(rèn)為公司業(yè)務(wù)面臨的最大障礙,,是很多老百姓仍然不了解藥價(jià)背后的貓膩,不了解自己本可以享受到更優(yōu)惠的價(jià)格,,仍然像以前一樣購(gòu)買(mǎi)處方藥,。

赫希對(duì)我說(shuō):“我們最大的競(jìng)爭(zhēng)對(duì)手,就是那些不知道本來(lái)能夠獲得更優(yōu)惠的藥價(jià)的美國(guó)人,?!彼M鸊oodRx品牌可以成為美國(guó)消費(fèi)者最信賴的伙伴。

很多第一次使用GoodRx的人——比如上文提到的懷特和艾利森,,都給出了幾乎不可思議的評(píng)價(jià),,認(rèn)為GoodRx“好得難以置信”。他們能夠相對(duì)輕松,、簡(jiǎn)單地在藥店完成購(gòu)買(mǎi),,而且藥價(jià)還很便宜。在買(mǎi)藥的過(guò)程中,,人們沒(méi)有醫(yī)??ㄒ部梢韵硎芡瑯拥姆?wù),而且不用考慮共付,、自付,、PBM和醫(yī)保這些糟心事。

當(dāng)然,,美國(guó)醫(yī)療行業(yè)的這些糟心事和種種深層問(wèn)題仍然存在,。GoodRx只是一家讓你忘了這些問(wèn)題的中間商。(財(cái)富中文網(wǎng))

譯者:樸成奎

布拉德·懷特有胃酸反流的老毛病,,所以需要長(zhǎng)年服用埃索美拉唑,,這種藥物是阿斯利康公司的專利藥物耐信的非專利版本。懷特是得克薩斯州南湖市的一名退休的學(xué)校行政人員,,可以享受醫(yī)保,。不過(guò)今年年初,他開(kāi)車到當(dāng)?shù)氐腃VS藥店取藥時(shí),,還是被嚇了一跳——藥店的工作人員告訴他,,要想購(gòu)買(mǎi)三個(gè)月的藥量,他還得自付490美元,。

他也不記得自己以前在買(mǎi)藥上花了多少錢(qián)——以前的處方藥都是郵寄來(lái)的,,買(mǎi)藥的錢(qián)都是通過(guò)自動(dòng)扣款。不過(guò)他知道,在達(dá)到3000美元的自付額之前,,他自己還是得在買(mǎi)藥上多花不少錢(qián),。一想到吃幾個(gè)月的非專利藥,就得花將近500美元的高價(jià),,他實(shí)在難以接受,。所以他沒(méi)有拿藥就走了,打算“重新部署”一下自己的用藥計(jì)劃,。

回到家后,,懷特開(kāi)始在谷歌上搜索“低藥價(jià)”等關(guān)鍵詞。很快,,他發(fā)現(xiàn)了一家名叫GoodRx的藥品折扣公司,。憑借該公司贈(zèng)送給他的優(yōu)惠券,他能夠在不動(dòng)用醫(yī)保的前提下,,以17美元的超低價(jià),,從附近的一家克羅格藥店拿到一個(gè)月的藥量。

他說(shuō):“我當(dāng)時(shí)覺(jué)得:‘這肯定不可行,!’但沒(méi)有想到,,它竟然真的可行?!?/p>

他最近又利用這款應(yīng)用程序購(gòu)買(mǎi)了另外一種處方藥,。如果使用醫(yī)保的話,購(gòu)買(mǎi)一個(gè)月的藥量,,需要自付36美元,。而在GoodRx上,只需要花費(fèi)16.6美元,。所以他當(dāng)然選擇了這個(gè)花錢(qián)更少的渠道,。懷特也知道,買(mǎi)藥不用醫(yī)保,,相當(dāng)于有便宜不占,,但他并不介意。

“當(dāng)藥價(jià)存在這么大的差距時(shí),,只要做個(gè)簡(jiǎn)單的計(jì)算,你就會(huì)知道,,最好不使用醫(yī)保,。老實(shí)說(shuō),我也覺(jué)得這很奇怪,?!?/p>

在和藥店的藥劑師聊天時(shí),懷特驚訝地發(fā)現(xiàn),藥店不僅接受GoodRx的優(yōu)惠券,,連這位藥劑師自己,,也會(huì)使用GoodRx的優(yōu)惠券,以更低的價(jià)格購(gòu)買(mǎi)他的哮喘藥,。

今年早些時(shí)候,,我跟懷特談到這件事情時(shí),他還處在一種既開(kāi)心又將信將疑的狀態(tài),,因?yàn)樗X(jué)得這里似乎有一個(gè)“悖論”,。

“我疑惑的是,這種情況到底可以持續(xù)多久,?因?yàn)槿绻腥嗽谫嶅X(qián)的話,,就肯定有人在虧錢(qián),只不過(guò)我不知道誰(shuí)虧誰(shuí)賺,?!?/p>

你大概也能夠理解懷特的困惑吧?如今在美國(guó),,每個(gè)月都有560萬(wàn)人通過(guò)GoodRx購(gòu)買(mǎi)打折的處方藥,。GoodRx有一個(gè)免費(fèi)的應(yīng)用程序,它會(huì)顯示多家零售藥店的處方藥價(jià)格,,并且提供相應(yīng)的優(yōu)惠券,。

目前,它已經(jīng)是蘋(píng)果的iTunes和谷歌的GooglePlay上下載次數(shù)最多的醫(yī)療類應(yīng)用程序之一,。該公司官網(wǎng)的月訪問(wèn)量達(dá)到了1800萬(wàn)次以上,。該公司的服務(wù)深受消費(fèi)者的喜愛(ài),并且也被醫(yī)生們大力推薦,。

ProPublica,、《紐約時(shí)報(bào)》和《財(cái)富》等媒體也對(duì)它贊譽(yù)有加。

《財(cái)富》雜志甚至將它列入2019年的“改變世界”排行榜,。該公司的“凈推廣分?jǐn)?shù)”——或者說(shuō)忠誠(chéng)度評(píng)分,,幾乎超過(guò)了90分。相比之下,,蘋(píng)果最新的忠誠(chéng)度得分只有47分,,沃爾格林(Walgreens)是25分,F(xiàn)acebook是負(fù)21分,。

GoodRx何以受到熱捧,?理由很明顯:該公司稱,從2011年以來(lái),,它已經(jīng)為廣大消費(fèi)者節(jié)省了合計(jì)超過(guò)250億美元的買(mǎi)藥成本,。而從2019年以來(lái),,它幾乎每天都可以為消費(fèi)者節(jié)省2000萬(wàn)美元的買(mǎi)藥支出??紤]到美國(guó)有5800萬(wàn)人存在買(mǎi)不起藥的問(wèn)題,,每個(gè)月估計(jì)有上萬(wàn)人因?yàn)橘I(mǎi)不起藥物而死亡,它已經(jīng)堪稱是一款英雄的應(yīng)用程序了,。

當(dāng)然,,GoodRx是一家商業(yè)企業(yè),不是慈善機(jī)構(gòu),。事實(shí)證明,,幫助大家節(jié)省買(mǎi)藥錢(qián),這本身就是一筆好生意,。

去年該公司的營(yíng)收為5.507億美元,,較2019年增長(zhǎng)42%。要知道,,受新冠疫情影響,,去年美國(guó)醫(yī)療保健服務(wù)的消費(fèi)量實(shí)際上是受到抑制的,醫(yī)生開(kāi)出的處方數(shù)也要低于往年,。(根據(jù)醫(yī)療數(shù)據(jù)公司IQVIA的數(shù)據(jù),,2010年美國(guó)開(kāi)具的處方量下降了3%。)另外,,GoodRx已經(jīng)實(shí)現(xiàn)了盈利,。2020年上半年,它的凈利潤(rùn)同比增長(zhǎng)了75%,,達(dá)到5500萬(wàn)美元,。(不過(guò)由于IPO的相關(guān)成本,GoodRx的全年虧損額仍然達(dá)到2.94億美元,。)

華爾街也看好GoodRx這種貌似違反直覺(jué)的商業(yè)模式,。去年9月,GoodRx通過(guò)IPO實(shí)現(xiàn)上市,,這也是去年規(guī)模最大的20宗IPO之一,,其交易規(guī)模達(dá)到11.4億美元。目前該公司的市值約為158億美元,。

GoodRx常說(shuō),,有了GoodRx,所有人都成為了贏家,。消費(fèi)者買(mǎi)得起藥,、存得下錢(qián),從而提高了健康水平,。醫(yī)療服務(wù)供應(yīng)商和醫(yī)保公司也是贏家,,因?yàn)椴∪烁心芰Π凑仗幏接盟幜恕V扑幧?、藥店和藥品福利管理公司(主要?fù)責(zé)為醫(yī)保公司管理用藥需求)同樣也是贏家,,因?yàn)橛行└邇r(jià)藥本來(lái)有可能一直在藥店里被放到過(guò)期,但現(xiàn)在卻通過(guò)打折的方式處理了出去,。(另外,,由于客流量提高了,藥店也會(huì)帶來(lái)更高的非藥物銷量,。)當(dāng)然,,最大的贏家還是GoodRx。只用了短短10年時(shí)間,,它就把自己打造成了一個(gè)英雄的形象,,在盤(pán)根錯(cuò)節(jié)的美國(guó)醫(yī)療保健行業(yè)里站穩(wěn)了腳根——雖然其本質(zhì)還是一家中間商。

****

如果美國(guó)的藥價(jià)體系不是如此復(fù)雜的話,,GoodRx可能根本不會(huì)存在,。約翰斯·霍普金斯大學(xué)(Johns Hopkins University)的流行病學(xué)和醫(yī)學(xué)教授凱萊布·亞歷山大說(shuō):“美國(guó)的藥品定價(jià)體系可以說(shuō)是不正常的,而它們找到了在這樣一個(gè)體系里做生意的好方法,?!?/p>

亞當(dāng)·費(fèi)恩是一名藥品經(jīng)濟(jì)學(xué)家和藥品分銷專家,也是藥物渠道研究所的首席執(zhí)行官,。他在推特上這樣評(píng)價(jià)GoodRx去年的驚人業(yè)績(jī):“哇,,藥品福利公司的格局被打破了?!?/p>

對(duì)此,,GoodRx的聯(lián)合創(chuàng)始人、聯(lián)合首席執(zhí)行官道格·赫希也并不否認(rèn),。去年秋天,,他告訴我:“我們的成功,恰恰說(shuō)明美國(guó)的醫(yī)療體系已經(jīng)爛到了什么樣子,?!?/p>

正是這種市場(chǎng)失靈,才造就了最初的GoodRx,。

2010年的一天,,赫希到當(dāng)?shù)氐囊患宜幍耆ベI(mǎi)一種藥,結(jié)果發(fā)現(xiàn)他要自付500美元的藥費(fèi),。赫希也是有醫(yī)保的,,他本來(lái)以為藥費(fèi)只是這個(gè)數(shù)字的一個(gè)零頭。于是他又去了馬路對(duì)面的另一家藥店,,結(jié)果發(fā)現(xiàn),,同樣的藥品,,這里只需要300美元。而到另一個(gè)地區(qū),,用藥成本變成了400美元,。赫希憤然離開(kāi)了藥店,但藥劑師卻追了上來(lái),,表示愿意跟赫希談判,。

談到這次經(jīng)歷時(shí),赫?;貞浀溃骸拔业哪X子有點(diǎn)崩潰,。”赫希曾經(jīng)是雅虎和Facebook的員工,,他也是照片標(biāo)簽功能的創(chuàng)造者之一,。作為一名科技從業(yè)者,他親自見(jiàn)證了數(shù)字化革命給航空業(yè)和房地產(chǎn)等行業(yè)帶來(lái)的透明度和便利性,。而處方藥市場(chǎng)的水既渾且深,,有中間商層層盤(pán)剝,價(jià)格極不統(tǒng)一,,這也恰恰是一個(gè)能夠顛覆的市場(chǎng),。因此,他和GoodRx的另一位創(chuàng)始人特雷弗·貝茲德克啟動(dòng)了這個(gè)耗時(shí)10年的創(chuàng)業(yè)項(xiàng)目,。

赫希表示,,這個(gè)創(chuàng)業(yè)項(xiàng)目起初純粹是出于好奇,只是想弄清楚藥價(jià)背后的貓膩,。

“坦率地說(shuō),,剛開(kāi)始創(chuàng)業(yè)的時(shí)候,我并不知道藥品福利管理公司是干什么的,?!彼推渌麕孜粍?chuàng)始人開(kāi)始收集藥價(jià)信息。

開(kāi)市客會(huì)在其官網(wǎng)上發(fā)布藥品價(jià)格,,沃爾瑪會(huì)以最低4美元的價(jià)格銷售部分處方藥,,還有一些州制定了法律,要求藥價(jià)必須在網(wǎng)上或在藥店里公示,。這些措施都旨在提高藥價(jià)的透明度,,但它們并未起到應(yīng)有的效果。

去年秋天他對(duì)我說(shuō):“這簡(jiǎn)直是一團(tuán)糟,?!?/p>

于是赫希和他的團(tuán)隊(duì)開(kāi)始打電話給各個(gè)藥店的藥劑師,并且面向整個(gè)醫(yī)療界尋求幫助,。

在《平價(jià)醫(yī)療法案》剛出臺(tái)的日子里,,很多人都覺(jué)得他們的努力是劃不來(lái)的,。大家要么認(rèn)為美國(guó)醫(yī)療體系的漏洞已經(jīng)被彌補(bǔ)了,要么認(rèn)為現(xiàn)有體系不可能被顛覆,。不過(guò)還是有足夠的人支持他們,,包括藥品福利管理公司MedImpact的一名員工。MedImpact最終也成了GoodRx的首批合作伙伴之一,。赫希稱:“大門(mén)總是向我們敞開(kāi)的?!?/p>

隨著時(shí)間的累積,,赫希的團(tuán)隊(duì)已經(jīng)收集了足夠的藥價(jià)信息,足以讓該公司的數(shù)據(jù)團(tuán)隊(duì)發(fā)現(xiàn)藥品福利管理公司與藥店之間無(wú)比復(fù)雜的合同里隱藏的貓膩,。他們發(fā)現(xiàn),,不同地方的藥價(jià),往往相差巨大,,特別是那些低成本的常用非專利藥品,。要想理解處方藥市場(chǎng)的運(yùn)行機(jī)制,首先要解決一個(gè)巨大且復(fù)雜的數(shù)據(jù)工程問(wèn)題,。不過(guò)GoodRx已經(jīng)解決了這個(gè)問(wèn)題,。

到2011年,該公司已經(jīng)建立了一個(gè)網(wǎng)站和一個(gè)產(chǎn)品——這是一個(gè)簡(jiǎn)單的數(shù)字化工具,,它可以清晰地展示不同銷售點(diǎn)的處方藥價(jià)格,,然而引導(dǎo)消費(fèi)者到價(jià)格最低的地方去購(gòu)買(mǎi)。隨著時(shí)間的推移,,該公司的數(shù)據(jù)庫(kù)也變得愈發(fā)復(fù)雜和完整,。

赫希表示,GoodRx現(xiàn)在幾乎能夠從所有的藥品福利管理公司渠道獲得藥價(jià)信息,,此外它還有其他的信息來(lái)源,,所以它的系統(tǒng)每天都可以收集2000多億條價(jià)格信息。

德意志銀行的醫(yī)療保健技術(shù)與服務(wù)證券研究部總經(jīng)理喬治·希爾認(rèn)為,,雖然GoodRx只是簡(jiǎn)單地對(duì)藥價(jià)進(jìn)行了比較,,讓消費(fèi)者可以去低價(jià)的地方買(mǎi)藥,但這已經(jīng)是行業(yè)一個(gè)了不起的突破了,。他指出,,一個(gè)美國(guó)人平均每年要購(gòu)買(mǎi)11種處方藥?!癎oodRx確實(shí)是醫(yī)療保健行業(yè)第一個(gè)被廣泛接受和采用的價(jià)格透明度工具,。”

****

那么,,GoodRx的運(yùn)行機(jī)制到底是什么,?或者更準(zhǔn)確地說(shuō),,它到底是怎樣賺錢(qián)的?要理解它錯(cuò)綜復(fù)雜的商業(yè)模式,,你必須首先了解藥店行業(yè)的經(jīng)濟(jì)生態(tài),。不過(guò)就像美國(guó)醫(yī)療行業(yè)的許多其他角落一樣,藥店這個(gè)行業(yè)的業(yè)態(tài),,是很難三言兩語(yǔ)解釋得清的,。

這個(gè)行業(yè)有很多參與者,都在爭(zhēng)搶這個(gè)5090億美元的大蛋糕,,其中大多數(shù)人都是中間商,。大家都在通過(guò)各種復(fù)雜操作試圖分一杯羹,比如所謂的回扣,、返點(diǎn),、共付等等。對(duì)于外行來(lái)說(shuō),,要想知道你用來(lái)買(mǎi)藥的錢(qián)都流向了哪里,,其難度簡(jiǎn)直復(fù)雜到無(wú)法想象。

在這些參與者中,,對(duì)GoodRx的成功影響最大的,,就是所謂的藥品福利管理公司(簡(jiǎn)稱PBM)。PBM最早出現(xiàn)在20世紀(jì)60年代,,它主要扮演了一個(gè)為醫(yī)保公司管理消費(fèi)者的處方藥需求的角色,。這現(xiàn)在仍然是它們的主要業(yè)務(wù),不過(guò)隨著時(shí)間的推移,,PBM在美國(guó)處方藥市場(chǎng)上的地位越來(lái)越強(qiáng)大,,成了一個(gè)攫取了大量利益的中間商群體。

PBM是醫(yī)保公司,、制藥公司和藥店之間的中間商,,它可以通過(guò)談判來(lái)決定醫(yī)保公司要向制藥公司支付多少錢(qián)、消費(fèi)者要付給藥店多少錢(qián),,以及藥店能夠報(bào)銷多少錢(qián),。它們還可以制定處方集,它直接決定了你的醫(yī)保能夠報(bào)銷哪些藥品,。它們還可以部署所謂的“醫(yī)療服務(wù)使用管理工具”,,比如預(yù)授權(quán)機(jī)制,以確保你的處方藥在醫(yī)療上確實(shí)具有必要性,。有的PBM公司還經(jīng)營(yíng)著自己的藥店,,能夠通過(guò)郵寄方式來(lái)向消費(fèi)者配送藥物,等等。所有這些活動(dòng)的目的,,以及PBM公司自我標(biāo)榜的目標(biāo),,表面上就是為了控制購(gòu)買(mǎi)藥品的醫(yī)保支出。

至于這些PBM公司到底起了多大的作用,,這是一個(gè)非常有爭(zhēng)議的問(wèn)題,。近年來(lái),這個(gè)規(guī)模高達(dá)4020億美元的龐大產(chǎn)業(yè)經(jīng)常因?yàn)椴煌该鞯闹虚g商行為而受到詬病,。

在過(guò)去的10年里,,美國(guó)最大的三家PBM公司都被大型保險(xiǎn)公司吞并,比如信諾旗下的Express Scripts,、CVS旗下的Caremark,、聯(lián)合健康旗下的Optum,而且創(chuàng)造了相當(dāng)可觀的收益,。可以說(shuō),,它們賺的每一分錢(qián),,都是消費(fèi)者在藥店花出去的錢(qián)。而GoodRx瞄準(zhǔn)的就是這個(gè)問(wèn)題,。

在本文中,,我們主要探討低成本的非專利藥市場(chǎng),因?yàn)樗荊oodRx為消費(fèi)者節(jié)省最多,、同時(shí)也是該公司盈利最多的地方,。

一般來(lái)說(shuō),當(dāng)你去藥店購(gòu)買(mǎi)處方藥的時(shí)候,,你要付給藥店多少錢(qián),,取決于以下幾個(gè)因素:一是你醫(yī)保計(jì)劃;二是你的醫(yī)保公司請(qǐng)來(lái)管理藥品成本的PBM公司,;三是你去買(mǎi)藥的那家藥店,。你支付給藥店多少錢(qián),取決于你的藥店與PBM公司之間的協(xié)議價(jià),。如果你沒(méi)有醫(yī)保,,就要按照藥店的零售價(jià)用現(xiàn)金購(gòu)買(mǎi),而這個(gè)價(jià)格通常是非常昂貴的,。

這就是為什么同一款藥品,,不同的人去買(mǎi),或者在不同的藥店購(gòu)買(mǎi),,價(jià)格相差會(huì)如此巨大,。

佐治亞州埃爾伯頓的獨(dú)立藥店Madden’s的老板兼藥劑師小唐恩·皮拉說(shuō):“如果有10個(gè)人在麥當(dāng)勞排隊(duì)買(mǎi)同樣的快樂(lè)兒童餐,那么所有人支付的金額都是一樣的,不管你是用現(xiàn)金還是刷信用卡,,也不管你是什么人,。但是在醫(yī)療行業(yè),特別是在藥品行業(yè),,如果有10個(gè)人排隊(duì),,想購(gòu)買(mǎi)30片降壓藥,那么10個(gè)人掏的錢(qián)都不一樣,,或者說(shuō)他們的醫(yī)保支付的錢(qián)都不一樣,。”他也認(rèn)為這個(gè)體系“很荒唐”,,更糟糕的是“沒(méi)有透明度”,。

GoodRx的應(yīng)用程序正是圍繞醫(yī)藥行業(yè)的這一漏洞打造的。它展示了PBM公司和各大藥店談判達(dá)成的所有價(jià)格,,而消費(fèi)者可以持GoodRx提供的優(yōu)惠券,,到任意一家藥店去購(gòu)買(mǎi)。

不過(guò),,具有諷刺意味的是,,通過(guò)與多家PBM公司的合作,這種優(yōu)惠本身也成了一種賺錢(qián)的門(mén)路,。

例如據(jù)赫希介紹,,當(dāng)一名消費(fèi)者拿著GoodRx的優(yōu)惠券,在當(dāng)?shù)氐哪臣宜幍曩?gòu)買(mǎi)了某種低價(jià)藥品時(shí),,PBM公司也會(huì)給GoodRx一筆“介紹費(fèi)”,。(這筆費(fèi)用貢獻(xiàn)了GoodRx收入的90%。)這種交易對(duì)PBM公司來(lái)說(shuō)也是很劃算的,,因?yàn)樗鼈冇纱诉M(jìn)入了一個(gè)全新的收入領(lǐng)域,。

南加利福尼亞大學(xué)謝弗中心的醫(yī)療政策主任、醫(yī)療經(jīng)濟(jì)學(xué)家杰弗里·喬伊斯稱:“對(duì)那些沒(méi)有醫(yī)保的消費(fèi)者來(lái)說(shuō),,他們相當(dāng)于扮演了一個(gè)PBM公司的角色,。”這一部分利潤(rùn)是相當(dāng)可觀的,?!皼](méi)有醫(yī)保的消費(fèi)者是藥店的現(xiàn)金大戶。他們?yōu)榉菍@幹Ц读烁叩秒x譜的價(jià)格,?!?/p>

GoodRx并不是第一家奉行這個(gè)戰(zhàn)略的公司。在美國(guó),,藥品折扣卡這個(gè)東西已經(jīng)存在幾十年了,,它能夠讓消費(fèi)者以更便宜的價(jià)格,,從PBM公司指定的藥店網(wǎng)絡(luò)購(gòu)買(mǎi)處方藥。只不過(guò)GoodRx的網(wǎng)絡(luò)更加復(fù)雜和強(qiáng)大,,它的PBM合作伙伴已經(jīng)超過(guò)了12家,,所以它不僅掌握了他們所有藥店網(wǎng)絡(luò)的零售價(jià),也可以提供更大范圍的折扣,。(另外,,GoodRx還開(kāi)發(fā)了一個(gè)先進(jìn)的技術(shù)網(wǎng)絡(luò),用來(lái)幫消費(fèi)者省錢(qián),。同時(shí)它在市場(chǎng)推廣上也不惜血本,。)

“所以通常情況下,他們會(huì)有一個(gè)很好的價(jià)格,?!钡乱庵俱y行網(wǎng)絡(luò)證券研究部的總經(jīng)理勞埃德·沃姆斯利說(shuō)。

凱蒂·雷·艾利森是懷俄明州吉列市的一家珠寶店的經(jīng)理兼設(shè)計(jì)師,。她從小就患有甲狀腺疾病,,每天都需要服藥控制,否則健康就會(huì)受到影響,。她工作的地方并不提供醫(yī)保,。所以今年年初,她第一次接觸到GoodRx的應(yīng)用程序時(shí),,她既感到如釋重負(fù),,但也抱有幾分懷疑,。

她對(duì)我說(shuō):“它好得簡(jiǎn)直難以置信,。”她只花了25美元,,就買(mǎi)到了90天的藥量,。而如果沒(méi)有GoodRx的優(yōu)惠券的話,她一個(gè)月的藥費(fèi)就得達(dá)到32美元,?!艾F(xiàn)在,三個(gè)月的藥量只花了不到以前一個(gè)月的錢(qián),。按照一年來(lái)計(jì)算的話,,它會(huì)給我省下很多錢(qián)?!?/p>

不過(guò),,在GoodRx的用戶中,像艾利森這樣沒(méi)有醫(yī)療保險(xiǎn)的只是少數(shù),。據(jù)該公司介紹,,它75%的用戶都有某種形式的醫(yī)療保險(xiǎn)(包括Medicare等政府醫(yī)保)。

當(dāng)這些消費(fèi)者使用GoodRx的優(yōu)惠券在一家藥店低價(jià)購(gòu)買(mǎi)處方藥時(shí),他們就不會(huì)動(dòng)用醫(yī)保,。這樣一來(lái),,得利就是GoodRx和在那家藥店擁有最低協(xié)議價(jià)格的PBM公司,而不是消費(fèi)者的醫(yī)保公司指定的PBM公司,。

為什么這么多人寧愿通過(guò)GoodRx自付藥費(fèi),,也不動(dòng)用辛辛苦苦工作換來(lái)的醫(yī)療保險(xiǎn)呢?很多人是出于跟上文的布拉德·懷特相同的考慮——即便我動(dòng)用了醫(yī)保,,我也得自付一部分高額藥費(fèi),。這也是因?yàn)榻陙?lái),很多雇主選擇了高自付額度的醫(yī)保方案,。在這種醫(yī)保方案下,,用戶至少要先自付1400美元,之后才能夠啟動(dòng)醫(yī)保報(bào)銷,。

根據(jù)凱撒家族基金會(huì)的數(shù)據(jù),,過(guò)去10年間,美國(guó)人的平均自付金額從917美元上漲至1644美元,,增長(zhǎng)率達(dá)到111%,。雇主的初衷是想讓雇員提高醫(yī)療保險(xiǎn)的成本意識(shí),但在實(shí)際上,,它并沒(méi)有起到預(yù)期的效果,。很多人反而因此而付不起高額的醫(yī)療賬單。研究表明,,在高自付額醫(yī)保計(jì)劃下,,人們會(huì)更傾向于推遲或放棄治療。

GoodRx可以減輕醫(yī)保用戶的短期經(jīng)濟(jì)壓力,,但這也是有代價(jià)的,。由于是通過(guò)現(xiàn)金支付的,消費(fèi)者相當(dāng)于沒(méi)有動(dòng)用自己的醫(yī)保自付額度,,這樣一來(lái),,也就延遲了他們享受醫(yī)保福利的機(jī)會(huì)——要知道,消費(fèi)者和他們的雇主每月可是要在醫(yī)保上繳納不少錢(qián)的,。(根據(jù)凱撒家庭基金會(huì)的數(shù)據(jù),,2020年,美國(guó)個(gè)人的人均保費(fèi)是7470美元,,家庭的平均保費(fèi)是21342美元,。)

哈佛商學(xué)院的教授利莫爾·達(dá)芙尼也擔(dān)心,由于GoodRx的支出不計(jì)入自付額度,,一些醫(yī)保消費(fèi)者最終花出去的錢(qián)有可能會(huì)更多,。(GoodRx在其官網(wǎng)上提供了醫(yī)保消費(fèi)指引,,比如如何提交收據(jù)和填寫(xiě)保險(xiǎn)報(bào)銷單等,以便讓消費(fèi)者在GoodRx上的消費(fèi)能夠被計(jì)入醫(yī)保自付額度,。不過(guò)該公司并沒(méi)有做出太多承諾,。該公司的一位發(fā)言人表示:“你很可能得不到報(bào)銷,但你總是可以嘗試一下的,?!保?/p>

不過(guò),一些有醫(yī)保的消費(fèi)者之所以使用GoodRx,,往往不僅僅是為了省錢(qián),,而是因?yàn)獒t(yī)保系統(tǒng)的官僚主義嚴(yán)重影響了治療,而不得不求助于GoodRx,。比如馬薩諸塞州伍斯特市的中學(xué)數(shù)學(xué)老師亞伊拉·帕金斯,。

今年33歲的帕金斯是兩個(gè)孩子的母親,她一直過(guò)著充實(shí)而積極的生活,。但2019年年末,,她開(kāi)始出現(xiàn)了系統(tǒng)性硬皮病的奇怪癥狀,身體日漸衰弱,。2020年年初,,她才確診患有這種罕見(jiàn)的自體免疫性疾病。雖然這種病并不危及生命,,但像其他自體免疫性疾病一樣,,它的致病機(jī)理尚不為人所知,也無(wú)法徹底治愈,。

對(duì)這種自體免疫性疾病,,醫(yī)生會(huì)給他們開(kāi)一些原本用來(lái)治療其他疾病的藥物,這些藥物有時(shí)候會(huì)有效,。帕金斯的病每天都會(huì)發(fā)作幾次,,醫(yī)生給了她開(kāi)了幾種免疫抑制劑,,幾種治療高血壓和痤瘡的藥物,,還有一些面霜、肉毒桿菌素,,甚至還有非專利版的偉哥(西地那非),,希望這些能夠控制住她的病情。

起初,,帕金斯的保險(xiǎn)公司拒絕報(bào)銷其中的很多藥物,,理由是這些藥物并不是針對(duì)她的病情的指定療法。為此她和她的醫(yī)生花了幾周甚至幾個(gè)月的時(shí)間去申訴,。比如西地那非可以緩解她雙手血液循環(huán)不暢的問(wèn)題,,而90天的西地那非的費(fèi)用就高達(dá)1363.89美元,。不過(guò)在用了醫(yī)生給她的GoodRx優(yōu)惠券后,她實(shí)際只支付了19.37美元,。

帕金斯的故事并非個(gè)例,。美國(guó)國(guó)家公共電臺(tái)、羅伯特·伍德·約翰遜基金會(huì)和哈佛公共衛(wèi)生學(xué)院去年的一項(xiàng)聯(lián)合調(diào)查顯示,,美國(guó)有超過(guò)三分之一的成年人和將近一半的低收入家庭,,都曾經(jīng)被告知,他們的醫(yī)保計(jì)劃無(wú)法報(bào)銷醫(yī)生開(kāi)具給他們的某一款處方藥,。

雖然帕金斯很感激GoodRx讓她終于負(fù)擔(dān)得起這些藥物,,但她的心情依然五味雜陳。今年2月,,她對(duì)我說(shuō):“整個(gè)體系都出了問(wèn)題,,這些公司——我不知道它們是如何盈利的,但我非常確定,,如果你深入研究的話,,你會(huì)發(fā)現(xiàn),不僅它們?cè)诰鹑±?,整個(gè)私營(yíng)保險(xiǎn)行業(yè)也在攫取利益,。”

從她和很多人的遭遇看,,她說(shuō)的一點(diǎn)不錯(cuò),。帕金斯的醫(yī)保公司(以及該醫(yī)保公司指定的PBM公司)雖然收了她繳納的保費(fèi),但她卻還要自己掏錢(qián)給GoodRx和另一家PBM公司,。

****

那么,,我們應(yīng)該如何看待GoodRx,以及它在美國(guó)醫(yī)療體系中扮演的角色呢,?這是一個(gè)很復(fù)雜的問(wèn)題,。

約翰斯·霍普金斯大學(xué)的卡萊布·亞歷山大深入研究了“藥價(jià)抵消”的問(wèn)題——比如GoodRx的優(yōu)惠券。他發(fā)現(xiàn),,消費(fèi)者節(jié)省下來(lái)的錢(qián),,主要集中在相對(duì)少量的非專利藥上。抵消的費(fèi)用相對(duì)來(lái)說(shuō)也并不高——大約是每筆交易16美元,,但它平均為用戶節(jié)省了約40%的自付費(fèi)用,。雖然他擔(dān)心這種價(jià)格采購(gòu)可能會(huì)營(yíng)造一種碎片化的環(huán)境,讓慢性病患者難以持續(xù),、穩(wěn)定地獲得藥品,但還是要肯定它的優(yōu)點(diǎn),。

他表示:“這些類型的折扣,,最終會(huì)給消費(fèi)者帶來(lái)很大的轉(zhuǎn)變,。”

就連密歇根大學(xué)的價(jià)值型保險(xiǎn)設(shè)計(jì)中心的主任,、內(nèi)科醫(yī)生馬克·芬德里克,,也在自己辦公室的電腦旁邊放了一疊GoodRx的優(yōu)惠券,以便那些付不起基本藥品費(fèi)用的病人使用,。他對(duì)美國(guó)的醫(yī)保體系有清醒的認(rèn)識(shí),,他指出,GoodRx“是一個(gè)證明了整個(gè)定價(jià),、報(bào)銷,、分配系統(tǒng)有多混亂的經(jīng)典案例?!痹谶@個(gè)體系得到修正前,,他支持病人通過(guò)GoodRx或其他形式的輔助手段(例如眾籌捐款等等)獲得必需的藥物。

最近,,他就通過(guò)這款應(yīng)用程序?yàn)樗〉膶櫸锶惱?gòu)買(mǎi)了60片西地那非,,GoodRx讓省下了整整720美元,他自己只支付了33美元——折扣高達(dá)95%,。他還表示,,如果他肯去城市另一邊的另一家藥店,他還可以再省一些錢(qián),。

南加州大學(xué)的喬伊斯也認(rèn)為,,GoodRx為那些負(fù)擔(dān)不起基本藥品的人提供了一條活路。不過(guò)對(duì)于那些已經(jīng)購(gòu)買(mǎi)了醫(yī)保的消費(fèi)者,,GoodRx的作用比較難以評(píng)估,,它對(duì)美國(guó)消費(fèi)者總體醫(yī)療出支出的影響也同樣難以評(píng)估。

喬伊斯說(shuō):“它們不是圣人,,它們這樣做是為了賺錢(qián),,而且它們的生意也是非常有利可圖的?!?/p>

雖然GoodRx為人們提供了大量的藥價(jià)數(shù)據(jù),,但喬伊斯認(rèn)為,GoodRx并未讓整個(gè)醫(yī)療體系變得更加透明,?!八鼈儧](méi)有帶來(lái)更高的透明度,,它們的價(jià)格仍然高于采購(gòu)成本,,它們并沒(méi)有把價(jià)格壓低到邊際成本?!?/p>

此外,,喬伊斯等人也不相信GoodRx真的像它聲稱的那樣為消費(fèi)者節(jié)省了那么多錢(qián),。

馬里蘭大學(xué)藥學(xué)院的副教授喬伊·馬丁利認(rèn)為,在宣傳替消費(fèi)者省錢(qián)上,,GoodRx用了和PBM公司相同的數(shù)學(xué)花招——即假定一名消費(fèi)者如果沒(méi)有使用GoodRx的優(yōu)惠券,,他就會(huì)按照最高的價(jià)格買(mǎi)藥。(從GoodRx公司對(duì)相關(guān)數(shù)據(jù)的解釋看,,馬丁利的懷疑很有可能是正確的,。)

盡管如此,馬丁利還是認(rèn)為,,GoodRx能夠給消費(fèi)者帶來(lái)很有意義的轉(zhuǎn)變,,尤其是對(duì)那些沒(méi)有醫(yī)保的人。

不過(guò)站在GoodRx的角度,,赫希認(rèn)為,,為消費(fèi)者節(jié)省250億美元還是一種保守的說(shuō)法。

“我認(rèn)為在確保病人按時(shí)用藥,、使病人盡量少去急診等方面,,我們的實(shí)際影響還要大得多。有了GoodRx,,消費(fèi)者可以支付全部的處方藥費(fèi)用,,所以保險(xiǎn)公司、付款人和政府的負(fù)擔(dān)都會(huì)有所減輕,?!备鶕?jù)該公司的分析,它已經(jīng)讓2200多萬(wàn)美國(guó)人買(mǎi)得起藥了,。

喬伊斯并未把“不透明”的帽子扣在GoodRx頭上,。他說(shuō):“它突顯了藥品供應(yīng)鏈的浪費(fèi)和低效,以及藥價(jià)的低透明度,。而PBM公司才是真正的罪魁禍?zhǔn)?。?/p>

2018年,,《美國(guó)醫(yī)學(xué)會(huì)雜志》發(fā)表了喬伊斯和他的同事的一篇研究,。研究發(fā)現(xiàn),在22%的情況下,,消費(fèi)者對(duì)處方藥的共付費(fèi)用超過(guò)了藥品本身的成本,。換句話說(shuō),患者并非是“共付”,,而是“過(guò)度支付”了藥價(jià),。從中得利的恰恰是PBM和保險(xiǎn)公司。

更過(guò)分的是,,直到最近,,很多藥店還在以合同的形式,,禁止藥劑師提醒醫(yī)保病人他們支付的金額可能超過(guò)了藥品的現(xiàn)金價(jià)格(也就是沒(méi)有醫(yī)保的病人支付的價(jià)格)。

從一些獨(dú)立藥劑師(比如獨(dú)立藥店Madden’s的老板小唐恩·皮拉)的角度看,,GoodRx的優(yōu)惠券,,只是PBM公司從藥店割肉的另一種方式。

他表示,,Madden’s藥店的現(xiàn)金價(jià)格往往比GoodRx上的價(jià)格更加優(yōu)惠,,不過(guò)它不會(huì)出現(xiàn)在GoodRx的應(yīng)用程序上。但當(dāng)消費(fèi)者使用優(yōu)惠券時(shí),,PBM公司會(huì)收取一筆“高額費(fèi)用”,,然后向藥店報(bào)銷一個(gè)較低的金額,有時(shí)甚至?xí)陀谒幤返某杀?。不過(guò)即使賠錢(qián)賣藥,,它也必須兌換GoodRx的優(yōu)惠券,因?yàn)樗嚓P(guān)的PBM公司有協(xié)議,。

作為一家小藥店,,和其他獨(dú)立藥房一樣,當(dāng)與強(qiáng)大的PBM公司談判的時(shí)候,,Madden’s是沒(méi)有什么話語(yǔ)權(quán)的,。而不與PBM打交道則根本不現(xiàn)實(shí)。

皮拉也認(rèn)為,,GoodRx提供的折扣,,確實(shí)可以幫助消費(fèi)者買(mǎi)得起他們所需的藥品。只不過(guò),,GoodRx提供給消費(fèi)者的只是一個(gè)“更好”的價(jià)格,,而并非“最好”的價(jià)格。(不過(guò)赫希表示,,GoodRx“專注于為消費(fèi)者提供最好的價(jià)格,。”)

皮拉說(shuō):“它們其實(shí)什么也沒(méi)有做,。它們沒(méi)有實(shí)際銷售一種產(chǎn)品,,也沒(méi)有給病人打電話,給他們提供咨詢服務(wù),,也沒(méi)有告訴病人如何用藥,。它只是做了一個(gè)算法,就能夠凈賺幾億美元,,這意味著什么,?”

赫希認(rèn)為,GoodRx不僅僅是一種算法——該公司也一直在擴(kuò)展其他業(yè)務(wù),包括遠(yuǎn)程醫(yī)療,,和所謂的“制藥商解決方案”,。這也是一項(xiàng)高增長(zhǎng),、高利潤(rùn)的業(yè)務(wù),。GoodRx會(huì)讓各大藥物品牌的制藥商與在其平臺(tái)上搜索藥品的消費(fèi)者建立聯(lián)系。該公司還提供了GoodRx Gold和Kroger Rx省錢(qián)俱樂(lè)部等會(huì)員服務(wù),,會(huì)員可以享受到比應(yīng)用程序更優(yōu)惠的藥價(jià),。該公司還發(fā)布了藥品價(jià)格研究報(bào)告,并就改善藥品行業(yè)生態(tài),,提供了一些最清晰的,、最有利于消費(fèi)者的見(jiàn)解。

去年11月,,在亞馬遜宣布啟動(dòng)自己的藥品優(yōu)惠計(jì)劃后,,GoodRx的股價(jià)出現(xiàn)了短暫的下跌。不過(guò)GoodRx的高管表示,,從業(yè)務(wù)上看,,GoodRx對(duì)亞馬遜的進(jìn)入并沒(méi)有什么可以擔(dān)憂的。(另外,,消費(fèi)者還能夠在亞馬遜的藥店使用GoodRx的優(yōu)惠券,。)

德意志銀行網(wǎng)絡(luò)證券研究部的總經(jīng)理勞埃德·沃姆斯利和瑞士信貸的分析師杰倫德拉·辛格等分析師也認(rèn)為,GoodRx的業(yè)務(wù)當(dāng)前面臨的威脅是被夸大了的,。

赫希表示,,他認(rèn)為公司業(yè)務(wù)面臨的最大障礙,是很多老百姓仍然不了解藥價(jià)背后的貓膩,,不了解自己本可以享受到更優(yōu)惠的價(jià)格,,仍然像以前一樣購(gòu)買(mǎi)處方藥。

赫希對(duì)我說(shuō):“我們最大的競(jìng)爭(zhēng)對(duì)手,,就是那些不知道本來(lái)能夠獲得更優(yōu)惠的藥價(jià)的美國(guó)人,。”他希望GoodRx品牌可以成為美國(guó)消費(fèi)者最信賴的伙伴,。

很多第一次使用GoodRx的人——比如上文提到的懷特和艾利森,,都給出了幾乎不可思議的評(píng)價(jià),認(rèn)為GoodRx“好得難以置信”,。他們能夠相對(duì)輕松,、簡(jiǎn)單地在藥店完成購(gòu)買(mǎi),而且藥價(jià)還很便宜,。在買(mǎi)藥的過(guò)程中,,人們沒(méi)有醫(yī)保卡也可以享受同樣的服務(wù),而且不用考慮共付,、自付,、PBM和醫(yī)保這些糟心事。

當(dāng)然,,美國(guó)醫(yī)療行業(yè)的這些糟心事和種種深層問(wèn)題仍然存在,。GoodRx只是一家讓你忘了這些問(wèn)題的中間商。(財(cái)富中文網(wǎng))

譯者:樸成奎

Brad White has taken esomeprazole, the generic version of Nexium, to treat his acid reflux, for years. A retired school administrator living in Southlake, Texas, White has insurance, and so when he drove through his local CVS to pick up the prescription earlier this year, he was shocked when the clerk told him he owed $490 for a three-month supply.

He wasn’t quite sure what he had paid before—he’d been receiving the prescription by mail and had set up automated payments—and he knew the pills would cost him more until he met his $3,000 deductible. But paying nearly $500 for a few months of a generic drug just struck him as outrageous. He drove off without his prescription, to “regroup.”

White went home and started googling terms like “cheaper drug prices.” He soon came across GoodRx, the drug discount company, and a coupon that entitled him to get a one-month supply of the medication, without his insurance, for $17 at a nearby Kroger. “I thought, ‘This is not going to work,’” he recalls. “It absolutely worked.”

He recently used the app for another prescription, which with his insurance would have cost him $36 for a month’s supply. Using GoodRx, he could buy it for $16.60, and so he did. White knows that spending the money out-of-pocket means he’s not contributing toward his deductible and that in the long run he’s losing out on the full benefit of his insurance. But he’s okay with that tradeoff. “When it's such a huge gap, the math tells you don't use your insurance for this. I think it's pretty bizarre, honestly.” In chatting up his CVS pharmacist, White was surprised to learn that not only does the chain accept GoodRx coupons, but the pharmacist himself uses them to get his own asthma medications for a more affordable price.

When I spoke to White earlier this year, he was in a happy state of disbelief over his GoodRx discounts—if mystified by how the whole thing works. “My question becomes, How long is this going to last?” says White. “Because somebody is making money and somebody is losing money, and I can't figure out who’s who.”

You can understand the confusion. White is just one of the roughly 5.6 million Americans who use a GoodRx discount to purchase their prescription medications every month. The company’s free app, which shows what prescription drugs cost at various retailers and provides coupons for those rates, is one of the most downloaded medical apps in the iTunes and GooglePlay stores; its website has more than 18 million monthly visitors. The company’s service is beloved by consumers, widely promoted by physicians, and even touted by outlets like ProPublica, the New York Times, and yes, Fortune, which in 2019 put GoodRx on our Change the World list.The company enjoys a “net promoter score,” or loyalty rating, that is practically off the charts at 90. (By comparison, Apple’s last known NPS is 47, Walgreens's is 25, and Facebook’s, –21.)

The reason for the enthusiasm is clear: The company claims to have saved Americans more than $25 billion on prescription drugs since 2011—and, since 2019, at a rate of more than $20 million every day. That’s heroic in a country where about 58 million people go without the medications they need because of cost—and an estimated 10,000 die every month for lack of them.

Of course, GoodRx is a business, and it turns out saving Americans bundles of money on their medications is a darned good business. The company took in $550.7 million in revenue last year. That’s 42% more than in 2019—recorded, even more strikingly, in a year when a global pandemic depressed use of health care services and, as a result, the number of prescriptions written. (According to IQVIA, the health data firm, prescriptions declined 3% in 2020.) The company has proved profitable too; net income in the first half of 2020 increased 75%, to $55 million, from the previous year. (GoodRx recorded a $294 million loss for the whole year, because of the costs of its IPO.)

The Street believes in GoodRx’s counterintuitive business model too. The company’s IPO in September was one of the 20 largest last year, with a deal size of $1.14 billion, and the business currently enjoys a market value of $15.8 billion.

The company—and some analysts, too—like to say, with GoodRx, everyone wins: Consumers can afford their medications, saving money and bettering their health; providers and insurers gain patients who are more likely and able to take their meds as prescribed; and manufacturers, drugstores, and the pharmacy benefit managers (which manage drug claims for insurers), gain revenue on prescriptions that, at a higher price, may have been abandoned at the checkout. (Pharmacies pick up nondrug sales that come with foot traffic too.) But the biggest winner of all, of course, is GoodRx, which in just over a decade has managed to carve out this benign-seeming role and insinuate itself—as yet another middleman—into this deeply entrenched, thickly padded corner of American health care.

*****

GoodRx would not exist without the byzantine structure that currently dictates how much Americans pay for their prescription medications. “They found a good way to build a business in a fairly dysfunctional drug pricing ecosystem,” says Caleb Alexander, a professor of epidemiology and medicine at Johns Hopkins.

Adam Fein, an expert in pharmaceutical economics and drug distribution and the CEO of the Drug Channels Institute, put it more bluntly in a tweet reacting to GoodRx’s striking 2020 results: “Wow. #Pharmacy benefits are broken.”

GoodRx co-CEO and cofounder Doug Hirsch doesn’t entirely disagree. “To some extent,” he told me last fall, “our success is a barometer of how broken the health care system is.”

That market dysfunction is key to GoodRx’s origin story, which dates back to 2010 when Hirsch experienced his own round of sticker shock at a local pharmacy after learning that he owed $500 for a prescription. Hirsch had insurance and expected the cost to be a tiny fraction of that. So he went to a pharmacy across the street, where he was surprised to learn that there, the price was $300. At yet another area pharmacy, the cost was $400. At that point Hirsch too walked away, only to be chased down by the pharmacist, who was willing to negotiate.

“It kind of broke my brain,” Hirsch has said of the experience. An early employee at Yahoo and Facebook, where he was one of the conceivers of photo tagging, Hirsch had a front-row view as the digital revolution brought transparency and ease to industries from air travel to homebuying. He regarded the opaque and bewildering marketplace of prescription drugs—with its many middlemen and prices—as a worthy and overdue target for disruption, and so he and his co-founder Trevor Bezdek began the decade-long project that is GoodRx.

By Hirsch’s telling, it began as a curiosity-driven journey simply to make sense of drug prices. “To be honest, I didn’t know what a PBM [pharmacy benefit manager] was when we started this process,” says Hirsch. He and cofounders began collecting information: Costco published its drug prices on its website, and Walmart sold a handful of prescription meds for $4. Some states had laws on the books—requiring prices be disclosed online, or at the pharmacy—aimed at providing transparency, but those tools didn’t work well. “It was just a total mess,” he told me last fall.

Hirsch and his team started calling up pharmacists and reaching out across the health care landscape for help. In those early days of the Affordable Care Act, there were plenty of people who didn’t think the effort would be worth the time. They thought the system was either fixed or impossible to disrupt. But enough of them did, including an employee at the PBM MedImpact, which eventually became one of GoodRx’s first partners. “Doors always opened for us,” Hirsch says.

In time, the team had cobbled together enough price information for its data scientists to unravel the complex contracts—between PBMs and pharmacies—that set those rates. They found (as have plenty of researchers) that prices varied widely, particularly on low-cost, frequently prescribed generic drugs. Understanding the inner workings of the prescription med marketplace was a big, hairy data engineering problem, and GoodRx had cracked it.

By 2011, the company had a website and a product: a simple digital tool that in clearly displaying the cost of prescription meds at various outlets, could guide consumers to the most affordable purchase. Over time, the company’s data set has gotten more sophisticated and complete. GoodRx now gets information from virtually every PBM, among other sources, and aggregates over 200 billion price points per day in its system, says Hirsch.

Simply making price comparison and price shopping possible was something of a breakthrough in the industry, says George Hill, managing director of health care technology and services equity research at Deutsche Bank, who notes that Americans, on average, fill 11 prescriptions a year. “[GoodRx] is really the first broadly accepted and broadly used price transparency tool that exists in health care.”

*****

So how exactly does GoodRx work—and perhaps more importantly, how does it make money? To grasp the intricacies of the company's business model, you must understand the economic ecosystem in which pharmacies operate. Unfortunately, like so many aspects of American health care, it's a landscape that defies easy or rational explanation. It consists of many players, mostly middlemen, all vying for a piece of a $509 billion pie, which gets sliced and diced according to obscuring jargon and business practices like rebates, clawbacks, and co-pays. For the uninitiated, trying to track where the money spent on prescription drugs goes is like an especially mind-numbing and complicated follow-the-ball trick.

Chief among these players, and key to GoodRx’s story and success, are pharmacy benefit managers, or PBMs, a class of companies that originated in the 1960s to process prescription drug claims for insurers. They still do that, but over time these entities have assumed an ever-more-powerful and lucrative intermediary role in America’s prescription drug marketplace. As the go-between for insurers, manufacturers, and pharmacies, PBMs negotiate how much insurers will pay drug manufacturers, what consumers owe at the pharmacy, and how much pharmacies will be reimbursed. They also develop the formularies that determine which medications your insurance will cover; deploy “utilization management” tools, like prior authorizations, to ensure your prescription is medically necessary; and operate mail-order pharmacies, among other things. The aim of all these activities and the PBM’s stated reason for being these days is, ostensibly, to keep drug spending in check for health plans.

How well they’ve done that is a matter of intense debate. In recent years, the $402 billion industry has just as often been accused of doing the opposite through its opaque, middleman business practices. PBMs, the three largest of which have all been absorbed by major insurers in the past decade (Cigna’s Express Scripts, CVS’s Caremark, and UnitedHealth’s Optum), have cultivated a number of revenue streams over the years. But for this story, suffice it to say, they make money when they process a claim at the pharmacy. This is where GoodRx enters the picture.

For the sake of this story, we’re focusing on the market of low-cost generic drugs, which is where GoodRx provides consumers the most savings and where it makes most of its money.

Normally, when you go to the pharmacy to pick up a prescription, what you owe depends on a few factors: (1) your health plan or insurance, (2) the pharmacy benefit manager, or PBM, that your health plan has hired to manage drug costs, and (3) the pharmacy where you have chosen to fill the prescription. What you will pay is determined by the rate negotiated between that pharmacy or chain of pharmacies and your health plan’s PBM. If you don’t have insurance, you will be charged that pharmacy’s cash price, which is often very steep.

This is why, as Hirsch discovered, the price of a medication can vary so widely, pharmacy to pharmacy, and person to person. “If you have 10 people that stand in line at a McDonald's, all 10 people pay the same price for a Happy Meal. It doesn't matter if you pay cash, or with a credit card. It doesn’t matter who you are. But in health care, and also in pharmacy, if you have 10 people that stand in line to get their blood pressure medication filled, 30 tablets, all 10 people are going to either pay a different price, or their insurance is going to pay a different price,” says Don Piela Jr., the head pharmacist and owner of Madden’s, an independent pharmacy in Elberton, Ga., who calls the system “ridiculous.” Worse, he adds, “there’s no transparency.”

Indeed. Those are the very bugs in the system around which GoodRx has astutely built its product—illuminating a whole range of prices that have been negotiated between PBMs and pharmacies and allowing consumers to access any of them through GoodRx coupons.

GoodRxis able to monetize the discounts, somewhat ironically, through its partnership with the various PBMs. When a consumer seeks out a lower-price medication at a particular pharmacy with a GoodRx coupon, the PBM with that contracted price processes the claim and rewards GoodRx with a sort of “referral fee,” explains Hirsch. (These fees account for 90% of GoodRx’s revenues.) It can be a sweet deal for PBMs in that they’re able to elbow their way in and pick up revenue on transactions that they previously had no part in.

“[GoodRx] is kind of a front for PBMs,” explains Geoffrey Joyce, a health economist and director of health policy at the University of Southern California’s Schaeffer Center. “They provide the benefits a PBM might provide for uninsured consumers.” Those benefits can be substantial. “Uninsured consumers, they’re a big cash cow for pharmacies,” says Joyce. “They pay ridiculously high prices [for generic drugs].”

GoodRx is not the first company to pursue this strategy. Drug discount cards, offering consumers a more affordable PBM-network rate for their meds, have been around for decades. But GoodRx’s offering is both far more robust and sophisticated than predecessors. Rather than working with just a single PBM, GoodRx partners withmore than 12 of them, accessing all their network rates and so, a much broader range of discounts. (The company also offers a slick tech platform to search out those savings and a sizable marketing budget to promote them.) “More often than not, they’ll have a very good price,” says Lloyd Walmsley, managing director of Internet equity research at Deutsche Bank.

For people like Katie Rae Allison, a jewelry store manager and designer in Gillette, Wyo., that’s a real service. She was diagnosed with thyroid disease as a child and takes medication daily to manage her condition; without it, her health suffers. She doesn’t have insurance through her job and so was relieved—but also skeptical—when she discovered GoodRx’s app earlier this year. “It seemed too good to be true,” she told me. But she tried it and got a 90-day supply of medication for $25; without the coupon, she would have been charged $32 for a month’s worth. “That’s three months’ worth for less than what I would have paid for a month,” she says. “In a year’s time, that saves me a lot of money.”

Uninsured individuals like Allison make up just a fraction of consumers using GoodRx discounts to save on prescriptions, though. According to the company, 75% of their users have some form of insurance (that includes through a government program like Medicare).

When these customers use a GoodRx coupon to get a prescription at a more affordable rate, they’re not using their insurance—and so the PBM with the lowest contracted price at the pharmacy and GoodRx captures the revenue from the transaction, rather than the PBM that works with that individual’s health plan.

Why are so many people choosing to pay out-of-pocket with GoodRx, instead of using their hard-earned health benefits? Many are in a situation like the one faced by Brad White—even with insurance, they’re paying a hefty price for prescriptions. That has a lot to do with a recent shift by many employers to high-deductible health plans, which require users to pay at least $1,400 out-of-pocket before their coverage kicks in. (Over the past decade, the average deductible for an individual has increased 111% from $917 to $1,644, according to the Kaiser Family Foundation.) The thinking behind these plans was that they would make employees more careful, cost-conscious consumers of health care. In reality, that’s hard to do, and many people get stuck with big health bills they can’t afford. Studies show that people on high-deductible plans are more likely to delay or forgo care.

GoodRx can save insured consumers from this short-term financial stress, but it comes with a tradeoff: By paying out-of-pocket, they’re not paying toward their deductible, which will delay or possibly prevent them from ever realizing the benefits of their insurance—on which they and their employers are paying considerable monthly premiums. (According to the Kaiser Family Foundation, the average insurance premium for single coverage was $7,470 in 2020; for a family, it was $21,342.) GoodRx payments also don’t count toward an individual’s out-of-pocket maximum, another reason why LeemoreDafny, a professor at Harvard Business School, worries that people with insurance who use GoodRx may, in some cases, end up spending more overall. (On its site, GoodRx offers instructions—including how to submit receipts and fill out insurance forms—for people who want to attempt to have their out-of-pocket GoodRx payments count toward their deductible, but the company doesn’t many any promises. Says a spokesperson, “You most likely won’t be reimbursed, but you can always try.”)

But insured consumers aren’t always just looking for a better deal. Some, like Yayra Perkins, a middle school math teacher in Worcester, Mass., turn to GoodRx when insurance bureaucracy impedes care.

Perkins, a 33-year-old mother of two, enjoyed a full and active life until late 2019, when she began to experience the odd and debilitating symptoms of systemic scleroderma, the rare autoimmune condition she was diagnosed with in early 2020. While not life-threatening, systemic scleroderma, like other autoimmune disorders, is not well understood, and it’s not curable.

Doctors do their best to treat those who suffer from it with a battery of sometimes-effective medications that were originally developed for other conditions. Perkins’s doctors prescribed her a handful of things they hoped might work to tame the disruptive and painful flare-ups she experiences multiple times per day: immunosuppressants, blood pressure and acne medications, face creams, Botox, and even generic Viagra (sildenafil).

Perkins’s insurer initially denied coverage of many of these medications, presumably because they’re not designated as treatments for her condition, leaving her to pick up the tab of her treatment while she and her physician pursued the weeks- or months-long appeals process. The cost for a 90-day supply of sildenafil, which helps alleviate debilitating circulation issues she suffers in her hands, was $1,363.89; with the GoodRx coupon her doctor pointed her to, she paid $19.37.

Perkins is not alone. A survey by NPR, the Robert Wood Johnson Foundation, and the Harvard School of Public Health last year found that more than a third of American adults, and nearly half of low-income adults, had been told their health plan would not cover a drug prescribed to them, or a family member, by a doctor.

Though grateful that GoodRx’s discount made that medication affordable for her, she doesn’t feel good about it. It feels like a racket. “The whole system—it’s not right,” she told me in February. “The fact that these companies—I don't know how they're making their profit, but I'm pretty sure that when you dig underneath their process…somehow not only they are benefiting, but the private insurance industry is benefiting as well.”

In her case, and many others, she’s not wrong. Perkins’s health plan (and the PBM it hired to manage pharmacy benefits) are collecting her premium payments; meanwhile she’s spending her own money on a prescription to the benefit of GoodRx and another PBM.

*****

So how should one think about GoodRx and the role it plays in American health care? Well, it’s complicated.

Caleb Alexander of Johns Hopkins has studied drug price “offsets,” including the ones provided by discount coupons like those from GoodRx. He found the savings were concentrated on a relatively small number of generic drugs, and that the offsets, while relatively small—about $16 per transaction—save the average customer about 40% of the out-of-pocket cost. While he worries a bit that price-shopping for medications could create a piecemeal environment that makes it hard, especially for patients with chronic illness, to have consistent access to medication, he sees the benefit. “These types of discounts can ultimately make a big difference for consumers,” he says.

That’s why Mark Fendrick, an internist and director of the Center for Value-Based Insurance Design at the University of Michigan, keeps a stack of GoodRx coupons next to his office computer for patients who can’t afford their essential medications. He’s not wild about the system it serves; he calls GoodRx a “classic example of how chaotic the whole pricing, reimbursement, and dispensing system is.” But until the system is fixed, he’s in favor of patients using GoodRx or other forms of assistance (better than bake sales or Kickstarter campaigns, he says)to get clinically necessary medications. He recently used the app himself to fill a prescription of sildenafil—generic Viagra—for his ailing dog, Bella. GoodRx saved him from spending $720 on 60 tablets of the drug. Instead, Fendrick paid $33—a 95% discount—and notes he could have gotten the medication for even less at a pharmacy across town.

USC’s Joyce agrees GoodRx is providing an important, potentially even lifesaving service for people who can’t afford medications, but he says the benefits are harder to parse for the insured, and that the company’s effect on overall spending is hard to know. “They're not saints,” says Joyce. “They're doing this to make money, and they are very profitable given what they do.”

Though GoodRx has made drug price data more available, Joyce dismisses the idea that the company has made the system more transparent. “They’re not bringing transparency. They’re still charging a price that’s above the acquisition cost,” he says. “It’s not as if they’re driving the price down to the marginal cost.”

He and many others also don’t believe GoodRx has saved people as much as it claims. Joey Mattingly, an associate professor with the University of Maryland School of Pharmacy, suspects GoodRx uses the same fantastical math that PBMs do in making savings claims—assuming that everyone who doesn’t use a GoodRx coupon would pay the highest possible cash price rate. (The company's own explanation of how it arrives at its savings figures suggests he's likely correct.) Still, Mattingly thinks GoodRx can make a meaningful difference, especially for uninsured customers.

For GoodRx’s part, Hirsch thinks its $25 billion savings calculation is an understatement. “I think our actual impact is much bigger in terms of improvements to adherence, ER visits, etc. With GoodRx, consumers pay the entire cost of their prescription, so there is a decreased burden on insurance companies, payers, and government.” According to the company’s analysis, GoodRx has helped more than 22 million Americans afford their drugs.

Joyce doesn’t blame GoodRx for getting in the game, though. “It highlights the waste and inefficiency in the pharmaceutical supply chain and the lack of transparency of prices,” he says. “The PBMs, they’re the real culprits in this.”

In 2018, The Journal of the American Medical Association published research from Joyce and colleagues that found that in 22% of cases, consumers’ co-payments for prescription medications exceeded the drug’s costs. In other words, patients aren’t “co-paying” for these drugs, they’re overpaying, and PBMs and insurers—which are increasingly one and the same—are profiting from it. Adding further insult, pharmacists until recently were contractually prohibited from alerting insured consumers in situations where they were paying more than the cash price (i.e., what an uninsured person would pay).

From the perspective of some independent pharmacists, including Madden’s Piela, GoodRx coupons are just another way PBMs profit off the back of pharmacies like his own. He says Madden’s cash price (which does not appear on the GoodRx app) usually beats GoodRx pricing, but when a customer does use a coupon, the PBM takes a “hefty fee” and reimburses his pharmacy a smaller amount than it would otherwise, sometimes less than the drug’s cost. Even when it's a losing proposition, he’s contractually bound to honor GoodRx coupons because he has agreements with the PBMs that process the claims.

Madden’s, like other independent pharmacies, has little clout when it comes to negotiating with powerful PBMs—and walking away from them is not an option. He acknowledges that discounts, including those provided by GoodRx, can help his customers afford drugs they need. But he takes offense to the portion of the pharmacy pie GoodRx is getting for providing consumers a better—but not always the best—price. (Hirsch says GoodRx is “focused on getting the consumer the best price, period.”)

“They’re not doing anything. They're not dispensing a product, they're not calling a patient and giving them counseling, they're not telling them how to use their medication,” Piela says. "I mean, if you're getting hundreds of millions of dollars for just being an algorithm? What does that mean?”

Hirsch sees GoodRx as more than an algorithm—the company has been expanding into other businesses including telehealth and “manufacturer solutions,” a high-growth, high-margin business that connects makers of branded pharmaceuticals with consumers searching for the drugs on the GoodRx platform. The company offers GoodRx Gold and Kroger Rx Savings Club, subscription services that promise members even better deals on drugs than they’d get with the app. It alsopublishes research on drug prices, and some of clearest, most-consumer friendly explainers on the dysfunctional pharmaceutical ecosystem.

While the company’s stock briefly plummeted in November after Amazon announced it was starting its own pharmacy discount program, GoodRx’s executives argue that when it comes to their business, the Everything Store is nothing to worry about. (Among other reasons: You can use a GoodRx coupon at the Amazon pharmacy.) Analysts like Walmsley and Credit Suisse’s Jailendra Singh also think that the current threat to the company’s business is overblown.

Instead, Hirsch says he considers his bigger obstacle to be the uninformed public, who, oblivious to price variation and the better deals they could be getting, continue to purchase their prescriptions like they always have. “Our biggest competitors are Americans who don’t know any better,” Hirsch told me. He aspires for the brand to become the American consumer’s most trusted partner.

It’s true that many who use GoodRx for the first time, like White and Allison, describe the experience in almost magical terms. “It’s too good to be true,” they think, before being completely delighted by a relatively pleasant, easy, inexpensive interaction at the pharmacy. In the exchange, they don’t have to dig out an insurance card, or think about co-pays, deductibles, PBMs, or health plans—all the things that make American health care so miserable. Of course, that stuff and all the dysfunction are still there in the background. GoodRx is just the middleman that lets you forget it.