2011年8月24日,,坐在輪椅上的史蒂夫·喬布斯被推進了會議室,,這將成為他人生中的最后一次蘋果公司(Apple)董事會會議。先是由時任首席運營官蒂姆·庫克和首席財務官彼得·奧本海默介紹了公司的最新動態(tài),。隨后,,喬布斯開始在輪椅上發(fā)表講話,由于罹患胰腺癌,,彼時的喬布斯身體已經(jīng)十分虛弱,,他要求除外部董事以外的所有人都離開會議室。在無關人等離開后,,喬布斯開口說道,,自己已經(jīng)無法繼續(xù)履行首席執(zhí)行官的職責,而后又不出意外地推薦由庫克接替自己的職位,。接著,,董事會完成了必要的決議,。喬布斯留下來吃了午飯,,之后董事們依次與他擁抱道別,在被送回家六周之后,,喬布斯與世長辭,。

在美國商業(yè)史上,這一戲劇性的場面具有里程碑意義,,也被沃爾特·艾薩克森記錄到了他為喬布斯撰寫的傳記中,。在這樣一個令人動容的時刻,喬布斯,,這位大名足以標榜史冊的偉大企業(yè)家,、創(chuàng)新者,為自己的傳奇故事拉上了帷幕,。相較于如此宏大的歷史畫卷,,董事會的權力移交手續(xù)顯得微不足道。然而事實證明,,當天董事會為庫克奉上全新薪酬方案的舉動所產(chǎn)生的影響要比當時大家的認識要大得多,。

可以說,在蘋果成為全球市值最高企業(yè)的過程中,庫克的薪酬方案起到了一定的作用,,那就是讓庫克成為了一名億萬富豪,。從更廣泛的意義上說,庫克薪酬方案的出現(xiàn)也讓首席執(zhí)行官群體的薪酬結構發(fā)生了深刻變化,,而且其影響范圍還在不斷擴大,。隨著今年各個企業(yè)陸續(xù)召開股東大會,我們看到了許多令人瞠目的高額薪酬:華納兄弟探索公司(Warner Bros. Discovery)首席執(zhí)行官大衛(wèi)·扎斯拉夫的2.47億美元,、亞馬遜(Amazon)首席執(zhí)行官安迪·賈西的2.13億美元,、英特爾(Intel)首席執(zhí)行官帕特·基辛格的1.79億美元,不勝枚舉,,而這些都能夠追溯到十多年前(授予庫克高薪)的那場董事會會議之上,。

“巨額股權獎勵”的興起

在擢升庫克擔任首席執(zhí)行官一職的同時,蘋果董事會向其授予了一筆“受限股票單位”(restricted stock units),,只要庫克達到相應的任職年限,,就可以領取相應的股票獎勵。作為留任高管,、激勵其提升股價的常用手段,,此類獎勵由來已久,但蘋果公司為庫克制定的激勵方案不同于過往的所有方案,。

限制性股權獎勵的期限通常為三到五年,,而“庫克方案”的時間跨度則長達十年。其獎勵規(guī)模更為令人瞠目:100萬股的蘋果股票(每股376美元),。

2021年8月,,在那次令人難忘的董事會會議召開10周年之際,上述獎勵發(fā)放完畢,。經(jīng)過股票分割,,最初的100萬股股票變成了2800萬股(盡管庫克實際并未獲得這么多股票,后文再做討論),,但截至最后一天,,他在整個歸屬期限內(nèi)獲得的股票價值已經(jīng)超過40億美元(準確的說是4159519189美元)。(蘋果拒絕對本文發(fā)表任何評論,。)

過去,,我們也見過一些在當時被視為“天價”的限制性股票授予計劃。20世紀90年代,,可口可樂(Coca-Cola)的首席執(zhí)行官郭思達(Roberto Goizueta)和惠普(Hewlett-Packard)的首席執(zhí)行官卡莉·菲奧莉娜分別獲得了價值約8000萬美元的股權獎勵,,一時成為頭條新聞。(在郭思達的股權激勵等待期內(nèi),,可口可樂的股價實現(xiàn)上漲,,而在菲奧莉娜的股權激勵等待期內(nèi),,受互聯(lián)網(wǎng)泡沫破滅影響,惠普的股價出現(xiàn)暴跌,。)然而在庫克獲授的股權獎勵面前,,上述二人就是“小巫見大巫”了。實際上,,庫克的薪酬方案重新定義了限制性股票的授予方式,。《薪酬與福利雜志》(Journal of Compensation and Benefits)進行的一項綜合研究表明,,“庫克方案”實際上拉開了“巨額股權獎勵”時代的序幕,。不僅今年,近年來,,在收入最高的首席執(zhí)行官排行榜上,,每年的前幾名都是那些領著巨額股權獎勵的首席執(zhí)行官。

面對8位數(shù),、9位數(shù)的高額薪酬,,懷疑者有之、嫉妒者有之,,憤怒者也有之,。在巨額股權獎勵風行的時代,人們不禁會問兩個問題:其一,,支付巨額股權獎勵是否是件好事,?其二,這些巨額數(shù)字究竟意味著什么,?具體來說,,我們是否了解首席執(zhí)行官們到底賺了多少錢?要想回答這兩個問題,,最好的方法就是研究一下巨額股權獎勵的鼻祖——蒂姆·庫克的薪酬方案,。

對于第一個問題——“巨額獎勵是否是件好事”,,答案十分明顯,,“要看情況”。不同的股權獎勵方案可能大有不同,,關鍵要看細節(jié),。與之前所有的限制性股權獎勵方案一樣,按照庫克方案,,他能夠拿到多少獎勵最初也是取決于其任職時間,。只要在歸屬期內(nèi)一直在該公司工作,受獎勵方就可以獲得相應的股權獎勵,。即便公司股票因為首席執(zhí)行官不稱職而出現(xiàn)下跌,,這些股票依然有其價值,。而且通常這些股權獎勵并不計算在工資、獎金和津貼之內(nèi),。簡而言之,,最初的限制性股權獎勵在留住高管方面確實有其作用,但在其他方面的激勵效果則并不明顯,。

在庫克升任首席執(zhí)行官的第二年,,蘋果董事會將其薪酬方案升級到了2.0版,加入了業(yè)績要求(據(jù)公司稱,,此舉是應庫克要求而為),。彼時,庫克尚未開始領取股票獎勵,。根據(jù)修改后的方案,,從2013年開始,約三分之一的獎勵改為浮動獎勵,,根據(jù)蘋果相對于標準普爾500指數(shù)(S&P 500)的股東總回報(total shareholder return)確定,。也就是說,蘋果公司的業(yè)績表現(xiàn)出色不會給庫克帶來更多的股權獎勵,,但如果蘋果的股東總回報未能進入標準普爾指數(shù)(S&P)的前三分之一,,則庫克當年所能夠獲得的股權獎勵將相應減少,甚至可能無法得到這部分股票,。

扣減股權獎勵的情況僅在2013年出現(xiàn)過一次,。因此,庫克最終獲得了2780萬股蘋果股票(如果庫克達成所有獎勵指標,,他從蘋果公司獲得的股權獎勵最多為2800萬股),。

巨額股權獎勵是好事嗎?一筆巨款,,按三年發(fā)放,,從某種意義上說,與贈送也差不了多少,。有時,,為了從其他公司挖人來自己公司做首席執(zhí)行官,企業(yè)必須給出此類獎勵,,因為這些人在自己原來的崗位上就享受著這種獎勵,,只有這樣才可以彌補他們的損失,但這種獎勵所能夠起到的激勵作用依然十分有限,。相比之下,,如果獎勵期限可以達到5年到10年,并且給予業(yè)績一定權重(權重大于庫克方案更好),,那么首席執(zhí)行官就更有做長遠打算的動力,。以庫克為例,,在該筆獎勵的激勵之下,他證明了自己不僅能夠繼承喬布斯的衣缽,,還可以在此基礎之上再上一層樓,。

看到像庫克這樣并非公司創(chuàng)始人卻依靠薪酬成為億萬富豪的首席執(zhí)行官,,有些觀察人士感覺十分憤怒,。要對此類首席執(zhí)行官作出評價,我們要看看他們?yōu)楣蓶|帶來了多少收益,。在庫克治下,,蘋果的市值增加了22萬億美元。他在擔任首席執(zhí)行官一職期間所獲得的股權獎勵及其他形式報酬(工資,、獎金,、津貼)加起來只相當于蘋果市值增加部分的不到0.1%。從這種角度來看,,很難說蘋果的股東們這筆交易做得不劃算,。

前面我們提到的第二個問題是,如此巨額的獎勵究竟意味著什么,,尤其是我們能否從中了解到他們究竟賺了多少錢。答案非常簡單:不能,。不要相信這些數(shù)字,。這些數(shù)字幾乎必然錯誤,,如果沒錯反而只是巧合,。

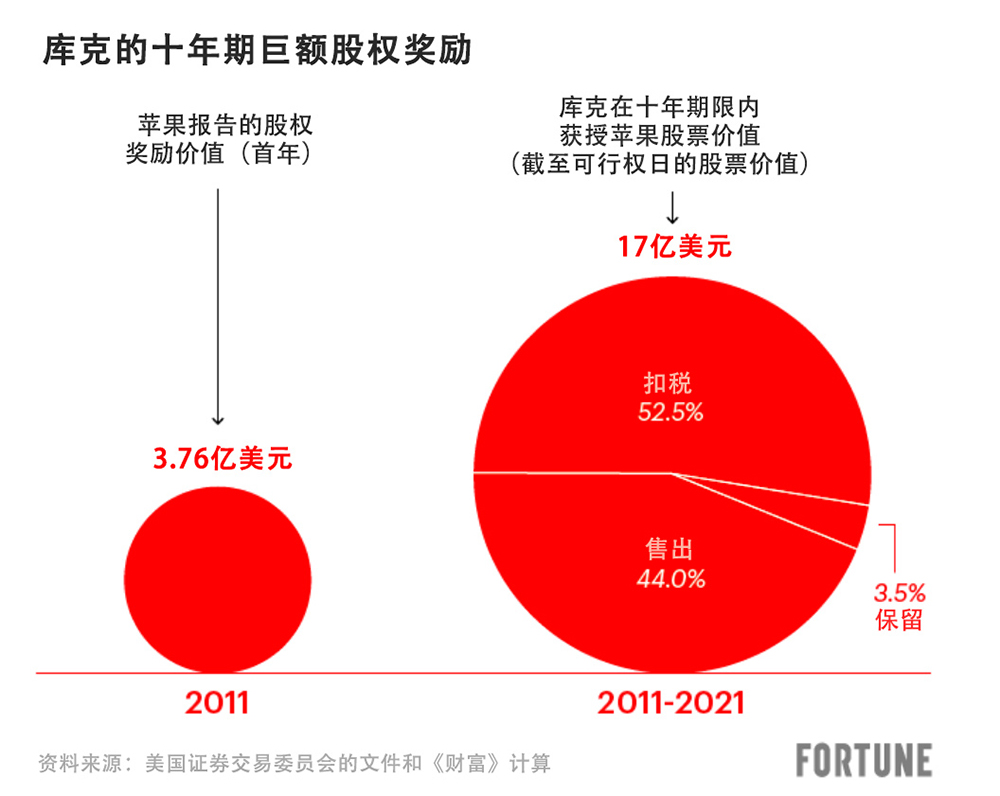

下面我們說一下原因,根據(jù)會計準則和美國證券交易委員會(SEC)規(guī)則,,企業(yè)需要報告高管(例如庫克)所獲得的股權獎勵的價值,,金額則由股票數(shù)量乘以獲授股票當日的股價得出。以庫克為例,,他所獲得的股權獎勵的價值為3.762億美元,。加上工資、獎金和津貼,,2011年,,在全美各大媒體的頭條報道中,他的薪酬都是3.78億美元,,一舉成為美國當年薪酬最高的首席執(zhí)行官,。在蘋果提交給美國證券交易委員會的文件中,他的薪酬也將一直定格在這一數(shù)字之上,。

這種算法看起來精確,,但只是對未來數(shù)年都無從知曉的數(shù)額的估算,而且可能最后錯得非常離譜,。自2011年以來,,股權獎勵機制變得越發(fā)復雜,有時會與多個具體業(yè)績指標掛鉤,,在估值時還會用上令人頭暈目眩的統(tǒng)計技術,,但原有的問題并未改變。

庫克的例子就很能夠說明問題,。投資者無法輕易了解庫克從股權獎勵中獲取了多少收益,但過去十年的美國證券交易委員會文件報告了相關數(shù)據(jù),。此類數(shù)據(jù)甚少在媒體公布,,今天我們將在本文中首次披露相關結果。

從2013年到2021年,,庫克分10批領取了自己的股權獎勵,。按照他領取股權獎勵當日的股價計算,所有股權獎勵的總價值為17億美元,,較蘋果委托書中披露的獎勵價值高出四倍,。

如上所述,如果按照他在2021年8月收到最后一筆股權獎勵時的股價計算,,這些股票的價值將超過40億美元,,現(xiàn)在的價值甚至更高。但是庫克并未將這些股票都留下來,。事實上,,他只留下了其中11%。

其余的股票去哪了呢,?按照法律規(guī)定,,蘋果需要代庫克扣稅,因此,,庫克在歸屬期間獲得的大多數(shù)股權獎勵從未真正進入過他的賬戶,,有52%的股權獎勵直接從蘋果公司劃給了稅務部門。在剩余的股票中,,庫克出售了約四分之三,,獲得了7.39億美元的收益,。

回過頭來看,從財務角度說,,拋售蘋果股票似乎是一個嚴重失誤,。但庫克的做法不過是遵循了許多首席執(zhí)行官、公司創(chuàng)始人都在采用的策略,,那就是不要把所有資產(chǎn)都放在一個籃子里,,他們明白,將絕大部分凈資產(chǎn)投資于單一資產(chǎn)是一種不明智的選擇,。為免在減持公司股票時違反內(nèi)幕交易規(guī)則,,他們會向美國證券交易委員會提交一份股票定期出售計劃。由于我們不清楚庫克的投資情況,,所以無法得知他是否因為拋售蘋果股票而犧牲了大量財富,,但是要想取得比持有蘋果股票更高的收益率,恐怕只有那種“神仙”級別的投資組合才有可能做到,。

想弄清楚這些并非易事,,由此也引出了巨額股權獎勵報告機制的另一問題。投資者很關心首席執(zhí)行官資產(chǎn)的具體情況,。如果某位首席執(zhí)行官的凈資產(chǎn)幾乎全部都投資了公司股票,,那么投資者可能會認為他是一位對公司“全心投入”的管理者,否則就可能會認為他對風險過于抵觸,,不愿意冒險把所有的雞蛋都放在同一個籃子里,。每年的股東委托書都會對首席執(zhí)行官的持股情況進行報告,但這還并非故事的全貌,,要想了解首席執(zhí)行官賣出了多少獲授股票,,以及通過出售股票賺取了多少錢,我們需要對相關的美國證券交易委員會文件進行梳理,,還要制作一個電子表格,,這種事沒有多少投資者會做。

在報告巨額股權獎勵的數(shù)額時,既可能過高,也可能過低,。對庫克所獲獎勵的估值屬于嚴重低估,,但對其他一些人則屬于嚴重高估,。羅恩·約翰遜就是一個明顯的例子,,與庫克相比,約翰遜的例子充滿諷刺意味,。2011年,,憑借巨額獎勵,庫克成為當年美國薪酬最高的首席執(zhí)行官,,而作為彭尼公司(J.C. Penney)的新任首席執(zhí)行官,,約翰遜憑借5320萬美元的薪酬(其中5260萬美元是巨額限制性股票)在這一榜單中排名第四位。相關獎勵在他上任首日便已經(jīng)全額發(fā)放,,在他出名短暫的任期內(nèi),,約翰遜一直持有這些(稅后)股票。17個月后,,在董事會解雇他時,,該公司的股價已經(jīng)暴跌了50%,他的獎勵的價值也隨之縮水,。此后數(shù)年,,彭尼公司一直在苦苦掙扎,并于2020年根據(jù)《美國破產(chǎn)法》第11章申請破產(chǎn),。

諷刺的是,,在加入彭尼公司之前,約翰遜是蘋果公司的高管,,一手打造了蘋果極為成功的零售業(yè)務體系,。在庫克出任首席執(zhí)行官后不久,他就從蘋果跳槽到了彭尼公司,。為彌補約翰遜因為離開蘋果而放棄的股權獎勵,,彭尼公司給了他一筆巨額獎金。然而這卻成了一筆雙輸?shù)慕灰?。如果約翰遜未在歸屬期限結束前離開蘋果,,他所持有的股票的市值現(xiàn)在將達到11億美元。

庫克的新薪酬方案

可以獲授8位數(shù),、9位數(shù)巨額股權獎勵的首席執(zhí)行官寥寥無幾,,但由于他們在首席執(zhí)行官薪酬排行榜中常年占據(jù)前排位置,自然吸引了更多關注,,也引發(fā)了外界監(jiān)管首席執(zhí)行官過高薪酬的呼聲,。而蒂姆·庫克,作為巨額股權獎勵的鼻祖,憑借蘋果過去十年中的非凡表現(xiàn),,仍然是證明巨額薪酬“物有所值”的最有力的論據(jù)之一,。

但事情并未到此結束,因為現(xiàn)在,,他需要再次證明這種巨額股權獎勵的合理性,。2021財年,蘋果董事會再次授予庫克一筆價值8230萬美元的巨額股權獎勵,,預定在2023年到2025年發(fā)放,,待全部獎勵發(fā)放完畢時,庫克將年滿65歲,。

如果庫克能夠重復甚至接近他過去的業(yè)績表現(xiàn),,他將為巨額獎勵的合理性提供強有力的證明,說明給予巨額獎勵可以帶來好的結果,。但如果他的表現(xiàn)明顯未達預期,,則會落人口實,批評者們能夠更理直氣壯地說,,巨額獎勵只會給那些幸運的首席執(zhí)行官帶來財富,。對庫克而言,要想達到自己過去的水準頗為不易,。在他首次獲授股權獎勵的十年間,,標準普爾500指數(shù)的股東總回報率達到了驚人的366%,而蘋果則更為驚人,,達到了1197%,。

庫克能否重現(xiàn)這一壯舉?蘋果的股東以及各地等著領取巨額獎勵的高管們都在祈禱,,希望他可以再創(chuàng)輝煌,。(財富中文網(wǎng))

譯者:梁宇

審校:夏林

2011年8月24日,坐在輪椅上的史蒂夫·喬布斯被推進了會議室,,這將成為他人生中的最后一次蘋果公司(Apple)董事會會議,。先是由時任首席運營官蒂姆·庫克和首席財務官彼得·奧本海默介紹了公司的最新動態(tài)。隨后,,喬布斯開始在輪椅上發(fā)表講話,,由于罹患胰腺癌,彼時的喬布斯身體已經(jīng)十分虛弱,,他要求除外部董事以外的所有人都離開會議室,。在無關人等離開后,喬布斯開口說道,,自己已經(jīng)無法繼續(xù)履行首席執(zhí)行官的職責,,而后又不出意外地推薦由庫克接替自己的職位,。接著,董事會完成了必要的決議,。喬布斯留下來吃了午飯,,之后董事們依次與他擁抱道別,在被送回家六周之后,,喬布斯與世長辭,。

在美國商業(yè)史上,這一戲劇性的場面具有里程碑意義,,也被沃爾特·艾薩克森記錄到了他為喬布斯撰寫的傳記中,。在這樣一個令人動容的時刻,,喬布斯,,這位大名足以標榜史冊的偉大企業(yè)家、創(chuàng)新者,,為自己的傳奇故事拉上了帷幕,。相較于如此宏大的歷史畫卷,董事會的權力移交手續(xù)顯得微不足道,。然而事實證明,,當天董事會為庫克奉上全新薪酬方案的舉動所產(chǎn)生的影響要比當時大家的認識要大得多。

可以說,,在蘋果成為全球市值最高企業(yè)的過程中,,庫克的薪酬方案起到了一定的作用,那就是讓庫克成為了一名億萬富豪,。從更廣泛的意義上說,,庫克薪酬方案的出現(xiàn)也讓首席執(zhí)行官群體的薪酬結構發(fā)生了深刻變化,而且其影響范圍還在不斷擴大,。隨著今年各個企業(yè)陸續(xù)召開股東大會,,我們看到了許多令人瞠目的高額薪酬:華納兄弟探索公司(Warner Bros. Discovery)首席執(zhí)行官大衛(wèi)·扎斯拉夫的2.47億美元、亞馬遜(Amazon)首席執(zhí)行官安迪·賈西的2.13億美元,、英特爾(Intel)首席執(zhí)行官帕特·基辛格的1.79億美元,,不勝枚舉,而這些都能夠追溯到十多年前(授予庫克高薪)的那場董事會會議之上,。

“巨額股權獎勵”的興起

在擢升庫克擔任首席執(zhí)行官一職的同時,,蘋果董事會向其授予了一筆“受限股票單位”(restricted stock units),只要庫克達到相應的任職年限,,就可以領取相應的股票獎勵,。作為留任高管、激勵其提升股價的常用手段,,此類獎勵由來已久,,但蘋果公司為庫克制定的激勵方案不同于過往的所有方案,。

限制性股權獎勵的期限通常為三到五年,而“庫克方案”的時間跨度則長達十年,。其獎勵規(guī)模更為令人瞠目:100萬股的蘋果股票(每股376美元),。

2021年8月,在那次令人難忘的董事會會議召開10周年之際,,上述獎勵發(fā)放完畢,。經(jīng)過股票分割,最初的100萬股股票變成了2800萬股(盡管庫克實際并未獲得這么多股票,,后文再做討論),,但截至最后一天,他在整個歸屬期限內(nèi)獲得的股票價值已經(jīng)超過40億美元(準確的說是4159519189美元),。(蘋果拒絕對本文發(fā)表任何評論,。)

過去,我們也見過一些在當時被視為“天價”的限制性股票授予計劃,。20世紀90年代,,可口可樂(Coca-Cola)的首席執(zhí)行官郭思達(Roberto Goizueta)和惠普(Hewlett-Packard)的首席執(zhí)行官卡莉·菲奧莉娜分別獲得了價值約8000萬美元的股權獎勵,一時成為頭條新聞,。(在郭思達的股權激勵等待期內(nèi),,可口可樂的股價實現(xiàn)上漲,而在菲奧莉娜的股權激勵等待期內(nèi),,受互聯(lián)網(wǎng)泡沫破滅影響,,惠普的股價出現(xiàn)暴跌。)然而在庫克獲授的股權獎勵面前,,上述二人就是“小巫見大巫”了,。實際上,庫克的薪酬方案重新定義了限制性股票的授予方式,?!缎匠昱c福利雜志》(Journal of Compensation and Benefits)進行的一項綜合研究表明,“庫克方案”實際上拉開了“巨額股權獎勵”時代的序幕,。不僅今年,,近年來,在收入最高的首席執(zhí)行官排行榜上,,每年的前幾名都是那些領著巨額股權獎勵的首席執(zhí)行官,。

面對8位數(shù)、9位數(shù)的高額薪酬,,懷疑者有之,、嫉妒者有之,憤怒者也有之,。在巨額股權獎勵風行的時代,,人們不禁會問兩個問題:其一,,支付巨額股權獎勵是否是件好事?其二,,這些巨額數(shù)字究竟意味著什么,?具體來說,我們是否了解首席執(zhí)行官們到底賺了多少錢,?要想回答這兩個問題,,最好的方法就是研究一下巨額股權獎勵的鼻祖——蒂姆·庫克的薪酬方案。

對于第一個問題——“巨額獎勵是否是件好事”,,答案十分明顯,,“要看情況”。不同的股權獎勵方案可能大有不同,,關鍵要看細節(jié),。與之前所有的限制性股權獎勵方案一樣,按照庫克方案,,他能夠拿到多少獎勵最初也是取決于其任職時間,。只要在歸屬期內(nèi)一直在該公司工作,,受獎勵方就可以獲得相應的股權獎勵,。即便公司股票因為首席執(zhí)行官不稱職而出現(xiàn)下跌,這些股票依然有其價值,。而且通常這些股權獎勵并不計算在工資,、獎金和津貼之內(nèi)。簡而言之,,最初的限制性股權獎勵在留住高管方面確實有其作用,,但在其他方面的激勵效果則并不明顯。

在庫克升任首席執(zhí)行官的第二年,,蘋果董事會將其薪酬方案升級到了2.0版,,加入了業(yè)績要求(據(jù)公司稱,此舉是應庫克要求而為),。彼時,,庫克尚未開始領取股票獎勵。根據(jù)修改后的方案,,從2013年開始,,約三分之一的獎勵改為浮動獎勵,根據(jù)蘋果相對于標準普爾500指數(shù)(S&P 500)的股東總回報(total shareholder return)確定,。也就是說,,蘋果公司的業(yè)績表現(xiàn)出色不會給庫克帶來更多的股權獎勵,但如果蘋果的股東總回報未能進入標準普爾指數(shù)(S&P)的前三分之一,,則庫克當年所能夠獲得的股權獎勵將相應減少,,甚至可能無法得到這部分股票,。

扣減股權獎勵的情況僅在2013年出現(xiàn)過一次。因此,,庫克最終獲得了2780萬股蘋果股票(如果庫克達成所有獎勵指標,,他從蘋果公司獲得的股權獎勵最多為2800萬股)。

巨額股權獎勵是好事嗎,?一筆巨款,,按三年發(fā)放,從某種意義上說,,與贈送也差不了多少,。有時,為了從其他公司挖人來自己公司做首席執(zhí)行官,,企業(yè)必須給出此類獎勵,,因為這些人在自己原來的崗位上就享受著這種獎勵,只有這樣才可以彌補他們的損失,,但這種獎勵所能夠起到的激勵作用依然十分有限,。相比之下,如果獎勵期限可以達到5年到10年,,并且給予業(yè)績一定權重(權重大于庫克方案更好),,那么首席執(zhí)行官就更有做長遠打算的動力。以庫克為例,,在該筆獎勵的激勵之下,,他證明了自己不僅能夠繼承喬布斯的衣缽,還可以在此基礎之上再上一層樓,。

看到像庫克這樣并非公司創(chuàng)始人卻依靠薪酬成為億萬富豪的首席執(zhí)行官,,有些觀察人士感覺十分憤怒。要對此類首席執(zhí)行官作出評價,,我們要看看他們?yōu)楣蓶|帶來了多少收益,。在庫克治下,蘋果的市值增加了22萬億美元,。他在擔任首席執(zhí)行官一職期間所獲得的股權獎勵及其他形式報酬(工資,、獎金、津貼)加起來只相當于蘋果市值增加部分的不到0.1%,。從這種角度來看,,很難說蘋果的股東們這筆交易做得不劃算。

前面我們提到的第二個問題是,,如此巨額的獎勵究竟意味著什么,,尤其是我們能否從中了解到他們究竟賺了多少錢。答案非常簡單:不能,。不要相信這些數(shù)字,。這些數(shù)字幾乎必然錯誤,,如果沒錯反而只是巧合。

下面我們說一下原因,,根據(jù)會計準則和美國證券交易委員會(SEC)規(guī)則,,企業(yè)需要報告高管(例如庫克)所獲得的股權獎勵的價值,金額則由股票數(shù)量乘以獲授股票當日的股價得出,。以庫克為例,,他所獲得的股權獎勵的價值為3.762億美元。加上工資,、獎金和津貼,,2011年,在全美各大媒體的頭條報道中,,他的薪酬都是3.78億美元,,一舉成為美國當年薪酬最高的首席執(zhí)行官。在蘋果提交給美國證券交易委員會的文件中,,他的薪酬也將一直定格在這一數(shù)字之上,。

這種算法看起來精確,但只是對未來數(shù)年都無從知曉的數(shù)額的估算,,而且可能最后錯得非常離譜,。自2011年以來,股權獎勵機制變得越發(fā)復雜,,有時會與多個具體業(yè)績指標掛鉤,,在估值時還會用上令人頭暈目眩的統(tǒng)計技術,但原有的問題并未改變,。

庫克的例子就很能夠說明問題。投資者無法輕易了解庫克從股權獎勵中獲取了多少收益,,但過去十年的美國證券交易委員會文件報告了相關數(shù)據(jù),。此類數(shù)據(jù)甚少在媒體公布,今天我們將在本文中首次披露相關結果,。

從2013年到2021年,,庫克分10批領取了自己的股權獎勵。按照他領取股權獎勵當日的股價計算,,所有股權獎勵的總價值為17億美元,,較蘋果委托書中披露的獎勵價值高出四倍。

如上所述,,如果按照他在2021年8月收到最后一筆股權獎勵時的股價計算,,這些股票的價值將超過40億美元,現(xiàn)在的價值甚至更高,。但是庫克并未將這些股票都留下來,。事實上,,他只留下了其中11%。

其余的股票去哪了呢,?按照法律規(guī)定,,蘋果需要代庫克扣稅,因此,,庫克在歸屬期間獲得的大多數(shù)股權獎勵從未真正進入過他的賬戶,,有52%的股權獎勵直接從蘋果公司劃給了稅務部門。在剩余的股票中,,庫克出售了約四分之三,,獲得了7.39億美元的收益。

回過頭來看,,從財務角度說,,拋售蘋果股票似乎是一個嚴重失誤。但庫克的做法不過是遵循了許多首席執(zhí)行官,、公司創(chuàng)始人都在采用的策略,,那就是不要把所有資產(chǎn)都放在一個籃子里,他們明白,,將絕大部分凈資產(chǎn)投資于單一資產(chǎn)是一種不明智的選擇,。為免在減持公司股票時違反內(nèi)幕交易規(guī)則,他們會向美國證券交易委員會提交一份股票定期出售計劃,。由于我們不清楚庫克的投資情況,,所以無法得知他是否因為拋售蘋果股票而犧牲了大量財富,但是要想取得比持有蘋果股票更高的收益率,,恐怕只有那種“神仙”級別的投資組合才有可能做到,。

想弄清楚這些并非易事,由此也引出了巨額股權獎勵報告機制的另一問題,。投資者很關心首席執(zhí)行官資產(chǎn)的具體情況,。如果某位首席執(zhí)行官的凈資產(chǎn)幾乎全部都投資了公司股票,那么投資者可能會認為他是一位對公司“全心投入”的管理者,,否則就可能會認為他對風險過于抵觸,,不愿意冒險把所有的雞蛋都放在同一個籃子里。每年的股東委托書都會對首席執(zhí)行官的持股情況進行報告,,但這還并非故事的全貌,,要想了解首席執(zhí)行官賣出了多少獲授股票,以及通過出售股票賺取了多少錢,,我們需要對相關的美國證券交易委員會文件進行梳理,,還要制作一個電子表格,這種事沒有多少投資者會做。

在報告巨額股權獎勵的數(shù)額時,,既可能過高,,也可能過低。對庫克所獲獎勵的估值屬于嚴重低估,,但對其他一些人則屬于嚴重高估,。羅恩·約翰遜就是一個明顯的例子,與庫克相比,,約翰遜的例子充滿諷刺意味,。2011年,憑借巨額獎勵,,庫克成為當年美國薪酬最高的首席執(zhí)行官,,而作為彭尼公司(J.C. Penney)的新任首席執(zhí)行官,約翰遜憑借5320萬美元的薪酬(其中5260萬美元是巨額限制性股票)在這一榜單中排名第四位,。相關獎勵在他上任首日便已經(jīng)全額發(fā)放,,在他出名短暫的任期內(nèi),約翰遜一直持有這些(稅后)股票,。17個月后,,在董事會解雇他時,該公司的股價已經(jīng)暴跌了50%,,他的獎勵的價值也隨之縮水,。此后數(shù)年,彭尼公司一直在苦苦掙扎,,并于2020年根據(jù)《美國破產(chǎn)法》第11章申請破產(chǎn),。

諷刺的是,在加入彭尼公司之前,,約翰遜是蘋果公司的高管,,一手打造了蘋果極為成功的零售業(yè)務體系。在庫克出任首席執(zhí)行官后不久,,他就從蘋果跳槽到了彭尼公司,。為彌補約翰遜因為離開蘋果而放棄的股權獎勵,彭尼公司給了他一筆巨額獎金,。然而這卻成了一筆雙輸?shù)慕灰住H绻s翰遜未在歸屬期限結束前離開蘋果,,他所持有的股票的市值現(xiàn)在將達到11億美元,。

庫克的新薪酬方案

可以獲授8位數(shù)、9位數(shù)巨額股權獎勵的首席執(zhí)行官寥寥無幾,,但由于他們在首席執(zhí)行官薪酬排行榜中常年占據(jù)前排位置,,自然吸引了更多關注,也引發(fā)了外界監(jiān)管首席執(zhí)行官過高薪酬的呼聲,。而蒂姆·庫克,,作為巨額股權獎勵的鼻祖,,憑借蘋果過去十年中的非凡表現(xiàn),仍然是證明巨額薪酬“物有所值”的最有力的論據(jù)之一,。

但事情并未到此結束,,因為現(xiàn)在,他需要再次證明這種巨額股權獎勵的合理性,。2021財年,,蘋果董事會再次授予庫克一筆價值8230萬美元的巨額股權獎勵,預定在2023年到2025年發(fā)放,,待全部獎勵發(fā)放完畢時,,庫克將年滿65歲。

如果庫克能夠重復甚至接近他過去的業(yè)績表現(xiàn),,他將為巨額獎勵的合理性提供強有力的證明,,說明給予巨額獎勵可以帶來好的結果。但如果他的表現(xiàn)明顯未達預期,,則會落人口實,,批評者們能夠更理直氣壯地說,巨額獎勵只會給那些幸運的首席執(zhí)行官帶來財富,。對庫克而言,,要想達到自己過去的水準頗為不易。在他首次獲授股權獎勵的十年間,,標準普爾500指數(shù)的股東總回報率達到了驚人的366%,,而蘋果則更為驚人,達到了1197%,。

庫克能否重現(xiàn)這一壯舉,?蘋果的股東以及各地等著領取巨額獎勵的高管們都在祈禱,希望他可以再創(chuàng)輝煌,。(財富中文網(wǎng))

譯者:梁宇

審校:夏林

Steve Jobs had been wheeled into the boardroom for what would be the Apple director’s last meeting of his life. It was Aug. 24, 2011. Chief Operating Officer Tim Cook and CFO Peter Oppenheimer made presentations on the company’s latest progress. Then Jobs, weakened by pancreatic cancer and speaking from his wheelchair, asked everyone but the outside directors to leave the room. Once they had, he said he could no longer carry out the duties of CEO. As expected, he recommended that Cook succeed him. The board passed the necessary resolutions. Jobs stayed for lunch, after which the directors hugged him in turn, and he was driven home. He died six weeks later.

That dramatic scene, chronicled by Walter Isaacson in his Jobs biography, marked a milestone in U.S. business history. It was the emotional final farewell of an all-time great entrepreneur and innovator. Against such a momentous backdrop, the board’s formalities in transferring power surely seemed insignificant. It turned out, however, that one of the board’s actions that day—giving Cook a new pay package—would prove far more important than it seemed at the time.

Cook's compensation package arguably played a role in making Apple the world’s most valuable company. It made Tim Cook a billionaire. More broadly, it changed CEO pay profoundly, and its influence is still expanding. As this year’s proxy season unfolds, all the most eye-popping as-reported CEO pay packages—Warner Bros. Discovery CEO David Zaslav’s $247 million, Amazon CEO Andy Jassy’s $213 million, Intel CEO Pat Gelsinger’s $179 million, and many more—can trace their lineage to that board meeting more than a decade ago.

The rise of the “mega-grant”

When the board promoted Cook to CEO, it gave him a grant of “restricted stock units” representing Apple shares that he would receive on future dates so long as he was still employed. Such grants have long been a common device for retaining executives and incentivizing them to raise the stock price—but this was unlike any that had come before.

Restricted stock awards typically vest over three to five years. This one spanned 10 years. Even more remarkable was the grant’s breathtaking size: one million shares of a stock that was trading at $376 a share.

The grant’s vesting schedule ended last August, on the 10th anniversary of that unforgettable board meeting. Through stock splits, the original million shares had become 28 million shares, though Cook didn’t get quite that many, as we shall see. Still, on the grant’s final day, the shares he had received over the grant’s life were worth more than $4 billion—$4,159,519,189, to be exact. (Apple declined to make any comment for this article.)

Previous restricted-stock grants were considered big in their time. In the 1990s, Coca-Cola CEO Roberto Goizueta and Hewlett-Packard CEO Carly Fiorina made headlines when each received grants valued at about $80 million. (The price of Coke's shares rose during the vesting period for Goizueta's grant, while HP's stock plunged in the dot-com bust as Fiorina's grant was vesting.) Cook’s grant was so much larger, however, that in effect it reconceived the restricted stock grant. A comprehensive study in the Journal of Compensation and Benefits identifies Cook’s grant as launching the era of the “mega-grant.” Rankings of the highest-paid CEOs in any recent year, not just this year, are topped by mega-grant recipients.

Eight- and nine-figure pay numbers spark disbelief, envy, and outrage. In the age of the mega-grant, two important questions immediately arise: Are such giant awards a good thing? And when we read the massive figures, what do they mean—specifically, are we learning how much money CEOs really make? The best way to answer both questions is to examine the proto-mega-grant, Tim Cook’s.

The answer to the first question—whether today’s mammoth awards are good—is an emphatic “That depends.” Stock grants are infinitely variable; details matter. Cook’s grant, like virtually all restricted-stock grants before his, was initially time-based. The recipient had only to stay employed at the company through the vesting schedule to get the shares. Even if the price went down through CEO incompetence, the shares were still worth something, and they were typically awarded on top of salary, bonus, and perks. Bottom line: Restricted stock 1.0 was effective at retention but otherwise not a great incentive.

In Cook’s second year as CEO the board moved to version 2.0, adding a performance requirement to his grant (at his request, the company says). Vesting hadn’t yet begun. Under the revised plan, starting in 2013 about one-third of his grant would be based on Apple’s total shareholder return (TSR) relative to the S&P 500. Great performance wouldn’t get him any more shares, but if Apple’s TSR wasn’t in the top third of the S&P, he could get fewer or no shares that year.

The penalty took effect just once, in 2013. As a result, Cook ultimately received 27.8 million shares of the potential maximum 28 million.

So are mega-grants a good thing? A huge grant with three-year time-based vesting is hard to defend; it’s little more than a gift. Sometimes it has to be offered to land an outsider CEO who’s forfeiting a similar grant from a previous employer, but it’s still a subpar incentive. By contrast, a five- to 10-year grant with at least partial performance-based vesting—though one featuring a heavier performance component than in Cook’s plan would be better—forces a CEO to think long-term. In Cook’s case, the grant incentivized him to show he could do more than just ride Jobs’ momentum.

Some observers are outraged that a non-founder CEO could become a billionaire entirely through pay, as Cook did. The way to judge such CEOs is against the fortunes of the shareholders. With Cook at the helm, Apple’s market value has increased by $2.2 trillion. His stock grant plus all the other forms of compensation he has received in his years as CEO (salary, incentive pay, perks) have in total brought him less than 0.1% of that amount. It’s hard to argue that the shareholders got a bad deal.

The second question asks what the reported pay of mega-grant recipients tells us, specifically whether we’re learning how much money they’re getting. The answer to that one is simple: No. Don’t believe those numbers. They’re almost certainly wrong, and if they’re right, it’s only by coincidence.

Here’s why: Accounting standards and SEC rules require that companies report the value of a stock grant like Cook’s by simply multiplying the number of shares by the share price on the date of the grant. In Cook’s case, the result was $376.2 million. Add his salary, incentive pay, and perks, and his 2011 pay was reported in headlines nationwide as $378 million, the largest pay package of any CEO in America that year. In Apple’s SEC-filed documents, the value of his grant would never be reported as any other amount.

But such valuations, seemingly precise, are estimates of amounts that won’t be known for years—and the estimates may turn out to be radically wrong. Stock grants have grown far more complex since 2011, sometimes linked to multiple specific performance measures and valued using head-spinning statistical techniques, but the problem hasn’t changed.

Cook’s grant is an illuminating example. Investors cannot easily find the value of what he received from his grant, but SEC filings over the past decade, rarely publicized in the media, report the data. The result is revealed here for the first time.

Cook received his shares in 10 tranches from 2013 to 2021. With all shares valued at their market price on the day he received them, they were worth $1.7 billion—over four times more than the value of the grant as reported in Apple’s proxy statement.

As noted above, those shares would have been worth over $4 billion on the day he received his last tranche, in August 2021, and would be worth even more now. But Cook didn’t keep them all. In fact, he kept only about 11% of them.

What happened to the rest? He never saw most of the shares he was awarded during the years of his grant; Apple withheld them for taxes, as required by law. As a result, 52% of his grant went directly from Apple to the tax authorities. Of the remaining shares, Cook sold three-quarters of them, receiving proceeds of $739 million.

In retrospect, dumping all those Apple shares may seem like an egregious personal finance blunder. But Cook was following a strategy used by many CEOs and founders who realize it’s imprudent to hold the vast majority of their net worth in a single asset. They file a plan with the SEC under which they sell shares on a regular schedule, enabling them to reduce their exposure to company stock without violating insider trading rules. Whether Cook sacrificed significant wealth by selling all that Apple stock is unknowable since we don’t know how he invested the proceeds—though it would take a superstar portfolio to have outperformed Apple.

Figuring all this out is hard work, which exposes another problem with mega-grant reporting. Investors care about the details of a CEO’s wealth. A CEO who holds virtually all their net worth in company stock could be seen by investors as an utterly devoted manager, or could be seen as too risk-averse, unwilling to take chances with the basket holding all the CEO’s eggs. A CEO’s holding of company stock is reported in the annual proxy statement, but that’s only half the story: Finding data on how many shares a mega-grant recipient didn’t keep, and the proceeds from selling them, requires combing through SEC documents and building a spreadsheet—not something many investors will do.

The errors in reporting mega-grants’ values can be wrong in either direction. The value of Cook’s grant was drastically understated, but other grants have been hugely overstated. A notable example—rich with irony when compared with Cook’s—is that of Ron Johnson. When Cook’s mega-grant made him America’s highest-paid CEO in 2011, Johnson ranked No. 4 as JCPenney’s new CEO, with total pay of $53.2 million; of that amount, $52.6 million represented a mega-grant of restricted stock. His grant vested in full on his first day at work, and he held the shares (after tax withholding) through his famously brief tenure. When the board fired him after 17 months, the stock had plunged 50%—and so had the value of his grant. Penney struggled on for years thereafter and filed for Chapter 11 bankruptcy in 2020.

As for the irony: Before joining Penney, Johnson was an Apple executive, the mastermind who built the company’s highly successful retail business. He left Apple for Penney shortly after Cook became CEO. Penney gave Johnson that mega-grant to compensate him for forfeiting unvested grants at Apple. It was an unfortunate trade. Had Johnson stayed at Apple long enough for the grants to vest, his shares would today be worth $1.1 billion.

Cook's new pay package

Mega-grants of eight or nine figures are still rare. But because they fill the top positions on lists of the highest-paid CEOs, those CEOs attract extra attention and fuel cries to regulate exorbitant CEO pay. Tim Cook, his original mega-grant, and Apple’s extraordinary performance over the past decade remain one of the strongest arguments that massive pay can be worth every cent.

But the case isn’t closed—because now he’ll have to prove it all over again. Apple’s board gave Cook another mega-grant in the company’s fiscal 2021. It’s valued at $82.3 million with vesting scheduled in 2023 through 2025, when Cook will reach age 65.

If Cook can reprise or even approach his past performance, he will powerfully strengthen the argument that mega-grants make sense, and that the flowering of such giant awards is a good thing, not a bad thing. But if he falls significantly short, critics will argue that such grants merely heap riches on CEOs who get lucky. Matching his own record will be staggeringly hard. The S&P 500 delivered a stunning total shareholder return of 366% in the decade of his first grant, and Apple whomped it with a TSR of 1,197%.

Can Cook possibly repeat that achievement? Apple's shareholders—and aspiring mega-grant recipients everywhere—are praying that he can.