數(shù)個月以來,,BP一直在策劃把今年的年度股東大會辦的時髦一些。公司的新任首席執(zhí)行官將登上倫敦ExCeL會展中心,,向數(shù)千名股東宣傳其綠色革命理念,。但在2020年,鮮有事情能夠按照計劃進行,。當(dāng)會議最終于5月底召開時,,現(xiàn)場沒有觀眾,也沒有掌聲,。

實際情況是,,全球最大石油公司的掌門人伯納德?魯尼坐在BP空空如也的總部大樓的一個沒有家具的房間中,對著攝像頭講話,,身旁坐著一名董事和公司高管,。截至當(dāng)時,英國已經(jīng)有3.8萬多人因為疫情而喪生,。與此同時,,ExCeL中心也并沒有用來舉行BP的大型活動,而是被改造為一座新冠病患的分診醫(yī)院,。在家隔離了數(shù)個月而剛出來不久的魯尼看起來并不像是一位有著111年歷史的知名石油巨頭負責(zé)人,,而是像一名落魄的船長,駕駛著一艘向地球傳播壞消息的太空船,。他對那些看不到的與會投資者說:“當(dāng)前的挑戰(zhàn)的規(guī)??芍^是前所未有,。”他將其稱之為“殘酷的環(huán)境”,。

就在三個月前,,魯尼開始了其BP的首席執(zhí)行官職業(yè)生涯,并通過推出一個激進的公司改造方案讓人們大吃一驚,。他承諾在2050年之前實現(xiàn)“凈零”碳排放,,該策略旨在對公司進行大刀闊斧的調(diào)整,隨后多個競爭對手也開始匆忙效仿這一舉措,。

然而魯尼還沒來得及慶祝,新冠疫情便給全球經(jīng)濟帶來了重創(chuàng),。飛機和汽車數(shù)個月以來都處于閑置的狀態(tài),,因為封鎖令而迫使數(shù)十億人口居家隔離,包括魯尼自己及其團隊,。在家中,,BP高管親眼看到了全球原油需求的崩塌,創(chuàng)下了二戰(zhàn)以來的最高跌幅,。由于沒有地方來儲存數(shù)千萬桶無法出售的油品,,原油期貨價格在4月一度跌至負值,這在歷史上還是首次,。

現(xiàn)實確實夠殘酷。BP第一季度財報顯示,,公司的債務(wù)超過了60億美元,,虧損達到了44億美元,而去年同期則是近30億美元的盈利,。6月,,該公司宣布裁員一萬人,相當(dāng)于全球總員工數(shù)的七分之一,,并將這一壞消息歸咎于公司的凈零目標(biāo)重組,。同月,公司警告稱即將對其資產(chǎn)價值進行高達175億美元的減記,。(實際減記額為174億美元,。)8月初則傳來了一個更不幸的消息:BP財報稱第二季度虧損168億美元,并將派息減半,。

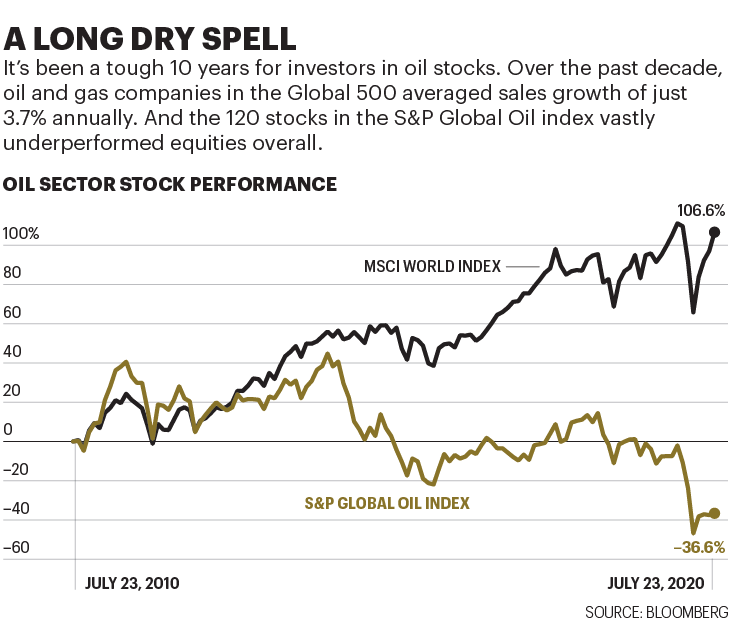

不過,,原油行業(yè)的危機并非源于新冠疫情。即便在新冠病毒開始在全球肆虐之前,,全球主要股市指數(shù)的各大石油公司股價都已經(jīng)嚴(yán)重落后其他股票,,原因在于運營成本的上升和原油價格的低位徘徊,。然而,類似于BP這樣的超級石油巨頭遠沒有到破產(chǎn)的邊緣,。至于證據(jù),,不妨看看今年的《財富》世界500強排名,其中排名前十的都是油氣公司,,BP位列第八,,2019年營收達到了2830億美元,利潤40億美元,。

盡管這些公司斬獲了數(shù)萬億美元的銷售業(yè)績,,但它們內(nèi)部逐漸出現(xiàn)了一種不安感,因為整個世界逐漸變得越來越注重環(huán)保,,而身處其中的它們也在評估自身的前景,。在一系列綜合因素的作用下,引發(fā)變革的外部壓力越來越大,,這包括加快惡化的氣候危機,;憤怒、目標(biāo)明確的年輕一代,;以及可能最為關(guān)鍵的是,,越來越多的股東正威脅拋售其油氣股票,除非他們能看到這些公司做出重大改變,。

在去年的氣候游行中,,數(shù)千萬青年在各大原油公司門前游行,指責(zé)其引發(fā)了全球變暖現(xiàn)象,;科學(xué)家預(yù)計,,大氣中三分之一的溫室氣體都與油氣行業(yè)有關(guān)。去年10月,,示威者向參加倫敦“石油與貨幣大會”的代表扔甜菜根汁,。在2月魯尼擔(dān)任首席執(zhí)行官的第一日,Greenspace激進人士在BP倫敦總部周圍設(shè)置了路障,,迫使辦公室臨時關(guān)閉,。明智的是,魯尼選擇在當(dāng)日去拜會了BP德國煉油廠,。

扔甜菜根汁和設(shè)置路障倒不是什么大事,。然而,各大原油公司已經(jīng)無法對這些更深層次的問題視而不見,。為了避免其核心業(yè)務(wù)在未來數(shù)十年內(nèi)突然崩塌,,這些原油公司需要執(zhí)行其悠久歷史中最為激進的轉(zhuǎn)型舉措。至少,,這是眾多外界人士得出的結(jié)論,。1月,,就在魯尼擔(dān)任首席執(zhí)行官不久,全球最大的資產(chǎn)管理基金貝萊德集團創(chuàng)始人兼首席執(zhí)行官拉里?芬克通過其年度信件讓投資者震驚了一把,,他在信中寫道,,“氣候變化應(yīng)對計劃已經(jīng)成為公司長期前景的決定性因素?!彼f,,隨著新一代人成長為投資者和首席執(zhí)行官,這一點將越來越明確,。簡而言之,,公司要么加入氣候變化應(yīng)對大軍,要么逐漸消亡,。

對于能源巨頭來說,這個選擇確實非常痛苦,。從邏輯上來講,,此舉可能意味著放任數(shù)億桶原油和數(shù)萬億公噸的天然氣躺在地底下,不去鉆探和勘探,。這一點與其與生俱來的業(yè)務(wù)特征格格不入,。非營利性組織“環(huán)境捍衛(wèi)基金”(Environmental Defense Fund)的總裁弗雷德克?拉普說:“原油行業(yè)面臨的挑戰(zhàn)就在眼前。這件事情實施起來將困難重重,?!?/p>

這個理念在BP內(nèi)部并未徹底消失。在貝萊德集團的芬克發(fā)布其信件之前,,魯尼已經(jīng)得出了同樣的結(jié)論,。2月12日,也就是上任一周后,,他通過沉重的標(biāo)題“重構(gòu)能源,,重建BP”,宣布了其對公司的巨大調(diào)整,。該理念的核心宗旨是在2050年或之前將碳排放降為零,,也印證了氣候科學(xué)家所宣揚的規(guī)避環(huán)境災(zāi)難應(yīng)采取的必要措施。

石油行業(yè)分析師和環(huán)保主義者對此的反應(yīng)可謂是希望與無奈并存,。在采訪中,,多位人士提到了BP在上個世紀(jì)90年代末的品牌重新定位運動,,以及隨之而來的口號“超越原油”,它也成為了業(yè)界探索清潔能源未果的典型案例,。如今,,BP再次成為了這場運動名義上的先鋒,而且魯尼堅持認為,,這一次BP將全身心地投入其中,。魯尼在2月說:“方向已經(jīng)確定。我們將朝凈零排放進發(fā),,而且沒有回頭路可走,。”

如果真是這樣,,魯尼的計劃對于BP來說可謂是顛覆性的轉(zhuǎn)變,,因為該公司自1909年以來的發(fā)展動力一直都源于從地下和海底開采石油和天然氣,然后提煉,,賣給全球加油站,。如今,BP需要在不超過30年的時間內(nèi),,來抵消公司每年向大氣排放的4.25噸碳,,方法包括使用風(fēng)力發(fā)電或太陽能電廠等非碳可再生能源、削減原油設(shè)施釋放的甲烷,、捕捉碳并將其儲存在地底,、保護森林,以及最困難的一點——首先停止生產(chǎn)部分含碳產(chǎn)品,。

魯尼在8月初對投資者說,,BP將在10年內(nèi)將其油氣產(chǎn)能削減40%,并停止在新國家開采化石燃料,。他說,,在從事這一行業(yè)一個多世紀(jì)之后,BP如今將成為一家“綜合性能源公司”,。確保這一轉(zhuǎn)型的實施有可能成為一個史詩級的挑戰(zhàn),。但BP的這位新老板堅持認為,這是不可逆的,。魯尼在一個長篇采訪中向《財富》雜志透露:“我真的認為這個趨勢是無可阻擋的,。我真是這么認為的?!?/p>

事后看來,,有鑒于投資者不斷施加的壓力,各大公司爭相調(diào)整公司發(fā)展方向的現(xiàn)象似乎是必然的,。倫敦Sanford C. Bernstein公司的分析師奧斯瓦爾德?克林特說,,“毫無疑問”,,這一舉措的影響是“非常巨大的”。他認為原油公司的高管們自身已經(jīng)變得對氣候問題非常在意,,并非是被迫采取行動,。克林特說:“也許各大公司在過去是被迫的,,但如今不是,,而是完全接受,其文化發(fā)生了變化,?!?/p>

BP成為這一歷史性轉(zhuǎn)變的先驅(qū)似乎出乎很多人的預(yù)料。早些時候,,BP通過利用現(xiàn)如今的伊朗,、伊拉克、利比亞以及其他地區(qū)的政治動蕩,,而得以發(fā)展壯大,。最近,BP成為了過街老鼠,,因為公司對不安全作業(yè)環(huán)境視而不見,,并造成了災(zāi)難性的后果。美國民眾應(yīng)該非常清楚地記得BP的兩個重大事故,,均源于操作的粗心大意,分別是2005年得州得克薩斯城的BP煉油廠爆炸,,造成了15名工人死亡,;以及2010年路易斯安那州近Deepwater Horizon的爆炸,造成11名員工死亡,,并給墨西哥灣造成了巨大損失,。此次事故是美國歷史上最嚴(yán)重的原油泄漏事件。到目前為止,,BP依然在向當(dāng)?shù)厣鐓^(qū)支付數(shù)十億美元的資金,。

魯尼升任公司首席執(zhí)行官最終也為公司提供了一個向全新角色轉(zhuǎn)變的機會。在其凈零決策發(fā)布數(shù)周之后,,BP在歐洲的競爭對手爭相效仿,,可能是覺得如果自己沒有這么做便會被視為環(huán)境罪人。在魯尼演講數(shù)周后,,荷蘭皇家殼牌,、意大利原油巨頭ENI以及法國的道達爾均宣布到2050年實現(xiàn)凈零碳排放的目標(biāo)。西班牙石油公司雷普索爾和挪威國家石油公司也在早些時候做出了類似的聲明,,承諾加大對可再生能源的投資,,并提升原油生產(chǎn)的能源效率,。

魯尼在8月推出的計劃將大幅改變BP的面貌。按照該計劃,,公司在2030年前對低碳能源資源的投資將增加10倍,,并最終以峰值水平為基準(zhǔn),將其油氣業(yè)務(wù)削減75%,。他說:“我們知道這件事并不容易,,但我們堅信它對于公司的所有利益相關(guān)方來說都是件好事?!痹撚媱潓⒅饾u影響B(tài)P的所有決策,。BP策略與可持續(xù)發(fā)展部門新執(zhí)行副總裁的吉尤里亞?奇爾琪婭說:“人們會看到低碳業(yè)務(wù)的增長,化石燃料在今后很長一段時間內(nèi)將呈現(xiàn)下降趨勢,。我們會做出選擇,,而這些選擇將是低碳的?!逼鏍栫鲖I于4月加入BP擔(dān)任這一職務(wù),,幫助管理凈零轉(zhuǎn)型。

對于49歲的魯尼來說,,這是他在深思熟慮之后做出的決定,。在6月底一個長達一小時的視頻采訪中,他表示自己意識到,,公司每天生產(chǎn)3800萬桶油氣的事實無法讓其去應(yīng)對日益嚴(yán)峻的氣候變化,。必須有所付出。魯尼在倫敦家中周邊跑完3英里之后,,穿著黑色的T恤衫坐在家中的辦公室說:“過去幾年很明顯的一個現(xiàn)象在于,,公司在很多方面都在逆勢而為?!蔽覇査?,如果BP和其他石油巨頭不采取碳印跡清零舉措會有什么樣的結(jié)果。他說:“如果不采取行動,,全球的未來將會黯淡無光,。”

魯尼稱,,他在思考BP未來時對兩個人群進行了重點權(quán)衡:雇員以及投資者,。很明顯,這兩個人群會因此而深感不安,。他說:“我們可以感覺到,,投資者真的開始敦促我們,并質(zhì)疑我們的目標(biāo),而這一現(xiàn)象也開始影響整個行業(yè)的財務(wù)業(yè)績,。公司的雇員則會感到焦慮,,焦慮的原因也就是我所說的個人目標(biāo)與公司目標(biāo)出現(xiàn)了偏差?!?/p>

喬?亞歷山大便是這樣一位焦慮的雇員,。她是一名地質(zhì)科學(xué)家,留著一頭紅色長發(fā),,自2003年畢業(yè)于牛津大學(xué)后便加入了BP,,然后在十年間一直從事一些主要的原油項目,包括利比亞和澳大利亞的項目,。她說,,這段生活充斥著冒險和旅行,但她對環(huán)境不斷增長的焦慮最終讓其感到自己的工作難以為繼,。她在2015年選擇離開BP,,并加入了專注于負責(zé)任投資的倫敦非營利性組織ShareAction。

在BP去年的股東大會上,,亞歷山大站起來發(fā)表了講話。她對高管們說,,BP內(nèi)部有很多人都存在促使她離職的類似顧慮,。她說:“我曾經(jīng)問過他們:‘BP什么時候才能提供有意義的工作?’”高管們對此感到吃驚,。會后,,魯尼找到她,對她說:“答應(yīng)我一定要回來,,咱兩再探討下這件事情?!彼ㄙM了數(shù)個月的時間悄悄地評估公司內(nèi)部所熟知之人的觀點,。然后在去年年底,她在BP總部與魯尼見了面,。當(dāng)時,,已經(jīng)有傳言稱時任BP上游業(yè)務(wù)的負責(zé)人魯尼將接替鮑勃?杜德利,擔(dān)任公司新首席執(zhí)行官,。亞歷山大分享了其準(zhǔn)備的有關(guān)BP雇員觀點的數(shù)據(jù),。然后魯尼告訴她自己將實施一個截然不同的策略。亞歷山大立即覺得這正是自己想要參與的工作。她說:“沒有我你做不成這件事,。這是我說過的最厚顏無恥的話,。”

她的膽識得到了回報,。魯尼聘請了39歲的亞歷山大,,并為其創(chuàng)建了一個職位——“使命管理經(jīng)理”,其職責(zé)在于動員BP員工參與“重構(gòu)能源”這一新的使命,。魯尼如今在每次說到變革時都會提到她,,不論在2月的“凈零”演講,還是在我采訪期間均是如此,。亞歷山大堅持認為,,她的出現(xiàn)并不是為了給魯尼的形象鍍金。她在談?wù)揃P的凈零計劃時表示:“我并不幼稚,。我并不認為這個計劃是一件輕而易舉的事情,。”不過,,她還說:“所有人都接受了這個使命,,人們的自豪感真的又回來了?!?/p>

然而,,并非所有的BP員工都對此抱有同樣樂觀的態(tài)度,例如類似于亞歷山大的另一名工程師邁克?柯芬,,他出于環(huán)保顧慮而退出了BP,。34歲的柯芬于2008年從劍橋大學(xué)畢業(yè)之后就以地質(zhì)學(xué)家的身份加入BP。與亞歷山大一樣,,他也在BP的各大勘探項目上工作了10年的時間,,并稱該工作基本上就是其心目中的理想工作:工作十分有趣,而且穩(wěn)健的職業(yè)道路能夠讓他有能力買房,、成家,。他說:“10至12年前,這一點非常有吸引力,?!?/p>

然而,柯芬對原油生產(chǎn)造成的環(huán)境破壞越發(fā)感到不安,。他擔(dān)心BP是否能在這場能源轉(zhuǎn)型中生存下來,,而且就算活了下來,像他這樣專注于尋找重大新發(fā)現(xiàn)的勘探工程師可能會不復(fù)存在,。他說:“我感覺未來不一定需要石油和天然氣,?!?/p>

去年早些時候,柯芬終于離開了BP,,并成為了倫敦非盈利機構(gòu)Carbon Tracker Initiative的油氣分析師,,該機構(gòu)致力于研究石油公司的氣候應(yīng)對舉措對金融市場的影響。在魯尼于今夏宣布開展大規(guī)模的化石燃料削減之后,,柯芬說:“BP如今成為了應(yīng)對氣候變化的行業(yè)領(lǐng)頭羊,。”即便如此,,他依然對石油公司是否真的能夠像其說的那樣重構(gòu)自身存在很大的疑問,。他還質(zhì)疑大型石油公司是否會拋棄其長期以來將分紅與化石燃料生產(chǎn)掛鉤的做法。(BP稱從現(xiàn)在開始,,公司將在考慮分紅時增加環(huán)保的權(quán)重,。)

隨著激進投資者變得越來越有組織性,出于對環(huán)保以及金融風(fēng)險的考慮,,從資產(chǎn)組合中剔除能源股的動作亦是如此,。Carbon Tracker Initiative的油氣和開采負責(zé)人安德魯?格蘭特說:“投資者可能對環(huán)境一點都不關(guān)心。但他們收到了來自于其客戶的壓力,。在眼下,,金融法規(guī)真的已經(jīng)與環(huán)保法規(guī)接軌?!?/p>

在美國和歐洲,,數(shù)十只養(yǎng)老基金和多家政府機構(gòu)已經(jīng)開始通過拋售化石燃料股票回籠了數(shù)十億美元的資金,。激進投資機構(gòu)Fossil Free稱,總資產(chǎn)額超過14萬億美元的各大機構(gòu)投資者如今正專注于撤資,。馬薩諸塞州劍橋市研究與倡議機構(gòu)Union of Concerned Scientists問責(zé)運動總監(jiān)凱西?穆爾維說:“投資者越來越了解這些公司,。”她還表示,,環(huán)保主義者擔(dān)心各大公司將通過“商業(yè)手段”而不是真正的碳排放削減來實現(xiàn)凈零目標(biāo),。她說:“要讓這些企業(yè)真正能夠懸崖勒馬,還有不少工作要做,。”

股東們也在尋求從公司內(nèi)部推動這一變革,。自2016年以來,,激進人士為推動氣候決議的通過一直在多家石油巨頭的年度股東大會上集結(jié)股東,以便達到進行投票表決所需的門檻。

2016年,,由機械工程師轉(zhuǎn)而成為積極人士的荷蘭人馬克?范巴爾成立了股東組織Follow This,,旨在通過股東決議向原油公司施壓,從而讓它們致力于實施環(huán)保政策,。他說:“有人說,,‘哦,你想改變殼牌,?做夢吧,。’”他在殼牌2016年年度股東大會上提出的第一份決議十分生猛:“我們告訴殼牌公司應(yīng)摒棄油氣資源勘探業(yè)務(wù),?!边@個決議很難通過,因為它是這家原油巨頭的唯一業(yè)務(wù),。他說:“不可思議的是,該決議得到了2.6%的支持?!?/p>

該組織的策略自那之后變得越發(fā)成熟,,如今還包括直接與原油高管協(xié)商。去年11月,,范巴爾從阿姆斯特丹坐上了歐洲之星列車,,前往BP倫敦總部與魯尼會面。魯尼當(dāng)時已經(jīng)被任命為新首席執(zhí)行官,。這兩位舉行了閉門會面,,當(dāng)時魯尼向范巴爾透露BP將發(fā)生重大變化。范巴爾說:“魯尼堅信,,他有必要在執(zhí)掌之后做出重大聲明,,而且需要股東的支持?!狈栋蜖枦Q定,,不會在5月召開的魯尼上任后首個股東會議上提出激進的決議,而是與魯尼合作,,針對明年的會議制定一個聯(lián)合決議,,從而讓BP致力于實施凈零策略。他說:“如果得到合理實施,,它將帶來顛覆性的轉(zhuǎn)變,。”

范巴爾成功地讓殼牌,、道達爾,、挪威國家石油公司以及BP對決議進行了投票,。在美國,美國證券交易委員會阻礙了類似的激進決議,,包括??松梨诤脱┓瘕埖哪甓裙蓶|大會,該機構(gòu)稱投資者曾經(jīng)嘗試干擾公司管理層決策,。范巴爾對此十分樂觀,,他堅信石油行業(yè)必須向現(xiàn)實低頭。他說:“我曾經(jīng)夢想原油巨頭的首席執(zhí)行官能夠頓悟,,可以徹夜不眠地思考其孩子的未來,。但這是不可能的。讓曾經(jīng)的油氣大亨魯尼幡然悔悟的是公司的股東,?!?/p>

然而,范巴爾認為BP的“油氣大亨”終于成為了他可以攜手的首席執(zhí)行官,。而且他認為魯尼在8月宣布的計劃對于行業(yè)來說具有里程碑式的意義,。范巴爾說:“這是第一家針對2050年目標(biāo)采取實際行動,而不只是紙上談兵的石油巨頭,。削減40%的原油產(chǎn)能真的是很激進的目標(biāo),。如果有一個石油巨頭站了出來,而且得到了股東的獎勵,,那么其他公司就會效仿,。”

當(dāng)魯尼描述他的早期生活時,,令人感到不可思議的是,,他可以成為任何領(lǐng)域的游戲改變者。他對BP尤為感激,。他說:“相對于我的背景而言,,公司給了我一個我以前做夢都沒有想到的機會。我并非出身與名校,,或有著深厚的背景,。”

這個說法著實十分低調(diào),。魯尼的父母在11歲便離開了學(xué)校,,并在愛爾蘭凱利郡鄉(xiāng)下的一個奶牛場撫養(yǎng)了5個孩子。他說自己與自己的兄弟在年輕時就學(xué)會了如何通過工作來賺外快,。當(dāng)我詢問魯尼其倫敦家中書架上的綠色玩具拖拉機時,,他稱這是在追憶自己的孩提時代。他說:“家里從來沒有買過什么好機器,,但我們一直都想要好東西,。我們通過倒賣舊拖拉機來賺錢,。只要能賺錢的活都干?!?/p>

他最深刻的記憶便是自己與同齡人的不同。他說:“男孩們擅長玩愛爾蘭曲棍球[傳統(tǒng)的愛爾蘭體育運動,,類似于長曲棍球]和橄欖球,,但說實話,我覺得自己一無是處,。我覺得自己的手很笨,,然而在農(nóng)場,一切活都得用手來完成,?!?/p>

魯尼是家里的第一個大學(xué)生。他在從都柏林大學(xué)畢業(yè)后直接以鉆探工程師的身份加入了BP,,而且先后數(shù)年效力于英國北海,、阿拉斯加、挪威和美國的一些項目,。他最終被前首席執(zhí)行官約翰?布朗尼欽點為“海龜”(名字取自于忍者神龜),,也就是有望向高層發(fā)展的高管助理。為了幫助其打好基礎(chǔ),,布朗尼將他派往斯坦福商學(xué)院學(xué)習(xí)了一年,。

即便在現(xiàn)在,魯尼說自己的童年給他留下了不可磨滅的印記,。他認為,,童年讓自己意識到非常有必要招募那些感覺自己與眾不同或受到歧視的人士。自他擔(dān)任首席執(zhí)行官之后接受的少數(shù)幾次采訪中,,有一次便是接受跨性別維權(quán)人士,、制片人杰克?格拉夫的采訪,魯尼對杰克說,,如果任何BP員工不支持性少數(shù)群體權(quán)益,,“那么他就不屬于BP這個大家庭”。在轟動的“黑人生命亦寶貴”抗議活動中,,他在6月1日致BP全球員工的信中敦促員工大聲揭露其生活中以及BP公司內(nèi)部的種族主義,。他說,自己隨后與員工召開了痛徹心扉的視頻會議,,“員工們有的留下了眼淚,,有的失聲痛哭”。

作為首席執(zhí)行官,,魯尼已經(jīng)將心理健康作為BP的首要慈善事業(yè),,公司向英國精神健康機構(gòu)Mind捐獻了大量的資金,。他將其看作公司內(nèi)部的一個關(guān)鍵問題,并認為疫情讓其出現(xiàn)了“進一步升級”,,但這明顯也是私人問題,。他說:“在人際關(guān)系方面,我自己也面臨著一些挑戰(zhàn),。我也接受過心理咨詢等服務(wù),。我認為每個員工都會受到影響?!比欢?,他并沒有透露這方面的細節(jié)。在封鎖期間,,魯尼向BP員工推薦了冥想應(yīng)用程序Headspace,,他稱自己如今每天晚上都會使用。他說:“它就在我的床邊,,其播放的陣陣波濤聲能夠讓我的心境平靜下來,。”

魯尼并沒有大企業(yè)高管的典型做派,,他似乎對于這種負面形象很在意,。當(dāng)BP的官方網(wǎng)頁便將其稱為“伯納德”,他創(chuàng)建了一個新Instrgram賬戶,,其為數(shù)不多的幾十張照片除了常規(guī)的企業(yè)照之外還包括同性戀驕傲大游行的彩虹,,熱帶雨林,他通常在這些場合下身穿藍色牛仔,,很少扎領(lǐng)帶,,即便在5月召開的股東大會上也沒有扎領(lǐng)帶。

這位新首席執(zhí)行官敦促員工與外界溝通,,有一些員工采納了他的建議,,使用新冠疫情封鎖這個機會與他進行在線溝通。在一個視頻電話中,,英國加油站工作人員向魯尼講述了疫情期間作為必要一線員工拿低薪的難處,。魯尼隨后便為他們漲了工資。在托萊多BP-Husky煉油廠運營協(xié)調(diào)員何塞?羅德里格茲因一時沖動,,使用公司的內(nèi)部社交網(wǎng)Yammer向魯尼發(fā)牢騷,,并邀請他參加員工會議。羅德里格茲對于能夠得到魯尼的反饋感到震驚,。魯尼迅速地確定了一個日期,,而且通過視頻與煉油廠工人聊了20分鐘。羅德里格茲眉飛色舞地說:“我們感到他真的是很關(guān)心我們?!彼€表示,,魯尼不同于其此前29年BP職業(yè)生涯中所經(jīng)歷的四位首席執(zhí)行官。羅德里格茲說:“一位工廠經(jīng)理的母親剛剛?cè)ナ?。伯納德說,,‘別忘了你的父親,他可能在掩飾自己的悲痛,?!绷_德里格茲和魯尼自此之后便一直保持著聯(lián)系。

我們很容易將其看作BP形象重塑舉措的一部分,,因為在眼下,公司已經(jīng)承諾對發(fā)展方向進行重大調(diào)整,。然而據(jù)我們所知,,它似乎也反映了魯尼真實的管理風(fēng)格和個性。

即便如此,,這位首席執(zhí)行官也很難說服那些記性好的外部懷疑人士,。公司于1997年推出的“超越石油”品牌重構(gòu)計劃便是由Ogilvy Public Relations Worldwide設(shè)計的一個價值2億美元的公關(guān)活動。當(dāng)時BP向世界宣布,,公司將“思考油桶之外的事情”,。為了凸顯這一理念,時任首席執(zhí)行官布朗尼將公司的名稱從英國石油簡化為BP,。

對于一些人來說,,魯尼的“重構(gòu)能源”計劃聽起來沒有多少區(qū)別。Union of Concerned Scientists的穆爾維說:“我們此前也聽說過類似的計劃,,也就是BP的‘超越石油’計劃,。人們當(dāng)時對此抱有很大的希望,這個計劃聽起來非常有突破性,?!彼f,環(huán)保主義者擔(dān)心會再次失望,。

布朗尼稱,,他的舉措在當(dāng)時取得了實質(zhì)性的進展,意味著公司真正開始擔(dān)心碳排放問題,,也是公司有別于其他石油巨頭的一個地方,。他說:“業(yè)界認為此舉對整個行業(yè)構(gòu)成了很大的威脅,并認為BP已經(jīng)走上了歧路,,但我們并不是在洗綠自己,。”

在該活動推出之際,,BP剛好在美國進行了80億美元的太陽能電板投資,,但這場冒險對于BP來說可謂是血本無歸,,因為當(dāng)時中國開始了大規(guī)模的電板制造運動,而且價格比BP低得多,。BP隨后收購了英國太陽能公司Lightsource 50%的股份,,并通過其修建和運營太陽能電廠,但沒有制造面板,。布朗尼稱,,石油公司在上個世紀(jì)90年代便清楚地意識到,其碳排放對全球氣候造成了嚴(yán)重的破壞,。然而,,當(dāng)時人們并沒有多少緊迫感。布朗尼說:“當(dāng)時的狀況與眼下相距甚遠,,我們有大把的時間,。”

但時間對于魯尼來說是件奢侈品,。為了在30年內(nèi)實現(xiàn)凈零排放,,他必須迅速地改變BP,而且刻不容緩,。布朗尼稱,,此外,與上個世紀(jì)90年代相比,,當(dāng)前的投資者不會容忍任何虛偽行徑,。他在談到用植樹或保護現(xiàn)有森林等舉措來平衡碳排放時說:“光把抵消碳印記掛在口頭上是不行的,得付諸實際行動,?!?/p>

投資者和基金人士終于聽到了魯尼的“實際行動”計劃。(而且他說,,該計劃并不依賴于碳抵消),。BP策略部門新負責(zé)人奇爾琪婭稱,疫情讓變革需求變得更加緊迫,。她說:“說到其中的教訓(xùn),,疫情告訴我們,我們所處的這個環(huán)境非常脆弱,。它凸顯了我們多元化的需求,。”她說自己在今年早些時候辭掉了麥肯錫的工作,,因為魯尼此前說服了自己,,稱BP將專注于削減排放,而且會不折不扣地去做。她說:“我想,,‘哇,,這些人對此是認真的?!艺J為如果我們獲得成功,,其他公司便會效仿?!?/p>

位于紐約的環(huán)境捍衛(wèi)基金的負責(zé)人科拉普曾經(jīng)與魯尼多次會面,,包括在疫情期間的視頻會面,來探討B(tài)P的凈零計劃,。他說BP從今年開始就需要部署一系列解決方案,,這樣才能滿足其2050年目標(biāo),??评战ㄗh魯尼迅速地從化石燃料轉(zhuǎn)變?yōu)榈吞寄茉瓷a(chǎn),減少原油設(shè)施的甲烷等污染物的排放,,并中和任何存在的碳排放,包括通過保護現(xiàn)有的熱帶雨林,。他還說,,所有這一切都應(yīng)該大規(guī)模地開展。他說:“他們實現(xiàn)轉(zhuǎn)變的里程碑必須減少對油氣的投資,。我們敦促伯納德要實現(xiàn)這一轉(zhuǎn)變過程中的里程碑,。”

一個超越一切的關(guān)鍵問題在于:這家能源巨頭愿意放棄多少油氣資源,?BP稱公司將使用其油氣生產(chǎn)來資助低碳能源,。如今,公司賬面上有193億桶的儲備,。

然而按照凈零策略,,數(shù)億桶油氣可能將永遠沉睡地底,成為財務(wù)領(lǐng)域所謂的擱淺資產(chǎn),。環(huán)保主義者擔(dān)心,隨著全球價格的上漲,,BP可能會因此而擴大鉆井活動,,而各大石油公司和歐佩克富油國在過去數(shù)十年間都是如此。BP稱,公司去年在可再生能源領(lǐng)域的投資不到其152億美元資本支出的3%,。市場情報公司Rystad Energy的能源服務(wù)研究業(yè)務(wù)副總裁馬修?菲茨蒙斯稱,當(dāng)前整個行業(yè)未來五年在清潔能源方面的開支預(yù)計將達到資本總支出的9%,。這些數(shù)字對環(huán)保主義者來說無異于杯水車薪。倫敦非政府組織ClientEarth的律師蘇菲?馬佳納克說:“在過去20年中,,整個行業(yè)一直對這個問題視而不見,,但愿它如今能夠得到重視?!?/p>

對于魯尼及其大型石油同行來說,,終極挑戰(zhàn)在于既要改變這一態(tài)勢,又要找到方式來交付股東要求的利潤,。有一件事似乎是肯定的:在今后數(shù)年內(nèi),,BP和其他公司可能會繼續(xù)其油氣生產(chǎn)。魯尼在8月公布其計劃時說:“要通過關(guān)閉龍頭來實現(xiàn)一家110歲公司的轉(zhuǎn)型基本上是不可能的,。”位于巴黎的國際能源機構(gòu)稱,,即便油氣公司在太陽能,、電動汽車和風(fēng)力發(fā)電機方面投入重金,但隨著新興國家財富的增加,,全球?qū)κ偷男枨箢A(yù)計至少在未來10年內(nèi)依然會呈現(xiàn)出上揚態(tài)勢,。

當(dāng)我問魯尼,隨著公司減少化石燃料產(chǎn)能,,BP是否必然會面臨利潤率下降的問題,?他說,相反,,他認為BP將從能源轉(zhuǎn)型獲得巨大收益,。各大政府正在投入海量的資金來推動能源轉(zhuǎn)型,包括歐盟數(shù)萬億美元的疫情恢復(fù)計劃,。這些原油巨頭可以借助數(shù)萬名工程師和國際化的供應(yīng)鏈參與這一進程,。魯尼說:“各國將花費數(shù)萬億美元來重建和更換全球的能源系統(tǒng),繼而會為像BP這樣的專業(yè)公司帶來巨大的機遇,?!?/p>

除了提及財務(wù)機遇之外,魯尼聽起來越來越像一位真正的氣候保護主義者,。他說:“目前各大公司有站隊的趨勢,。我對這個不感興趣,。我希望大家去做我認為有益于這個世界的事情。關(guān)鍵在于找到適合BP的發(fā)展之路,,以及適合所有人的發(fā)展之路,,這個沒有什么區(qū)別?!?/p>

10年之后:Deepwater Horizon災(zāi)難讓BP發(fā)生了哪些轉(zhuǎn)變

10年前,,BP油井的爆炸導(dǎo)致了美國史上最嚴(yán)重的原油泄漏事件,。公司依然在為此買單。

2010年4月20日,,Deepwater Horizon井架正在鉆探位于路易斯安那州近海的一個名為“馬貢多”的超深油藏,,油田名字取自于加夫列爾?加西亞?馬爾克斯知名著作《百年孤獨》(One Hundred Years of Solitude)中的地名。隨后,,該項目成為了一個史詩級的災(zāi)難,。

氣體撕裂了油井,在墨西哥灣深達1.5英里的海底發(fā)生爆炸,,11名平臺員工因此而喪生,。它所引發(fā)的火焰束在太空中清晰可見,同時也對海灣的漁業(yè)資源和濕地造成了巨大破壞,。在這場持續(xù)了87天,、美國史上最大的漏油事件中,約320萬桶的原油流入了墨西哥灣,,還有81萬桶油被BP回收。

10年過去了,,特朗普政府已經(jīng)回滾了多項Deepwater Horizon事件之后制定的重要監(jiān)管法規(guī),,包括獨立檢查和安全要求,例如預(yù)防爆裂的備用系統(tǒng),。

這場事故讓BP的可信度在隨后的數(shù)年中一蹶不振,,直到如今才開始有所好轉(zhuǎn)。當(dāng)時幫助監(jiān)管清理舉措的BP高級副總裁,、BP現(xiàn)任首席執(zhí)行官魯尼說:“這是一個令人絕望的困難經(jīng)歷,。”法院認為BP在安全方面走捷徑,,奧巴馬總統(tǒng)譴責(zé)公司“行事粗心大意”,。

BP依然在支付約690億美元和解費用以及當(dāng)?shù)厣鐓^(qū)和海灣沿線各州補助金的剩余部分,包括去年支付的約24億美元,。公司預(yù)計自己在未來13年內(nèi)每年將支付約10億美元的費用,。

盡管出現(xiàn)了這一災(zāi)難,,BP依然在墨西哥灣深水井的鉆探方面投入了大量資金,而且其目標(biāo)是到2020年中期實現(xiàn)該海域每天約40萬桶的產(chǎn)量,,與爆炸前2009年的產(chǎn)量一致,。但魯尼稱,Deepwater Horizon讓公司發(fā)生了永久性的變化,。他說,,安全環(huán)境目前已經(jīng)成為BP運營的首要考慮因素,而且公司也學(xué)會了不能過于依賴某一個單體項目,,這是評論人士在2010年事故之后用來批判BP的一個罪名,。

他說:“我們永遠不會忘記,而且必須始終銘記,。我們在事故之后感到羞愧難當(dāng),對此,,我個人完全有理由認為羞愧感從很多方面來講是件好事,。”然而,,對于BP和海灣沿岸來說,,這是一個異常慘痛的教訓(xùn)。(財富中文網(wǎng))

本文另一版本刊載于《財富》雜志2020年8/9月刊,,標(biāo)題為《BP終于準(zhǔn)備“另起爐灶”了嗎,?》

譯者:馮豐

審校:夏林

數(shù)個月以來,BP一直在策劃把今年的年度股東大會辦的時髦一些,。公司的新任首席執(zhí)行官將登上倫敦ExCeL會展中心,,向數(shù)千名股東宣傳其綠色革命理念。但在2020年,,鮮有事情能夠按照計劃進行,。當(dāng)會議最終于5月底召開時,現(xiàn)場沒有觀眾,,也沒有掌聲,。

實際情況是,全球最大石油公司的掌門人伯納德?魯尼坐在BP空空如也的總部大樓的一個沒有家具的房間中,,對著攝像頭講話,,身旁坐著一名董事和公司高管。截至當(dāng)時,,英國已經(jīng)有3.8萬多人因為疫情而喪生,。與此同時,ExCeL中心也并沒有用來舉行BP的大型活動,,而是被改造為一座新冠病患的分診醫(yī)院,。在家隔離了數(shù)個月而剛出來不久的魯尼看起來并不像是一位有著111年歷史的知名石油巨頭負責(zé)人,,而是像一名落魄的船長,駕駛著一艘向地球傳播壞消息的太空船,。他對那些看不到的與會投資者說:“當(dāng)前的挑戰(zhàn)的規(guī)??芍^是前所未有?!彼麑⑵浞Q之為“殘酷的環(huán)境”,。

就在三個月前,魯尼開始了其BP的首席執(zhí)行官職業(yè)生涯,,并通過推出一個激進的公司改造方案讓人們大吃一驚,。他承諾在2050年之前實現(xiàn)“凈零”碳排放,該策略旨在對公司進行大刀闊斧的調(diào)整,,隨后多個競爭對手也開始匆忙效仿這一舉措,。

然而魯尼還沒來得及慶祝,新冠疫情便給全球經(jīng)濟帶來了重創(chuàng),。飛機和汽車數(shù)個月以來都處于閑置的狀態(tài),,因為封鎖令而迫使數(shù)十億人口居家隔離,包括魯尼自己及其團隊,。在家中,,BP高管親眼看到了全球原油需求的崩塌,創(chuàng)下了二戰(zhàn)以來的最高跌幅,。由于沒有地方來儲存數(shù)千萬桶無法出售的油品,,原油期貨價格在4月一度跌至負值,這在歷史上還是首次,。

現(xiàn)實確實夠殘酷,。BP第一季度財報顯示,公司的債務(wù)超過了60億美元,,虧損達到了44億美元,,而去年同期則是近30億美元的盈利。6月,,該公司宣布裁員一萬人,,相當(dāng)于全球總員工數(shù)的七分之一,,并將這一壞消息歸咎于公司的凈零目標(biāo)重組,。同月,公司警告稱即將對其資產(chǎn)價值進行高達175億美元的減記,。(實際減記額為174億美元,。)8月初則傳來了一個更不幸的消息:BP財報稱第二季度虧損168億美元,并將派息減半,。

不過,,原油行業(yè)的危機并非源于新冠疫情,。即便在新冠病毒開始在全球肆虐之前,全球主要股市指數(shù)的各大石油公司股價都已經(jīng)嚴(yán)重落后其他股票,,原因在于運營成本的上升和原油價格的低位徘徊,。然而,類似于BP這樣的超級石油巨頭遠沒有到破產(chǎn)的邊緣,。至于證據(jù),,不妨看看今年的《財富》世界500強排名,其中排名前十的都是油氣公司,,BP位列第八,,2019年營收達到了2830億美元,利潤40億美元,。

盡管這些公司斬獲了數(shù)萬億美元的銷售業(yè)績,,但它們內(nèi)部逐漸出現(xiàn)了一種不安感,因為整個世界逐漸變得越來越注重環(huán)保,,而身處其中的它們也在評估自身的前景,。在一系列綜合因素的作用下,引發(fā)變革的外部壓力越來越大,,這包括加快惡化的氣候危機,;憤怒、目標(biāo)明確的年輕一代,;以及可能最為關(guān)鍵的是,,越來越多的股東正威脅拋售其油氣股票,除非他們能看到這些公司做出重大改變,。

在去年的氣候游行中,,數(shù)千萬青年在各大原油公司門前游行,指責(zé)其引發(fā)了全球變暖現(xiàn)象,;科學(xué)家預(yù)計,,大氣中三分之一的溫室氣體都與油氣行業(yè)有關(guān)。去年10月,,示威者向參加倫敦“石油與貨幣大會”的代表扔甜菜根汁,。在2月魯尼擔(dān)任首席執(zhí)行官的第一日,Greenspace激進人士在BP倫敦總部周圍設(shè)置了路障,,迫使辦公室臨時關(guān)閉,。明智的是,魯尼選擇在當(dāng)日去拜會了BP德國煉油廠,。

扔甜菜根汁和設(shè)置路障倒不是什么大事,。然而,各大原油公司已經(jīng)無法對這些更深層次的問題視而不見,。為了避免其核心業(yè)務(wù)在未來數(shù)十年內(nèi)突然崩塌,,這些原油公司需要執(zhí)行其悠久歷史中最為激進的轉(zhuǎn)型舉措,。至少,這是眾多外界人士得出的結(jié)論,。1月,,就在魯尼擔(dān)任首席執(zhí)行官不久,全球最大的資產(chǎn)管理基金貝萊德集團創(chuàng)始人兼首席執(zhí)行官拉里?芬克通過其年度信件讓投資者震驚了一把,,他在信中寫道,,“氣候變化應(yīng)對計劃已經(jīng)成為公司長期前景的決定性因素?!彼f,,隨著新一代人成長為投資者和首席執(zhí)行官,這一點將越來越明確,。簡而言之,,公司要么加入氣候變化應(yīng)對大軍,要么逐漸消亡,。

對于能源巨頭來說,,這個選擇確實非常痛苦。從邏輯上來講,,此舉可能意味著放任數(shù)億桶原油和數(shù)萬億公噸的天然氣躺在地底下,,不去鉆探和勘探。這一點與其與生俱來的業(yè)務(wù)特征格格不入,。非營利性組織“環(huán)境捍衛(wèi)基金”(Environmental Defense Fund)的總裁弗雷德克?拉普說:“原油行業(yè)面臨的挑戰(zhàn)就在眼前,。這件事情實施起來將困難重重?!?/p>

這個理念在BP內(nèi)部并未徹底消失,。在貝萊德集團的芬克發(fā)布其信件之前,魯尼已經(jīng)得出了同樣的結(jié)論,。2月12日,,也就是上任一周后,他通過沉重的標(biāo)題“重構(gòu)能源,,重建BP”,,宣布了其對公司的巨大調(diào)整。該理念的核心宗旨是在2050年或之前將碳排放降為零,,也印證了氣候科學(xué)家所宣揚的規(guī)避環(huán)境災(zāi)難應(yīng)采取的必要措施,。

石油行業(yè)分析師和環(huán)保主義者對此的反應(yīng)可謂是希望與無奈并存。在采訪中,,多位人士提到了BP在上個世紀(jì)90年代末的品牌重新定位運動,,以及隨之而來的口號“超越原油”,,它也成為了業(yè)界探索清潔能源未果的典型案例,。如今,,BP再次成為了這場運動名義上的先鋒,而且魯尼堅持認為,,這一次BP將全身心地投入其中,。魯尼在2月說:“方向已經(jīng)確定。我們將朝凈零排放進發(fā),,而且沒有回頭路可走,。”

如果真是這樣,,魯尼的計劃對于BP來說可謂是顛覆性的轉(zhuǎn)變,,因為該公司自1909年以來的發(fā)展動力一直都源于從地下和海底開采石油和天然氣,然后提煉,,賣給全球加油站,。如今,BP需要在不超過30年的時間內(nèi),,來抵消公司每年向大氣排放的4.25噸碳,,方法包括使用風(fēng)力發(fā)電或太陽能電廠等非碳可再生能源、削減原油設(shè)施釋放的甲烷,、捕捉碳并將其儲存在地底,、保護森林,,以及最困難的一點——首先停止生產(chǎn)部分含碳產(chǎn)品,。

魯尼在8月初對投資者說,BP將在10年內(nèi)將其油氣產(chǎn)能削減40%,,并停止在新國家開采化石燃料,。他說,,在從事這一行業(yè)一個多世紀(jì)之后,,BP如今將成為一家“綜合性能源公司”。確保這一轉(zhuǎn)型的實施有可能成為一個史詩級的挑戰(zhàn),。但BP的這位新老板堅持認為,這是不可逆的,。魯尼在一個長篇采訪中向《財富》雜志透露:“我真的認為這個趨勢是無可阻擋的,。我真是這么認為的?!?/p>

事后看來,有鑒于投資者不斷施加的壓力,,各大公司爭相調(diào)整公司發(fā)展方向的現(xiàn)象似乎是必然的。倫敦Sanford C. Bernstein公司的分析師奧斯瓦爾德?克林特說,“毫無疑問”,這一舉措的影響是“非常巨大的”,。他認為原油公司的高管們自身已經(jīng)變得對氣候問題非常在意,,并非是被迫采取行動,??肆痔卣f:“也許各大公司在過去是被迫的,但如今不是,而是完全接受,其文化發(fā)生了變化。”

BP成為這一歷史性轉(zhuǎn)變的先驅(qū)似乎出乎很多人的預(yù)料,。早些時候,BP通過利用現(xiàn)如今的伊朗,、伊拉克,、利比亞以及其他地區(qū)的政治動蕩,而得以發(fā)展壯大,。最近,BP成為了過街老鼠,因為公司對不安全作業(yè)環(huán)境視而不見,,并造成了災(zāi)難性的后果,。美國民眾應(yīng)該非常清楚地記得BP的兩個重大事故,均源于操作的粗心大意,,分別是2005年得州得克薩斯城的BP煉油廠爆炸,,造成了15名工人死亡;以及2010年路易斯安那州近Deepwater Horizon的爆炸,,造成11名員工死亡,,并給墨西哥灣造成了巨大損失。此次事故是美國歷史上最嚴(yán)重的原油泄漏事件,。到目前為止,,BP依然在向當(dāng)?shù)厣鐓^(qū)支付數(shù)十億美元的資金。

魯尼升任公司首席執(zhí)行官最終也為公司提供了一個向全新角色轉(zhuǎn)變的機會,。在其凈零決策發(fā)布數(shù)周之后,,BP在歐洲的競爭對手爭相效仿,可能是覺得如果自己沒有這么做便會被視為環(huán)境罪人,。在魯尼演講數(shù)周后,,荷蘭皇家殼牌、意大利原油巨頭ENI以及法國的道達爾均宣布到2050年實現(xiàn)凈零碳排放的目標(biāo),。西班牙石油公司雷普索爾和挪威國家石油公司也在早些時候做出了類似的聲明,,承諾加大對可再生能源的投資,并提升原油生產(chǎn)的能源效率,。

魯尼在8月推出的計劃將大幅改變BP的面貌,。按照該計劃,公司在2030年前對低碳能源資源的投資將增加10倍,,并最終以峰值水平為基準(zhǔn),,將其油氣業(yè)務(wù)削減75%。他說:“我們知道這件事并不容易,,但我們堅信它對于公司的所有利益相關(guān)方來說都是件好事,?!痹撚媱潓⒅饾u影響B(tài)P的所有決策。BP策略與可持續(xù)發(fā)展部門新執(zhí)行副總裁的吉尤里亞?奇爾琪婭說:“人們會看到低碳業(yè)務(wù)的增長,,化石燃料在今后很長一段時間內(nèi)將呈現(xiàn)下降趨勢,。我們會做出選擇,而這些選擇將是低碳的,?!逼鏍栫鲖I于4月加入BP擔(dān)任這一職務(wù),幫助管理凈零轉(zhuǎn)型,。

對于49歲的魯尼來說,,這是他在深思熟慮之后做出的決定。在6月底一個長達一小時的視頻采訪中,,他表示自己意識到,,公司每天生產(chǎn)3800萬桶油氣的事實無法讓其去應(yīng)對日益嚴(yán)峻的氣候變化。必須有所付出,。魯尼在倫敦家中周邊跑完3英里之后,,穿著黑色的T恤衫坐在家中的辦公室說:“過去幾年很明顯的一個現(xiàn)象在于,公司在很多方面都在逆勢而為,?!蔽覇査?,如果BP和其他石油巨頭不采取碳印跡清零舉措會有什么樣的結(jié)果,。他說:“如果不采取行動,全球的未來將會黯淡無光,?!?/p>

魯尼稱,他在思考BP未來時對兩個人群進行了重點權(quán)衡:雇員以及投資者,。很明顯,,這兩個人群會因此而深感不安。他說:“我們可以感覺到,,投資者真的開始敦促我們,,并質(zhì)疑我們的目標(biāo),而這一現(xiàn)象也開始影響整個行業(yè)的財務(wù)業(yè)績,。公司的雇員則會感到焦慮,,焦慮的原因也就是我所說的個人目標(biāo)與公司目標(biāo)出現(xiàn)了偏差?!?/p>

喬?亞歷山大便是這樣一位焦慮的雇員,。她是一名地質(zhì)科學(xué)家,留著一頭紅色長發(fā),,自2003年畢業(yè)于牛津大學(xué)后便加入了BP,,然后在十年間一直從事一些主要的原油項目,,包括利比亞和澳大利亞的項目。她說,,這段生活充斥著冒險和旅行,,但她對環(huán)境不斷增長的焦慮最終讓其感到自己的工作難以為繼。她在2015年選擇離開BP,,并加入了專注于負責(zé)任投資的倫敦非營利性組織ShareAction,。

在BP去年的股東大會上,亞歷山大站起來發(fā)表了講話,。她對高管們說,,BP內(nèi)部有很多人都存在促使她離職的類似顧慮。她說:“我曾經(jīng)問過他們:‘BP什么時候才能提供有意義的工作,?’”高管們對此感到吃驚,。會后,魯尼找到她,,對她說:“答應(yīng)我一定要回來,,咱兩再探討下這件事情?!彼ㄙM了數(shù)個月的時間悄悄地評估公司內(nèi)部所熟知之人的觀點,。然后在去年年底,她在BP總部與魯尼見了面,。當(dāng)時,,已經(jīng)有傳言稱時任BP上游業(yè)務(wù)的負責(zé)人魯尼將接替鮑勃?杜德利,擔(dān)任公司新首席執(zhí)行官,。亞歷山大分享了其準(zhǔn)備的有關(guān)BP雇員觀點的數(shù)據(jù),。然后魯尼告訴她自己將實施一個截然不同的策略。亞歷山大立即覺得這正是自己想要參與的工作,。她說:“沒有我你做不成這件事,。這是我說過的最厚顏無恥的話?!?/p>

她的膽識得到了回報,。魯尼聘請了39歲的亞歷山大,并為其創(chuàng)建了一個職位——“使命管理經(jīng)理”,,其職責(zé)在于動員BP員工參與“重構(gòu)能源”這一新的使命,。魯尼如今在每次說到變革時都會提到她,不論在2月的“凈零”演講,,還是在我采訪期間均是如此,。亞歷山大堅持認為,她的出現(xiàn)并不是為了給魯尼的形象鍍金,。她在談?wù)揃P的凈零計劃時表示:“我并不幼稚,。我并不認為這個計劃是一件輕而易舉的事情,。”不過,,她還說:“所有人都接受了這個使命,,人們的自豪感真的又回來了?!?/p>

然而,,并非所有的BP員工都對此抱有同樣樂觀的態(tài)度,例如類似于亞歷山大的另一名工程師邁克?柯芬,,他出于環(huán)保顧慮而退出了BP,。34歲的柯芬于2008年從劍橋大學(xué)畢業(yè)之后就以地質(zhì)學(xué)家的身份加入BP。與亞歷山大一樣,,他也在BP的各大勘探項目上工作了10年的時間,,并稱該工作基本上就是其心目中的理想工作:工作十分有趣,而且穩(wěn)健的職業(yè)道路能夠讓他有能力買房,、成家,。他說:“10至12年前,這一點非常有吸引力,?!?/p>

然而,柯芬對原油生產(chǎn)造成的環(huán)境破壞越發(fā)感到不安,。他擔(dān)心BP是否能在這場能源轉(zhuǎn)型中生存下來,,而且就算活了下來,像他這樣專注于尋找重大新發(fā)現(xiàn)的勘探工程師可能會不復(fù)存在,。他說:“我感覺未來不一定需要石油和天然氣,?!?/p>

去年早些時候,,柯芬終于離開了BP,并成為了倫敦非盈利機構(gòu)Carbon Tracker Initiative的油氣分析師,,該機構(gòu)致力于研究石油公司的氣候應(yīng)對舉措對金融市場的影響,。在魯尼于今夏宣布開展大規(guī)模的化石燃料削減之后,柯芬說:“BP如今成為了應(yīng)對氣候變化的行業(yè)領(lǐng)頭羊,?!奔幢闳绱耍廊粚κ凸臼欠裾娴哪軌蛳衿湔f的那樣重構(gòu)自身存在很大的疑問,。他還質(zhì)疑大型石油公司是否會拋棄其長期以來將分紅與化石燃料生產(chǎn)掛鉤的做法,。(BP稱從現(xiàn)在開始,公司將在考慮分紅時增加環(huán)保的權(quán)重,。)

隨著激進投資者變得越來越有組織性,,出于對環(huán)保以及金融風(fēng)險的考慮,,從資產(chǎn)組合中剔除能源股的動作亦是如此。Carbon Tracker Initiative的油氣和開采負責(zé)人安德魯?格蘭特說:“投資者可能對環(huán)境一點都不關(guān)心,。但他們收到了來自于其客戶的壓力,。在眼下,金融法規(guī)真的已經(jīng)與環(huán)保法規(guī)接軌,?!?/p>

在美國和歐洲,數(shù)十只養(yǎng)老基金和多家政府機構(gòu)已經(jīng)開始通過拋售化石燃料股票回籠了數(shù)十億美元的資金,。激進投資機構(gòu)Fossil Free稱,,總資產(chǎn)額超過14萬億美元的各大機構(gòu)投資者如今正專注于撤資。馬薩諸塞州劍橋市研究與倡議機構(gòu)Union of Concerned Scientists問責(zé)運動總監(jiān)凱西?穆爾維說:“投資者越來越了解這些公司,?!彼€表示,環(huán)保主義者擔(dān)心各大公司將通過“商業(yè)手段”而不是真正的碳排放削減來實現(xiàn)凈零目標(biāo),。她說:“要讓這些企業(yè)真正能夠懸崖勒馬,,還有不少工作要做?!?/p>

股東們也在尋求從公司內(nèi)部推動這一變革,。自2016年以來,激進人士為推動氣候決議的通過一直在多家石油巨頭的年度股東大會上集結(jié)股東,,以便達到進行投票表決所需的門檻,。

2016年,由機械工程師轉(zhuǎn)而成為積極人士的荷蘭人馬克?范巴爾成立了股東組織Follow This,,旨在通過股東決議向原油公司施壓,,從而讓它們致力于實施環(huán)保政策。他說:“有人說,,‘哦,,你想改變殼牌?做夢吧,?!彼跉づ?016年年度股東大會上提出的第一份決議十分生猛:“我們告訴殼牌公司應(yīng)摒棄油氣資源勘探業(yè)務(wù)?!边@個決議很難通過,,因為它是這家原油巨頭的唯一業(yè)務(wù)。他說:“不可思議的是,,該決議得到了2.6%的支持,。”

該組織的策略自那之后變得越發(fā)成熟,如今還包括直接與原油高管協(xié)商,。去年11月,,范巴爾從阿姆斯特丹坐上了歐洲之星列車,前往BP倫敦總部與魯尼會面,。魯尼當(dāng)時已經(jīng)被任命為新首席執(zhí)行官,。這兩位舉行了閉門會面,當(dāng)時魯尼向范巴爾透露BP將發(fā)生重大變化,。范巴爾說:“魯尼堅信,,他有必要在執(zhí)掌之后做出重大聲明,而且需要股東的支持,?!狈栋蜖枦Q定,不會在5月召開的魯尼上任后首個股東會議上提出激進的決議,,而是與魯尼合作,,針對明年的會議制定一個聯(lián)合決議,從而讓BP致力于實施凈零策略,。他說:“如果得到合理實施,,它將帶來顛覆性的轉(zhuǎn)變?!?/p>

范巴爾成功地讓殼牌,、道達爾、挪威國家石油公司以及BP對決議進行了投票,。在美國,,美國證券交易委員會阻礙了類似的激進決議,包括??松梨诤脱┓瘕埖哪甓裙蓶|大會,,該機構(gòu)稱投資者曾經(jīng)嘗試干擾公司管理層決策。范巴爾對此十分樂觀,,他堅信石油行業(yè)必須向現(xiàn)實低頭,。他說:“我曾經(jīng)夢想原油巨頭的首席執(zhí)行官能夠頓悟,可以徹夜不眠地思考其孩子的未來,。但這是不可能的,。讓曾經(jīng)的油氣大亨魯尼幡然悔悟的是公司的股東?!?/p>

然而,范巴爾認為BP的“油氣大亨”終于成為了他可以攜手的首席執(zhí)行官,。而且他認為魯尼在8月宣布的計劃對于行業(yè)來說具有里程碑式的意義,。范巴爾說:“這是第一家針對2050年目標(biāo)采取實際行動,而不只是紙上談兵的石油巨頭。削減40%的原油產(chǎn)能真的是很激進的目標(biāo),。如果有一個石油巨頭站了出來,,而且得到了股東的獎勵,那么其他公司就會效仿,?!?/p>

當(dāng)魯尼描述他的早期生活時,令人感到不可思議的是,,他可以成為任何領(lǐng)域的游戲改變者,。他對BP尤為感激。他說:“相對于我的背景而言,,公司給了我一個我以前做夢都沒有想到的機會,。我并非出身與名校,或有著深厚的背景,?!?/p>

這個說法著實十分低調(diào)。魯尼的父母在11歲便離開了學(xué)校,,并在愛爾蘭凱利郡鄉(xiāng)下的一個奶牛場撫養(yǎng)了5個孩子,。他說自己與自己的兄弟在年輕時就學(xué)會了如何通過工作來賺外快。當(dāng)我詢問魯尼其倫敦家中書架上的綠色玩具拖拉機時,,他稱這是在追憶自己的孩提時代,。他說:“家里從來沒有買過什么好機器,但我們一直都想要好東西,。我們通過倒賣舊拖拉機來賺錢,。只要能賺錢的活都干?!?/p>

他最深刻的記憶便是自己與同齡人的不同,。他說:“男孩們擅長玩愛爾蘭曲棍球[傳統(tǒng)的愛爾蘭體育運動,類似于長曲棍球]和橄欖球,,但說實話,,我覺得自己一無是處。我覺得自己的手很笨,,然而在農(nóng)場,,一切活都得用手來完成?!?/p>

魯尼是家里的第一個大學(xué)生,。他在從都柏林大學(xué)畢業(yè)后直接以鉆探工程師的身份加入了BP,而且先后數(shù)年效力于英國北海,、阿拉斯加,、挪威和美國的一些項目,。他最終被前首席執(zhí)行官約翰?布朗尼欽點為“海龜”(名字取自于忍者神龜),也就是有望向高層發(fā)展的高管助理,。為了幫助其打好基礎(chǔ),,布朗尼將他派往斯坦福商學(xué)院學(xué)習(xí)了一年。

即便在現(xiàn)在,,魯尼說自己的童年給他留下了不可磨滅的印記,。他認為,童年讓自己意識到非常有必要招募那些感覺自己與眾不同或受到歧視的人士,。自他擔(dān)任首席執(zhí)行官之后接受的少數(shù)幾次采訪中,,有一次便是接受跨性別維權(quán)人士、制片人杰克?格拉夫的采訪,,魯尼對杰克說,,如果任何BP員工不支持性少數(shù)群體權(quán)益,“那么他就不屬于BP這個大家庭”,。在轟動的“黑人生命亦寶貴”抗議活動中,,他在6月1日致BP全球員工的信中敦促員工大聲揭露其生活中以及BP公司內(nèi)部的種族主義。他說,,自己隨后與員工召開了痛徹心扉的視頻會議,,“員工們有的留下了眼淚,有的失聲痛哭”,。

作為首席執(zhí)行官,,魯尼已經(jīng)將心理健康作為BP的首要慈善事業(yè),公司向英國精神健康機構(gòu)Mind捐獻了大量的資金,。他將其看作公司內(nèi)部的一個關(guān)鍵問題,,并認為疫情讓其出現(xiàn)了“進一步升級”,但這明顯也是私人問題,。他說:“在人際關(guān)系方面,,我自己也面臨著一些挑戰(zhàn)。我也接受過心理咨詢等服務(wù),。我認為每個員工都會受到影響,。”然而,,他并沒有透露這方面的細節(jié),。在封鎖期間,魯尼向BP員工推薦了冥想應(yīng)用程序Headspace,,他稱自己如今每天晚上都會使用,。他說:“它就在我的床邊,其播放的陣陣波濤聲能夠讓我的心境平靜下來,?!?/p>

魯尼并沒有大企業(yè)高管的典型做派,,他似乎對于這種負面形象很在意,。當(dāng)BP的官方網(wǎng)頁便將其稱為“伯納德”,,他創(chuàng)建了一個新Instrgram賬戶,其為數(shù)不多的幾十張照片除了常規(guī)的企業(yè)照之外還包括同性戀驕傲大游行的彩虹,,熱帶雨林,,他通常在這些場合下身穿藍色牛仔,很少扎領(lǐng)帶,,即便在5月召開的股東大會上也沒有扎領(lǐng)帶,。

這位新首席執(zhí)行官敦促員工與外界溝通,有一些員工采納了他的建議,,使用新冠疫情封鎖這個機會與他進行在線溝通,。在一個視頻電話中,英國加油站工作人員向魯尼講述了疫情期間作為必要一線員工拿低薪的難處,。魯尼隨后便為他們漲了工資,。在托萊多BP-Husky煉油廠運營協(xié)調(diào)員何塞?羅德里格茲因一時沖動,使用公司的內(nèi)部社交網(wǎng)Yammer向魯尼發(fā)牢騷,,并邀請他參加員工會議,。羅德里格茲對于能夠得到魯尼的反饋感到震驚。魯尼迅速地確定了一個日期,,而且通過視頻與煉油廠工人聊了20分鐘,。羅德里格茲眉飛色舞地說:“我們感到他真的是很關(guān)心我們?!彼€表示,,魯尼不同于其此前29年BP職業(yè)生涯中所經(jīng)歷的四位首席執(zhí)行官。羅德里格茲說:“一位工廠經(jīng)理的母親剛剛?cè)ナ?。伯納德說,,‘別忘了你的父親,他可能在掩飾自己的悲痛,?!绷_德里格茲和魯尼自此之后便一直保持著聯(lián)系。

我們很容易將其看作BP形象重塑舉措的一部分,,因為在眼下,,公司已經(jīng)承諾對發(fā)展方向進行重大調(diào)整。然而據(jù)我們所知,,它似乎也反映了魯尼真實的管理風(fēng)格和個性,。

即便如此,這位首席執(zhí)行官也很難說服那些記性好的外部懷疑人士,。公司于1997年推出的“超越石油”品牌重構(gòu)計劃便是由Ogilvy Public Relations Worldwide設(shè)計的一個價值2億美元的公關(guān)活動,。當(dāng)時BP向世界宣布,,公司將“思考油桶之外的事情”。為了凸顯這一理念,,時任首席執(zhí)行官布朗尼將公司的名稱從英國石油簡化為BP,。

對于一些人來說,魯尼的“重構(gòu)能源”計劃聽起來沒有多少區(qū)別,。Union of Concerned Scientists的穆爾維說:“我們此前也聽說過類似的計劃,,也就是BP的‘超越石油’計劃。人們當(dāng)時對此抱有很大的希望,,這個計劃聽起來非常有突破性,。”她說,,環(huán)保主義者擔(dān)心會再次失望,。

布朗尼稱,他的舉措在當(dāng)時取得了實質(zhì)性的進展,,意味著公司真正開始擔(dān)心碳排放問題,,也是公司有別于其他石油巨頭的一個地方。他說:“業(yè)界認為此舉對整個行業(yè)構(gòu)成了很大的威脅,,并認為BP已經(jīng)走上了歧路,,但我們并不是在洗綠自己?!?/p>

在該活動推出之際,,BP剛好在美國進行了80億美元的太陽能電板投資,但這場冒險對于BP來說可謂是血本無歸,,因為當(dāng)時中國開始了大規(guī)模的電板制造運動,,而且價格比BP低得多。BP隨后收購了英國太陽能公司Lightsource 50%的股份,,并通過其修建和運營太陽能電廠,,但沒有制造面板。布朗尼稱,,石油公司在上個世紀(jì)90年代便清楚地意識到,,其碳排放對全球氣候造成了嚴(yán)重的破壞。然而,,當(dāng)時人們并沒有多少緊迫感,。布朗尼說:“當(dāng)時的狀況與眼下相距甚遠,我們有大把的時間,?!?/p>

但時間對于魯尼來說是件奢侈品。為了在30年內(nèi)實現(xiàn)凈零排放,,他必須迅速地改變BP,,而且刻不容緩,。布朗尼稱,此外,,與上個世紀(jì)90年代相比,,當(dāng)前的投資者不會容忍任何虛偽行徑。他在談到用植樹或保護現(xiàn)有森林等舉措來平衡碳排放時說:“光把抵消碳印記掛在口頭上是不行的,,得付諸實際行動,?!?/p>

投資者和基金人士終于聽到了魯尼的“實際行動”計劃,。(而且他說,,該計劃并不依賴于碳抵消),。BP策略部門新負責(zé)人奇爾琪婭稱,疫情讓變革需求變得更加緊迫,。她說:“說到其中的教訓(xùn),,疫情告訴我們,,我們所處的這個環(huán)境非常脆弱,。它凸顯了我們多元化的需求,?!彼f自己在今年早些時候辭掉了麥肯錫的工作,,因為魯尼此前說服了自己,稱BP將專注于削減排放,,而且會不折不扣地去做,。她說:“我想,‘哇,,這些人對此是認真的,?!艺J為如果我們獲得成功,其他公司便會效仿,。”

位于紐約的環(huán)境捍衛(wèi)基金的負責(zé)人科拉普曾經(jīng)與魯尼多次會面,,包括在疫情期間的視頻會面,,來探討B(tài)P的凈零計劃。他說BP從今年開始就需要部署一系列解決方案,,這樣才能滿足其2050年目標(biāo)??评战ㄗh魯尼迅速地從化石燃料轉(zhuǎn)變?yōu)榈吞寄茉瓷a(chǎn),減少原油設(shè)施的甲烷等污染物的排放,,并中和任何存在的碳排放,,包括通過保護現(xiàn)有的熱帶雨林。他還說,,所有這一切都應(yīng)該大規(guī)模地開展。他說:“他們實現(xiàn)轉(zhuǎn)變的里程碑必須減少對油氣的投資,。我們敦促伯納德要實現(xiàn)這一轉(zhuǎn)變過程中的里程碑,?!?/p>

一個超越一切的關(guān)鍵問題在于:這家能源巨頭愿意放棄多少油氣資源?BP稱公司將使用其油氣生產(chǎn)來資助低碳能源,。如今,,公司賬面上有193億桶的儲備,。

然而按照凈零策略,數(shù)億桶油氣可能將永遠沉睡地底,,成為財務(wù)領(lǐng)域所謂的擱淺資產(chǎn),。環(huán)保主義者擔(dān)心,隨著全球價格的上漲,,BP可能會因此而擴大鉆井活動,,而各大石油公司和歐佩克富油國在過去數(shù)十年間都是如此。BP稱,公司去年在可再生能源領(lǐng)域的投資不到其152億美元資本支出的3%,。市場情報公司Rystad Energy的能源服務(wù)研究業(yè)務(wù)副總裁馬修?菲茨蒙斯稱,,當(dāng)前整個行業(yè)未來五年在清潔能源方面的開支預(yù)計將達到資本總支出的9%,。這些數(shù)字對環(huán)保主義者來說無異于杯水車薪,。倫敦非政府組織ClientEarth的律師蘇菲?馬佳納克說:“在過去20年中,,整個行業(yè)一直對這個問題視而不見,,但愿它如今能夠得到重視,。”

對于魯尼及其大型石油同行來說,終極挑戰(zhàn)在于既要改變這一態(tài)勢,,又要找到方式來交付股東要求的利潤。有一件事似乎是肯定的:在今后數(shù)年內(nèi),,BP和其他公司可能會繼續(xù)其油氣生產(chǎn),。魯尼在8月公布其計劃時說:“要通過關(guān)閉龍頭來實現(xiàn)一家110歲公司的轉(zhuǎn)型基本上是不可能的,。”位于巴黎的國際能源機構(gòu)稱,,即便油氣公司在太陽能,、電動汽車和風(fēng)力發(fā)電機方面投入重金,,但隨著新興國家財富的增加,全球?qū)κ偷男枨箢A(yù)計至少在未來10年內(nèi)依然會呈現(xiàn)出上揚態(tài)勢,。

當(dāng)我問魯尼,,隨著公司減少化石燃料產(chǎn)能,BP是否必然會面臨利潤率下降的問題,?他說,,相反,他認為BP將從能源轉(zhuǎn)型獲得巨大收益,。各大政府正在投入海量的資金來推動能源轉(zhuǎn)型,,包括歐盟數(shù)萬億美元的疫情恢復(fù)計劃,。這些原油巨頭可以借助數(shù)萬名工程師和國際化的供應(yīng)鏈參與這一進程。魯尼說:“各國將花費數(shù)萬億美元來重建和更換全球的能源系統(tǒng),,繼而會為像BP這樣的專業(yè)公司帶來巨大的機遇,。”

除了提及財務(wù)機遇之外,,魯尼聽起來越來越像一位真正的氣候保護主義者,。他說:“目前各大公司有站隊的趨勢。我對這個不感興趣,。我希望大家去做我認為有益于這個世界的事情,。關(guān)鍵在于找到適合BP的發(fā)展之路,以及適合所有人的發(fā)展之路,,這個沒有什么區(qū)別,。”

10年之后:Deepwater Horizon災(zāi)難讓BP發(fā)生了哪些轉(zhuǎn)變

10年前,,BP油井的爆炸導(dǎo)致了美國史上最嚴(yán)重的原油泄漏事件,。公司依然在為此買單。

2010年4月20日,,Deepwater Horizon井架正在鉆探位于路易斯安那州近海的一個名為“馬貢多”的超深油藏,,油田名字取自于加夫列爾?加西亞?馬爾克斯知名著作《百年孤獨》(One Hundred Years of Solitude)中的地名。隨后,,該項目成為了一個史詩級的災(zāi)難,。

氣體撕裂了油井,在墨西哥灣深達1.5英里的海底發(fā)生爆炸,,11名平臺員工因此而喪生,。它所引發(fā)的火焰束在太空中清晰可見,同時也對海灣的漁業(yè)資源和濕地造成了巨大破壞,。在這場持續(xù)了87天,、美國史上最大的漏油事件中,約320萬桶的原油流入了墨西哥灣,,還有81萬桶油被BP回收。

10年過去了,,特朗普政府已經(jīng)回滾了多項Deepwater Horizon事件之后制定的重要監(jiān)管法規(guī),,包括獨立檢查和安全要求,例如預(yù)防爆裂的備用系統(tǒng),。

這場事故讓BP的可信度在隨后的數(shù)年中一蹶不振,,直到如今才開始有所好轉(zhuǎn)。當(dāng)時幫助監(jiān)管清理舉措的BP高級副總裁,、BP現(xiàn)任首席執(zhí)行官魯尼說:“這是一個令人絕望的困難經(jīng)歷,?!狈ㄔ赫J為BP在安全方面走捷徑,奧巴馬總統(tǒng)譴責(zé)公司“行事粗心大意”,。

BP依然在支付約690億美元和解費用以及當(dāng)?shù)厣鐓^(qū)和海灣沿線各州補助金的剩余部分,,包括去年支付的約24億美元。公司預(yù)計自己在未來13年內(nèi)每年將支付約10億美元的費用,。

盡管出現(xiàn)了這一災(zāi)難,,BP依然在墨西哥灣深水井的鉆探方面投入了大量資金,而且其目標(biāo)是到2020年中期實現(xiàn)該海域每天約40萬桶的產(chǎn)量,,與爆炸前2009年的產(chǎn)量一致,。但魯尼稱,Deepwater Horizon讓公司發(fā)生了永久性的變化,。他說,,安全環(huán)境目前已經(jīng)成為BP運營的首要考慮因素,而且公司也學(xué)會了不能過于依賴某一個單體項目,,這是評論人士在2010年事故之后用來批判BP的一個罪名,。

他說:“我們永遠不會忘記,而且必須始終銘記,。我們在事故之后感到羞愧難當(dāng),,對此,我個人完全有理由認為羞愧感從很多方面來講是件好事,?!比欢瑢τ贐P和海灣沿岸來說,,這是一個異常慘痛的教訓(xùn),。(財富中文網(wǎng))

本文另一版本刊載于《財富》雜志2020年8/9月刊,標(biāo)題為《BP終于準(zhǔn)備“另起爐灶”了嗎,?》

譯者:馮豐

審校:夏林

For months, BP had planned this year’s annual general meeting as a sleek presentation. The company’s brand-new CEO would be onstage at London’s ExCeL convention center, trumpeting his green revolution to hundreds of shareholders. But this being 2020, nothing went as planned. When the day of the meeting finally arrived in late May, there was no audience, and no applause.

Instead, Bernard Looney, head of one of the world’s biggest oil companies, sat in a bare room in BP’s deserted London headquarters, next to a board member and a company official, talking into a camera. By then, the pandemic had killed more than 38,000 people in Britain. And rather than hosting BP’s big event, the ExCeL center had been transformed into a triage hospital for coronavirus patients. Looney, on a brief outing from months of lockdown at home, looked less like the head of an iconic 111-year-old giant than the captain of a troubled spaceship beaming bad news down to Earth. “Today’s challenge is of a different scale than any experienced before,” he told the invisible investors logged on for the meeting. He called it a “brutal environment.”

Just three months earlier, Looney had begun his tenure as CEO with a bang by unveiling a drastic overhaul for BP. He committed to “net-zero” carbon emissions by 2050—a strategy that promises to radically transform the company, and which several of his competitors then rushed to match.

Yet Looney barely had time to elaborate before COVID-19 hit the global economy with seismic force. Planes and cars sat grounded for months, with lockdown orders forcing billions of people indoors, including Looney and his team. From their homes, BP executives watched global oil demand collapse in the steepest drop since the Second World War. With no place left to store millions of barrels of unsold oil, futures prices of crude briefly dropped below $0 in April for the first time in history.

It was “brutal” indeed. BP’s first-quarter earnings showed debt of more than $6 billion and losses of $4.4 billion, compared with almost $3 billion in profits for the same period the year before. In June, the company announced 10,000 layoffs, equal to one in seven employees in its global workforce, and cast the bad news as being part of its net-zero restructuring. That same month it warned of a coming write-down in the value of its assets of up to $17.5 billion. (The actual figure turned out to be $17.4 billion.) And in early August, there was still more grim news: BP reported losses of $16.8 billion for the second quarter and slashed its dividend in half.

It didn’t take a pandemic to cause a crisis in the oil industry, however. Even before the virus began its rampage across the planet, oil companies’ stocks were lagging badly behind others on the major global indexes, as operating costs rose and crude prices remained low. And yet, oil super-majors like BP are hardly on the verge of collapse. Proof of that, if any is needed, is this year’s Global 500 list, in which five of the top 10 are oil and gas companies. BP sits at No. 8, with $283 billion in revenues and $4 billion in profits for 2019.

Yet for all their hundreds of billions of dollars in sales, a sense of unease has steadily grown inside these companies as they assess their prospects in a world increasingly committed to going green. And a combination of factors has ratcheted up the external pressure for change: a fast-worsening climate crisis; an angry and motivated younger generation; and, perhaps most critically, growing numbers of shareholders who are threatening to move their money out of oil and gas stocks unless they see serious change.

In last year’s climate marches, millions of youth railed against oil companies for causing global warming; scientists estimate that about one-third of greenhouse gases in the atmosphere today can be connected to the oil and gas industry. Protesters threw beetroot juice on delegates to the Oil & Money conference in London last October. And on Looney’s first day as CEO in February, Greenpeace activists barricaded BP’s London offices, forcing a temporary shutdown. Wisely, Looney opted to spend the day visiting a BP refinery in Germany.

Ducking beetroot juice and barricades is relatively simple. However, the bigger problems are no longer possible for oil companies to sidestep. To avoid a precipitous collapse in their core business in decades to come, they will need to execute the most dramatic pivot in their long history. At least, that’s the conclusion from many outside the industry. In January, shortly before Looney began as CEO, Larry Fink, founder and CEO of BlackRock, the world’s biggest asset management fund with more than $7 trillion under management, stunned investors by writing in his annual letter that “climate change has become the defining factor in companies’ long-term prospects.” That, he said, would become increasingly true as the new generation grow up to be investors and CEOs themselves. Simply put: Companies can either join the fight for climate, or slowly wither and die.

For the energy giants, that choice is painful indeed. Taken logically, it could well mean leaving in the ground, undrilled and unexplored, billions of barrels of oil and trillions of metric tons of gas. That seems to run contrary to their very DNA. “The oil industry has an existential challenge,” says Fred Krupp, president of the nonprofit Environmental Defense Fund. “Nothing will be easy about it.”

The message has not been lost inside BP. By the time Fink published his BlackRock letter, Looney had reached the same conclusion. On Feb. 12, one week after taking over, he announced his dramatic shift in the company under the clunky title, “Reimagining Energy, Reinventing BP.” The core promise to zero out carbon emissions by 2050 or sooner mirrors what climate scientists believe is needed to avert environmental catastrophe.

Among both oil analysts and environmentalists, the reaction was a mix of hope and eye-rolling. In interviews, several pointed to BP’s last major rebrand in the late 1990s and the accompanying slogan “Beyond Petroleum,” which became symbolic of the industry’s unfulfilled promises to explore clean energy. Now BP is nominally leading the charge again, and Looney insists that this time his company is all in. “The direction is set,” Looney said in February. “We are moving to net zero. There is no turning back.”

If that is the case, Looney’s plan is a staggering shift for BP, whose driving purpose since 1909 has been to pump oil and gas out of the ground and oceans, and to refine and sell it at gas stations around the world. Now, within 30 years tops, it needs to account for all the 415 million metric tons of carbon it adds to the atmosphere every year by offsetting it with non-carbon renewables like wind turbines or solar plants; cutting methane emissions leaking out of oil facilities; capturing carbon and storing it deep underground; protecting forests, and—the hardest of all—simply not producing some of that carbon in the first place.

Looney told investors in early August that BP would cut its oil and gas production by 40% within a decade and stop exploring for fossil fuels in new countries. After more than a century in business, BP, he says, will now become an “integrated energy company.” Seeing that transformation through could prove to be an epic challenge. But BP’s new boss insists there will be no reversal. “I really think this direction is unstoppable,” Looney told Fortune in a long interview. “I really do.”

With hindsight, the rush to switch directions seems like an inevitable development, given the intense investor pressure. The impact of that has been “massive, massive. There is no question,” says Oswald Clint, senior research analyst at Sanford C. Bernstein in London. He believes oil execs have become far more concerned about the climate themselves, rather than being dragged into taking action. “Perhaps the companies have been forced to buckle,” Clint says. “But they are not buckling today. It is full embracement, a cultural change.”

That BP could be in the vanguard of this historic shift will seem unlikely to many. Early on, the company was built by capitalizing on political upheaval in what is now Iran, Iraq, Libya, and elsewhere. And more recently, BP earned notoriety for unsafe operating conditions that went unattended—with disastrous results. Americans probably best remember BP for two major accidents, both found to have been the result of slipshod practices: the explosion at a BP refinery in Texas City, Texas, in 2005, in which 15 workers died; and the Deepwater Horizon explosion in 2010 off the coast of Louisiana, which killed 11 people and wreaked mammoth damage to the Gulf of Mexico. It was the worst oil spill in U.S. history, for which BP is still paying out billions to local communities.

Looney’s ascent as CEO finally gives the company a chance for a very new role. In the weeks following his net-zero decision, BP’s competitors in Europe rushed to do the same, perhaps sensing that if they failed to do so they would be cast as climate villains. Within weeks of Looney’s speech, Royal Dutch Shell, the Italian oil major ENI, and France’s Total all announced goals for net-zero carbon emissions by 2050. The Spanish oil company Repsol and Norway’s Equinor had made similar pronouncements earlier, promising to boost investments in renewables and increase energy efficiency in oil production.

The plan Looney unveiled in August would radically change BP by increasing its investment in low-carbon energy sources 10-fold by 2030, and eventually cutting oil and gas exploration by about 75% from its peak levels. “We know this will not be easy, but we are confident that this is the right thing for all our stakeholders,” he said. The plan would steadily determine all BP’s decisions. “You will see low carbon increasing, and fossil fuels in the long term decreasing,” says Giulia Chierchia, who joined BP in April, as its new executive vice president for strategy and sustainability, to help manage the net-zero transition. “We will make choices, and those choices will be low carbon.”

For Looney, 49, the decision came after much thought. In an hour-long video interview in late June, he said he came to realize that there was no way to square the growing alarm over climate change with his company’s business of pumping out 3.8 million barrels of oil and gas a day. Something had to give. “It became increasingly apparent over the last few years that we were in many ways swimming against the tide,” Looney says, sitting in a black T-shirt in his home office, back from a three-mile run around his London neighborhood. I ask him what would happen if BP and other big oil companies do not zero out their carbon footprint. “Without action,” he says, “it is a rather bleak future for the world.”

Looney says two groups of people had weighed heavily on his mind in thinking of BP’s future: his employees, and the investors. Both groups, it was clear, were deeply perturbed. “The sense that investors were really beginning to push, and question our purpose, started to weigh on the financial performance of our sector,” he says. “And our employees were becoming anxious about what I would describe as their personal purpose being misaligned with our corporate purpose.”

One of those anxious employees was Jo Alexander. A geoscientist with a long mane of red hair, she joined BP after graduating from Oxford University in 2003, then spent a decade working on major oil projects, including in Libya and Australia. It was a life of adventure and travel, she says. But her growing distress over the environment finally made the work feel untenable. She took a buyout from BP in 2015 and joined ShareAction, a nonprofit in London focusing on responsible investment.

At BP’s annual meeting last year, Alexander stood up to speak. She told the executives that many inside BP felt the same frustration that had driven her to leave the company. “I asked them, ‘When is BP going to give them jobs that are meaningful?’?” she says. The execs were taken aback. After the meeting, Looney came to find her and said, “Promise me you’ll come talk to me about this,” she says. She spent months quietly gauging the views of people she knew within BP. Then late last year, she met with Looney at BP headquarters. Looney, who headed BP’s upstream division, was already rumored to be the next CEO, succeeding Bob Dudley. Alexander shared a presentation she had prepared with data about the views of BP’s employees. Then Looney told her that he was about to unveil a drastically different strategy. Alexander knew in an instant she wanted to be involved. “I said, ‘You cannot do that without me,’?” she says. “It was the cheekiest thing I had ever said.”

Her boldness worked. Looney hired Alexander, 39, creating a job for her titled “purpose engagement manager,” with a brief to engage BP staff in the new purpose of “reimagining energy.” Looney now mentions her at every turn, including in his “net-zero” speech in February and in his interview with me. Alexander insists she is not there just to make Looney look good. “I am not naive. I do not think it is a slam dunk,” she says of BP’s net-zero plan. Still, she says, “everyone is on board with our purpose. A sense of pride has really returned.”

That optimism has not been shared equally by all BP alumni. Consider Mike Coffin, another engineer who, like Alexander, quit BP over environmental concerns. Coffin, 34, joined BP in 2008 as a geologist, right out of Cambridge University. Like Alexander, he spent a decade working on BP’s exploration projects and says the job offered him much of what he wanted: interesting work, and a solid career path that would enable him to buy a house and start a family. “Ten, 12 years ago, it was a very attractive proposition,” he says.

But Coffin grew increasingly uneasy about the environmental damage from oil production. He worried whether BP could even survive the energy transition, and that, even if it did, exploration engineers like him, hunting for big new finds, could become extinct. “I felt there was not necessarily a future in oil and gas,” he says.

Early last year, Coffin finally left BP and became an oil and gas analyst for Carbon Tracker Initiative, a nonprofit organization in London that researches oil companies’ climate impact on financial markets. With the stunning fossil-fuel cuts Looney announced over the summer, Coffin says, “BP is now the industry leader in responding to climate change.” Even so, he still harbors strong doubts about whether oil companies can truly reinvent themselves as dramatically as they claim. He also questions whether Big Oil will abandon its long practice of pegging bonuses to fossil-fuel production. (BP says from now on, it will increase the environmental weighting in bonus considerations.)

As activist investors have grown more organized, so has the movement to dump energy stocks from portfolios—both from environmental concern and for reasons of financial risk. “Investors maybe do not care about climate at all,” says Andrew Grant, head of oil, gas, and mining for Carbon Tracker Initiative. “But they are getting pressure from their clients,” he says. “At this point, the financial imperative has really lined up with the environmental imperative.”

In the U.S. and Europe, dozens of pension funds and governments have begun pulling billions of dollars’ worth of stocks from fossil-fuel companies. According to the activist organization Fossil Free, institutions with a total of more than $14 trillion in assets have now committed to divestment. “Investors have gotten more and more savvy about these companies,” says Kathy Mulvey, accountability campaign director at the Union of Concerned Scientists, a research and advocacy organization in Cambridge, Mass. She adds that environmentalists fear that companies will use “corporate gymnastics,” rather than real carbon emission cuts, to reach net-zero targets. “There is quite a bit of work to be done to hold their feet to the fire,” she says.

Shareholders have also sought to drive change from within the companies. Since 2016, activists have pushed climate resolutions at the annual meetings of several big oil companies by grouping shareholders together, in order to meet the required threshold for a vote.

In 2016, Mark van Baal, a Dutch mechanical engineer turned activist, founded the shareholder group Follow This, specifically to put pressure on oil companies to commit to environmental policies via shareholder resolutions. “People said, ‘Oh, you want to change Shell? Dream on,’?” he says. His first resolution, at Shell’s 2016 annual shareholder meeting, was blunt: “We told the company they should not explore oil and gas.” That was a tough sell, considering that the oil giant’s sole purpose was to do just that. “It’s a miracle the resolution got 2.6% support,” he says.

The group’s strategy has since grown more sophisticated and now includes directly negotiating with oil executives. Last November, van Baal hopped the Eurostar train from Amsterdam to meet Looney at BP’s London headquarters. Looney had by then been named as the next CEO. The two holed up in a closed room, where Looney revealed to van Baal that big changes were coming. “He was quite convinced he would need to make a big announcement when he took the helm, and that he would need shareholder support,” van Baal says. Van Baal agreed not to push an activist resolution at Looney’s first shareholder meeting in late May and to rather work with Looney on a joint resolution for next year’s meeting, committing BP to net-zero strategies. “If implemented properly, it would be a radical shift,” he says.

Van Baal has succeeded in getting resolutions to a vote in Shell, Total, Equinor, and BP; in the U.S., the Securities and Exchange Commission has blocked similar activist resolutions, including at the annual shareholder meetings of Exxon Mobil and Chevron, claiming that investors were trying to interfere with the companies’ management decisions. Van Baal is sanguine, confident that the oil industry must bow to reality. “I used to dream about a big oil CEO having an epiphany, a sleepless night about his children’s future,” he says. “That is not going to happen. Looney was woken up by his shareholders. He’s an oil and gas guy.”

Yet van Baal believes BP’s “oil and gas guy” is finally a CEO he can work with. And he believes that the plan Looney outlined in August could be a landmark moment for the industry. “This is the first oil major to walk the walk instead of just talking about 2050. Cutting oil production by 40%, that’s really immense,” says van Baal. “If one oil major breaks ranks and shareholders reward them for it, others will follow.”

****

When Looney describes his early life, it seems extraordinary that he could emerge as a game changer of any kind. He feels hugely grateful to BP. “It has given me an opportunity I never could have dreamed of, coming from where I came from,” he says. “I didn’t come from the right school or the right background.”

That is an understatement. Looney’s parents left school at age 11 and raised their five children on a dairy farm with 14 cows in rural County Kerry, Ireland. Money was tight. He says he and his brothers learned at a young age how to work for extra cash. When I ask Looney about the green toy tractor sitting on his bookshelf at home in London, he says it is a nod to his childhood. “We never had good machinery, and we always wanted good stuff,” he says. “We made money buying old tractors and selling them. Anything to make a few pounds.”

His strongest memory was of being different from his peers. “Boys were good at hurling [a traditional Irish sport somewhat similar to lacrosse] and rugby, and to be honest with you, I was pretty useless,” he says. “I was not good with my hands, on a farm where everything is about your hands.”

Looney was the first in his family to go to college. He joined BP as a drilling engineer immediately after graduating from University College, Dublin, and spent years working on projects in Britain’s North Sea, Alaska, Norway, and the U.S. He was eventually handpicked by former CEO Lord John Browne as a “turtle”—an executive assistant (named for the Ninja Turtles) on a likely track to the top. In preparation, Browne sent him for a year to Stanford Graduate School of Business.

Even now, Looney says his childhood has indelibly marked him. He believes it left him with a heightened need to include people who feel different or disrespected. One of the few interviews since his appointment to CEO was with transsexual activist and filmmaker Jake Graf, telling him that if any BP employees do not support LGBTQ+ rights, “they don’t belong in our company.” Amid the explosive Black Lives Matter protests, he wrote to BP’s worldwide staff on June 1, urging them to “call out” racism in their lives as well as inside BP. Wrenching video meetings with staff followed, with “people in tears, people crying,” he says.

As CEO, Looney has made mental health BP’s main charitable cause, with the company donating heavily to Mind, a British mental-health organization. He sees it as a critical issue within corporations and thinks it has been “turbocharged” by the pandemic. But it is clear that the issue is also personal. “I have had my own relationship challenges. I have had counseling and all of those things,” he says, without offering details. “I believe it affects each and every one of us.” Under lockdown, Looney offered BP employees access to Headspace, a meditation app, which he says he now uses every night. “It’s next to my bed,” he says. “I put on waves rolling in. It is calming.”

Looney does not sound much like the typical head of a giant corporation, and he seems to recoil from being depicted as one. “Bernard,” as he is called on BP’s official website, has a new Instagram account whose few dozen posts include Pride rainbows and rain forests amid the regular corporate photos, where he is typically dressed in blue jeans, and rarely in a tie, not even at the shareholder meeting in May.

The new CEO has urged workers to reach out, and some have taken him up on the offer, using the coronavirus lockdown as a chance to catch time with him online. On one video call, gas-station attendants in Britain spoke to Looney about their difficulties in working low-paying jobs through the pandemic as essential frontline workers; Looney afterward raised their wages. In Toledo, Jose Rodriguez, operations coordinator for the BP-Husky oil refinery, pinged Looney on a whim, using the company’s internal social network Yammer, and invited him to join one of their staff meetings. Rodriguez was stunned to hear back. Looney quickly set a date and chatted by video to the refinery workers for 20 minutes. “It made us feel like he actually cared about us,” Rodriguez says with amazement, adding that Looney was unlike the four former BP CEOs during his 29 years at the company. “One plant manager’s mom had just died,” Rodriguez says. “Bernard said, ‘Don’t forget about your dad. He might be hiding his feelings.’?” Rodriguez and Looney have since kept in touch.

It is tempting to dismiss this all as part of BP’s image-making, at a moment when the company is promising a drastic shift in direction. But by all accounts it appears to reflect Looney’s actual management style and personality.

Even so, the CEO will have trouble winning over doubters on the outside with long memories. The company’s “Beyond Petroleum” rebrand, launched in 1997, was a $200 million PR campaign designed by Ogilvy Public Relations Worldwide. The company, the world was told, would “think outside the barrel.” For emphasis, then-CEO Browne changed the company’s name from British Petroleum to BP.

To some, Looney’s “Reimagining Energy” does not sound all that different. “We’ve heard this before from BP with ‘Beyond Petroleum,’?” says Mulvey, from the Union of Concerned Scientists. “People were pretty hopeful at that time. It felt like it was a breakthrough.” Environmentalists fear being let down again, she says.

Browne says his efforts represented serious progress at the time, signaling the company’s real worries about carbon emissions, in a break from other oil majors. “The industry felt very threatened by it, telling us we were leaving the church,” he says. “We had no intention of greenwashing.”

The campaign coincided with BP’s $8 billion investment in solar panels in the U.S., an expenditure that cost it dearly when China began mass-producing panels at a fraction of the price; BP later took a 50% share in Lightsource, a solar company in Britain, with which it builds and operates solar plants, without manufacturing the panels. Browne says oil companies were well aware, as far back as the 1990s, that their carbon emissions were wreaking severe damage on the world’s climate. Yet there was still little sense of urgency. “We were nowhere near the position we are in today,” Browne says. “We had plenty of time.”

Looney has no such luxury. To reach net-zero in 30 years, he must race to change BP, starting now. What is more, far more than in the 1990s, investors will reject any hint of hypocrisy, Browne says. “You cannot just say you are offsetting,” he says, referring to the practice of balancing carbon emissions with, for example, planting trees or protecting existing forests. “You have to do something real.”

****

Investors and activists are finally hearing Looney’s plan for “something real.” (And, he says, it doesn’t depend on carbon offsets.) Chierchia, BP’s new head of strategy, says that the pandemic has made the need for change feel more immediate. “If anything, it’s showed us the exposure we have to an environment that is very volatile,” she says. “It reinforced our need to diversify.” She says she quit her previous position at McKinsey & Co. earlier this year, after Looney convinced her BP was fully committed to cutting emissions and would not make compromises. “I thought, ‘Wow these guys are actually serious about it,’?” she says. “I thought if we could be successful, others would follow.”

Krupp, head of the Environmental Defense Fund in New York, has met several times with Looney to discuss BP’s net-zero plans, including by video during the pandemic. He says BP will need to deploy myriad solutions, starting this year, in order to meet its 2050 target. Krupp has advised Looney to rapidly shift from fossil fuels to low-carbon energy production; reduce pollutants like methane around oil facilities; and neutralize whatever carbon emissions remain, including by protecting existing tropical forests. All of those, he says, should be done on a massive scale. “They have to shift away from investing in more oil and gas,” he says. “We have challenged Bernard to find the milestones in that shift.”

One crucial question towers over all: Just how much oil and gas will the energy giants be willing not to drill? BP says it will use its oil and gas production to fund investment in low-carbon energy. Right now it has 19.3 billion barrels in reserves on its books.

But in a net-zero strategy, millions of barrels will likely need to remain in the ground forever, becoming so-called stranded assets, in finance-speak. Environmentalists fear that BP might be tempted to increase drilling as world prices rise—just as oil companies and OPEC’s oil-rich countries have done for decades. BP invested less than 3% on renewables last year out of its $15.2 billion capital expenditure, according to the company. The industry overall is currently projected to devote about 9% of its spending on clean energy over the next five years, says Matthew Fitzsimmons, vice president of energy service research at the market intelligence firm Rystad Energy. Those figures are hardly reassuring to environmentalists. “The industry has been kicking the can down the road for the past 20 years,” says Sophie Marjanac, a lawyer for ClientEarth, a London NGO. “Hopefully, the game is up now.”

Changing that dynamic while still finding a way to deliver the profits that shareholders demand is the ultimate challenge for Looney and his Big Oil peers. One thing seems almost certain: BP and others are likely to continue their oil and gas production for many years. “It is simply not possible to transform a company of 110 years old by shutting off the taps,” Looney said when unveiling his plans in August. And even if they invest heavily in solar power, electric vehicles, and wind turbines, oil demand is projected to continue rising for at least a decade, as wealth rises in emerging countries, according to the International Energy Agency in Paris.

When I ask Looney if BP might inevitably become less profitable as the company moves away from fossil-fuel production, he says that on the contrary, he believes BP will gain hugely from the energy transition. Governments are rolling out gargantuan investments to facilitate the energy shift, including the European Union’s trillion-dollar pandemic recovery plan. With thousands of engineers and a global supply chain, the oil majors could position themselves to be part of that rollout. “Trillions of dollars will be spent rewiring and replumbing the world’s energy system,” Looney says. “That presents an enormous opportunity for a company of our skills.”

Besides just identifying a financial opportunity, Looney is also increasingly sounding like a true climate believer. “There’s a tendency to take position. I am not into positions,” he says. “I want us to do what I think is right for the world.” The trick will be making what’s right for BP, and right for all of us, one and the same.

****

10 years after: How the Deepwater Horizon debacle changed BP

A decade ago, the explosion at a BP well caused the biggest oil spill in U.S. history. The company is still paying the price.

On April 20, 2010, the Deepwater Horizon rig was drilling into an ultra-deep oil prospect off the coast of Louisiana named Macondo, after the setting for Gabriel García Márquez’s epic novel One Hundred Years of Solitude. And then it turned into an epic disaster.

Gas ripped through the well and blew up 1.5 miles undersea in the Gulf of Mexico, killing 11 platform workers. It sent up a plume of fire visible from space and wreaked mammoth damage on the Gulf’s fishing stocks and wetlands. About 3.2 million barrels of oil poured into the Gulf over 87 days, and another 810,000 barrels were soaked up by BP, in the biggest oil spill in U.S. history.

Ten years on, the Trump administration has rolled back several key oversight regulations that were introduced after Deepwater Horizon, including independent inspections and safety requirements such as backup systems to prevent blowouts.

The incident cast a shadow for years over BP’s trustworthiness, which it is only now beginning to shake off. “It was a desperately difficult experience,” says current CEO Looney, back then a senior BP executive who helped oversee the cleanup effort. In court, BP was found to have cut corners on safety, and President Barack Obama accused the company of “recklessness.”

BP is still paying the remainder of the $69 billion or so in settlements and grants to local communities and states along the Gulf, including about $2.4 billion paid last year. The company predicts it will pay about $1 billion a year for the next 13 years.

Despite the disaster, BP still invests heavily in deepwater drilling in the Gulf of Mexico, and aims to pump about 400,000 barrels a day from its waters by the mid-2020s—about the same amount it produced in 2009, before the explosion. But Looney says Deepwater Horizon forever changed the company. He says safety conditions are now the primary consideration in BP’s operations, and that the company has learned not to get too attached to one particular project—a charge that critics leveled against BP after the 2010 accident.

“We will never forget, and we must never forget,” he says. “We walked away with a lot of humility, which I personally believe is good for all seasons.” For BP and for the Gulf Coast, it was a very costly lesson.

A version of this article appears in the August/September 2020 issue of Fortune with the headline “Is BP finally ready to ‘think outside the barrel’?”