在13世紀(jì),元朝皇帝忽必烈憑借一紙?jiān)t書(shū)顛覆了當(dāng)時(shí)的貨幣系統(tǒng):要么接受我的紙幣,,要么就死,。

當(dāng)然,處決的威脅在當(dāng)時(shí)并不是什么新鮮事,。忽必烈真正的創(chuàng)新之處在于,,他對(duì)貨幣本身進(jìn)行了改造,。這位令人聞風(fēng)喪膽的成吉思汗之孫意識(shí)到,他能夠不受貴金屬供應(yīng)的限制,,為自己的國(guó)家制造貨幣,其地緣政治影響力也將不再依賴于在絲綢之路沿線勞神費(fèi)力開(kāi)采和冶煉的礦石,。相反,,他能夠開(kāi)發(fā)無(wú)限量的輕質(zhì)原料,利用樹(shù)木來(lái)制造貨幣,。

準(zhǔn)確地說(shuō),,是桑樹(shù)。在一份當(dāng)代記述資料中,,周游列國(guó)的威尼斯商人馬可·波羅對(duì)“偉大的忽必烈用樹(shù)皮做成類似紙的國(guó)家流通貨幣”表示無(wú)比驚嘆,。他寫(xiě)道,鈔票的發(fā)行,,帶著“如同純金或純銀般的莊嚴(yán)和權(quán)威感”,。

馬可·波羅的報(bào)告讓中世紀(jì)的歐洲人看得瞠目結(jié)舌,但這位皇帝確實(shí)走在他所處時(shí)代的前列,。如今,,靠政府法令而非硬資產(chǎn)支持的法定貨幣已經(jīng)成為了各地的標(biāo)準(zhǔn)貨幣,其前身就是忽必烈發(fā)行的交鈔,。

時(shí)間快進(jìn)至本世紀(jì),,中國(guó)正在又一次重鑄貨幣。但這一次,,被拋棄卻是紙幣,,因?yàn)橹袊?guó)正在走向數(shù)字化。雖然蒙古人的結(jié)局并不好——印鈔形成了惡性通脹,,讓他們失去了王位——但中國(guó)現(xiàn)任領(lǐng)導(dǎo)人制訂了更加穩(wěn)健,、長(zhǎng)遠(yuǎn)的規(guī)劃。

在開(kāi)發(fā)國(guó)家數(shù)字貨幣方面,,中國(guó)比任何大國(guó)都走得更遠(yuǎn)——這種單純的數(shù)字人民幣基于區(qū)塊鏈技術(shù)開(kāi)發(fā),,而區(qū)塊鏈?zhǔn)潜忍貛诺燃用茇泿诺挠涗洈?shù)據(jù)庫(kù)。去年10月,,習(xí)總書(shū)記在一次講話中展現(xiàn)了對(duì)區(qū)塊鏈的大力支持,,也成為第一位支持這項(xiàng)技術(shù)的世界主要領(lǐng)導(dǎo)人。他表示要“抓住機(jī)遇”,,希望中國(guó)在該領(lǐng)域“占據(jù)領(lǐng)先地位”,。

這種未來(lái)貨幣的全稱有點(diǎn)冗長(zhǎng),被稱為“數(shù)字貨幣/電子支付”(DC/EP,,以下簡(jiǎn)稱數(shù)字貨幣),,但這是朝數(shù)字方向邁出的激動(dòng)人心的一步,。中國(guó)政府旨在讓目前處于內(nèi)測(cè)階段的貨幣做好準(zhǔn)備,到2022年2月北京舉辦冬奧會(huì)時(shí)實(shí)現(xiàn)更廣泛的應(yīng)用——讓中國(guó)能夠在全球舞臺(tái)彰顯金融科技實(shí)力,。

比特幣或?qū)⒅鼗馗呶?!?shù)字人民幣的研發(fā)受到比特幣的啟發(fā)。近日,,這種具高波動(dòng)性的加密貨幣價(jià)格飆升,。投資者應(yīng)該感謝全球經(jīng)濟(jì)中彌漫的恐慌氣氛——還有允許美國(guó)銀行為消費(fèi)者持有比特幣的監(jiān)管規(guī)定。來(lái)源:彭博社,;截至美東時(shí)間8月3日下午4時(shí)

中國(guó)官員曾經(jīng)在公開(kāi)場(chǎng)合贊揚(yáng)數(shù)字貨幣的諸多優(yōu)點(diǎn):運(yùn)營(yíng)和交易成本更低,、金融包容性更強(qiáng);同時(shí)對(duì)國(guó)家來(lái)說(shuō),,可以增強(qiáng)打擊犯罪的能力和擴(kuò)大海外影響力,。這項(xiàng)創(chuàng)新能加強(qiáng)對(duì)中國(guó)貨幣體系的管控。

有觀察人士甚至認(rèn)為,,數(shù)字人民幣或?qū)㈩A(yù)示著美元作為國(guó)際貿(mào)易通用貨幣的終結(jié),。對(duì)于那些認(rèn)為中國(guó)的數(shù)字桑樹(shù)將結(jié)碩果的西方人來(lái)說(shuō),這個(gè)可能性令人震驚——因?yàn)檫@將削弱美國(guó)維護(hù)經(jīng)濟(jì)和政治利益的能力,。

國(guó)際清算銀行在最近一項(xiàng)研究中調(diào)查了66家中央銀行,,其中80%的銀行稱已經(jīng)開(kāi)始研究數(shù)字貨幣的可行性,但只有10%付諸實(shí)際行動(dòng),;美聯(lián)儲(chǔ)不在其中,。

其結(jié)果就是:中國(guó)正在一場(chǎng)幾乎無(wú)人意識(shí)已經(jīng)開(kāi)賽的競(jìng)賽中向前沖刺。

隨意觀察下蘇州火車(chē)站——這是一個(gè)位于上海西北方向的運(yùn)河水系城市——可能并不會(huì)覺(jué)得有何異樣之處,。車(chē)廂里滿是佩戴口罩的乘客,,人們?cè)谌胝究谂抨?duì)向保安人員出示智能手機(jī)上的綠碼,以此表明未感染新冠肺炎,。

但有些乘客的手機(jī)里還有另一項(xiàng)功能:持有官方批準(zhǔn)的數(shù)字貨幣,。中國(guó)已經(jīng)從5月起開(kāi)始落地測(cè)試數(shù)字人民幣,蘇州市公務(wù)員收到了以數(shù)字貨幣形式發(fā)放的50%交通補(bǔ)貼,,深圳,、成都和北京附近的雄安新區(qū)也在進(jìn)行類似的與本地商戶有關(guān)的測(cè)試工作。

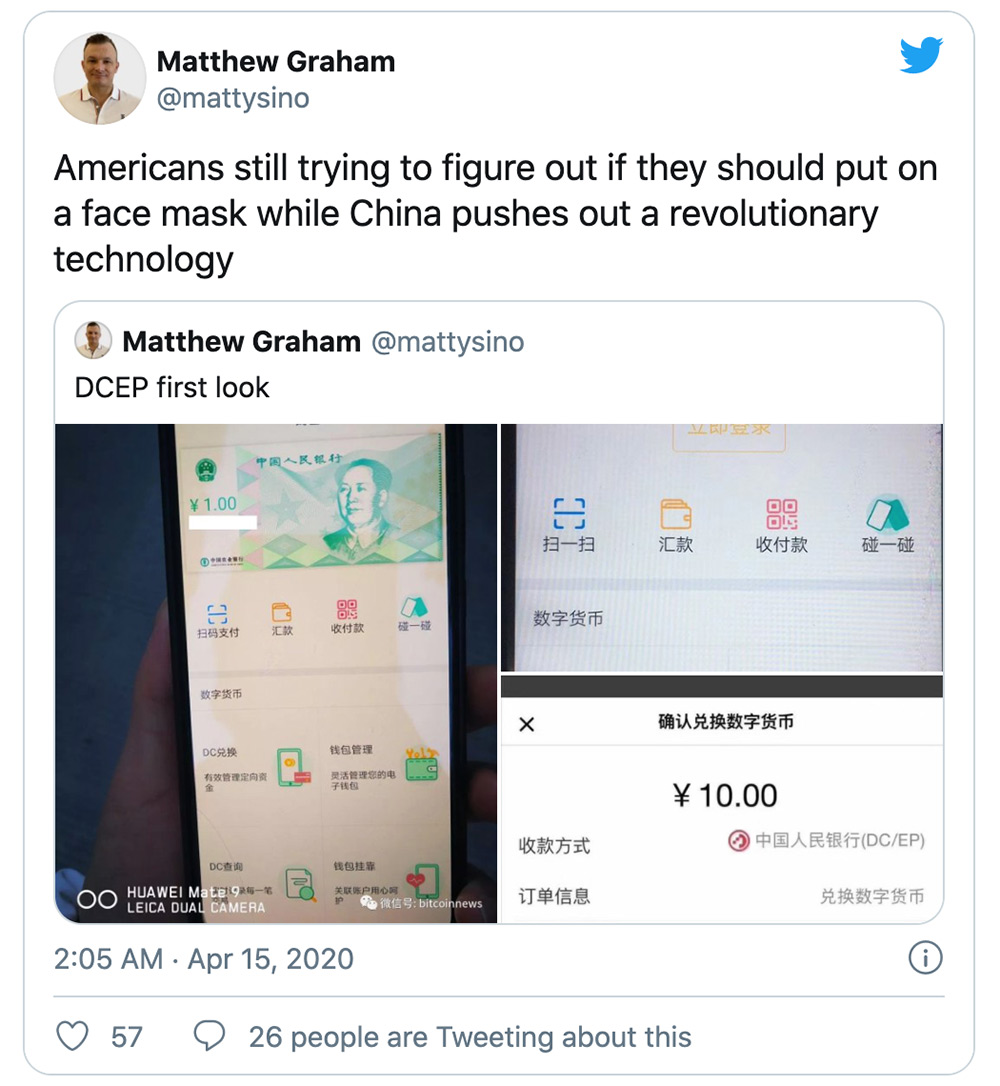

這些交易數(shù)額很小,,卻傳遞了一個(gè)重大的信息:當(dāng)大多數(shù)國(guó)家還在因?yàn)樾鹿谝咔槎中臅r(shí),,一場(chǎng)技術(shù)變革已經(jīng)悄然在中國(guó)上演了。漢全咨詢投資公司的首席執(zhí)行官馬修·格雷厄姆發(fā)在推特上的“測(cè)試版”數(shù)字錢(qián)包圖片也表達(dá)了這一重要訊息,。他評(píng)論道:“美國(guó)人仍然在試圖搞清楚是否應(yīng)該戴口罩,,中國(guó)卻已經(jīng)在推動(dòng)一項(xiàng)革命性技術(shù)了,。”

自宣布試點(diǎn)計(jì)劃以來(lái),,中國(guó)對(duì)此幾乎未發(fā)表任何言論,。中國(guó)的大型公司似乎也避談數(shù)字貨幣。不過(guò),,各大公司正在饒有興趣地關(guān)注著形勢(shì)發(fā)展。據(jù)報(bào)道,,網(wǎng)約車(chē)服務(wù)公司滴滴出行,、外賣(mài)平臺(tái)美團(tuán)大眾點(diǎn)評(píng)等國(guó)內(nèi)龍頭企業(yè),還有麥當(dāng)勞,、賽百味等外資企業(yè),,都在為測(cè)試工作做準(zhǔn)備。(滴滴已經(jīng)確認(rèn)參與該計(jì)劃,;美團(tuán)拒絕置評(píng),;麥當(dāng)勞和賽百味未回復(fù)置評(píng)請(qǐng)求。)

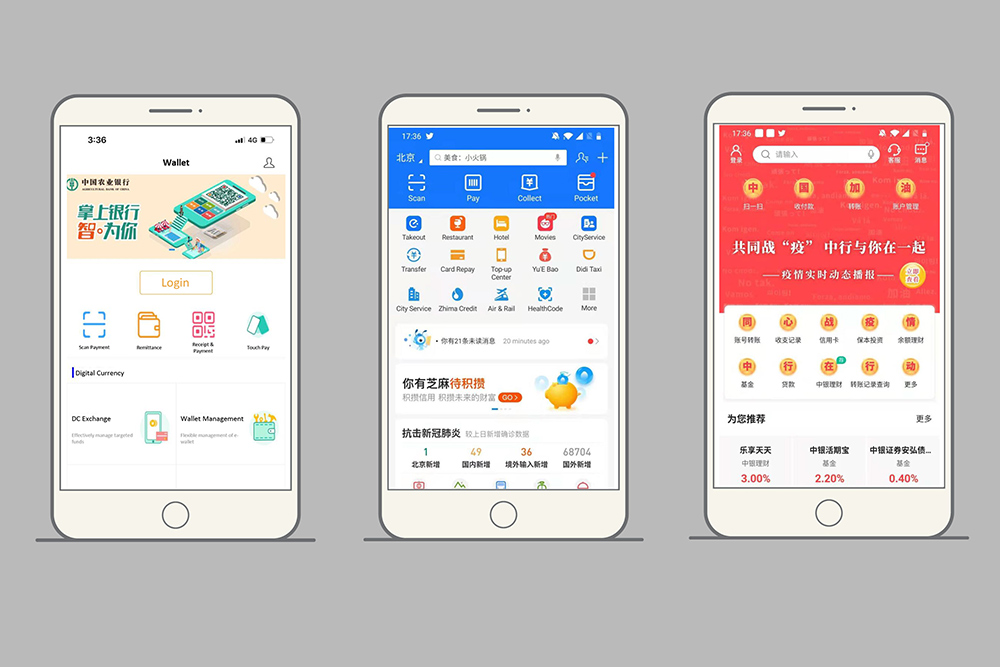

超過(guò)80%的中國(guó)人都在使用支付寶,、微信支付等智能手機(jī)應(yīng)用程序進(jìn)行付款,。表面來(lái)看,數(shù)字貨幣應(yīng)用程序和那些隨處可見(jiàn)的電子錢(qián)包似乎并無(wú)二致,。但從技術(shù)角度講,,兩種數(shù)字貨幣之間存在著巨大的區(qū)別。其中有一大關(guān)鍵性創(chuàng)新,,即數(shù)字貨幣在任何地方都能使用,,甚至各方處于“離線”狀態(tài)時(shí)也是如此。但兩者最大的分別在于,,擁有借貸記錄的所有方不同,。有別于私營(yíng)企業(yè),數(shù)字人民幣與央行中國(guó)人民銀行所維護(hù)的中央分類賬有內(nèi)在聯(lián)系,。

其影響是多方面的,。中國(guó)的這一策略有助于將2.25億“無(wú)銀行賬戶”人士納入經(jīng)濟(jì)領(lǐng)域;只需一部智能手機(jī)就能實(shí)現(xiàn),,甚至不需要傳統(tǒng)的銀行賬戶,。數(shù)字人民幣錢(qián)包可以被用來(lái)發(fā)放刺激款項(xiàng)、補(bǔ)貼和退稅,。但最根本的是,,數(shù)字貨幣將讓政府對(duì)中國(guó)經(jīng)濟(jì)有無(wú)可比擬的監(jiān)督和調(diào)控權(quán),。就像忽必烈時(shí)代的古老交鈔一樣,國(guó)家可能是最大受益方,。

幾年前,,風(fēng)投公司Race Capital的中國(guó)投資者楊珮珊在中國(guó)國(guó)家電視臺(tái)看到一段關(guān)于區(qū)塊鏈技術(shù)的影片,當(dāng)時(shí)她覺(jué)得似乎缺了點(diǎn)什么,。她回憶道,,“影片試圖用通俗易懂的語(yǔ)言向大眾講解什么是區(qū)塊鏈”,但是,,“‘去中心化’一詞卻未被提及”,。這個(gè)說(shuō)法是加密貨幣推行者的慣用語(yǔ),。楊珮珊當(dāng)時(shí)感覺(jué),,那可能不是真的區(qū)塊鏈。

2014年,,當(dāng)中國(guó)人民銀行首次開(kāi)始考慮數(shù)字貨幣時(shí),,比特幣才剛剛進(jìn)入主流意識(shí),。自由主義者喜愛(ài)這項(xiàng)技術(shù),是因?yàn)榭稍诒O(jiān)管之外完成價(jià)值創(chuàng)造和轉(zhuǎn)移,,但許多銀行和國(guó)家也看到了區(qū)塊鏈的分布式分類賬技術(shù)中吸引人的潛力:以難以置信的精準(zhǔn)度追蹤金融活動(dòng),。

中國(guó)擔(dān)心資本外流可能會(huì)讓人民幣走弱,因此從2013年起就先發(fā)制人,,禁止銀行處理加密貨幣,。但對(duì)于數(shù)字貨幣項(xiàng)目,領(lǐng)導(dǎo)層對(duì)區(qū)塊鏈技術(shù)進(jìn)行了研究和甄別——保留了該技術(shù)原本的透明性,,但去掉了潛在風(fēng)險(xiǎn),。

與此同時(shí),在快速崛起的中產(chǎn)階級(jí)引領(lǐng)下,,中國(guó)的金融科技行業(yè)正在騰飛,。中國(guó)的移動(dòng)支付應(yīng)用交易量從2013年微不足道的金額,躍升至2019年的350萬(wàn)億元人民幣(約合50萬(wàn)億美元),。如今,,螞蟻集團(tuán)的支付寶、騰訊的微信支付分別占據(jù)了55%和39%的市場(chǎng)份額,。手機(jī)已經(jīng)取代了實(shí)體現(xiàn)金,;中國(guó)家庭金融資產(chǎn)中的現(xiàn)金使用量占4%(美國(guó)為24%),是世界上比例最低的國(guó)家之一,,金融科技應(yīng)用程序的持有比例也越來(lái)越高,。

中國(guó)人民銀行認(rèn)為,國(guó)有銀行的存款外流數(shù)量龐大且速度驚人,,正在演變成缺乏監(jiān)管的雙頭壟斷問(wèn)題,。中國(guó)人民銀行行長(zhǎng)易綱在去年一次會(huì)議上認(rèn)為:“那些大型高科技公司帶來(lái)了很多挑戰(zhàn)和金融風(fēng)險(xiǎn),。在這個(gè)游戲中,贏家通吃,?!币虼耍畯?017年起要求支付寶和微信將客戶備付金存入央行的不計(jì)息賬戶,。中國(guó)人民銀行還設(shè)立了一個(gè)網(wǎng)絡(luò)支付清算平臺(tái),,掌握大公司的資金流向。

通過(guò)數(shù)字貨幣,,中國(guó)將獲得更大的能見(jiàn)度,,對(duì)系統(tǒng)中的流動(dòng)資金進(jìn)行監(jiān)管。數(shù)字交易將不必經(jīng)過(guò)清算平臺(tái),,在后端分類賬中就能全部看到,。新加坡跨國(guó)銀行星展銀行高級(jí)經(jīng)濟(jì)學(xué)家內(nèi)森·周解釋說(shuō),中國(guó)可能會(huì)更密切地關(guān)注投資風(fēng)險(xiǎn),,或?qū)⒂兄诒苊庥绊懼袊?guó)經(jīng)濟(jì)的周期性債務(wù)危機(jī)。比如,,如果當(dāng)局認(rèn)為無(wú)法挽救某個(gè)如“鬼城”般的大型住房項(xiàng)目,,國(guó)家財(cái)政的工程師就能通過(guò)調(diào)整數(shù)字人民幣代碼,限制投資者向該項(xiàng)目投入更多資金,。內(nèi)森·周說(shuō),,數(shù)字人民幣不是事后解決問(wèn)題,而是讓中國(guó)“提前掌控一切,,預(yù)先部署”,。

不過(guò),也有人質(zhì)疑和擔(dān)心產(chǎn)生更隱蔽的問(wèn)題,。中國(guó)人民銀行數(shù)字貨幣研究所所長(zhǎng)穆長(zhǎng)春承諾,,數(shù)字貨幣將提供“可控制的匿名性”。數(shù)字貨幣讓國(guó)家更有可能掌握金融活動(dòng)的一舉一動(dòng),。通過(guò)數(shù)字人民幣,,中國(guó)可以監(jiān)控犯罪嫌疑人和恐怖分子的交易。

但對(duì)于隱私的擔(dān)憂,,可能并不會(huì)阻止全球競(jìng)逐數(shù)字貨幣,。

Facebook在2019年宣布Libra數(shù)字貨幣計(jì)劃。Libra在初期受挫后縮減了項(xiàng)目規(guī)模,,中國(guó)人民銀行卻加快了步伐,。中國(guó)不僅僅只獲得技術(shù)優(yōu)勢(shì),數(shù)字人民幣還表明這是一個(gè)挑戰(zhàn)美元的全球儲(chǔ)備貨幣地位的最佳機(jī)會(huì),。,。

第二次世界大戰(zhàn)以來(lái),,美元的全球儲(chǔ)備貨幣地位讓美國(guó)獲利頗豐。出口商向美國(guó)出售的商品更便宜,,放款人要求更低的利率,,因?yàn)樗麄冑嵢〉氖侨虮V地泿拧C绹?guó)面臨更小的匯率波動(dòng)風(fēng)險(xiǎn),,同時(shí)還可對(duì)較小經(jīng)濟(jì)體的貨幣政策施加更大的影響力,。

所有貨幣體系都會(huì)受到網(wǎng)絡(luò)的影響——使用人數(shù)越多,獲得的價(jià)值更大,。在今天,,人民幣僅占全球外匯儲(chǔ)備的2%,而美元占60%以上(歐元占20%),。但如果數(shù)字貨幣在某天達(dá)到臨界規(guī)模,,這很可能要?dú)w功于中國(guó)的“一帶一路”全球貿(mào)易和基礎(chǔ)設(shè)施倡議。

“一帶一路”是中國(guó)在外交政策方面的重中之重,,該倡議正在幫助中國(guó)構(gòu)建從東南亞,、埃及到厄瓜多爾的經(jīng)濟(jì)網(wǎng)絡(luò)。如果中國(guó)能夠吸引這些國(guó)家加入數(shù)字人民幣生態(tài)系統(tǒng),,將可能有助于人民幣成為制衡美元的強(qiáng)大力量,。中國(guó)在這些國(guó)家中擁有相當(dāng)大的影響力——不少國(guó)家向中國(guó)申請(qǐng)大量貸款,但中國(guó)也提供了誘人的條件,。在發(fā)展中國(guó)家,,交易費(fèi)會(huì)讓跨境貿(mào)易和借貸變得緩慢和昂貴。上海區(qū)塊鏈項(xiàng)目公司Neo的首席執(zhí)行官兼聯(lián)合創(chuàng)始人達(dá)鴻飛表示,,數(shù)字貨幣所需的中間機(jī)構(gòu)更少,,數(shù)字人民幣有望“最大限度地減少交易滯后問(wèn)題,同時(shí)降低準(zhǔn)入門(mén)檻”,。

即便數(shù)字貨幣沒(méi)能撼動(dòng)美元的全球儲(chǔ)備地位,,也有可能給美國(guó)帶來(lái)麻煩。受益于美元的主導(dǎo)地位,,美國(guó)成為了全球金融守門(mén)人:可以有效地決定和批準(zhǔn)哪個(gè)國(guó)家使用SWIFT網(wǎng)絡(luò)(全球銀行結(jié)算系統(tǒng)),,或?qū)⑵淞腥牒诿麊巍1热绻鸫髮W(xué)肯尼迪學(xué)院貝爾??茖W(xué)與國(guó)際事務(wù)中心執(zhí)行主任阿迪提·庫(kù)馬爾認(rèn)為,,這能讓美國(guó)“回應(yīng)俄羅斯特定寡頭政治家的不良行徑,實(shí)施非常有針對(duì)性的制裁”,。

中國(guó)的數(shù)字貨幣將對(duì)這種權(quán)力造成威脅,。香港投資公司Radian Partners的創(chuàng)始人朱晉酈指出:“數(shù)字貨幣的內(nèi)置功能之一是繞過(guò)SWIFT,直接完成匯款?!备鼜V泛地采用數(shù)字貨幣可能會(huì)降低美國(guó)懲罰對(duì)手和罪犯的能力,,并給任何卷入美國(guó)政策爭(zhēng)端的人士提供另一個(gè)交易場(chǎng)所。

去年12月,,美國(guó)財(cái)政部部長(zhǎng)史蒂文·姆努欽告知國(guó)會(huì),,他和美聯(lián)儲(chǔ)主席杰羅姆·鮑威爾認(rèn)為,數(shù)字貨幣屬于低優(yōu)先級(jí)別問(wèn)題,。他說(shuō):“我們認(rèn)為美聯(lián)儲(chǔ)在未來(lái)五年內(nèi)沒(méi)有必要發(fā)行數(shù)字貨幣,。”新冠疫情重新引發(fā)了國(guó)會(huì)山對(duì)數(shù)字貨幣的興趣——原因之一是華盛頓方面難以通過(guò)傳統(tǒng)渠道迅速發(fā)放刺激資金福利,,然而該項(xiàng)目進(jìn)展仍然十分緩慢,。

這種惰性可能反映出一種根深蒂固的懷疑態(tài)度,即不相信中國(guó)能超越美國(guó),。亨利·保爾森是前美國(guó)財(cái)政部部長(zhǎng),,也是一家中美關(guān)系智囊機(jī)構(gòu)的創(chuàng)始人。他在5月為《外交事務(wù)》(Foreign Affairs)撰寫(xiě)的一篇評(píng)論文章中表示,,數(shù)字貨幣“不是一個(gè)嚴(yán)重的問(wèn)題”,。保爾森認(rèn)為,中國(guó)的管治方式過(guò)于保守,,這種貨幣無(wú)法獲得廣泛采用,。

但有人認(rèn)為,反對(duì)者沒(méi)有看到更廣闊的圖景,。“我認(rèn)為,,這類似于我們目前對(duì)于5G的辯論,,美國(guó)一直在敦促盟國(guó)不要使用華為提供的5G技術(shù)?!睅?kù)馬爾說(shuō),。雖然美國(guó)聲稱該公司構(gòu)成風(fēng)險(xiǎn),但消費(fèi)者辯稱,,他們不能錯(cuò)過(guò)以低成本獲得高質(zhì)量技術(shù)的機(jī)會(huì),。

與此同時(shí),中國(guó)正在抓住機(jī)遇,,力爭(zhēng)成為未來(lái)幾十年里世界數(shù)字版圖中不可或缺的一部分,。紅棗科技是一家獲得國(guó)家支持的公司,致力于提供基于區(qū)塊鏈的云服務(wù),。該公司首席執(zhí)行官何亦凡將所有工作都比作是在“建設(shè)下一個(gè)互聯(lián)網(wǎng)”,。當(dāng)然,當(dāng)前的互聯(lián)網(wǎng)要?dú)w功于五角大樓資助的研究。這在提醒著人們,,對(duì)技術(shù)懷有雄心壯志的政府是能夠以深刻的方式重塑經(jīng)濟(jì)史的,。只要問(wèn)問(wèn)忽必烈就知道了。

數(shù)字貨幣競(jìng)爭(zhēng)對(duì)手

從PayPal的Venmo到非洲的M-Pesa,,私營(yíng)企業(yè)一直主導(dǎo)著數(shù)字支付領(lǐng)域。而現(xiàn)在,,各國(guó)央行正聯(lián)合企業(yè)開(kāi)發(fā)本國(guó)的數(shù)字貨幣,,但沒(méi)有哪一個(gè)國(guó)家的進(jìn)度能趕上中國(guó)。

瑞典

瑞典中央銀行是全世界歷史最悠久的央行,,自2016年以來(lái)就宣布要推出數(shù)字貨幣,。目前,瑞典央行正與埃森哲咨詢公司合作為數(shù)字克朗做技術(shù)研發(fā),,并計(jì)劃于明年進(jìn)行測(cè)試,。

新加坡

新加坡金融管理局在今年7月稱,他們與摩根大通和有政府背景的巨頭淡馬錫攜手,,“成功”完成了一項(xiàng)支持多貨幣結(jié)算的區(qū)塊鏈網(wǎng)絡(luò)測(cè)試,。央行董事總經(jīng)理表示,歡迎與中國(guó)合作,。

巴哈馬

巴哈馬于2019年12月27日在??颂K馬地區(qū)啟動(dòng)了“沙幣計(jì)劃”試點(diǎn)項(xiàng)目,一個(gè)月內(nèi)吸引了1000多名測(cè)試者,。該國(guó)計(jì)劃在年底前將試點(diǎn)區(qū)域擴(kuò)展至全部700個(gè)島嶼,。

委內(nèi)瑞拉

2018年,委內(nèi)瑞拉推出加密貨幣petro(據(jù)傳有石油儲(chǔ)備支持),,旨在幫助公民應(yīng)對(duì)國(guó)際制裁和本國(guó)失衡的惡性通脹問(wèn)題,。不過(guò)petro慘遭失敗,美國(guó)正懸賞500萬(wàn)美元逮捕貨幣負(fù)責(zé)人,,此人被控販毒和違反制裁,。(財(cái)富中文網(wǎng))

本文另一版本刊載于《財(cái)富》雜志2020年8/9月刊,標(biāo)題為《中國(guó)努力爭(zhēng)取數(shù)字貨幣主導(dǎo)地位的內(nèi)幕》,。

譯者:Emily

在13世紀(jì),,元朝皇帝忽必烈憑借一紙?jiān)t書(shū)顛覆了當(dāng)時(shí)的貨幣系統(tǒng):要么接受我的紙幣,要么就死,。

當(dāng)然,,處決的威脅在當(dāng)時(shí)并不是什么新鮮事。忽必烈真正的創(chuàng)新之處在于,,他對(duì)貨幣本身進(jìn)行了改造,。這位令人聞風(fēng)喪膽的成吉思汗之孫意識(shí)到,,他能夠不受貴金屬供應(yīng)的限制,為自己的國(guó)家制造貨幣,,其地緣政治影響力也將不再依賴于在絲綢之路沿線勞神費(fèi)力開(kāi)采和冶煉的礦石,。相反,他能夠開(kāi)發(fā)無(wú)限量的輕質(zhì)原料,,利用樹(shù)木來(lái)制造貨幣,。

準(zhǔn)確地說(shuō),是桑樹(shù),。在一份當(dāng)代記述資料中,,周游列國(guó)的威尼斯商人馬可·波羅對(duì)“偉大的忽必烈用樹(shù)皮做成類似紙的國(guó)家流通貨幣”表示無(wú)比驚嘆。他寫(xiě)道,,鈔票的發(fā)行,,帶著“如同純金或純銀般的莊嚴(yán)和權(quán)威感”。

馬可·波羅的報(bào)告讓中世紀(jì)的歐洲人看得瞠目結(jié)舌,,但這位皇帝確實(shí)走在他所處時(shí)代的前列,。如今,靠政府法令而非硬資產(chǎn)支持的法定貨幣已經(jīng)成為了各地的標(biāo)準(zhǔn)貨幣,,其前身就是忽必烈發(fā)行的交鈔,。

時(shí)間快進(jìn)至本世紀(jì),中國(guó)正在又一次重鑄貨幣,。但這一次,,被拋棄卻是紙幣,因?yàn)橹袊?guó)正在走向數(shù)字化,。雖然蒙古人的結(jié)局并不好——印鈔形成了惡性通脹,,讓他們失去了王位——但中國(guó)現(xiàn)任領(lǐng)導(dǎo)人制訂了更加穩(wěn)健、長(zhǎng)遠(yuǎn)的規(guī)劃,。

在開(kāi)發(fā)國(guó)家數(shù)字貨幣方面,,中國(guó)比任何大國(guó)都走得更遠(yuǎn)——這種單純的數(shù)字人民幣基于區(qū)塊鏈技術(shù)開(kāi)發(fā),而區(qū)塊鏈?zhǔn)潜忍貛诺燃用茇泿诺挠涗洈?shù)據(jù)庫(kù),。去年10月,習(xí)總書(shū)記在一次講話中展現(xiàn)了對(duì)區(qū)塊鏈的大力支持,,也成為第一位支持這項(xiàng)技術(shù)的世界主要領(lǐng)導(dǎo)人,。他表示要“抓住機(jī)遇”,希望中國(guó)在該領(lǐng)域“占據(jù)領(lǐng)先地位”,。

這種未來(lái)貨幣的全稱有點(diǎn)冗長(zhǎng),,被稱為“數(shù)字貨幣/電子支付”(DC/EP,以下簡(jiǎn)稱數(shù)字貨幣),,但這是朝數(shù)字方向邁出的激動(dòng)人心的一步,。中國(guó)政府旨在讓目前處于內(nèi)測(cè)階段的貨幣做好準(zhǔn)備,到2022年2月北京舉辦冬奧會(huì)時(shí)實(shí)現(xiàn)更廣泛的應(yīng)用——讓中國(guó)能夠在全球舞臺(tái)彰顯金融科技實(shí)力。

中國(guó)官員曾經(jīng)在公開(kāi)場(chǎng)合贊揚(yáng)數(shù)字貨幣的諸多優(yōu)點(diǎn):運(yùn)營(yíng)和交易成本更低,、金融包容性更強(qiáng),;同時(shí)對(duì)國(guó)家來(lái)說(shuō),可以增強(qiáng)打擊犯罪的能力和擴(kuò)大海外影響力,。這項(xiàng)創(chuàng)新能加強(qiáng)對(duì)中國(guó)貨幣體系的管控,。

有觀察人士甚至認(rèn)為,數(shù)字人民幣或?qū)㈩A(yù)示著美元作為國(guó)際貿(mào)易通用貨幣的終結(jié),。對(duì)于那些認(rèn)為中國(guó)的數(shù)字桑樹(shù)將結(jié)碩果的西方人來(lái)說(shuō),,這個(gè)可能性令人震驚——因?yàn)檫@將削弱美國(guó)維護(hù)經(jīng)濟(jì)和政治利益的能力。

國(guó)際清算銀行在最近一項(xiàng)研究中調(diào)查了66家中央銀行,,其中80%的銀行稱已經(jīng)開(kāi)始研究數(shù)字貨幣的可行性,,但只有10%付諸實(shí)際行動(dòng);美聯(lián)儲(chǔ)不在其中,。

其結(jié)果就是:中國(guó)正在一場(chǎng)幾乎無(wú)人意識(shí)已經(jīng)開(kāi)賽的競(jìng)賽中向前沖刺,。

隨意觀察下蘇州火車(chē)站——這是一個(gè)位于上海西北方向的運(yùn)河水系城市——可能并不會(huì)覺(jué)得有何異樣之處。車(chē)廂里滿是佩戴口罩的乘客,,人們?cè)谌胝究谂抨?duì)向保安人員出示智能手機(jī)上的綠碼,,以此表明未感染新冠肺炎。

但有些乘客的手機(jī)里還有另一項(xiàng)功能:持有官方批準(zhǔn)的數(shù)字貨幣,。中國(guó)已經(jīng)從5月起開(kāi)始落地測(cè)試數(shù)字人民幣,,蘇州市公務(wù)員收到了以數(shù)字貨幣形式發(fā)放的50%交通補(bǔ)貼,深圳,、成都和北京附近的雄安新區(qū)也在進(jìn)行類似的與本地商戶有關(guān)的測(cè)試工作,。

這些交易數(shù)額很小,卻傳遞了一個(gè)重大的信息:當(dāng)大多數(shù)國(guó)家還在因?yàn)樾鹿谝咔槎中臅r(shí),,一場(chǎng)技術(shù)變革已經(jīng)悄然在中國(guó)上演了,。漢全咨詢投資公司的首席執(zhí)行官馬修·格雷厄姆發(fā)在推特上的“測(cè)試版”數(shù)字錢(qián)包圖片也表達(dá)了這一重要訊息。他評(píng)論道:“美國(guó)人仍然在試圖搞清楚是否應(yīng)該戴口罩,,中國(guó)卻已經(jīng)在推動(dòng)一項(xiàng)革命性技術(shù)了,。”

自宣布試點(diǎn)計(jì)劃以來(lái),,中國(guó)對(duì)此幾乎未發(fā)表任何言論,。中國(guó)的大型公司似乎也避談數(shù)字貨幣。不過(guò),,各大公司正在饒有興趣地關(guān)注著形勢(shì)發(fā)展,。據(jù)報(bào)道,網(wǎng)約車(chē)服務(wù)公司滴滴出行,、外賣(mài)平臺(tái)美團(tuán)大眾點(diǎn)評(píng)等國(guó)內(nèi)龍頭企業(yè),,還有麥當(dāng)勞,、賽百味等外資企業(yè),都在為測(cè)試工作做準(zhǔn)備,。(滴滴已經(jīng)確認(rèn)參與該計(jì)劃,;美團(tuán)拒絕置評(píng);麥當(dāng)勞和賽百味未回復(fù)置評(píng)請(qǐng)求,。)

超過(guò)80%的中國(guó)人都在使用支付寶,、微信支付等智能手機(jī)應(yīng)用程序進(jìn)行付款。表面來(lái)看,,數(shù)字貨幣應(yīng)用程序和那些隨處可見(jiàn)的電子錢(qián)包似乎并無(wú)二致,。但從技術(shù)角度講,兩種數(shù)字貨幣之間存在著巨大的區(qū)別,。其中有一大關(guān)鍵性創(chuàng)新,,即數(shù)字貨幣在任何地方都能使用,甚至各方處于“離線”狀態(tài)時(shí)也是如此,。但兩者最大的分別在于,,擁有借貸記錄的所有方不同。有別于私營(yíng)企業(yè),,數(shù)字人民幣與央行中國(guó)人民銀行所維護(hù)的中央分類賬有內(nèi)在聯(lián)系,。

其影響是多方面的。中國(guó)的這一策略有助于將2.25億“無(wú)銀行賬戶”人士納入經(jīng)濟(jì)領(lǐng)域,;只需一部智能手機(jī)就能實(shí)現(xiàn),,甚至不需要傳統(tǒng)的銀行賬戶。數(shù)字人民幣錢(qián)包可以被用來(lái)發(fā)放刺激款項(xiàng),、補(bǔ)貼和退稅,。但最根本的是,數(shù)字貨幣將讓政府對(duì)中國(guó)經(jīng)濟(jì)有無(wú)可比擬的監(jiān)督和調(diào)控權(quán),。就像忽必烈時(shí)代的古老交鈔一樣,,國(guó)家可能是最大受益方。

幾年前,,風(fēng)投公司Race Capital的中國(guó)投資者楊珮珊在中國(guó)國(guó)家電視臺(tái)看到一段關(guān)于區(qū)塊鏈技術(shù)的影片,,當(dāng)時(shí)她覺(jué)得似乎缺了點(diǎn)什么。她回憶道,,“影片試圖用通俗易懂的語(yǔ)言向大眾講解什么是區(qū)塊鏈”,,但是,“‘去中心化’一詞卻未被提及”,。這個(gè)說(shuō)法是加密貨幣推行者的慣用語(yǔ)。楊珮珊當(dāng)時(shí)感覺(jué),,那可能不是真的區(qū)塊鏈,。

2014年,,當(dāng)中國(guó)人民銀行首次開(kāi)始考慮數(shù)字貨幣時(shí),比特幣才剛剛進(jìn)入主流意識(shí),。自由主義者喜愛(ài)這項(xiàng)技術(shù),,是因?yàn)榭稍诒O(jiān)管之外完成價(jià)值創(chuàng)造和轉(zhuǎn)移,但許多銀行和國(guó)家也看到了區(qū)塊鏈的分布式分類賬技術(shù)中吸引人的潛力:以難以置信的精準(zhǔn)度追蹤金融活動(dòng),。

中國(guó)擔(dān)心資本外流可能會(huì)讓人民幣走弱,,因此從2013年起就先發(fā)制人,禁止銀行處理加密貨幣,。但對(duì)于數(shù)字貨幣項(xiàng)目,,領(lǐng)導(dǎo)層對(duì)區(qū)塊鏈技術(shù)進(jìn)行了研究和甄別——保留了該技術(shù)原本的透明性,但去掉了潛在風(fēng)險(xiǎn),。

與此同時(shí),,在快速崛起的中產(chǎn)階級(jí)引領(lǐng)下,中國(guó)的金融科技行業(yè)正在騰飛,。中國(guó)的移動(dòng)支付應(yīng)用交易量從2013年微不足道的金額,,躍升至2019年的350萬(wàn)億元人民幣(約合50萬(wàn)億美元)。如今,,螞蟻集團(tuán)的支付寶,、騰訊的微信支付分別占據(jù)了55%和39%的市場(chǎng)份額。手機(jī)已經(jīng)取代了實(shí)體現(xiàn)金,;中國(guó)家庭金融資產(chǎn)中的現(xiàn)金使用量占4%(美國(guó)為24%),,是世界上比例最低的國(guó)家之一,金融科技應(yīng)用程序的持有比例也越來(lái)越高,。

中國(guó)人民銀行認(rèn)為,,國(guó)有銀行的存款外流數(shù)量龐大且速度驚人,正在演變成缺乏監(jiān)管的雙頭壟斷問(wèn)題,。中國(guó)人民銀行行長(zhǎng)易綱在去年一次會(huì)議上認(rèn)為:“那些大型高科技公司帶來(lái)了很多挑戰(zhàn)和金融風(fēng)險(xiǎn),。在這個(gè)游戲中,贏家通吃,?!币虼耍畯?017年起要求支付寶和微信將客戶備付金存入央行的不計(jì)息賬戶,。中國(guó)人民銀行還設(shè)立了一個(gè)網(wǎng)絡(luò)支付清算平臺(tái),,掌握大公司的資金流向。

通過(guò)數(shù)字貨幣,,中國(guó)將獲得更大的能見(jiàn)度,,對(duì)系統(tǒng)中的流動(dòng)資金進(jìn)行監(jiān)管。數(shù)字交易將不必經(jīng)過(guò)清算平臺(tái),,在后端分類賬中就能全部看到,。新加坡跨國(guó)銀行星展銀行高級(jí)經(jīng)濟(jì)學(xué)家內(nèi)森·周解釋說(shuō),,中國(guó)可能會(huì)更密切地關(guān)注投資風(fēng)險(xiǎn),或?qū)⒂兄诒苊庥绊懼袊?guó)經(jīng)濟(jì)的周期性債務(wù)危機(jī),。比如,,如果當(dāng)局認(rèn)為無(wú)法挽救某個(gè)如“鬼城”般的大型住房項(xiàng)目,國(guó)家財(cái)政的工程師就能通過(guò)調(diào)整數(shù)字人民幣代碼,,限制投資者向該項(xiàng)目投入更多資金,。內(nèi)森·周說(shuō),數(shù)字人民幣不是事后解決問(wèn)題,,而是讓中國(guó)“提前掌控一切,,預(yù)先部署”。

不過(guò),,也有人質(zhì)疑和擔(dān)心產(chǎn)生更隱蔽的問(wèn)題,。中國(guó)人民銀行數(shù)字貨幣研究所所長(zhǎng)穆長(zhǎng)春承諾,數(shù)字貨幣將提供“可控制的匿名性”,。數(shù)字貨幣讓國(guó)家更有可能掌握金融活動(dòng)的一舉一動(dòng),。通過(guò)數(shù)字人民幣,中國(guó)可以監(jiān)控犯罪嫌疑人和恐怖分子的交易,。

但對(duì)于隱私的擔(dān)憂,,可能并不會(huì)阻止全球競(jìng)逐數(shù)字貨幣。

Facebook在2019年宣布Libra數(shù)字貨幣計(jì)劃,。Libra在初期受挫后縮減了項(xiàng)目規(guī)模,,中國(guó)人民銀行卻加快了步伐。中國(guó)不僅僅只獲得技術(shù)優(yōu)勢(shì),,數(shù)字人民幣還表明這是一個(gè)挑戰(zhàn)美元的全球儲(chǔ)備貨幣地位的最佳機(jī)會(huì),。。

第二次世界大戰(zhàn)以來(lái),,美元的全球儲(chǔ)備貨幣地位讓美國(guó)獲利頗豐,。出口商向美國(guó)出售的商品更便宜,放款人要求更低的利率,,因?yàn)樗麄冑嵢〉氖侨虮V地泿?。美?guó)面臨更小的匯率波動(dòng)風(fēng)險(xiǎn),同時(shí)還可對(duì)較小經(jīng)濟(jì)體的貨幣政策施加更大的影響力,。

所有貨幣體系都會(huì)受到網(wǎng)絡(luò)的影響——使用人數(shù)越多,,獲得的價(jià)值更大。在今天,,人民幣僅占全球外匯儲(chǔ)備的2%,,而美元占60%以上(歐元占20%)。但如果數(shù)字貨幣在某天達(dá)到臨界規(guī)模,這很可能要?dú)w功于中國(guó)的“一帶一路”全球貿(mào)易和基礎(chǔ)設(shè)施倡議,。

“一帶一路”是中國(guó)在外交政策方面的重中之重,,該倡議正在幫助中國(guó)構(gòu)建從東南亞、埃及到厄瓜多爾的經(jīng)濟(jì)網(wǎng)絡(luò),。如果中國(guó)能夠吸引這些國(guó)家加入數(shù)字人民幣生態(tài)系統(tǒng),將可能有助于人民幣成為制衡美元的強(qiáng)大力量,。中國(guó)在這些國(guó)家中擁有相當(dāng)大的影響力——不少國(guó)家向中國(guó)申請(qǐng)大量貸款,,但中國(guó)也提供了誘人的條件。在發(fā)展中國(guó)家,,交易費(fèi)會(huì)讓跨境貿(mào)易和借貸變得緩慢和昂貴,。上海區(qū)塊鏈項(xiàng)目公司Neo的首席執(zhí)行官兼聯(lián)合創(chuàng)始人達(dá)鴻飛表示,數(shù)字貨幣所需的中間機(jī)構(gòu)更少,,數(shù)字人民幣有望“最大限度地減少交易滯后問(wèn)題,,同時(shí)降低準(zhǔn)入門(mén)檻”。

即便數(shù)字貨幣沒(méi)能撼動(dòng)美元的全球儲(chǔ)備地位,,也有可能給美國(guó)帶來(lái)麻煩,。受益于美元的主導(dǎo)地位,美國(guó)成為了全球金融守門(mén)人:可以有效地決定和批準(zhǔn)哪個(gè)國(guó)家使用SWIFT網(wǎng)絡(luò)(全球銀行結(jié)算系統(tǒng)),,或?qū)⑵淞腥牒诿麊?。比如哈佛大學(xué)肯尼迪學(xué)院貝爾福科學(xué)與國(guó)際事務(wù)中心執(zhí)行主任阿迪提·庫(kù)馬爾認(rèn)為,,這能讓美國(guó)“回應(yīng)俄羅斯特定寡頭政治家的不良行徑,,實(shí)施非常有針對(duì)性的制裁”。

中國(guó)的數(shù)字貨幣將對(duì)這種權(quán)力造成威脅,。香港投資公司Radian Partners的創(chuàng)始人朱晉酈指出:“數(shù)字貨幣的內(nèi)置功能之一是繞過(guò)SWIFT,,直接完成匯款?!备鼜V泛地采用數(shù)字貨幣可能會(huì)降低美國(guó)懲罰對(duì)手和罪犯的能力,,并給任何卷入美國(guó)政策爭(zhēng)端的人士提供另一個(gè)交易場(chǎng)所。

去年12月,,美國(guó)財(cái)政部部長(zhǎng)史蒂文·姆努欽告知國(guó)會(huì),,他和美聯(lián)儲(chǔ)主席杰羅姆·鮑威爾認(rèn)為,數(shù)字貨幣屬于低優(yōu)先級(jí)別問(wèn)題,。他說(shuō):“我們認(rèn)為美聯(lián)儲(chǔ)在未來(lái)五年內(nèi)沒(méi)有必要發(fā)行數(shù)字貨幣,。”新冠疫情重新引發(fā)了國(guó)會(huì)山對(duì)數(shù)字貨幣的興趣——原因之一是華盛頓方面難以通過(guò)傳統(tǒng)渠道迅速發(fā)放刺激資金福利,,然而該項(xiàng)目進(jìn)展仍然十分緩慢,。

這種惰性可能反映出一種根深蒂固的懷疑態(tài)度,即不相信中國(guó)能超越美國(guó),。亨利·保爾森是前美國(guó)財(cái)政部部長(zhǎng),,也是一家中美關(guān)系智囊機(jī)構(gòu)的創(chuàng)始人,。他在5月為《外交事務(wù)》(Foreign Affairs)撰寫(xiě)的一篇評(píng)論文章中表示,數(shù)字貨幣“不是一個(gè)嚴(yán)重的問(wèn)題”,。保爾森認(rèn)為,,中國(guó)的管治方式過(guò)于保守,這種貨幣無(wú)法獲得廣泛采用,。

但有人認(rèn)為,,反對(duì)者沒(méi)有看到更廣闊的圖景?!拔艺J(rèn)為,,這類似于我們目前對(duì)于5G的辯論,美國(guó)一直在敦促盟國(guó)不要使用華為提供的5G技術(shù),?!睅?kù)馬爾說(shuō)。雖然美國(guó)聲稱該公司構(gòu)成風(fēng)險(xiǎn),,但消費(fèi)者辯稱,,他們不能錯(cuò)過(guò)以低成本獲得高質(zhì)量技術(shù)的機(jī)會(huì)。

與此同時(shí),,中國(guó)正在抓住機(jī)遇,,力爭(zhēng)成為未來(lái)幾十年里世界數(shù)字版圖中不可或缺的一部分。紅棗科技是一家獲得國(guó)家支持的公司,,致力于提供基于區(qū)塊鏈的云服務(wù),。該公司首席執(zhí)行官何亦凡將所有工作都比作是在“建設(shè)下一個(gè)互聯(lián)網(wǎng)”。當(dāng)然,,當(dāng)前的互聯(lián)網(wǎng)要?dú)w功于五角大樓資助的研究,。這在提醒著人們,對(duì)技術(shù)懷有雄心壯志的政府是能夠以深刻的方式重塑經(jīng)濟(jì)史的,。只要問(wèn)問(wèn)忽必烈就知道了,。

瑞典克朗

數(shù)字貨幣競(jìng)爭(zhēng)對(duì)手

從PayPal的Venmo到非洲的M-Pesa,私營(yíng)企業(yè)一直主導(dǎo)著數(shù)字支付領(lǐng)域,。而現(xiàn)在,,各國(guó)央行正聯(lián)合企業(yè)開(kāi)發(fā)本國(guó)的數(shù)字貨幣,但沒(méi)有哪一個(gè)國(guó)家的進(jìn)度能趕上中國(guó),。

瑞典

瑞典中央銀行是全世界歷史最悠久的央行,,自2016年以來(lái)就宣布要推出數(shù)字貨幣。目前,,瑞典央行正與埃森哲咨詢公司合作為數(shù)字克朗做技術(shù)研發(fā),,并計(jì)劃于明年進(jìn)行測(cè)試。

新加坡

新加坡金融管理局在今年7月稱,他們與摩根大通和有政府背景的巨頭淡馬錫攜手,,“成功”完成了一項(xiàng)支持多貨幣結(jié)算的區(qū)塊鏈網(wǎng)絡(luò)測(cè)試,。央行董事總經(jīng)理表示,歡迎與中國(guó)合作,。

巴哈馬

巴哈馬于2019年12月27日在??颂K馬地區(qū)啟動(dòng)了“沙幣計(jì)劃”試點(diǎn)項(xiàng)目,一個(gè)月內(nèi)吸引了1000多名測(cè)試者,。該國(guó)計(jì)劃在年底前將試點(diǎn)區(qū)域擴(kuò)展至全部700個(gè)島嶼,。

委內(nèi)瑞拉

2018年,委內(nèi)瑞拉推出加密貨幣petro(據(jù)傳有石油儲(chǔ)備支持),,旨在幫助公民應(yīng)對(duì)國(guó)際制裁和本國(guó)失衡的惡性通脹問(wèn)題。不過(guò)petro慘遭失敗,,美國(guó)正懸賞500萬(wàn)美元逮捕貨幣負(fù)責(zé)人,,此人被控販毒和違反制裁。(財(cái)富中文網(wǎng))

本文另一版本刊載于《財(cái)富》雜志2020年8/9月刊,,標(biāo)題為《中國(guó)努力爭(zhēng)取數(shù)字貨幣主導(dǎo)地位的內(nèi)幕》,。

譯者:Emily

In the 13th century, Kublai Khan, the Mongolian emperor who founded China’s Yuan Dynasty, upended monetary convention with a magisterial edict: Accept my money, or die.

The threat of execution was not so novel back then, of course. The Khan’s true innovation lay in his refashioning of money itself. The grandson of fearsome Genghis realized he could finance his realm untethered to finite supplies of precious metals. No longer would his geopolitical reach depend on backbreakingly mined and smelted ores hauled along the Silk Road. Instead, he could tap a boundless, lightweight resource—and make money grow on trees.

Mulberry trees, to be exact. In a contemporary account, Marco Polo, the wandering merchant of Venice, marveled at “how the great Khan causeth the bark of trees, made into something like paper, to pass for money overall his country.” The banknotes were issued, he wrote, “with as much solemnity and authority as if they were of pure gold or silver.”

Medieval Europeans were dumbfounded by Polo’s report. But the emperor was ahead of his time. Fiat currencies—descendants of Kublai Khan’s chao, backed by government edict rather than hard assets—are standard everywhere today.

Fast-forward to this century, and China once again is remaking money. Except this time, it is paper currency that’s getting tossed; China is going digital. And while things didn’t end well for the Mongols—they printed themselves into hyperinflation, and lost the throne—China’s current leaders have something far more stable and enduring in mind.

China is further along than any other large country in its development of a national digital currency—in this case, a purely electronic yuan based on technology inspired by blockchains, the record-keeping databases that underlie cryptocurrencies like Bitcoin. President Xi Jinping issued a ringing endorsement of blockchains in an October speech, making him the first major world leader to get behind the technology. Xi vowed to “seize the opportunity” that would let China “take the leading position” in the field.

The futuristic money, clunkily dubbed the “digital currency/electronic payment,” or DC/EP, is a dramatic step in that direction. The government aims for the currency, now in a pilot phase, to be ready for broader rollout by the time Beijing hosts the Winter Olympics in February 2022—allowing China to demonstrate its fintech prowess on a global stage.

Chinese officials publicly tout the currency’s many benefits: lower operational and transaction costs; greater financial inclusion; and, for the state, enhanced crime-fighting capabilities and expanded influence abroad. The innovation is set to strengthen the government’s control of China’s monetary system, while restoring the government’s power over China’s tech giants, especially Tencent’s WeChat and Alipay, run by Alibaba’s IPO-bound Ant Group division.

Some observers even believe the e-yuan could spell the beginning of the end for the U.S. dollar as the de facto conduit of international commerce. For Westerners who think China’s digital mulberry tree will bear fruit, that’s a startling possibility—one that would diminish America’s ability to defend its economic and political interests.

Out of 66 central banks surveyed in a recent study by the Bank for International Settlements, 80% reported having begun investigating the feasibility of a digital currency. But only 10% were anywhere close to minting one; the Federal Reserve is not among them.

The upshot: China is sprinting ahead in a race that few others realize they’re running.

****

A casual observer visiting a railway station in Suzhou, a canal-sluiced city northwest of Shanghai, might notice nothing out of the ordinary. Train cars are thronged with masked passengers. At entryways, commuters queue up and show guards their green-colored smartphone codes, indicating bills of good health for COVID-19.

But some passengers have another feature on their phones: an officially approved digital currency. China began testing an e-yuan in the real world in May, as municipal workers in Suzhou started receiving half their monthly transit subsidy in the form of DC/EP. Similar trials, some involving local merchants, are taking place in Shenzhen, Chengdu, and Xiong’an, near Beijing.

The transactions are small, but they send a big message: While most countries were distracted by a pandemic, China staged a technological coup. Matthew Graham, CEO of investment firm Sino Global Capital, conveyed the significance after posting leaked images of “beta” DC/EP wallets on Twitter. “Americans [are] still trying to figure out if they should put on a face mask while China pushes out a revolutionary technology,” he commented.

Beijing has said little about the pilot program since announcing it. Big companies operating in China have been reluctant to talk about DC/EP. But they’re watching the situation with interest, and homegrown stars such as ride-hailing service Didi Chuxing and food deliverer Meituan-Dianping, along with foreigners McDonald’s and Subway, have been reported to be preparing for the trials. (Didi confirmed its participation; Meituan declined to comment; McDonald’s and Subway did not reply to requests for comment.)

More than 80% of Chinese people already use smartphone apps like Alipay and WeChat Pay to conduct payments. Cosmetically, DC/EP apps resemble those omnipresent e-wallets. Yet technologically, there’s a wide divide between the two types of digital money. The DC/EP, in one key innovation, will be usable everywhere, even among parties who are otherwise “offline.” But the biggest difference lies in who logs the debits and credits. Unlike its private-sector counterparts, the e-yuan is intrinsically linked to a centralized ledger maintained by the People’s Bank of China (PBOC), the nation’s central bank.

The ramifications are manifold. China’s gambit could help bring 225 million “unbanked” people into its economic fold; all they’ll need is a smartphone, not even a traditional bank account. E-yuan wallets could be used to distribute stimulus payments, subsidies, and tax refunds. But most fundamentally, the digital money will grant the government unparalleled oversight and fine-tuned control of China’s economy. As with the Khan’s ancient cash, the biggest benefits are likely to accrue to the state.

****

When Edith Yeung, a Chinese national and investor at VC firm Race Capital, caught a Chinese state television segment on blockchain technology a couple of years ago, something seemed off. “It tried to teach the masses in layman’s terms what blockchain was all about,” she recalls. But “the word ‘decentralization’?”—the mantra of cryptocurrency boosters—“was not mentioned at all,” she says. That’s not really blockchain, Yeung remembers thinking.

When the PBOC first started considering a digital currency, in 2014, Bitcoin was just breaking into the mainstream consciousness. Libertarians loved how it permitted the creation and transfer of value, independent of government. But many banks and states saw in the blockchain’s distributed ledger technology something equally attractive: the potential to track financial activity with incredible precision.

China, ever wary of capital outflows that could weaken its currency, preemptively barred banks from handling cryptocurrencies starting in 2013. But the country’s leadership studied and cherry-picked aspects of blockchain technology for the DC/EP project—keeping its innate transparency, while scrapping its potential dangers.

Meanwhile, China’s fintech sector, lofted by a fast-rising middle class, was taking off. Transaction volume on mobile payment apps in China rose from a negligible amount in 2013 to as much as 350 trillion renminbi, or $50 trillion, in 2019. Today, Ant Group’s Alipay and Tencent’s WeChat Pay command 55% and 39%, respectively, of that market. Phones displaced physical cash; China’s ratio of cash use to household financial assets, an increasing share of which is held in fintech apps, is among the lowest in the world, at 4%. (In the U.S., it’s 24%.)

The PBOC viewed this flight of deposits from state-controlled banks into a rising, under-regulated duopoly as too much, too fast. “Those big tech companies bring to us a lot of challenges and financial risks,” Yi Gang, governor of the PBOC, explained at a conference last year. “In this game, winners take all.” So, in 2017, the government started requiring Alipay and WeChat to store customer funds in non-interest-bearing accounts at the central bank. The PBOC also set up a clearinghouse for online payments, a checkpoint allowing it to scrutinize the giants’ money flows.

With an e-currency, China will gain even greater visibility into, and command over, the money sloshing around the system. Digital transactions won’t have to be routed through a checkpoint; transparency will be inherent in the all-seeing, back-end ledger. That could also enable the country to keep closer tabs on investment risks, potentially helping avert the debt crises that periodically disrupt China’s economy, explains Nathan Chow, senior economist at DBS Holdings, a Singapore-based multinational bank. Say authorities deem a “ghost town” mega–housing project to be unsalvageable: The nation’s fiscal engineers could restrict—literally, by tweaking e-yuan code—investors from plowing more money into it. Rather than address problems after the fact, an e-yuan will let China “have everything under control in advance, preprogrammed,” says Chow.

But skeptics fear more insidious outcomes. Mu Changchun, head of the PBOC’s digital currency research institute, has promised the DC/EP will offer “controllable anonymity.” More likely, the digital currency will grant the state financial omniscience. With an e-yuan, China will be able to monitor the transactions of suspected criminals and terrorists.

But privacy concerns may not stop DC/EP from attracting a global following.

****

Facebook announced its plans for Libra in 2019. Libra has since scaled back its ambitions after early stumbles, while the PBOC has accelerated its timeline. And China stands to gain more than just a technological edge: The e-yuan represents its best chance yet to challenge the dollar as the global reserve currency.

The U.S. has benefited enormously from the greenback’s status as the global reserve currency since World War II. Exporters sell to the U.S. more cheaply, and lenders ask for lower interest rates, because they get paid in a globally prized currency. The U.S. also faces less risk from fluctuating exchange rates and wields greater sway over lesser economies’ monetary policies.

All money systems are subject to network effects—gaining greater value as more people use them. Today, the renminbi makes up only 2% of global foreign-exchange reserves, while the U.S. dollar accounts for more than 60% (and the euro 20%). But if the DC/EP ever attains critical mass, it will likely be thanks to China’s “Belt and Road” global trade and infrastructure initiatives.

Belt and Road, the centerpiece of China’s foreign policy, is helping China cinch together a network of economy from Southeast Asia to Egypt to Ecuador. If China can lure those countries into the e-yuan ecosystem, that could help the currency become a serious counterweight to the dollar. China has considerable leverage over these nations—many have borrowed heavily from Beijing. But China also has enticements to offer. Transaction fees can make cross-border trade and borrowing slow and costly in developing nations. Because digital currencies require fewer intermediaries, an e-yuan could “minimize transaction lag while lowering barriers to entry,” says Da Hongfei, CEO and cofounder of Neo, a Shanghai-based blockchain project.

The DC/EP could cause problems for the U.S. even without attaining global-reserve status. Thanks to the dollar’s dominance, the U.S. is a global financial gatekeeper: It can effectively decide who is approved for or blacklisted from using the SWIFT network, the international bank money-wiring system. That enables the U.S., for example, to “inflict very targeted sanctions on specific Russian oligarchs in response to bad behavior,” says Aditi Kumar, executive director of the Belfer Center for Science and International Affairs at Harvard Kennedy School.

A Chinese digital currency threatens that power. “One of the built-in functions for DC/EP is direct remittance, which would bypass SWIFT,” notes Jennifer Zhu Scott, founder of investment firm Radian Partners in Hong Kong. Wider adoption of DC/EP could reduce America’s ability to punish adversaries and criminals—and give anyone embroiled in a policy dispute with the U.S. an alternative place to do business.

****

Last December, Treasury Secretary Steven Mnuchin told Congress that he and Fed Chairman Jerome Powell considered digital currency a low-priority issue. “In the next five years, we see no need for the Fed to issue a digital currency,” Mnuchin said. The pandemic has revived interest on Capitol Hill—in part because Washington has struggled to issue stimulus benefits quickly through traditional channels—but progress remains slow.

The inertia may reflect a deep-seated disbelief that China can overtake America. Hank Paulson, former secretary of the Treasury and founder of a think tank focused on U.S.-China relations, regards DC/EP as “not a serious concern,” as he wrote in an op-ed for Foreign Affairs in May. Beijing’s approach to governance is too illiberal for its currency to win widespread adoption, Paulson argued.

But others believe the naysayers miss the bigger picture. “I think of it as analogous to the debate we’re having about 5G,” Kumar says. “The U.S. has had a tough time urging allies not to use the 5G tech Huawei is providing,” she says, referring to the controversial Chinese telecom giant. While the U.S. alleges that the company poses espionage risks, customers argue that they can’t pass up a chance to get high-quality tech at low cost.

China’s government, meanwhile, is seizing the chance to become an integral part of the world’s digital fabric for decades to come. Yifan He, CEO of Red Date Technology, a state-supported company that aims to offer blockchain-based cloud services, likens all this work to “building the next Internet.” The current Internet, of course, owes its existence to Pentagon-funded research. It’s a reminder that technologically ambitious governments can reshape economic history in profound ways. Just ask Kublai Khan.

****

Currency contestants

From PayPal’s Venmo to M-Pesa in Africa, the private sector has dominated digital payments. Now central banks are exploring national digital currencies of their own, often with corporate partners—though none has progressed as far as China.

Sweden

Sweden’s Riksbank, the world’s oldest central bank, has talked about launching a digital currency since 2016. It’s now working with consulting firm Accenture to develop the technology behind an e-krona that it plans to test next year.

Singapore

In July, the Monetary Authority of Singapore said it “successfully” concluded a trial with JPMorgan Chase and state-backed giant Temasek that settled payments in different currencies on a blockchain-based network. The bank’s managing director has said he would welcome cooperation with China.

The Bahamas

The Bahamas started its “project sand dollar” pilot in its Exuma district on Dec. 27, 2019. The trial attracted more than 1,000 testers in a month, and the nation plans to expand the program across all 700 of its islands before year’s end.

Venezuela

In 2018, Venezuela launched the petro, a cryptocurrency (allegedly backed by oil reserves) designed to help citizens cope with international sanctions and the dysfunctional nation’s hyperinflation. The petro has been a flop, and the U.S. is offering a $5 million bounty for information leading to the capture of the initiative’s leader, who has been indicted for drug trafficking and sanctions violations.

A version of this article appears in the August/September 2020 issue of Fortune with the headline “China’s drive for digital currency dominance.”