幾乎從所有角度看,2020年都是歷史性的一年——其中也包括股市,。LPL的萊恩·德特里克向《財富》雜志表示,,2020年股市的瘋狂波動可以用一個詞來概括:“難以置信”。

“這將是歷史上第一次出現(xiàn)年中股市一度下跌30%,、最終卻實現(xiàn)反彈走高的年份,。”德特里克說,,“對我來說,,這意味著很多——我們從沒見過像2020年這樣,一年里打了個來回,?!?/p>

事實上,今年3月美股以創(chuàng)紀錄的速度迅速跌入熊市之后,,已完全實現(xiàn)反彈,,目前正處于歷史高點附近,截至周二收盤,,今年以來已累計上漲14%,。

盡管近期股市走勢有橫盤趨勢,但市場通常會在12月表現(xiàn)強勁,,部分策略師認為有理由相信年底股市可能再攀高峰,。

遲到的12月行情?

可以肯定的是,在股市上,,歷史模式并不總是可靠(2020年也時常證明這一點),。

但LPL的德特里克指出,歷史上看(從1950年的標(biāo)準(zhǔn)普爾500指數(shù)算起),,12月下半月市場往往表現(xiàn)十分強勁,。

股市往往在12月表現(xiàn)強勁,不過圣誕老人要到下半月才來,。

- 萊恩·德特里克, CMT (@RyanDetrick),,2020年12月11日

他說,12月股市平均漲幅約為1.5%,,但“幾乎所有”行情都始于12月15日,。

他說,即使2020年一直不可預(yù)測,,“我們認為今年也不會違背12月規(guī)律,。”這是因為,,疫苗開始配送,,經(jīng)濟刺激法案可能通過,交易員和投資者開始休圣誕假期,,德特里克認為交易量和波動性應(yīng)該不大,。他說:“這可能促成年底實現(xiàn)小幅上漲,也就是歷史上常見的圣誕行情,?!?/p>

嘉信理財(Charles Schwab)的首席投資策略師利茲·安·桑德斯則表示,隨著2021年即將到來,,主要存在兩種尾部風(fēng)險:一是“情況甚至比我們期望的更好,”這可能導(dǎo)致“經(jīng)濟增長過熱,,通貨膨脹更嚴重,將美聯(lián)儲置于“他們是否不得不放棄寬松政策?’的困境中,?!鄙5滤瓜颉敦敻弧冯s志表示,“另一個極端則完全相反:我們做了一系列非常積極的假設(shè),,如果其中幾個或好幾個假設(shè)不對怎么辦?”

為回調(diào)做好準(zhǔn)備

事實上,,一些華爾街人已經(jīng)對市場過熱感到不安,擔(dān)心很可能會出現(xiàn)拋售——或者至少是暫緩的情況,。

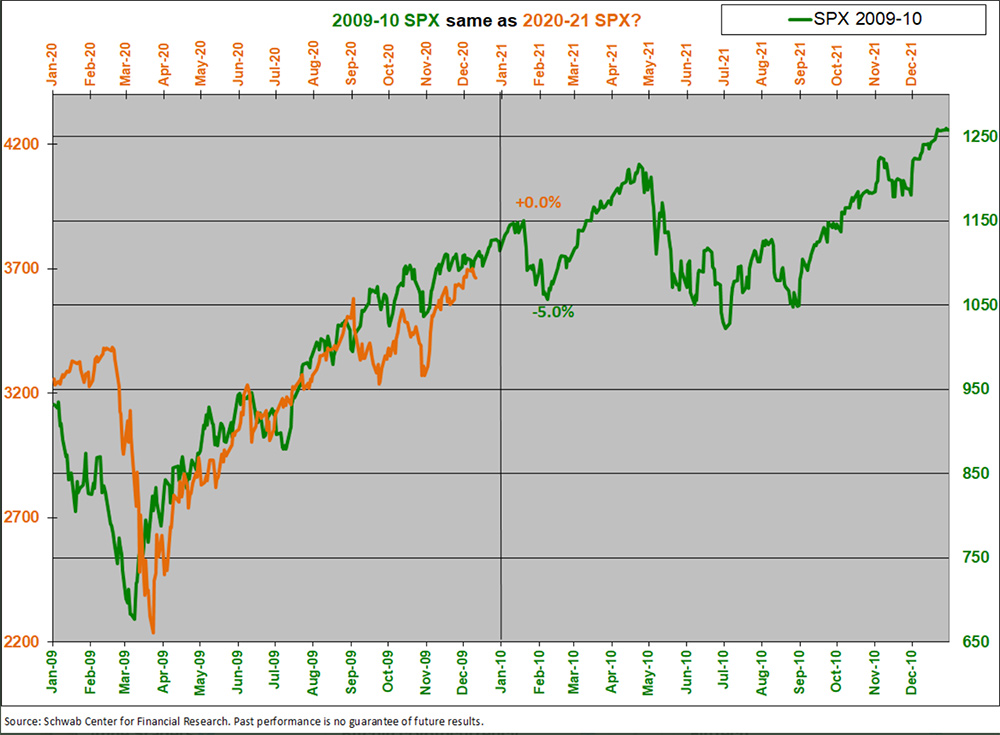

許多策略師都注意到了很重要的一點,,今年行情與2009年的牛市驚人相似。(詳見下面嘉信金融研究中心的圖表,。)一些策略師表示,,這張圖預(yù)示著前面可能會出現(xiàn)一些動蕩,。

嘉信理財交易和衍生品副總裁蘭迪·弗雷德里克在最近的一條推特上寫道:“沒有人知道2021年是否還會沿著這張圖走,但如果會,,1月下半月看起來有點令人擔(dān)憂,?!?/p>

但即使2021不繼續(xù)遵循2009-2010的曲線圖,,LPL的德特里克認為,過去幾個月市場上一些“破紀錄的表現(xiàn)”,,“可以這么說,,可能偷了一點明年的收益?!彼J為“最令人擔(dān)心的”是估值,。他認為,2021年第一季度出現(xiàn)10%左右的修正將是合理的,,建議投資者考慮調(diào)倉,,重新實現(xiàn)平衡。

但與此同時,,嘉信理財?shù)纳5滤拐J為,,從現(xiàn)在到2021年,投資者可能會學(xué)到一個相當(dāng)重要的教訓(xùn):“我認為市場不應(yīng)該依賴于美聯(lián)儲總是會支持市場這樣的假設(shè),,”她說,。

“等下次市場回調(diào)時——雖然我不知道是什么時候,但總會調(diào)整的——如果下次回調(diào)不會威脅到金融系統(tǒng)穩(wěn)定,,也不是由危機引發(fā)的,,我想我們不能再依賴所謂的‘鮑威爾賣權(quán)’了,不能認為美聯(lián)儲會永伴身側(cè),,為市場提供支撐,。”桑德斯說,,“2021年,,我們必須要關(guān)注這一點?!保ㄘ敻恢形木W(wǎng))

譯者:Agatha

幾乎從所有角度看,,2020年都是歷史性的一年——其中也包括股市。LPL的萊恩·德特里克向《財富》雜志表示,,2020年股市的瘋狂波動可以用一個詞來概括:“難以置信”,。

“這將是歷史上第一次出現(xiàn)年中股市一度下跌30%、最終卻實現(xiàn)反彈走高的年份,?!钡绿乩锟苏f,,“對我來說,這意味著很多——我們從沒見過像2020年這樣,,一年里打了個來回,。”

事實上,,今年3月美股以創(chuàng)紀錄的速度迅速跌入熊市之后,,已完全實現(xiàn)反彈,目前正處于歷史高點附近,,截至周二收盤,,今年以來已累計上漲14%。

盡管近期股市走勢有橫盤趨勢,,但市場通常會在12月表現(xiàn)強勁,,部分策略師認為有理由相信年底股市可能再攀高峰。

遲到的12月行情,?

可以肯定的是,,在股市上,歷史模式并不總是可靠(2020年也時常證明這一點),。

但LPL的德特里克指出,,歷史上看(從1950年的標(biāo)準(zhǔn)普爾500指數(shù)算起),12月下半月市場往往表現(xiàn)十分強勁,。

股市往往在12月表現(xiàn)強勁,,不過圣誕老人要到下半月才來。

- 萊恩·德特里克, CMT (@RyanDetrick),,2020年12月11日

他說,,12月股市平均漲幅約為1.5%,但“幾乎所有”行情都始于12月15日,。

他說,,即使2020年一直不可預(yù)測,“我們認為今年也不會違背12月規(guī)律,?!边@是因為,疫苗開始配送,,經(jīng)濟刺激法案可能通過,,交易員和投資者開始休圣誕假期,德特里克認為交易量和波動性應(yīng)該不大,。他說:“這可能促成年底實現(xiàn)小幅上漲,,也就是歷史上常見的圣誕行情?!?/p>

嘉信理財(Charles Schwab)的首席投資策略師利茲·安·桑德斯則表示,,隨著2021年即將到來,,主要存在兩種尾部風(fēng)險:一是“情況甚至比我們期望的更好,”這可能導(dǎo)致“經(jīng)濟增長過熱,通貨膨脹更嚴重,,將美聯(lián)儲置于“他們是否不得不放棄寬松政策?’的困境中,。”桑德斯向《財富》雜志表示,,“另一個極端則完全相反:我們做了一系列非常積極的假設(shè),,如果其中幾個或好幾個假設(shè)不對怎么辦?”

為回調(diào)做好準(zhǔn)備

事實上,一些華爾街人已經(jīng)對市場過熱感到不安,,擔(dān)心很可能會出現(xiàn)拋售——或者至少是暫緩的情況,。

許多策略師都注意到了很重要的一點,,今年行情與2009年的牛市驚人相似,。(詳見下面嘉信金融研究中心的圖表。)一些策略師表示,,這張圖預(yù)示著前面可能會出現(xiàn)一些動蕩,。

嘉信理財交易和衍生品副總裁蘭迪·弗雷德里克在最近的一條推特上寫道:“沒有人知道2021年是否還會沿著這張圖走,但如果會,,1月下半月看起來有點令人擔(dān)憂?!?/p>

但即使2021不繼續(xù)遵循2009-2010的曲線圖,,LPL的德特里克認為,過去幾個月市場上一些“破紀錄的表現(xiàn)”,,“可以這么說,,可能偷了一點明年的收益?!彼J為“最令人擔(dān)心的”是估值,。他認為,,2021年第一季度出現(xiàn)10%左右的修正將是合理的,建議投資者考慮調(diào)倉,,重新實現(xiàn)平衡。

但與此同時,,嘉信理財?shù)纳5滤拐J為,,從現(xiàn)在到2021年,投資者可能會學(xué)到一個相當(dāng)重要的教訓(xùn):“我認為市場不應(yīng)該依賴于美聯(lián)儲總是會支持市場這樣的假設(shè),,”她說,。

“等下次市場回調(diào)時——雖然我不知道是什么時候,但總會調(diào)整的——如果下次回調(diào)不會威脅到金融系統(tǒng)穩(wěn)定,,也不是由危機引發(fā)的,,我想我們不能再依賴所謂的‘鮑威爾賣權(quán)’了,,不能認為美聯(lián)儲會永伴身側(cè),為市場提供支撐,?!鄙5滤拐f,“2021年,,我們必須要關(guān)注這一點,。”(財富中文網(wǎng))

譯者:Agatha

This year was a historic year by pretty much all measures—and that includes the stock market. To those like LPL's Ryan Detrick, the market's wild moves in 2020 can be summed up in one word: "Unbelievable," he tells Fortune.

"This is going to be the first year in history that stocks were down 30% for the year at one point and managed to finish higher," Detrick says. "That, to me, summarizes a lot—We’ve never seen a round-trip like 2020."

Indeed, after a record-fast plunge into a bear market in March, stocks have managed to completely recover and are currently trading around all-time highs, up 14% for the year at Tuesday's close.

Though stocks of late have traded rather sideways, December is typically a strong month for investors, and some strategists see reason to believe stocks might close out the year on a high note.

A late December rally?

To be sure, historical patterns don't always hold up when it comes to the market (that's been true of 2020 at times as well).

But LPL's Detrick points out that historically (going back to 1950 for the S&P 500), the latter half of December tended to be strong for investors.

December is usually a strong month for stocks, but Santa doesn't show until the second half of the month. pic.twitter.com/MLcAMnUZp9

— Ryan Detrick, CMT (@RyanDetrick) December 11, 2020

He says on average December is up approximately 1.5%, but "nearly all" the gains tend to build from Dec. 15 on.

And even though 2020 has been unpredictable to say the least, "We wouldn’t want to bet against that this year," he says. That's because with a vaccine starting to be distributed, a stimulus bill likely to be passed, and traders and investors beginning to take vacation for the holidays, Detrick believes volume and volatility should be light. "That can lead to a little bit of a higher move into the end of the year, this historical Santa Claus rally," he says.

Others like Charles Schwab's chief investment strategist Liz Ann Sonders note that going into 2021, there are two main tail risks: One is that "things are even better than what we expect," which could create the "possibility of overheating growth, maybe more inflation, and putting the Fed in a pickle in terms of, 'do they have to back away from this easy policy?'," Sonders tells Fortune. "The other extreme would be the opposite: That we built in a pretty positive set of assumptions, and what if several or a bunch of them go wrong?"

Prepare for a pullback

Indeed, some on Wall Street are already antsy that the markets have gotten overheated and a sell off—or at least pause—might be in the cards.

One big theme many strategists noticed this year was its eerie similarity to the 2009 bull market. (See chart via Schwab Center for Financial Research below.) And according to some strategists, that map could be signaling some turbulence ahead.

"No one knows if the roadmap will continue into 2021, but if it does, the latter half of January looks a bit worrisome," Charles Schwab's vice president of trading and derivatives Randy Frederick wrote in a recent tweet.

But even if 2021 doesn't continue to follow the 2009-10 map, LPL's Detrick believes some of the "record run" of the past several months in the market "might be stealing, if you will, a little bit from some of the gains next year," he says, pointing to valuations as one of the "biggest concerns." He thinks something like a 10% correction would make sense in the 1st quarter of 2021, and suggests investors consider rebalancing with moves up or down.

But in the meantime, Schwab's Sonders believes investors can glean a pretty big lesson from 2020 heading into next year: "I don't think the market should rest on an assumption that the Fed is always going to have the market’s back," she says.

"When we get the next correction—and we’ll get one, I don’t know when—if it doesn’t threaten financial systems stability, if it’s not crisis-driven, I don't think we can rely on the so-called 'Powell Put,' that the Fed’s just always going to be there," Sonders says. "We have to be mindful of that in 2021."