新冠疫情像一根不斷揮打的鞭子,美國(guó)數(shù)十個(gè)州和城市很有可能將感受到其新一輪鞭笞的威力,,而政府則要應(yīng)對(duì)財(cái)政收入的大規(guī)模突然損失,。新冠疫情爆發(fā)后大范圍的企業(yè)關(guān)停不僅僅是重創(chuàng)企業(yè)銷售和拖累數(shù)千萬(wàn)工人薪資這么簡(jiǎn)單,它還在不斷地削減這兩個(gè)類目貢獻(xiàn)的稅收收入,。

近期的預(yù)測(cè)顯示,2021財(cái)年,,僅銷售和個(gè)人所得稅的降低便會(huì)讓州政府的財(cái)政收入減少1060億美元至1250億美元,。然而,加州大學(xué)圣迭戈分校的經(jīng)濟(jì)學(xué)副教授杰弗瑞?克勒門斯稱,,如果計(jì)算州和地方其他財(cái)政收入來(lái)源受到的影響,,整體缺口可能會(huì)輕易達(dá)到這個(gè)數(shù)額的兩倍??死臻T斯于6月與美國(guó)企業(yè)研究所(American Enterprise Institute)的經(jīng)濟(jì)師斯坦?維格一道就該課題發(fā)表了一篇工作論文,。

美國(guó)人口普查局(U.S. Census Bureau)現(xiàn)有的最近年份統(tǒng)計(jì)數(shù)據(jù)顯示,美國(guó)50個(gè)州在2019財(cái)年的稅收額超過(guò)了1萬(wàn)億美元,,這是美國(guó)稅收額連續(xù)8年出現(xiàn)增長(zhǎng),。有48個(gè)州稱2019年的財(cái)政收入有所增長(zhǎng),而2018年有49個(gè)州,。

總的來(lái)說(shuō),,超過(guò)三分之二的財(cái)政收入來(lái)自于居民的個(gè)人所得稅(約38%)以及普通銷售稅(31%),不過(guò),,這兩類以及其他稅收來(lái)源(包括企業(yè)所得稅,、不動(dòng)產(chǎn)稅和特種商品銷售稅,例如汽油,、煙草或酒)可能會(huì)因地區(qū)不同出現(xiàn)巨大的差異,。例如,在弗吉尼亞州,個(gè)人所得稅占到了該州2019財(cái)年凈財(cái)政收入的51.9%,。與此同時(shí),,包括佛羅里達(dá)州、得克薩斯州和懷俄明州在內(nèi)的7個(gè)州并不征收個(gè)人所得稅,。同樣,,不動(dòng)產(chǎn)稅占美國(guó)州財(cái)政總收入的比例不到2%,但卻占到了佛蒙特州的約四分之一,,而且這一比例每年都在增長(zhǎng),。

盡管幾乎上述所有的收入來(lái)源對(duì)經(jīng)濟(jì)下行十分敏感,個(gè)人所得稅(受就業(yè)狀況的影響十分明顯)和普通銷售稅(反映了消費(fèi)開(kāi)支的實(shí)力)受疫情相關(guān)關(guān)停以及對(duì)公眾聚集限令的影響尤為嚴(yán)重,。

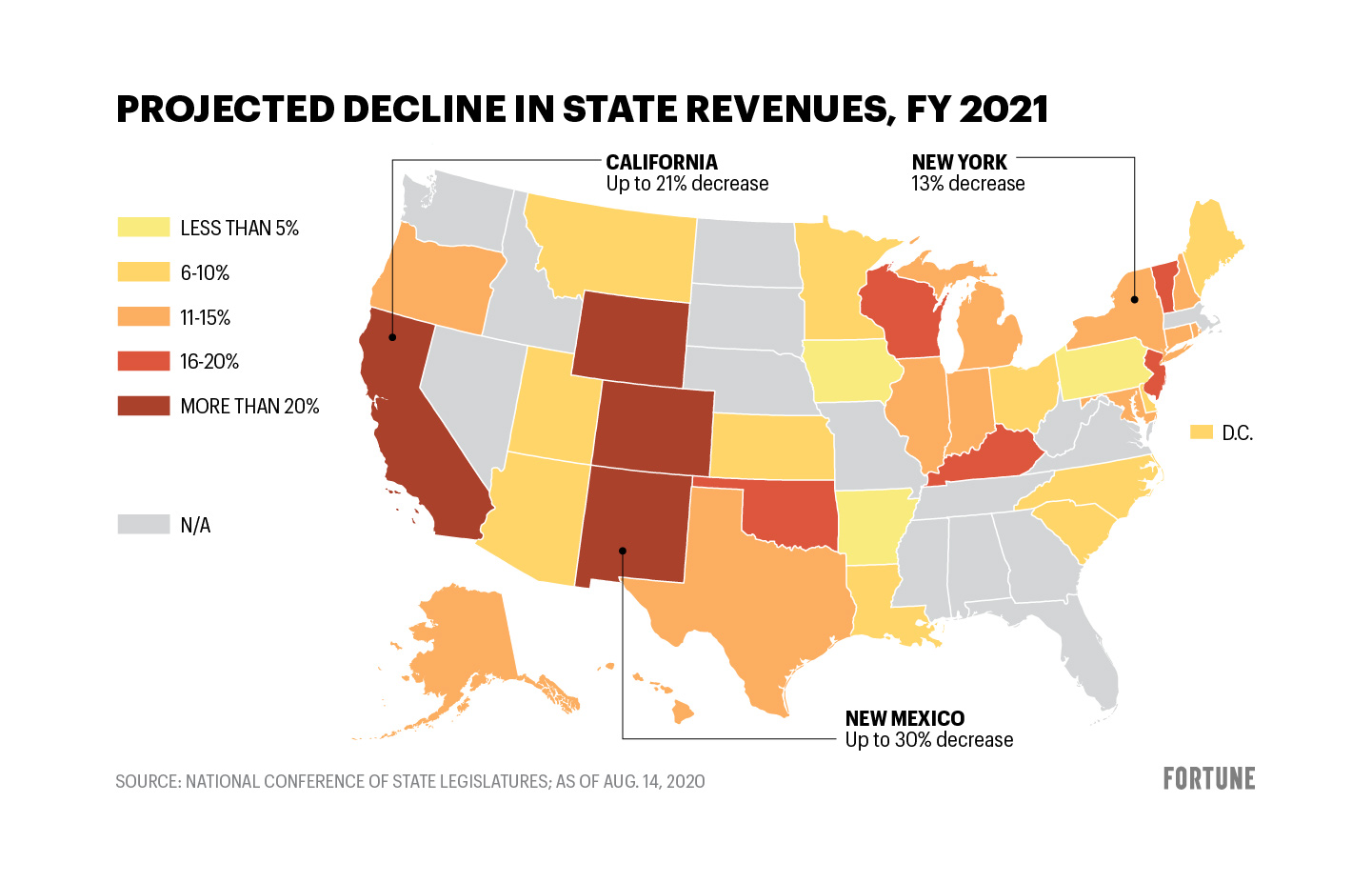

全美州議會(huì)聯(lián)合會(huì)(National Conference of State Legislatures)統(tǒng)計(jì)的數(shù)據(jù)顯示,,這種經(jīng)濟(jì)領(lǐng)域的痛楚尤為劇烈和突然,在過(guò)去的5個(gè)月中,,35個(gè)州與哥倫比亞特區(qū)發(fā)布了下調(diào)其2021財(cái)年財(cái)政收入的預(yù)測(cè),,至少有24個(gè)州將其預(yù)估財(cái)政收入較2019年削減了10%或更多。有7個(gè)州預(yù)計(jì)財(cái)政收入會(huì)下降15%或更多,。這些修訂基于對(duì)2020財(cái)年財(cái)政收入損失的判斷,,也就是企業(yè)關(guān)停開(kāi)始之時(shí)。

新澤西州政府稱,,該州如今的缺口預(yù)計(jì)達(dá)到了100億美元,。加州在5月預(yù)測(cè),該州將出現(xiàn)180億美元的資金缺口,,如果衰退和恢復(fù)最終呈現(xiàn)出“U型”(在今春短暫的暴跌之后出現(xiàn)短暫的恢復(fù)),。例如在“L型”恢復(fù)中,該州則會(huì)出現(xiàn)310億美元的缺口,。不過(guò),這個(gè)數(shù)字還只是今夏災(zāi)難性,、代價(jià)慘重的野火發(fā)生之前的估計(jì),。

阿拉斯加州無(wú)需擔(dān)心個(gè)人所得稅所導(dǎo)致的財(cái)政收入萎縮,因?yàn)樗鼪](méi)有這個(gè)稅種,。然而,,其財(cái)政亦受到了新冠疫情的強(qiáng)烈沖擊。在最近的2019財(cái)年,,阿拉斯加112億美元的財(cái)政收入中有四分之一來(lái)自于石油特許費(fèi)和相關(guān)稅收,。(阿拉斯加將其中的一些收費(fèi)稱之為“遣散稅”,因?yàn)閷⒂蜌鈴钠渫恋刂谐殡x,。)然而在新冠疫情爆發(fā)后,,該州的經(jīng)濟(jì)學(xué)家估計(jì)政府會(huì)出現(xiàn)數(shù)十億美元的赤字,基本歸咎于今春超低的油價(jià)。專家們稱其起因源于“極度失衡的供需”,,至少有一部分是受到了全球日趨嚴(yán)重的新冠疫情的影響,。

該州悲觀的財(cái)政前景基于37美元/桶的阿拉斯加North Slope原油。如今,,價(jià)格較當(dāng)時(shí)上漲了19%,,可能也讓該州的預(yù)算編制者多少松了口氣。然而,,該價(jià)格依然遠(yuǎn)低于年初70美元/桶的價(jià)格,。

即便是嚴(yán)重依賴于個(gè)人所得和銷售稅的州也會(huì)定期從一系列收入來(lái)源中獲得非稅收入,例如屬于“自有來(lái)源收入”類目的大學(xué),、醫(yī)院,、高速公路、機(jī)場(chǎng),、停車設(shè)施,、停車場(chǎng)、公共設(shè)施和很多其他機(jī)構(gòu),。人口普查局現(xiàn)有最近年份的數(shù)據(jù)顯示,,各州2017年的非稅收入達(dá)到了3710億美元。但各州如今的情況大致都差不多:其中大量的項(xiàng)目在經(jīng)濟(jì)關(guān)停中受到了波及,,而且可能會(huì)再次因?yàn)樾鹿谝咔榈奶ь^而遭到?jīng)_擊,。

各大城市和市區(qū)每年的“自有來(lái)源”收入超過(guò)了一萬(wàn)億美元,它們也有可能迎來(lái)預(yù)算噩夢(mèng),。盡管這些資金的三分之二都來(lái)自于每年相對(duì)穩(wěn)定的不動(dòng)產(chǎn)稅,,但其余部分基本上都來(lái)自于銷售稅費(fèi),而后者像州財(cái)政一樣受到了經(jīng)濟(jì)下行的影響,。

克勒門斯說(shuō):“我認(rèn)為最有可能出現(xiàn)的情況是,,如果經(jīng)濟(jì)在未來(lái)的財(cái)年收縮10%,那么整個(gè)財(cái)政收入可能也會(huì)收縮10%左右,?!?017年,州與地方自有來(lái)源收入共計(jì)達(dá)到了2.4萬(wàn)億美元,,也就是說(shuō)各州和城市的整體財(cái)政收入將減少2400億美元,。

正因?yàn)槿绱耍芏嘀莞荚谄疵叵蛉A盛頓尋求援助,。確實(shí),,眾議院的民主黨正在圍繞新刺激方案與特朗普政府以及共和黨主導(dǎo)的參議院打口水戰(zhàn),針對(duì)各州和城市的財(cái)政援助依然是一個(gè)重要的議題,。如今,,這兩方似乎陷入了僵局,。如果這個(gè)僵局持續(xù)下去,那么受影響最嚴(yán)重的州可能很快就會(huì)采取激進(jìn)的舉措,。

與聯(lián)邦政府不同的是,,可以隨意發(fā)債(而且證據(jù)表明它們也希望發(fā)債)州和地方政府在通過(guò)借貸這條路走出困境方面沒(méi)有多少回旋的余地??死臻T斯說(shuō):“受預(yù)算平衡要求限制的大多數(shù)州都不允許使用長(zhǎng)期債來(lái)資助普通資金開(kāi)支,。”

在沒(méi)有聯(lián)邦援助的情況下,,等待州和城市工作人員的將是大量的裁員,,而且新稅種的出臺(tái)幾乎已成定局。不過(guò),,提振財(cái)政收入的各類可選措施都會(huì)帶來(lái)嚴(yán)重的副作用,,克勒門斯說(shuō):“提升銷售稅會(huì)在充分收入分配領(lǐng)域?qū)彝?lái)影響,而提升所得稅可能會(huì)逼迫高收入人群離開(kāi)該州,?!?/p>

最后,最佳(從政治上最可行)方案可能是成本削減以及收入提振的雙管齊下,??死臻T斯說(shuō):“大多數(shù)這類問(wèn)題的最佳解決方案都不是僅靠一種財(cái)務(wù)手段,而是分?jǐn)傄恍┩闯?。避免出現(xiàn)超出必要的經(jīng)濟(jì)干擾的最佳辦法涵蓋當(dāng)前州和地方政府雇員的工資凍結(jié),,當(dāng)然像我這樣的大學(xué)教職員工亦無(wú)法幸免?!保ㄘ?cái)富中文網(wǎng))

譯者:馮豐

審校:夏林

新冠疫情像一根不斷揮打的鞭子,,美國(guó)數(shù)十個(gè)州和城市很有可能將感受到其新一輪鞭笞的威力,而政府則要應(yīng)對(duì)財(cái)政收入的大規(guī)模突然損失,。新冠疫情爆發(fā)后大范圍的企業(yè)關(guān)停不僅僅是重創(chuàng)企業(yè)銷售和拖累數(shù)千萬(wàn)工人薪資這么簡(jiǎn)單,,它還在不斷地削減這兩個(gè)類目貢獻(xiàn)的稅收收入。

2021財(cái)年各州財(cái)政收入預(yù)計(jì)降幅,。來(lái)源:全美州議會(huì)聯(lián)合會(huì)(截至2020年8月14日)

近期的預(yù)測(cè)顯示,,2021財(cái)年,,僅銷售和個(gè)人所得稅的降低便會(huì)讓州政府的財(cái)政收入減少1060億美元至1250億美元。然而,,加州大學(xué)圣迭戈分校的經(jīng)濟(jì)學(xué)副教授杰弗瑞?克勒門斯稱,,如果計(jì)算州和地方其他財(cái)政收入來(lái)源受到的影響,整體缺口可能會(huì)輕易達(dá)到這個(gè)數(shù)額的兩倍,??死臻T斯于6月與美國(guó)企業(yè)研究所(American Enterprise Institute)的經(jīng)濟(jì)師斯坦?維格一道就該課題發(fā)表了一篇工作論文,。

美國(guó)人口普查局(U.S. Census Bureau)現(xiàn)有的最近年份統(tǒng)計(jì)數(shù)據(jù)顯示,美國(guó)50個(gè)州在2019財(cái)年的稅收額超過(guò)了1萬(wàn)億美元,,這是美國(guó)稅收額連續(xù)8年出現(xiàn)增長(zhǎng),。有48個(gè)州稱2019年的財(cái)政收入有所增長(zhǎng),而2018年有49個(gè)州,。

總的來(lái)說(shuō),,超過(guò)三分之二的財(cái)政收入來(lái)自于居民的個(gè)人所得稅(約38%)以及普通銷售稅(31%),不過(guò),,這兩類以及其他稅收來(lái)源(包括企業(yè)所得稅,、不動(dòng)產(chǎn)稅和特種商品銷售稅,例如汽油,、煙草或酒)可能會(huì)因地區(qū)不同出現(xiàn)巨大的差異,。例如,在弗吉尼亞州,,個(gè)人所得稅占到了該州2019財(cái)年凈財(cái)政收入的51.9%,。與此同時(shí),包括佛羅里達(dá)州,、得克薩斯州和懷俄明州在內(nèi)的7個(gè)州并不征收個(gè)人所得稅,。同樣,不動(dòng)產(chǎn)稅占美國(guó)州財(cái)政總收入的比例不到2%,,但卻占到了佛蒙特州的約四分之一,,而且這一比例每年都在增長(zhǎng)。

盡管幾乎上述所有的收入來(lái)源對(duì)經(jīng)濟(jì)下行十分敏感,,個(gè)人所得稅(受就業(yè)狀況的影響十分明顯)和普通銷售稅(反映了消費(fèi)開(kāi)支的實(shí)力)受疫情相關(guān)關(guān)停以及對(duì)公眾聚集限令的影響尤為嚴(yán)重,。

全美州議會(huì)聯(lián)合會(huì)(National Conference of State Legislatures)統(tǒng)計(jì)的數(shù)據(jù)顯示,這種經(jīng)濟(jì)領(lǐng)域的痛楚尤為劇烈和突然,,在過(guò)去的5個(gè)月中,,35個(gè)州與哥倫比亞特區(qū)發(fā)布了下調(diào)其2021財(cái)年財(cái)政收入的預(yù)測(cè),至少有24個(gè)州將其預(yù)估財(cái)政收入較2019年削減了10%或更多,。有7個(gè)州預(yù)計(jì)財(cái)政收入會(huì)下降15%或更多,。這些修訂基于對(duì)2020財(cái)年財(cái)政收入損失的判斷,也就是企業(yè)關(guān)停開(kāi)始之時(shí),。

新澤西州政府稱,,該州如今的缺口預(yù)計(jì)達(dá)到了100億美元。加州在5月預(yù)測(cè),,該州將出現(xiàn)180億美元的資金缺口,如果衰退和恢復(fù)最終呈現(xiàn)出“U型”(在今春短暫的暴跌之后出現(xiàn)短暫的恢復(fù)),。例如在“L型”恢復(fù)中,,該州則會(huì)出現(xiàn)310億美元的缺口,。不過(guò),這個(gè)數(shù)字還只是今夏災(zāi)難性,、代價(jià)慘重的野火發(fā)生之前的估計(jì),。

阿拉斯加州無(wú)需擔(dān)心個(gè)人所得稅所導(dǎo)致的財(cái)政收入萎縮,,因?yàn)樗鼪](méi)有這個(gè)稅種,。然而,其財(cái)政亦受到了新冠疫情的強(qiáng)烈沖擊,。在最近的2019財(cái)年,阿拉斯加112億美元的財(cái)政收入中有四分之一來(lái)自于石油特許費(fèi)和相關(guān)稅收,。(阿拉斯加將其中的一些收費(fèi)稱之為“遣散稅”,,因?yàn)閷⒂蜌鈴钠渫恋刂谐殡x。)然而在新冠疫情爆發(fā)后,,該州的經(jīng)濟(jì)學(xué)家估計(jì)政府會(huì)出現(xiàn)數(shù)十億美元的赤字,基本歸咎于今春超低的油價(jià),。專家們稱其起因源于“極度失衡的供需”,,至少有一部分是受到了全球日趨嚴(yán)重的新冠疫情的影響。

該州悲觀的財(cái)政前景基于37美元/桶的阿拉斯加North Slope原油,。如今,,價(jià)格較當(dāng)時(shí)上漲了19%,,可能也讓該州的預(yù)算編制者多少松了口氣,。然而,該價(jià)格依然遠(yuǎn)低于年初70美元/桶的價(jià)格,。

即便是嚴(yán)重依賴于個(gè)人所得和銷售稅的州也會(huì)定期從一系列收入來(lái)源中獲得非稅收入,,例如屬于“自有來(lái)源收入”類目的大學(xué)、醫(yī)院,、高速公路,、機(jī)場(chǎng)、停車設(shè)施,、停車場(chǎng),、公共設(shè)施和很多其他機(jī)構(gòu)。人口普查局現(xiàn)有最近年份的數(shù)據(jù)顯示,,各州2017年的非稅收入達(dá)到了3710億美元,。但各州如今的情況大致都差不多:其中大量的項(xiàng)目在經(jīng)濟(jì)關(guān)停中受到了波及,而且可能會(huì)再次因?yàn)樾鹿谝咔榈奶ь^而遭到?jīng)_擊,。

各大城市和市區(qū)每年的“自有來(lái)源”收入超過(guò)了一萬(wàn)億美元,,它們也有可能迎來(lái)預(yù)算噩夢(mèng)。盡管這些資金的三分之二都來(lái)自于每年相對(duì)穩(wěn)定的不動(dòng)產(chǎn)稅,,但其余部分基本上都來(lái)自于銷售稅費(fèi),,而后者像州財(cái)政一樣受到了經(jīng)濟(jì)下行的影響。

克勒門斯說(shuō):“我認(rèn)為最有可能出現(xiàn)的情況是,,如果經(jīng)濟(jì)在未來(lái)的財(cái)年收縮10%,,那么整個(gè)財(cái)政收入可能也會(huì)收縮10%左右?!?017年,,州與地方自有來(lái)源收入共計(jì)達(dá)到了2.4萬(wàn)億美元,也就是說(shuō)各州和城市的整體財(cái)政收入將減少2400億美元,。

正因?yàn)槿绱耍芏嘀莞荚谄疵叵蛉A盛頓尋求援助,。確實(shí),,眾議院的民主黨正在圍繞新刺激方案與特朗普政府以及共和黨主導(dǎo)的參議院打口水戰(zhàn),針對(duì)各州和城市的財(cái)政援助依然是一個(gè)重要的議題,。如今,,這兩方似乎陷入了僵局。如果這個(gè)僵局持續(xù)下去,,那么受影響最嚴(yán)重的州可能很快就會(huì)采取激進(jìn)的舉措,。

與聯(lián)邦政府不同的是,可以隨意發(fā)債(而且證據(jù)表明它們也希望發(fā)債)州和地方政府在通過(guò)借貸這條路走出困境方面沒(méi)有多少回旋的余地,??死臻T斯說(shuō):“受預(yù)算平衡要求限制的大多數(shù)州都不允許使用長(zhǎng)期債來(lái)資助普通資金開(kāi)支?!?/p>

在沒(méi)有聯(lián)邦援助的情況下,,等待州和城市工作人員的將是大量的裁員,而且新稅種的出臺(tái)幾乎已成定局,。不過(guò),,提振財(cái)政收入的各類可選措施都會(huì)帶來(lái)嚴(yán)重的副作用,克勒門斯說(shuō):“提升銷售稅會(huì)在充分收入分配領(lǐng)域?qū)彝?lái)影響,,而提升所得稅可能會(huì)逼迫高收入人群離開(kāi)該州,。”

最后,,最佳(從政治上最可行)方案可能是成本削減以及收入提振的雙管齊下,。克勒門斯說(shuō):“大多數(shù)這類問(wèn)題的最佳解決方案都不是僅靠一種財(cái)務(wù)手段,,而是分?jǐn)傄恍┩闯?。避免出現(xiàn)超出必要的經(jīng)濟(jì)干擾的最佳辦法涵蓋當(dāng)前州和地方政府雇員的工資凍結(jié),,當(dāng)然像我這樣的大學(xué)教職員工亦無(wú)法幸免?!保ㄘ?cái)富中文網(wǎng))

譯者:馮豐

審校:夏林

The coronavirus pandemic is the scourge that keeps on whipping—and its latest punishment is likely to be felt in dozens of states and municipalities across the United States as governments reckon with a massive and sudden loss of revenue. The widespread shutdown of businesses in the wake of COVID-19 didn’t just hammer sales from those businesses, along with the salaries of millions of workers, it’s also continuing to reduce the bounty that comes from taxing both of those sources of income.

Lower tax hauls from sales and personal income alone, according to recent projections, could cost state governments anywhere from $106 billion to $125 billion in fiscal year 2021, which began on July 1 in 46 states. The overall shortfall, however, could easily reach twice that amount when hits to other sources of state and local funds are factored in, says Jeffrey Clemens, an associate professor of economics at the University of California, San Diego, who published a working paper on the issue in June with Stan Veuger, an economist at the American Enterprise Institute.

The 50 states collected more than a trillion dollars in taxes in FY2019, the most recent year for which the U.S. Census Bureau has summary data. It was the eighth consecutive year state tax receipts had risen. Forty-eight states that year reported a bump in revenue, compared with 49 the year before.

Overall, more than two-thirds of that treasure derives from taxes on residents’ personal income (around 38%) as well as from general sales taxes (31%)—though the share from these and other sources (including taxes on corporate income, property, and sales of specific items such as gasoline, cigarettes, or alcohol) can differ dramatically from place to place. In Virginia, for instance, personal income taxes accounted for 51.9% of the commonwealth’s total net revenue collections in FY2019. Seven states, meanwhile—including Florida, Texas, and Wyoming—don’t levy a personal income tax at all. In the same vein, property taxes account for less than 2% of state revenues nationwide, but comprise roughly a quarter of the revenue Vermont raises each year.

While nearly all of these funding sources are vulnerable to economic downturns, personal income (which is clearly influenced by employment status) and general sales (which reflect the strength of consumer spending) have been particularly hit by the pandemic-related closures and restrictions on public gatherings.

The economic pain has been so sharp and swift that, over the past five months, 35 states plus the District of Columbia have released projections revising their FY2021 revenue downward—with at least 24 of those states slicing revenue estimates by 10% or more from pre-COVID forecasts, according to data gathered by the National Conference of State Legislatures. Seven states expect revenues to be down 15% or more. These revisions come on top of revenue losses in FY2020, when the shuttering of businesses began.

New Jersey now expects to be $10 billion in the hole, the state says. California predicted in May that state coffers would have an $18 billion shortfall—if the recession and recovery ended up looking like a “U” (with a brisk comeback following the equally brisk collapse this spring). An “L-shaped” recovery, for that matter, would leave it $31 billion underwater. That assessment, notably, came before this summer’s catastrophic and costly wildfires.

Alaska doesn’t have to worry about shrinking revenues from the personal income tax—it doesn’t have one. But its coffers are nonetheless getting thumped by the coronavirus. As recently as FY2019, the state got roughly a quarter of its $11.2 billion in revenue from petroleum royalties and related taxes. (Alaska calls some of these levies “severance taxes,” to account for the oil and gas that’s being severed from its land.) In the wake of COVID-19, however, state economists estimated a billion-dollar deficit, largely based on extremely low oil prices this spring—a crash they blamed on an “extreme supply and demand imbalance” caused at least in part by a global growth-killing pandemic.

The state’s dire fiscal outlook was based on a $37-a-barrel price for Alaska North Slope crude, and the price is up about 19% since then—so state budgeteers might be a little more sanguine these days. But it’s still way down from its $70 perch at the start of the year.

Even states that rely heavily on personal income and sales taxes routinely draw non-tax dollars from a litany of sources: universities, hospitals, highways, airports, parking facilities, parks, utilities, and a slew of other things that also fall under the heading of “own-source revenue.” States received $371 billion in these non-tax fees in 2017, the latest year available from the Census Bureau. But the story is largely the same here: Lots of these line items were bludgeoned in the economic shutdown and may get hit again if COVID-19 infections surge anew.

Cities and municipalities, which receive more than a trillion dollars in their own “own-source” revenue each year, are likewise facing budgetary nightmares. While two-thirds of those funds come from property taxes, which are relatively stable from year to year, the rest—which largely hails from sales taxes and fees—is just as affected by an economic downturn as the state revenue.

“My best guess would be that, if the economy is going to be 10% smaller over this coming fiscal year, then the whole of these revenues will probably be about 10% smaller,” says Clemens. In 2017, state and local own-source revenue totaled $2.4 trillion. That translates to a $240 billion gut-punch to states and cities.

And that has many state capitals desperately looking to Washington for help. Indeed, as Democrats in the House wrangle with the Trump administration and the Republican-led Senate over a new stimulus plan, financial assistance for states and cities remains a key sticking point. For now, the two sides appear to be at an impasse. If the stalemate continues, the hardest-hit states may have to start taking aggressive measures very soon.

Unlike the federal government, which can issue as much debt as it wants (and it has shown that it wants), state and local governments have much less leeway to borrow their way out of the ditch. “Most states, which face balanced-budget requirements, are not allowed to use long-term debt to finance general fund expenditures,” says Clemens.

Without federal aid, state and city workers will face significant layoffs, and there is almost certain to be a push for new taxes too. But all the various options on the revenue-raising side come with serious downsides, Clemens says: “Increasing taxes on sales affects families across the full-income distribution; raising income taxes risks chasing higher-income folks out of the state.”

In the end, the best (and most politically acceptable) option is likely to be a combination of cost-cutting and revenue-raising measures. “Most problems of this kind are best solved by not going all-in on any one financial lever, but rather by spreading some of the pain around,” says Clemens. “The best options for avoiding more-than-necessary economic disruption would be things like wage freezes of current state and local government employees—which, of course, includes, university faculty like myself.”