雖然中國目前復(fù)工復(fù)產(chǎn),,經(jīng)濟似乎已走出停擺狀態(tài),,但世界最大經(jīng)濟體美國開始衰退,歐洲,、加拿大,、日本、韓國等重要經(jīng)濟體也很可能緊跟其后,。全球性的經(jīng)濟衰退似乎已不可避免,,世界第二大經(jīng)濟體中國也難以獨善其身。金融全球化,,牽一發(fā)而動全身,,最近的因國際原油價格波動而引發(fā)的中行“原油寶”就是一個例子。作為投資者而言,,應(yīng)該在出現(xiàn)熊市的時候密切關(guān)注市場環(huán)境,,恐慌只會帶來更大的問題。從歷史角度看,,熊市終會有結(jié)束的那一天,。

“這次不一樣?!?/p>

“這就是每一次熊市帶給投資者的感覺:每一次都是感到害怕和恐慌,,但每一次都覺得,這次不一樣,?!盚averford Trust 投資公司的聯(lián)席投資總監(jiān)漢克·史密斯說。

熊市中連續(xù)巨虧讓投資者受到驚嚇,,落荒而逃,。就在行情似乎開始好轉(zhuǎn)時,股市再次下行,。

這正是今年3月初的情況。2020年3月12日,,道指創(chuàng)下自1987年來創(chuàng)紀(jì)錄的最大單日跌幅,,跌入熊市,,標(biāo)普500 指數(shù)也一并暴跌。盡管后來股市又漲了幾天,,其中一天還創(chuàng)下1933年來最大的單日漲幅,,但很多投資者依舊惴惴不安。

身陷熊市讓人惱火,,特別對于那些從未經(jīng)歷過熊市的人,。投資者,包括那些把養(yǎng)老金投資到股市里的普通人,,只有在股市走熊一段時間后才明白,,熊市真的來了,但他們也看不到熊市到底什么時候會結(jié)束,。

我們找到幾位華爾街資深人士,,請教他們的看法。這些人都經(jīng)歷過此前的三次大熊市:1987年美股暴跌,、千禧年互聯(lián)網(wǎng)泡沫破滅和2008年的金融崩潰,。

1987年熊市

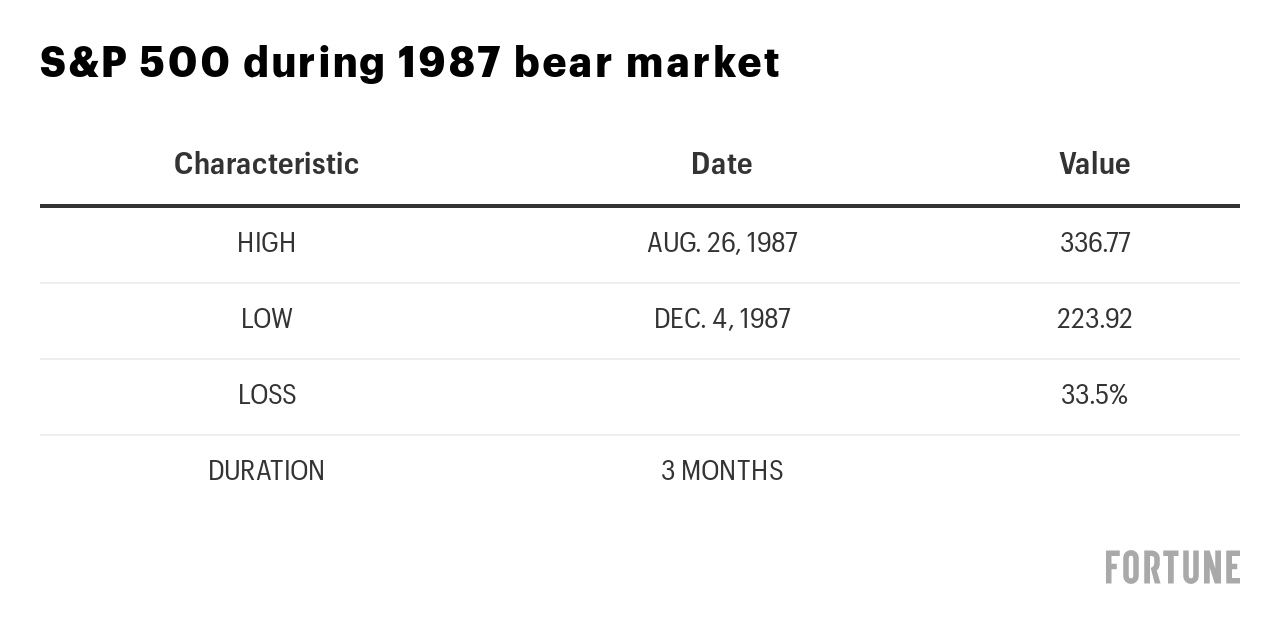

現(xiàn)在說到1987年的黑色星期一,人們通常會想到,,這次史上最大的一次股市單日跌幅,。那天是10月19日,標(biāo)普500指數(shù)下跌了20.5%,。相比當(dāng)前2500點的估值,,那時標(biāo)普500估值要小得多,所以其實容易一點,,而且,,這次熊市持續(xù)時間相對短暫,三個月后就回漲了,。

這一天對于CoreCap投資公司的法律顧問和首席合規(guī)官朱迪思·維拉里爾來說,,她首先想到的是另外的事情。當(dāng)時,,她在一家機構(gòu)從事合規(guī)業(yè)務(wù),,負(fù)責(zé)芝加哥的幾乎所有股指期貨交易員的合規(guī)審查。

那是瘋狂的一天。公司通常為在當(dāng)時外來期貨市場上交易的專業(yè)人士提供金融擔(dān)保,,當(dāng)天行情洶涌澎湃,,一位老板在第二天甚至被迫給開出一張600萬美元的支票,確保所有交易能順利進行,。那時負(fù)責(zé)下單的員工全是男士,,管理層給他們每人配發(fā)了剃須刀和一個空咖啡罐子(省得他們?nèi)ド蠋?,要他們待在崗位上?/p>

維拉里爾坐在茶水間對面的一間小辦公室里,她回憶說:“每次有人從我身邊走過,,都有人說:‘又跌了一百點了,。’”

一些人知道,,此前的好時光不可能持續(xù),,但是市場如此大亂還是超出了他們的認(rèn)知?!盎久媸遣恢С诌@樣的股價的,,但市場做出這樣的自我調(diào)整,所有人還是震驚不已,?!本S拉里爾說:

針對目前疫情導(dǎo)致的危機,她說,,效應(yīng)是累積出來,。“你先是擔(dān)心自己的社?;鸨2蛔×?,接著眼看著養(yǎng)老金賬戶比昨天少了22%,然后,,衛(wèi)生紙也全賣完了,。”她說,,此次危機帶來的累積效益對消費者的影響超出了1987年的崩盤,,導(dǎo)致了更大范圍的恐慌。

不過,,經(jīng)歷過1987年危機的維拉里爾也有所建議,,“我那時還很年輕,上一輩的專業(yè)人士說的是,,市場大幅調(diào)整時,,你應(yīng)該把它看成像百貨商店降價甩賣那樣。投資者有機會以便宜的價格買入,,這最終又會讓市場反轉(zhuǎn),。”

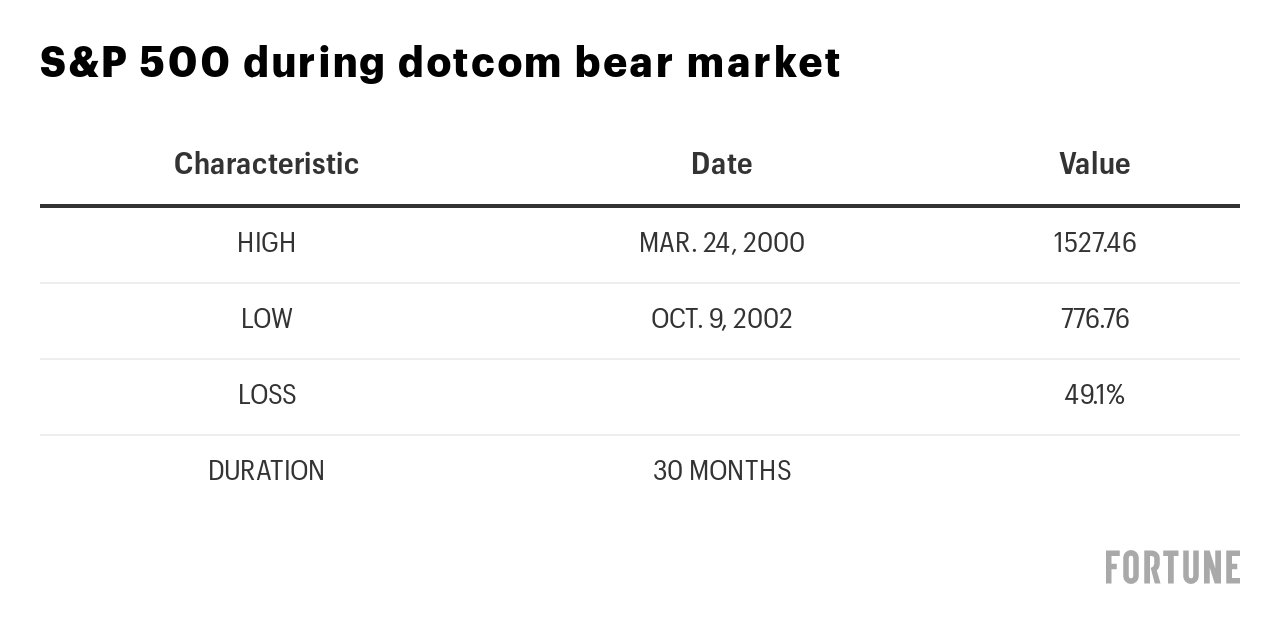

互聯(lián)網(wǎng)熊市

你很難向沒有經(jīng)歷過互聯(lián)網(wǎng)狂熱的人解釋清楚那段日子,。那時候,,科技公司和它們的投資人堅信,商業(yè)已經(jīng)發(fā)生前所未有的變化。無須考慮利潤,,只要能抓眼球,,其他事以后再說。

互聯(lián)網(wǎng)泡沫時期,,到處都在瘋狂撒錢。

注冊投資顧問史蒂芬·亞金當(dāng)時為數(shù)家大型經(jīng)紀(jì)公司工作,。他和妻子都愛好帆船運動,,他們在圣托馬斯度假時,在碼頭看到了一艘漂亮的風(fēng)帆游艇,,船尾寫著名字:Dot Calm(與網(wǎng)站的英文詞“dotcom”諧音),。

“在圣托馬斯的那艘船,是我看到的第一個警示,?!眮喗鹫f。游艇的主人適時套現(xiàn)了,,但大多數(shù)人可沒有這么幸運,。

“真難以想象,互聯(lián)網(wǎng)泡沫持續(xù)了那么長時間,?!眮喗鹫f,“上世紀(jì)90年代,,股市形勢大好,,所有人都認(rèn)為,它會一直漲下去,?!?/p>

終于有一天漲不動了。

亞金不僅知道加杠桿和過度擴張的威力,,也知道這么做的危險,。“(美聯(lián)儲前主席)格林斯潘認(rèn)為,,自保意識會讓銀行和對沖基金好好自我控制,,因為沒有人想死?!边@種理性的自私能確保市場出現(xiàn)調(diào)整時不至于失控,。

“但是太多的投資者以為,總會有人來保護他們,?!眮喗鸾忉屨f,“所以他們當(dāng)中很多人過度使用了杠桿,。投資者最好明白,,不要指望有人救你,,一定要有危險意識?!?/p>

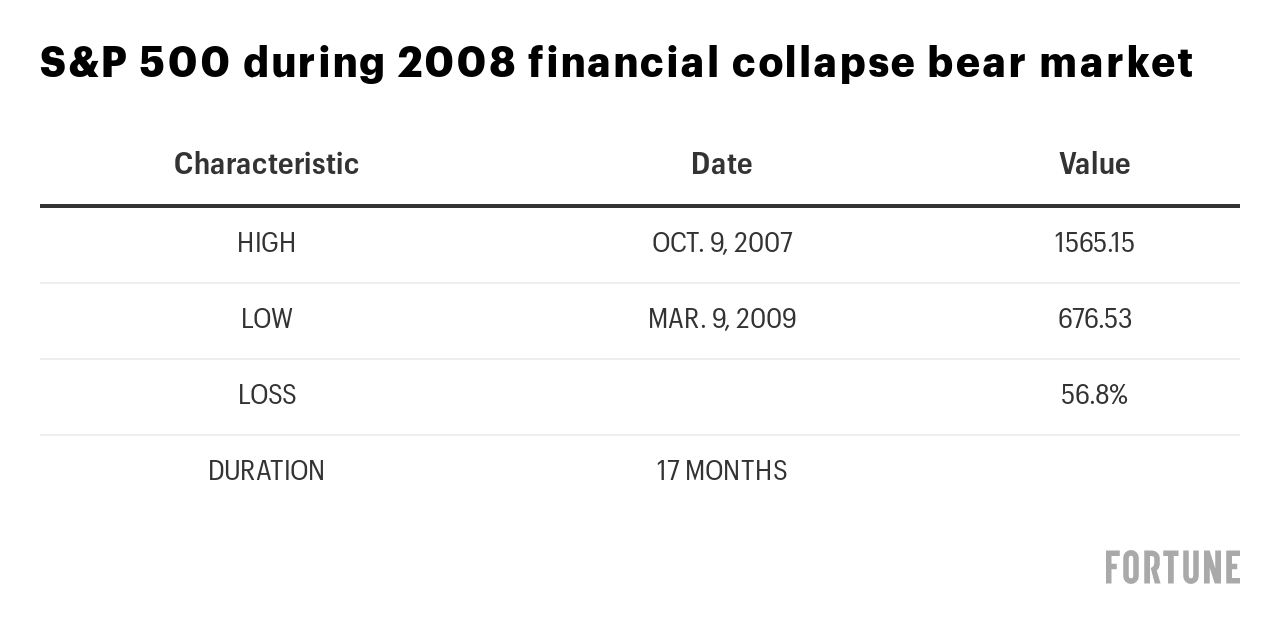

經(jīng)濟大衰退熊市

08年經(jīng)濟大衰退造成史上最大的一次金融崩潰,,其影響至今難以徹底消除。那次熊市過后,,人們迎來了史上最長的一次牛市,,其終結(jié)于2020年3月9日。

“08年1月就出現(xiàn)過一個賣股高潮,,我投資的市場本來跌個10%或20%就可以見底了,,”Smead 資產(chǎn)管理公司的首席執(zhí)行官比爾·斯米德說,但當(dāng)時這樣有特殊性,,“當(dāng)時有兩個利好因素:石油和中國經(jīng)濟,。因為中國崛起,投資者極度看漲石油,,認(rèn)為中國會成為世界最大和最成功的經(jīng)濟體,,二十年前,這個經(jīng)濟體還不存在,?!?/p>

過了一段時間,,投資者才意識到,金融領(lǐng)域有一些生僻的地方,,潛伏著巨大的風(fēng)險,。斯米德說:“人們發(fā)現(xiàn),自己犯了這么多錯誤,,根本沒法知曉金融系統(tǒng)內(nèi)部到底發(fā)生了什么,,這一想法帶來了巨大恐懼,最終引發(fā)股市崩盤,?!?/p>

有一本書幫助了斯米德:阿米蒂·施萊斯的《被遺忘的人:大蕭條新史》?!拔耶?dāng)時覺得,,我得回過頭看歷史,理解大蕭條時期發(fā)生了什么,,這樣才能幫到客戶,。”斯米德說,這本書讓他得以拉開與當(dāng)下的距離,,獲得了亟需的視角,。

例如,他發(fā)現(xiàn),,盡管GDP的78%都來自消費者支出,,但真正自由支配的部分僅為20%,“電費是消費者支出,,買房是消費者支出,,這是雷打不動的?!币簿褪钦f,GDP跌再多,,也會有個相對的墊底部分,。

類似的,失業(yè)會出現(xiàn)在某些領(lǐng)域,,不一定遍及所有行業(yè),。在2008年經(jīng)濟危機中,首當(dāng)其沖的是樓市相關(guān)產(chǎn)業(yè),,如房地產(chǎn)中介,、產(chǎn)權(quán)公司、房屋檢查業(yè)等,?!案叻鍟r,這個行業(yè)占到美國成人就業(yè)的4%,?!彼姑椎抡f。而1929年經(jīng)濟危機時,,45%的就業(yè)人口受雇于農(nóng)業(yè),,沒有存款保險的銀行的倒閉摧毀了儲蓄和流動性,迫使大量農(nóng)民破產(chǎn),。斯米德意識到,,一定要著眼于當(dāng)前,而非歷史上經(jīng)濟危機時的市場環(huán)境,。

這一次,,市場因為新冠疫情而遭受重創(chuàng),何時反彈也看不清楚,。沙特和俄羅斯持續(xù)打壓油價,,導(dǎo)致一些企業(yè)破產(chǎn),比如一些杠桿過高的美國能源公司。這一次,,還是沒有人預(yù)見到引發(fā)股市暴跌的導(dǎo)火索,。

現(xiàn)在能做的,只有死等,,記得還有買入機會,,別把攤子鋪得太大,時刻關(guān)注當(dāng)下的市場環(huán)境,,還有,,不要忘了,即便是最嚴(yán)重的熊市,,也終有反轉(zhuǎn)的那一天,。(財富中文網(wǎng))

譯者:MS

責(zé)編:雨晨

雖然中國目前復(fù)工復(fù)產(chǎn),經(jīng)濟似乎已走出停擺狀態(tài),,但世界最大經(jīng)濟體美國開始衰退,,歐洲、加拿大,、日本,、韓國等重要經(jīng)濟體也很可能緊跟其后。全球性的經(jīng)濟衰退似乎已不可避免,,世界第二大經(jīng)濟體中國也難以獨善其身,。金融全球化,牽一發(fā)而動全身,,最近的因國際原油價格波動而引發(fā)的中行“原油寶”就是一個例子,。作為投資者而言,應(yīng)該在出現(xiàn)熊市的時候密切關(guān)注市場環(huán)境,,恐慌只會帶來更大的問題,。從歷史角度看,熊市終會有結(jié)束的那一天,。

“這次不一樣,。”

“這就是每一次熊市帶給投資者的感覺:每一次都是感到害怕和恐慌,,但每一次都覺得,,這次不一樣?!盚averford Trust 投資公司的聯(lián)席投資總監(jiān)漢克·史密斯說,。

熊市中連續(xù)巨虧讓投資者受到驚嚇,落荒而逃,。就在行情似乎開始好轉(zhuǎn)時,,股市再次下行,。

這正是今年3月初的情況。2020年3月12日,,道指創(chuàng)下自1987年來創(chuàng)紀(jì)錄的最大單日跌幅,,跌入熊市,標(biāo)普500 指數(shù)也一并暴跌,。盡管后來股市又漲了幾天,,其中一天還創(chuàng)下1933年來最大的單日漲幅,但很多投資者依舊惴惴不安,。

身陷熊市讓人惱火,,特別對于那些從未經(jīng)歷過熊市的人。投資者,,包括那些把養(yǎng)老金投資到股市里的普通人,,只有在股市走熊一段時間后才明白,熊市真的來了,,但他們也看不到熊市到底什么時候會結(jié)束,。

我們找到幾位華爾街資深人士,請教他們的看法,。這些人都經(jīng)歷過此前的三次大熊市:1987年美股暴跌、千禧年互聯(lián)網(wǎng)泡沫破滅和2008年的金融崩潰,。

1987年熊市

現(xiàn)在說到1987年的黑色星期一,,人們通常會想到,這次史上最大的一次股市單日跌幅,。那天是10月19日,,標(biāo)普500指數(shù)下跌了20.5%。相比當(dāng)前2500點的估值,,那時標(biāo)普500估值要小得多,,所以其實容易一點,而且,,這次熊市持續(xù)時間相對短暫,,三個月后就回漲了。

這一天對于CoreCap投資公司的法律顧問和首席合規(guī)官朱迪思·維拉里爾來說,,她首先想到的是另外的事情,。當(dāng)時,她在一家機構(gòu)從事合規(guī)業(yè)務(wù),,負(fù)責(zé)芝加哥的幾乎所有股指期貨交易員的合規(guī)審查,。

那是瘋狂的一天。公司通常為在當(dāng)時外來期貨市場上交易的專業(yè)人士提供金融擔(dān)保,,當(dāng)天行情洶涌澎湃,,一位老板在第二天甚至被迫給開出一張600萬美元的支票,,確保所有交易能順利進行。那時負(fù)責(zé)下單的員工全是男士,,管理層給他們每人配發(fā)了剃須刀和一個空咖啡罐子(省得他們?nèi)ド蠋?,要他們待在崗位上?/p>

維拉里爾坐在茶水間對面的一間小辦公室里,她回憶說:“每次有人從我身邊走過,,都有人說:‘又跌了一百點了,。’”

一些人知道,,此前的好時光不可能持續(xù),,但是市場如此大亂還是超出了他們的認(rèn)知?!盎久媸遣恢С诌@樣的股價的,,但市場做出這樣的自我調(diào)整,所有人還是震驚不已,?!本S拉里爾說:

針對目前疫情導(dǎo)致的危機,她說,,效應(yīng)是累積出來,。“你先是擔(dān)心自己的社?;鸨2蛔×?,接著眼看著養(yǎng)老金賬戶比昨天少了22%,然后,,衛(wèi)生紙也全賣完了,。”她說,,此次危機帶來的累積效益對消費者的影響超出了1987年的崩盤,,導(dǎo)致了更大范圍的恐慌。

不過,,經(jīng)歷過1987年危機的維拉里爾也有所建議,,“我那時還很年輕,上一輩的專業(yè)人士說的是,,市場大幅調(diào)整時,,你應(yīng)該把它看成像百貨商店降價甩賣那樣。投資者有機會以便宜的價格買入,,這最終又會讓市場反轉(zhuǎn),。”

互聯(lián)網(wǎng)熊市

你很難向沒有經(jīng)歷過互聯(lián)網(wǎng)狂熱的人解釋清楚那段日子,。那時候,,科技公司和它們的投資人堅信,,商業(yè)已經(jīng)發(fā)生前所未有的變化。無須考慮利潤,,只要能抓眼球,,其他事以后再說。

互聯(lián)網(wǎng)泡沫時期,,到處都在瘋狂撒錢,。

注冊投資顧問史蒂芬·亞金當(dāng)時為數(shù)家大型經(jīng)紀(jì)公司工作。他和妻子都愛好帆船運動,,他們在圣托馬斯度假時,,在碼頭看到了一艘漂亮的風(fēng)帆游艇,船尾寫著名字:Dot Calm(與網(wǎng)站的英文詞“dotcom”諧音),。

“在圣托馬斯的那艘船,,是我看到的第一個警示?!眮喗鹫f,。游艇的主人適時套現(xiàn)了,但大多數(shù)人可沒有這么幸運,。

“真難以想象,,互聯(lián)網(wǎng)泡沫持續(xù)了那么長時間?!眮喗鹫f,,“上世紀(jì)90年代,股市形勢大好,,所有人都認(rèn)為,它會一直漲下去,?!?/p>

終于有一天漲不動了。

亞金不僅知道加杠桿和過度擴張的威力,,也知道這么做的危險,。“(美聯(lián)儲前主席)格林斯潘認(rèn)為,,自保意識會讓銀行和對沖基金好好自我控制,,因為沒有人想死?!边@種理性的自私能確保市場出現(xiàn)調(diào)整時不至于失控,。

“但是太多的投資者以為,總會有人來保護他們,?!眮喗鸾忉屨f,,“所以他們當(dāng)中很多人過度使用了杠桿。投資者最好明白,,不要指望有人救你,,一定要有危險意識?!?/p>

經(jīng)濟大衰退熊市

08年經(jīng)濟大衰退造成史上最大的一次金融崩潰,,其影響至今難以徹底消除。那次熊市過后,,人們迎來了史上最長的一次牛市,,其終結(jié)于2020年3月9日。

“08年1月就出現(xiàn)過一個賣股高潮,,我投資的市場本來跌個10%或20%就可以見底了,,”Smead 資產(chǎn)管理公司的首席執(zhí)行官比爾·斯米德說,但當(dāng)時這樣有特殊性,,“當(dāng)時有兩個利好因素:石油和中國經(jīng)濟,。因為中國崛起,投資者極度看漲石油,,認(rèn)為中國會成為世界最大和最成功的經(jīng)濟體,,二十年前,這個經(jīng)濟體還不存在,?!?/p>

2008年6月27日,投資者擠在紐約證券交易所的交易大廳,。

過了一段時間,,投資者才意識到,金融領(lǐng)域有一些生僻的地方,,潛伏著巨大的風(fēng)險,。斯米德說:“人們發(fā)現(xiàn),自己犯了這么多錯誤,,根本沒法知曉金融系統(tǒng)內(nèi)部到底發(fā)生了什么,,這一想法帶來了巨大恐懼,最終引發(fā)股市崩盤,?!?/p>

有一本書幫助了斯米德:阿米蒂·施萊斯的《被遺忘的人:大蕭條新史》?!拔耶?dāng)時覺得,,我得回過頭看歷史,理解大蕭條時期發(fā)生了什么,,這樣才能幫到客戶,?!彼姑椎抡f,這本書讓他得以拉開與當(dāng)下的距離,,獲得了亟需的視角,。

例如,他發(fā)現(xiàn),,盡管GDP的78%都來自消費者支出,,但真正自由支配的部分僅為20%,“電費是消費者支出,,買房是消費者支出,,這是雷打不動的?!币簿褪钦f,,GDP跌再多,也會有個相對的墊底部分,。

類似的,,失業(yè)會出現(xiàn)在某些領(lǐng)域,不一定遍及所有行業(yè),。在2008年經(jīng)濟危機中,,首當(dāng)其沖的是樓市相關(guān)產(chǎn)業(yè),如房地產(chǎn)中介,、產(chǎn)權(quán)公司,、房屋檢查業(yè)等?!案叻鍟r,,這個行業(yè)占到美國成人就業(yè)的4%?!彼姑椎抡f,。而1929年經(jīng)濟危機時,45%的就業(yè)人口受雇于農(nóng)業(yè),,沒有存款保險的銀行的倒閉摧毀了儲蓄和流動性,迫使大量農(nóng)民破產(chǎn),。斯米德意識到,一定要著眼于當(dāng)前,,而非歷史上經(jīng)濟危機時的市場環(huán)境,。

這一次,市場因為新冠疫情而遭受重創(chuàng),,何時反彈也看不清楚,。沙特和俄羅斯持續(xù)打壓油價,,導(dǎo)致一些企業(yè)破產(chǎn),比如一些杠桿過高的美國能源公司,。這一次,,還是沒有人預(yù)見到引發(fā)股市暴跌的導(dǎo)火索。

現(xiàn)在能做的,,只有死等,,記得還有買入機會,別把攤子鋪得太大,,時刻關(guān)注當(dāng)下的市場環(huán)境,,還有,不要忘了,,即便是最嚴(yán)重的熊市,,也終有反轉(zhuǎn)的那一天,。(財富中文網(wǎng))

譯者:MS

責(zé)編:雨晨

“It’s different this time.”

That, says Hank Smith, co–chief investment officer at The Haverford Trust Co., is what every bear market feels like. “The common theme is fear and panic,” he says, and a feeling that “we have not been here before.”

A series of big losses, repeating in cycles, spooks investors, who then start to panic. Just as conditions seem to be getting better, things fall again.

That’s exactly what happened earlier this month. The Dow had its biggest one-day loss on March 12, 2020, since the 1987 all-time record and dropped into bear market territory, with the S&P 500 following. Though there have since been a few up days—including the best day percentage-wise since 1933—many investors are settling in for an unsettling time.

Understanding a bear market, especially for those who haven’t experienced one before, can be maddening. Investors—including everyone with a 401(k) or IRA—can’t know they’re in one until after it begins. And there’s no telling how long it will last.

For perspective, we turned to Wall Street veterans who lived through the three most recent big bear markets—the 1987 crash, the dotcom crash, and the financial collapse.

1987 bear market

When people talk of the 1987 crash—Black Monday—it’s typically a reference to one of the biggest one-day percentage market drops ever. On Oct. 19 of that year, the S&P 500 fell by 20.5%, which was a lot easier back then given how much smaller the values were compared with current values over 2,500. Remarkably, that bear market only lasted a relatively short three months.

What comes first to mind for Judith Villarreal, general counsel and chief compliance officer for CoreCap Investments, is something else. At the time, she was working in compliance at a firm that cleared almost all of the market index futures traders in Chicago.

It was a manic day. The company ordinarily guaranteed the finances of the professionals trading on the then exotic futures markets. Business was so furious that one of the owners had to write a $6 million check to the firm the next day to cover all the trades. Employees placing the transactions from traders were all men. Management gave each a razor and a coffee can (to avoid bathroom breaks), and told them to stay in place.

Villarreal had a tiny office across from the kitchen. “Every time someone walked by me, they said, ‘Another hundred points down,’” she recalls.

Some people knew the previous good times wouldn’t last, but that didn’t help when the market orders hit the fan. “The fundamentals didn’t support the prices, and yet everyone was shocked that the markets corrected themselves,” Villarreal says.

“If you’re worried about whether social security is going to be there, and your 401(k) is worth 22% less today than yesterday, and you can’t buy toilet paper, the effects are cumulative and affecting consumers in ways the 1987 crash didn’t,” she adds. “That makes it a wider-spread panic.” But she has advice from then.

“I was very young in ’87," remembers Villarreal. “What the older professionals were saying was, when the market does this, you should look at it like when Macy’s puts stuff on sale. You have the opportunity to buy good stuff cheap. And that’s eventually what turns the market around.”

Dotcom bear market

For those who don’t remember dotcom madness, it can be hard to explain. Tech companies, and their investors, swore that business was different than ever before. No need to think of profits. Just get eyeballs—and figure out what to do with them later.

The money tossed around was outrageous.

Stephen Akin, a registered investment adviser who worked for some major brokers back then, and his wife were sailing enthusiasts. On a vacation in St. Thomas, they saw a sweet sailing yacht at the dock. On the back was painted the name, Dot Calm.

“When I saw that boat in St. Thomas, that was the first red flag for me,” Akin says. The owners had cashed out while they could. Most were not so lucky.

“It was amazing how long it went,” Akin says. “When you’re in a rising market like we had in the ’90s, everyone kept thinking it would go and go and go.”

Until it didn’t.

Akin remembers not just the power, but the danger, of leverage and overextension. “[Former Federal Reserve chair Alan] Greenspan’s philosophy thought self-preservation would keep the banks and hedge funds in line, because no one wanted to die.” That rational self-interest would be the corrective safety brake.

“But [too many investors] thought someone would protect them,” explains Akin. “That’s why so many of them got so leveraged out.” It’s wiser to realize that, in investing, you can’t count on a rescue and should assume you’re working without a net.

Great recession bear market

Even today, it’s hard to get away from the biggest financial meltdown since the Great Depression. The aftermath has had a long reach even after the bear market turned to the longest bull run ever—one that finally ended Mar. 9, 2020.

“We had a selling climax in January of ’08 that would have bottomed at 80% or 90% of the markets I’d been in,” says Bill Smead, CEO and lead portfolio of Smead Capital Management.

But the time wasn’t normal. “There were two things doing well: energy and China-related activities,” Smead recalls. “People were incredibly bullish about oil because of the emergence of what people thought would be the largest and most successful economy in the world that didn’t exist 20 years before.”

It took a while for investors to realize how much danger was lurking in arcane parts of the financial world. “What exacerbated the final part of [the collapse] was the complete and total fear that came from the idea that because of all the mistakes they made, you couldn’t know what was inside the financial system,” Smead says.

What helped Smead was a book: The Forgotten Man: A New History of the Great Depression by Amity Shlaes. “I felt like I had to go back and understand what had happened in the Depression to be useful to my clients,” Smead recalls. What he got was some distance from the current times and much-needed perspective.

For example, he realized that while 78% of GDP owes to consumer spending, only 20% was really discretionary. “Your electric bill is consumer spending,” Smead notes. “Your housing is consumer spending.” In other words, there was a relative bottom to how low GDP could fall.

Similarly, unemployment happens in sectors, not necessarily everywhere. In the 2008 crash, the heart of the impact came in housing: real estate brokerages, title companies, inspection businesses. “At the peak, it was 4% of all U.S. adult employment,” he says. That was unlike the 1929 crash where “45% of adults were employed in agriculture,” and the crash of banks without deposit insurance destroyed savings and liquidity, forcing many farmers out of business.

Smead realized that he had to look at current market conditions, not those of the previous downturn.

This time, markets are struggling with COVID-19 and the accompanying lack of clarity about when things will turn around. Saudi Arabia and Russia continue to drive down oil prices and push others, like over-leveraged U.S. energy companies, out of business. Again, the triggers are things no one expected.

All people can do is hang in, remember buying opportunities, avoid overextension, look at the conditions governing current markets—and remember that even the worst bear markets eventually turn around.