雖然我們還看不到經(jīng)濟(jì)的“V字型”回升,,但是納斯達(dá)克指數(shù)卻正在出現(xiàn)“V字型”回彈,。

新冠病毒對(duì)資本市場(chǎng)的殺傷力巨大,但納斯達(dá)克指數(shù)好像很快就緩過(guò)勁來(lái)了,。美國(guó)時(shí)間周二早上,,納斯達(dá)克100指數(shù)作為高科技企業(yè)的風(fēng)向標(biāo)迎來(lái)大幅上漲,只比今年2月創(chuàng)下的歷史高點(diǎn)低了2%,。納斯達(dá)克綜合指數(shù)也出現(xiàn)了類似的漲幅,,截至美國(guó)周二午盤(pán),該指數(shù)同樣只比2月份的歷史高點(diǎn)低了不到4%,。

納斯達(dá)克100指數(shù)中出現(xiàn)上漲的股票包括聯(lián)合航空(United Airlines)和艾派迪(Expedia),。聯(lián)合航空在周二早盤(pán)交易中上漲逾13%,艾派迪上漲約10%,。

相較于3月份的市場(chǎng)最低點(diǎn),,納斯達(dá)克指數(shù)已經(jīng)回彈了30%以上,,盡管過(guò)去一個(gè)月的波動(dòng)較大,,但上周市場(chǎng)仍出現(xiàn)了上漲。標(biāo)普500指數(shù)今年以來(lái)下跌了7%,,而納斯達(dá)克100指數(shù)卻上漲了6%,。

隨著美國(guó)各州慢慢開(kāi)始解禁,民眾對(duì)于新疫苗的研發(fā)保有樂(lè)觀的心態(tài),,加之美聯(lián)儲(chǔ)持續(xù)不斷的扶持政策,,股市行情被大幅提振。然而,,這種現(xiàn)象也讓一些分析師感到擔(dān)憂,。

在一定程度上,指數(shù)的增長(zhǎng)只是由一些巨頭推動(dòng)的。標(biāo)普500指數(shù)中20%的成分股都是由諸如亞馬遜,、Alphabet,、微軟、蘋(píng)果,、Facebook這樣的大企業(yè)占領(lǐng)的,,納斯達(dá)克100指數(shù)中也是同樣的情況。

分析師表示,,在這樣的背景下,,強(qiáng)者愈強(qiáng)、弱者愈弱的馬太效應(yīng)會(huì)更加明顯,,在“市場(chǎng)”這個(gè)充滿不確定性的黑匣子里,,投資者總會(huì)傾向于選擇其中有確定性和增長(zhǎng)性的部分,這就是市場(chǎng)的神奇之處,。

富國(guó)銀行投資研究院全球市場(chǎng)策略師薩馬納在接受《財(cái)富》雜志采訪時(shí)表示,,疫情爆發(fā)以后,在家工作,、在線購(gòu)物,、流媒體觀影成了一種新趨勢(shì),一些大型科技公司顯然會(huì)從中獲益,。

那么,,誰(shuí)會(huì)最先慶祝股市的回升呢?

特朗普在昨日第一時(shí)間發(fā)Twitter指出,,目前標(biāo)普500指數(shù)自3月初以來(lái)首次突破了3000點(diǎn)關(guān)口,。

"道瓊斯指數(shù)突破25000點(diǎn),標(biāo)普500指數(shù)超過(guò)3000點(diǎn),,股市正在大幅上漲,!各州應(yīng)該盡快開(kāi)放,向偉大的過(guò)渡已經(jīng)提前開(kāi)啟,,也許會(huì)有起起落落,,但明年將是最好的一年!"

——唐納德?特朗普(@realDonaldTrump) 2020年5月26日

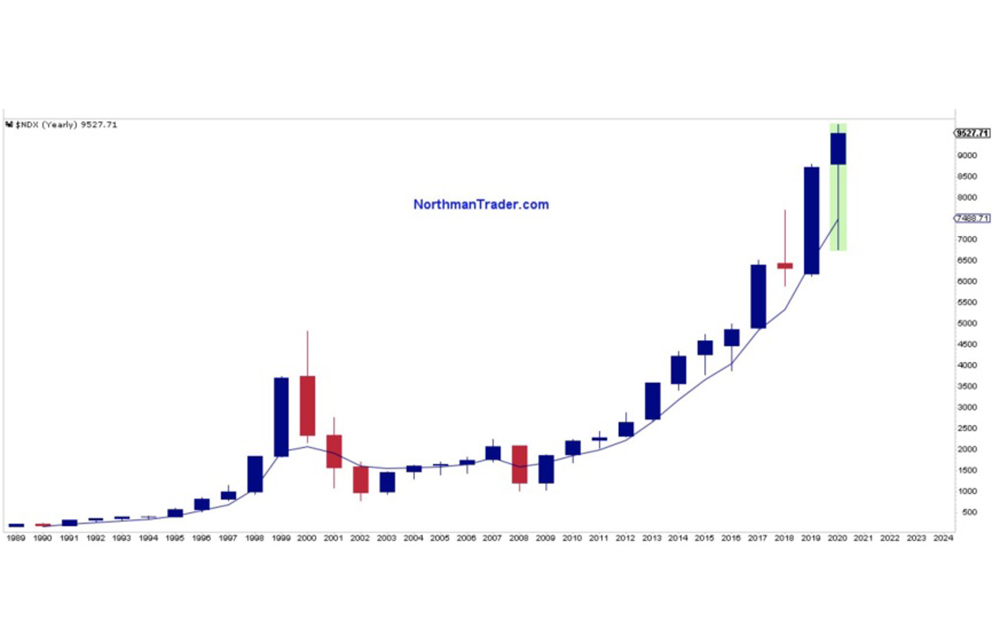

然而,也有市場(chǎng)觀察人士則對(duì)此表示懷疑,,有人用一張從1989年至今的納斯達(dá)克指數(shù)圖進(jìn)行了諷刺:

女士們,,先生們,我給你們展示的是:一輩子里最“偉大”的經(jīng)濟(jì)危機(jī),。

——斯文?亨里奇((@NorthmanTrader) 2020年5月26日

(財(cái)富中文網(wǎng))

編譯:陳怡軒

雖然我們還看不到經(jīng)濟(jì)的“V字型”回升,,但是納斯達(dá)克指數(shù)卻正在出現(xiàn)“V字型”回彈。

新冠病毒對(duì)資本市場(chǎng)的殺傷力巨大,,但納斯達(dá)克指數(shù)好像很快就緩過(guò)勁來(lái)了,。美國(guó)時(shí)間周二早上,納斯達(dá)克100指數(shù)作為高科技企業(yè)的風(fēng)向標(biāo)迎來(lái)大幅上漲,只比今年2月創(chuàng)下的歷史高點(diǎn)低了2%,。納斯達(dá)克綜合指數(shù)也出現(xiàn)了類似的漲幅,,截至美國(guó)周二午盤(pán),該指數(shù)同樣只比2月份的歷史高點(diǎn)低了不到4%,。

納斯達(dá)克100指數(shù)中出現(xiàn)上漲的股票包括聯(lián)合航空(United Airlines)和艾派迪(Expedia),。聯(lián)合航空在周二早盤(pán)交易中上漲逾13%,艾派迪上漲約10%,。

相較于3月份的市場(chǎng)最低點(diǎn),,納斯達(dá)克指數(shù)已經(jīng)回彈了30%以上,盡管過(guò)去一個(gè)月的波動(dòng)較大,,但上周市場(chǎng)仍出現(xiàn)了上漲,。標(biāo)普500指數(shù)今年以來(lái)下跌了7%,而納斯達(dá)克100指數(shù)卻上漲了6%,。

隨著美國(guó)各州慢慢開(kāi)始解禁,,民眾對(duì)于新疫苗的研發(fā)保有樂(lè)觀的心態(tài),加之美聯(lián)儲(chǔ)持續(xù)不斷的扶持政策,,股市行情被大幅提振,。然而,這種現(xiàn)象也讓一些分析師感到擔(dān)憂,。

在一定程度上,,指數(shù)的增長(zhǎng)只是由一些巨頭推動(dòng)的。標(biāo)普500指數(shù)中20%的成分股都是由諸如亞馬遜,、Alphabet,、微軟、蘋(píng)果,、Facebook這樣的大企業(yè)占領(lǐng)的,,納斯達(dá)克100指數(shù)中也是同樣的情況。

分析師表示,,在這樣的背景下,,強(qiáng)者愈強(qiáng)、弱者愈弱的馬太效應(yīng)會(huì)更加明顯,,在“市場(chǎng)”這個(gè)充滿不確定性的黑匣子里,,投資者總會(huì)傾向于選擇其中有確定性和增長(zhǎng)性的部分,,這就是市場(chǎng)的神奇之處,。

富國(guó)銀行投資研究院全球市場(chǎng)策略師薩馬納在接受《財(cái)富》雜志采訪時(shí)表示,疫情爆發(fā)以后,,在家工作,、在線購(gòu)物、流媒體觀影成了一種新趨勢(shì),一些大型科技公司顯然會(huì)從中獲益,。

那么,,誰(shuí)會(huì)最先慶祝股市的回升呢?

特朗普在昨日第一時(shí)間發(fā)Twitter指出,,目前標(biāo)普500指數(shù)自3月初以來(lái)首次突破了3000點(diǎn)關(guān)口,。

"道瓊斯指數(shù)突破25000點(diǎn),標(biāo)普500指數(shù)超過(guò)3000點(diǎn),,股市正在大幅上漲,!各州應(yīng)該盡快開(kāi)放,向偉大的過(guò)渡已經(jīng)提前開(kāi)啟,,也許會(huì)有起起落落,,但明年將是最好的一年!"

——唐納德?特朗普(@realDonaldTrump) 2020年5月26日

然而,也有市場(chǎng)觀察人士則對(duì)此表示懷疑,,有人用一張從1989年至今的納斯達(dá)克指數(shù)圖進(jìn)行了諷刺:

女士們,,先生們,我給你們展示的是:一輩子里最“偉大”的經(jīng)濟(jì)危機(jī),。

——斯文?亨里奇((@NorthmanTrader) 2020年5月26日

(財(cái)富中文網(wǎng))

編譯:陳怡軒

While we may not see a V-shaped recovery in the economy coming out of the coronavirus crisis, investors are certainly seeing a V-shaped rebound in the Nasdaq.

Despite the coronavirus pandemic wreaking havoc on markets, the tech-heavy index, which holds 100 top names including Amazon and Alphabet, soared higher on Tuesday morning, only 2% off from its all-time highs reached in February this year. The Nasdaq Composite (the widely-followed index for the Nasdaq) saw a similar jump, and as of midday Tuesday was less than 4% from its February highs.

In fact, the Nasdaq has recovered over 30% from market-wide lows in March, as markets rose last week despite volatility over the past month. The Nasdaq 100 is up 6% for the year, versus a drop of 7% for the S&P 500.

Stocks have been buoyed by optimism around a possible new vaccine, states slowly starting to reopen, and continued support from the Fed. Yet the rapid rise is making some analysts antsy.

Partly the rise has been fueled by a few giant names. Amazon, Alphabet, Microsoft, Apple, and Facebook make up roughly 20% of the S&P 500 and a similar chunk of the Nasdaq 100. The dichotomy between “winners” and “l(fā)osers” has become even more apparent, analysts say, because, “in a market where there’s quite a bit of uncertainty, investors almost always…are on the hunt for growth and certainty—that’s the magic combination,” Wells Fargo Investment Institute's senior global market strategist Sameer Samana recently told Fortune. That sentiment has benefited big tech names that have thrived as working from home, shopping online, and streaming have all accelerated during the pandemic.

One person eager to cheer the rally? The President took to Twitter, referencing the fact that the S&P 500 broke the 3,000-point mark for the first time since early March.

Stock Market up BIG, DOW crosses 25,000. S&P 500 over 3000. States should open up ASAP. The Transition to Greatness has started, ahead of schedule. There will be ups and downs, but next year will be one of the best ever!

— Donald J. Trump (@realDonaldTrump) May 26, 2020

Other market observers struck a note of skepticism. One neatly captured that sentiment in one chart:

Ladies and gentlemen I present: The greatest economic crisis in our lifetime.

— Sven Henrich (@NorthmanTrader) May 26, 2020