拉夫?勞倫喜歡講他在服裝行業(yè)的早期經(jīng)歷,。那是在1967年,。他設(shè)計(jì)了一些領(lǐng)帶,,想以Polo這個(gè)他新選擇的品牌名稱,賣給曼哈頓的多家商店,。這些領(lǐng)帶比多數(shù)領(lǐng)帶更寬,,使用的也不是傳統(tǒng)面料。50多年后,,他向一群投資者和華爾街分析師回憶這段經(jīng)歷時(shí)說(shuō),,他特別希望能把這些領(lǐng)帶賣給布魯明戴爾百貨店,這是“美國(guó)最熱門的百貨店”,。布魯明戴爾百貨店的采購(gòu)員說(shuō)他很喜歡這些領(lǐng)帶,,只要?jiǎng)趥惔饝?yīng)兩個(gè)條件他就買下這些領(lǐng)帶:把領(lǐng)帶的寬度做窄一些,并把領(lǐng)帶背面的商標(biāo)更換成布魯明戴爾百貨店的標(biāo)志,。他說(shuō):“我真得很想賣給布魯明戴爾百貨店,。”但面對(duì)這次機(jī)會(huì),,勞倫選擇了拒絕,。他說(shuō):“我不想改領(lǐng)帶的設(shè)計(jì),于是在拒絕之后,,我離開(kāi)了那里,。當(dāng)時(shí)我兩腿發(fā)軟?!?/font>

六個(gè)月后,,布魯明戴爾百貨店打電話同意買下他的領(lǐng)帶。

這成為了勞倫的人生轉(zhuǎn)折點(diǎn),。他告訴華爾街的分析師:“如果我改了領(lǐng)帶的設(shè)計(jì),,我今天就不會(huì)站在這里?!彼麖倪@段經(jīng)歷中得到了重要的啟示:“相信自己,。”

這個(gè)信念在這位白手起家的億萬(wàn)富翁的事業(yè)中發(fā)揮了巨大的作用,,讓他成為在世的最成功的時(shí)尚設(shè)計(jì)師,。他的成功源自他自創(chuàng)的品牌。這個(gè)品牌的歷史可以追溯到布魯明戴爾百貨店給他打電話的那一天,。除了Polo以外,,他豐富了品牌組合,包括以他自己的名字命名的品牌,,產(chǎn)品種類也從領(lǐng)帶增加到男裝,、女裝、童裝,、飾品,、家具,、餐廳、咖啡等,。他一手締造的這個(gè)品牌,,其規(guī)模和業(yè)務(wù)范圍是業(yè)內(nèi)前所未有的。

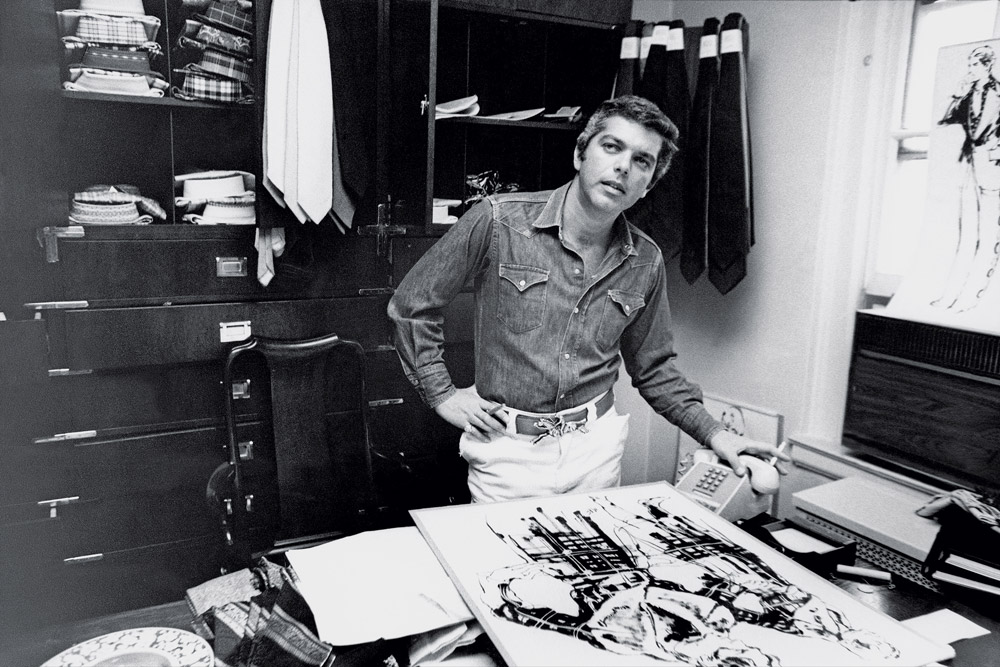

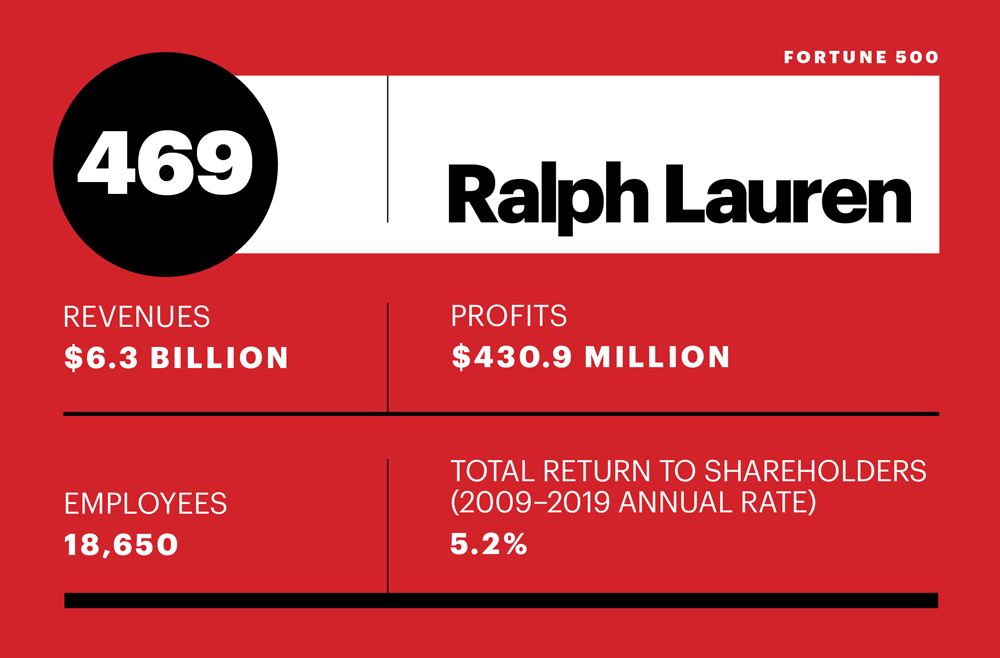

拉夫勞倫公司(Ralph Lauren)是《財(cái)富》美國(guó)500強(qiáng)公司中使用在世創(chuàng)始人的姓名作為名稱的兩家公司之一,,另外一家是嘉信理財(cái)(Charles Schwab),。(為避免混淆,我們以拉夫勞倫公司稱呼公司,,以勞倫稱呼創(chuàng)始人,。)公司向美國(guó)證券交易委員會(huì)提交的年度申報(bào)文件,以其執(zhí)行董事長(zhǎng)身穿舊牛仔上衣,、戴著皮手套和一頂牛仔帽的照片作為封面,。它可能是唯一一家這樣做的公司。但是,,為什么不呢,?勞倫本人、拉夫勞倫這個(gè)品牌和公司三者是密不可分的,。

現(xiàn)年80歲的勞倫已經(jīng)有權(quán)利慶祝自己的勝利,,事實(shí)上,在今年2月,,他剛剛擺脫了一場(chǎng)由他自己造成的品牌價(jià)值危機(jī),,但新冠疫情又令公司的業(yè)務(wù)遭到重創(chuàng)。在短短三個(gè)月內(nèi),,由于實(shí)體店銷售全部停止,,公司股價(jià)從115美元下跌到70美元。(公司拒絕高管接受采訪,。該公司表示:“我們團(tuán)隊(duì)正專注于保護(hù)團(tuán)隊(duì)的安全和健康,,保證我們?cè)谶@場(chǎng)危機(jī)當(dāng)中和危機(jī)過(guò)后都能保持優(yōu)勢(shì)地位?!保?

現(xiàn)在,,勞倫在步入90歲高齡的過(guò)程中,面臨著三重威脅:帶領(lǐng)他的夢(mèng)幻品牌度過(guò)這段可怕的疫情,,證明電子商務(wù)對(duì)于該傳奇奢侈品牌而言是可行的,,并繼續(xù)發(fā)展該品牌,吸引千禧一代和Z世代,,而不只是吸引他們的父母。

與公司的業(yè)務(wù)一樣,,應(yīng)對(duì)這場(chǎng)挑戰(zhàn)的擔(dān)子大都落在了勞倫肩上,。他持有公司大部分股份,,所以擁有絕對(duì)控股權(quán)。雖然公司近幾年聘請(qǐng)了兩位外部CEO,,但從來(lái)沒(méi)有人懷疑過(guò)誰(shuí)才是公司真正的主事人,。2015年,公司宣布一位新高管上任之后,,勞倫給全體員工發(fā)了封信,,里面寫到:“拉夫勞倫公司是我一手創(chuàng)辦、發(fā)展和熱愛(ài)的公司,?!苯裉欤視?huì)像過(guò)去近50年一樣,,繼續(xù)領(lǐng)導(dǎo)公司前進(jìn),。我不會(huì)下臺(tái),也不會(huì)退縮,。我要勇敢向前,。”

接下來(lái),,無(wú)論成敗都將系于勞倫一身,。

一個(gè)成熟的品牌

要了解拉夫勞倫公司的現(xiàn)狀,需要從該品牌如日中天的時(shí)候說(shuō)起,。從2010年至2015年,,公司營(yíng)收激增53%,達(dá)到76億美元,。其他公司可能有過(guò)未達(dá)到營(yíng)收目標(biāo)或者嚴(yán)重庫(kù)存混亂等問(wèn)題,,但拉夫勞倫公司從未出現(xiàn)過(guò)這樣的情況。在公司盈利的情況下,,勞倫依舊在兜售一個(gè)不現(xiàn)實(shí)的理想化世界,。2000年至2014年期間曾任公司二把手的羅杰?法拉赫說(shuō):“他的腦子里總是像在放電影一樣,里面裝著各種各樣的創(chuàng)意,,從產(chǎn)品,、門店到營(yíng)銷和展示廳,應(yīng)有盡有,?!崩?勞倫不止設(shè)計(jì)服裝。他還導(dǎo)演電影,,創(chuàng)建了一個(gè)令人難以抗拒的平行宇宙,,讓人們可以逃離現(xiàn)實(shí)。他甚至就活在那個(gè)世界里,,或者似乎是這樣,。他在科羅拉多州有一座占地19,000英畝的農(nóng)場(chǎng),;在紐約貝德福德有莊園;在長(zhǎng)島有一座歷史悠久的海濱別墅,;他還收藏有全世界最優(yōu)雅,、被完美修復(fù)的汽車,過(guò)去幾十年,,這些都曾經(jīng)是他營(yíng)銷宣傳的主題,。正如他曾經(jīng)說(shuō)過(guò):“我做的不是衣服,而是不同的世界,?!?/font>

零售顧問(wèn)史蒂芬?丹尼斯表示,在2015年之前,,公司面臨的問(wèn)題是:“作為一個(gè)成熟的品牌,,從哪里尋找新的增長(zhǎng)點(diǎn)?”拉夫勞倫公司的答案是找到那些正在增長(zhǎng)的銷售渠道,。與此同時(shí),,曾在諾德斯特龍和電商公司任職的零售業(yè)資深人士凱西?格希表示,“增長(zhǎng)主要來(lái)自折扣市場(chǎng),?!盩.J. Maxx和Marshalls等零售店以及梅西百貨和Dillard’s等中檔百貨公司都表現(xiàn)不錯(cuò)。于是,,拉夫勞倫公司選擇與這些渠道合作,。

其中最重要的梅西百貨曾占到公司總銷售額的12%。梅西百貨的時(shí)任CEO特里?蘭格倫說(shuō)道:“2010年至2014年是梅西百貨史上業(yè)績(jī)最好的一段時(shí)期,。我記得在2010年還是2011年,,拉夫勞倫公司在梅西百貨的銷售額接近10億美元。這對(duì)我們而言是一個(gè)重要的里程碑,?!痹诿肺靼儇涗N售的所有品牌中,拉夫勞倫是“最出類拔萃的,?!?/font>

所以,,拉夫勞倫公司的策略在理論上是明智的,,在實(shí)踐中至少在一段時(shí)間內(nèi)也是成功的。拉夫勞倫公司在尼曼百貨和布魯明戴爾百貨店尤其是勞倫自己位于曼哈頓的旗艦店,銷售旗下的高端品牌,。該旗艦店是一座面積巨大,、富麗堂皇的豪宅,勞倫在1986年對(duì)內(nèi)部進(jìn)行了翻新,。當(dāng)時(shí)裝修人員訂購(gòu)了82,000平方英尺的洪都拉斯紅木。梅西百貨和其他大眾百貨商店讓中產(chǎn)階級(jí)消費(fèi)者,,有機(jī)會(huì)進(jìn)入拉夫?勞倫創(chuàng)建的令人迷醉的世界里,。

但這種策略很快出現(xiàn)了問(wèn)題。

過(guò)度專注增長(zhǎng)的公司管理者擔(dān)心庫(kù)存太少不足以供應(yīng)零售商,,因此他們選擇了增加庫(kù)存,。通常情況下,商家會(huì)以原價(jià)或接近原價(jià)銷售商品,,但零售商包括公司自己的店鋪卻不會(huì)這樣做,。結(jié)果,百貨商店為了清倉(cāng)有時(shí)候會(huì)降價(jià)七成銷售,,有更多商品進(jìn)入了折扣店,。凌亂的貨架和裝在箱子里被無(wú)數(shù)人摸來(lái)摸去的衣服,這還是奢侈品牌嗎,?許多消費(fèi)者給出了否定答案,。這種增長(zhǎng)策略在削弱品牌價(jià)值的同時(shí),實(shí)際上是在破壞增長(zhǎng),。

公司的銷售額從小幅下滑演變成大幅減少,,令人擔(dān)憂的是連續(xù)幾個(gè)季度保持下降趨勢(shì)。在拉夫勞倫公司的歷史上從未出現(xiàn)過(guò)這樣的情況,。過(guò)去20年,,公司年收入曾有過(guò)一次下滑,那是在2008年至2009年毀滅性的金融危機(jī)和經(jīng)濟(jì)衰退期間,,但當(dāng)時(shí)的下降幅度不足1%,。如今,拉夫勞倫公司身上所獨(dú)有的那種魔力正在消退,。

Kate Spade,、Michael Kors、蔻馳(Coach)等奢侈品牌的領(lǐng)導(dǎo)者也曾犯過(guò)同樣的根本性錯(cuò)誤,。他們都發(fā)現(xiàn)了資深零售業(yè)者都知道的一個(gè)規(guī)律:一個(gè)高端品牌一旦按照他們所說(shuō)的“走下神壇”,,要恢復(fù)原有的定位幾乎無(wú)力回天。但規(guī)模龐大的拉夫勞倫公司必須這么做,。

2015年,,當(dāng)公司開(kāi)始走下坡路的時(shí)候,勞倫決定聘請(qǐng)新的管理人員。他幾十年來(lái)一直沒(méi)有設(shè)置首席運(yùn)營(yíng)官,,而是把這份工作交給了經(jīng)驗(yàn)豐富的管理者,,主要是法拉赫。在法拉赫離開(kāi)公司一年以后,,勞倫做出了一個(gè)讓時(shí)尚界震驚的舉動(dòng),,他從蓋璞集團(tuán)(Gap)的Old Navy連鎖品牌挖來(lái)了斯蒂芬?拉爾森。拉爾森對(duì)Old Navy的改造令人印象深刻,,他此前曾在快速時(shí)尚連鎖品牌H&M工作了15年,。為什么聘請(qǐng)一位41歲的快速時(shí)尚專家經(jīng)營(yíng)一個(gè)頂級(jí)品牌?勞倫告訴媒體WWD:因?yàn)樗巴瑫r(shí)兼具了設(shè)計(jì)師的敏感性和建立與發(fā)展一家公司的能力,。這在業(yè)內(nèi)是極其罕見(jiàn)的,。通常情況下,人們只具備一種品質(zhì),?!?/font>

拉爾森很快就找到了公司銷量下滑的關(guān)鍵原因。他向投資者和分析師解釋說(shuō),,公司的產(chǎn)品從訂購(gòu)到擺上貨架“有15個(gè)月前置時(shí)間,。”對(duì)一家季節(jié)性的公司來(lái)說(shuō),,這就是問(wèn)題所在,。例如,這意味著公司還沒(méi)有看到今年春季銷售季的業(yè)績(jī)結(jié)果,,也不知道零售商是否愿意訂購(gòu)下一季的商品,,就必須要訂購(gòu)明年的春裝。

所以公司的管理者通常會(huì)額外訂購(gòu),;因?yàn)樗麄儾恢懒闶凵淘诮衲甏杭镜匿N量,,也不清楚他們明年春季想要什么樣的商品,為了保險(xiǎn)起見(jiàn),,他們只能這樣做,。拉爾森說(shuō),這種“供需不匹配”意味著“我們的原價(jià)零售店在銷售季開(kāi)始之前就已經(jīng)出現(xiàn)了庫(kù)存過(guò)剩,?!睅?kù)存過(guò)剩“增加了促銷壓力,,更糟糕的是,,庫(kù)存會(huì)進(jìn)入價(jià)值零售渠道?!边@也讓購(gòu)物者知道了不要原價(jià)購(gòu)買拉夫勞倫的產(chǎn)品,。

拉爾森的解決辦法是將前置時(shí)間縮短到九個(gè)月,關(guān)閉50家門店(之前一年已經(jīng)關(guān)閉了43家),并裁員約1,200人(之前一年已經(jīng)裁員約750人),。然而,,雖然公司向華爾街承諾終于要認(rèn)真對(duì)待庫(kù)存過(guò)剩問(wèn)題,但他們的認(rèn)真態(tài)度還需要接受考驗(yàn),。公司高管們得回答一個(gè)重要的問(wèn)題:如何處理現(xiàn)有的過(guò)剩庫(kù)存,?

他們沒(méi)有降價(jià)銷售,或者把過(guò)剩庫(kù)存送到折扣零售商銷售,,而是將其付之一炬,。

銷毀剩余庫(kù)存是奢侈品牌的慣例,盡管這會(huì)讓人覺(jué)得心痛,,而且很少會(huì)有人提到這種做法。一把火燒掉過(guò)剩庫(kù)存,,避免高價(jià)商品進(jìn)入折扣銷售渠道,,可以維持品牌的專有性。自從拉夫勞倫公司1997年上市以來(lái),,沒(méi)有證據(jù)證明公司曾經(jīng)這樣做過(guò),。過(guò)剩的庫(kù)存至少可以帶來(lái)一些收入,顯然,,這種誘惑常常令人難以抗拒,。但拉夫勞倫公司卻選擇了銷毀價(jià)值1.55億美元的商品。這表明了一個(gè)頂級(jí)品牌的自律,。

拉爾森清楚,,公司還有很多問(wèn)題急需要解決,比如改造疲軟的電商業(yè)務(wù),、淘汰不暢銷的產(chǎn)品,、繼續(xù)關(guān)店和裁員,以及執(zhí)行其他削減成本的措施等,。但公司的情況正在好轉(zhuǎn),。Piper Sandler公司的分析師艾瑞恩?墨菲說(shuō):“斯蒂芬?拉爾森制定的策略是有效的??上肋h(yuǎn)沒(méi)有機(jī)會(huì)繼續(xù)推行下去,。”

2017年2月,,擔(dān)任CEO剛剛15個(gè)月后,,勞倫宣布他與拉爾森“同意分道揚(yáng)鑣?!彼f(shuō)的理由是“對(duì)于如何發(fā)展公司業(yè)務(wù)的創(chuàng)意部門和面向消費(fèi)者的部分,,兩人存在分歧”,但沒(méi)有提供詳細(xì)的解釋。拉爾森后來(lái)前往服裝公司PVH任總裁,。PVH旗下有Calvin Klein和Tommy Hilfiger等品牌,。他拒絕對(duì)《財(cái)富》雜志的置評(píng)請(qǐng)求做出回應(yīng)。法拉赫認(rèn)為,,有快速時(shí)尚行業(yè)背景的拉爾森,,“并不適合”拉夫勞倫公司。為了讓華爾街安心,,公司在宣布人事變動(dòng)時(shí)特別提到公司會(huì)繼續(xù)執(zhí)行拉爾森提出的策略,。

改造這個(gè)重要的品牌必然會(huì)伴隨著痛苦和混亂。除此之外,,還有另外一個(gè)原因讓勞倫對(duì)這些事件感到困擾,。投資者對(duì)他的“賺錢能力”做出了評(píng)價(jià),但結(jié)果并不理想,。在他宣布辭去CEO一職由拉爾森接任時(shí),,公司股價(jià)暴漲,但在他宣布拉爾森離職的消息后,,股價(jià)應(yīng)聲下跌,。投資者傳達(dá)出來(lái)的信息很殘酷:他們已經(jīng)不再信任勞倫的魔力。

拉夫勞倫公司已聘請(qǐng)?jiān)趯殱嵢温?8年的高管帕特里斯?盧維出任CEO,。盧維雖然沒(méi)有服裝行業(yè)的從業(yè)經(jīng)驗(yàn),,但他在被譽(yù)為“管理學(xué)院”的寶潔管理全球美容美妝業(yè)務(wù),積累非常豐富的經(jīng)驗(yàn),。低調(diào)的盧維目前一直在為拉夫勞倫公司推行基本的策略:繼續(xù)提升品牌,;恢復(fù)可持續(xù)的、贏利性增長(zhǎng),;吸引新一代消費(fèi)者,;增強(qiáng)電商業(yè)務(wù)。

但他的任務(wù)并不輕松,。公司全年銷售額直到2019財(cái)年(截至2019年3月30日)才恢復(fù)增長(zhǎng),。但公司的管理者知道他們的策略取得了勝利,因?yàn)殡m然銷售額仍在下滑,,但利潤(rùn)卻恢復(fù)了增長(zhǎng),。品牌的自律帶來(lái)了回報(bào)。據(jù)零售業(yè)分析公司Edited的數(shù)據(jù)顯示,,公司的折扣率為五年最低,,這意味著消費(fèi)者支付的價(jià)格更高。在截至去年新年前夜的一個(gè)季度,,拉夫勞倫公司的季度利潤(rùn)打破了歷史記錄,。它又恢復(fù)了往日的魔力,。巴克萊(Barclays)的分析師阿德里安娜?易驚嘆道:“這家公司的數(shù)據(jù)完全打破了零售業(yè)的趨勢(shì)?!彼K于可以自信地說(shuō),,拉夫勞倫執(zhí)行了“成功的(但也很難實(shí)現(xiàn)的)品牌價(jià)值提升策略?!痹谶@個(gè)令人喜悅的時(shí)刻,,似乎可以放心地開(kāi)香檳慶祝了。

拉夫?勞倫:從前與現(xiàn)在

拉夫勞倫公司的未來(lái)前景

現(xiàn)在預(yù)測(cè)新冠疫情對(duì)拉夫勞倫公司的影響是徒勞的,,因?yàn)檫@取決于疫情的實(shí)際情況,但目前世界各地的疫情仍不明朗,。今年被拿來(lái)與大蕭條相提并論,,在這樣的背景下,作為價(jià)格高昂且非必要商品的賣家,,拉夫勞倫公司可能要比多數(shù)公司的處境更加艱難,。Cowen的分析師約翰?克南在最近的一篇報(bào)告中寫道:“拉夫勞倫依舊是一個(gè)強(qiáng)大的品牌,它有服裝紡織品行業(yè)最優(yōu)秀的管理團(tuán)隊(duì)之一,?!北M管如此,由于大環(huán)境疲軟,,他還是下調(diào)了對(duì)拉夫勞倫股票的評(píng)級(jí),。

有幾個(gè)因素可以緩解拉夫勞倫公司面臨的困境。公司利潤(rùn)大部分來(lái)自多年來(lái)暢銷的核心產(chǎn)品,,如Polo衫,、國(guó)旗圖案毛衣、針織毛衣等,。這些產(chǎn)品即使今年滯銷,,也可以等到明年繼續(xù)銷售,。凱西?格希表示:“拉夫勞倫并不是一個(gè)潮流品牌。它不是普拉達(dá)(Prada),。這是它的優(yōu)勢(shì),。”墨菲指出,,至少對(duì)拉夫勞倫公司同樣重要的是,,它的“資產(chǎn)負(fù)債表狀況非常穩(wěn)健,長(zhǎng)期負(fù)債幾乎可以忽略不計(jì),?!彼坪鯖](méi)有分析師懷疑拉夫勞倫公司能夠度過(guò)這次危機(jī),并以比多數(shù)競(jìng)爭(zhēng)對(duì)手更強(qiáng)勁的勢(shì)頭走出困境,。

但眼前的危機(jī)不應(yīng)該掩蓋這個(gè)品牌面臨的更大,、更長(zhǎng)遠(yuǎn)的挑戰(zhàn)。雖然它避免了被扔到T.J. Maxx的尾貨箱子里的命運(yùn),,但它已經(jīng)不再是以前的那個(gè)拉夫勞倫,,這是不爭(zhēng)的事實(shí)。不妨看看Interbrand,、凱度(Kantar)和Brand Finance這三家市場(chǎng)營(yíng)銷公司的年度品牌價(jià)值評(píng)估排名,。雖然三家公司使用的評(píng)估方法不同,但評(píng)估結(jié)果顯示的拉夫勞倫在過(guò)去十年的趨勢(shì)完全一致:“拉夫勞倫”品牌的價(jià)值在2014年達(dá)到最高峰,,然后大幅下降,;現(xiàn)在距離最高峰已相去甚遠(yuǎn)。

繼續(xù)向前追溯會(huì)發(fā)現(xiàn)更嚴(yán)重的品牌價(jià)值下降趨勢(shì),。廣告業(yè)巨頭WPP旗下的品牌研究與評(píng)價(jià)公司BAV集團(tuán)表示,,今天美國(guó)成年人評(píng)價(jià)“拉夫勞倫”品牌“高質(zhì)量”、“高價(jià)值”和“獨(dú)特性”的比例,,與2005年相比有所下降,。該公司的調(diào)查顯示,在消費(fèi)者眼中,,認(rèn)為該品牌有差異化特色的比例減少了28%,,認(rèn)同該品牌的相關(guān)性的比例減少了43%。

再向前追溯,通過(guò)一個(gè)非正統(tǒng)的文化影響力指標(biāo)可以看出該品牌價(jià)值的起伏,。據(jù)美國(guó)社會(huì)保障署的數(shù)據(jù)顯示,,在1967年勞倫創(chuàng)業(yè)之初,“勞倫”在當(dāng)年出生的女孩使用的姓名中排在第242位,。1989年,,勞倫登上了《時(shí)代》(Time)周刊封面,,并刊登了多條內(nèi)頁(yè)廣告,用奢華的照片描繪了他所創(chuàng)造的世界,,當(dāng)年“勞倫”的排名上升到第9位,。2018年(有可用信息的最近一年),其排名下降到171位,。

公司的未來(lái)問(wèn)題也與勞倫有關(guān),。法拉赫說(shuō):“繼任者問(wèn)題已經(jīng)讓公司困擾了至少十年之久。我想他只要身體健康就會(huì)繼續(xù)工作下去,,而他的身體一直都很好,。我想他在很長(zhǎng)時(shí)間內(nèi)會(huì)繼續(xù)擔(dān)任公司領(lǐng)導(dǎo)人?!逼渌私鈩趥惖娜艘舱J(rèn)為,,他選擇離開(kāi)公司是難以想象的事情。勞倫最近出版的個(gè)人自傳的作者艾倫?弗魯瑟說(shuō):“拉夫退休,?那他還能有什么娛樂(lè)活動(dòng),?他肯定還會(huì)做目前在做的事情?!备ヴ斏彩且晃荒醒b設(shè)計(jì)師,,同時(shí)也是勞倫的老朋友。

勞倫很早就學(xué)會(huì)了相信自己,,他不會(huì)改變這種信念,。他在公司控股意味著只要他愿意就可以一直留在公司。而這讓一些人感到擔(dān)憂,。格希說(shuō)道:“他會(huì)退休還是只是換個(gè)職位,可能決定公司的成敗,。如果在需要他放手的時(shí)候,,他還繼續(xù)抓住不放,公司的未來(lái)就會(huì)面臨風(fēng)險(xiǎn),?!碧乩A大學(xué)的企業(yè)治理專家查爾斯?艾爾森說(shuō):“沒(méi)有人愿意承認(rèn)自己已經(jīng)垂垂老矣,但有時(shí)候人要服老,。你不能永遠(yuǎn)掌控著公司,。雖然根據(jù)公司股權(quán)結(jié)構(gòu)你可以這樣做,但這會(huì)損害投資者的利益,?!?/font>

這種擔(dān)憂可能為時(shí)尚早。89歲的沃倫?巴菲特經(jīng)營(yíng)伯克希爾-哈撒韋(Berkshire Hathaway)依舊業(yè)績(jī)出色,,他的合伙人查理?芒格已經(jīng)96歲了,,卻仍在為公司做著貢獻(xiàn),。馬上就要97歲的亨利?基辛格依舊筆耕不輟,他的文章還是觀點(diǎn)犀利?,F(xiàn)在人到80歲不見(jiàn)得像以前一樣年邁昏憒,。但人們有這種擔(dān)憂是難免的。

創(chuàng)造世界與單純的設(shè)計(jì)服裝的區(qū)別在于,,世界是可以永久存在的,。到目前為止,拉夫?勞倫和他的公司一直關(guān)系緊密,。但未來(lái),,他們必然要分開(kāi),讓拉夫勞倫公司延續(xù)下去,。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

拉夫?勞倫喜歡講他在服裝行業(yè)的早期經(jīng)歷,。那是在1967年。他設(shè)計(jì)了一些領(lǐng)帶,,想以Polo這個(gè)他新選擇的品牌名稱,,賣給曼哈頓的多家商店。這些領(lǐng)帶比多數(shù)領(lǐng)帶更寬,,使用的也不是傳統(tǒng)面料,。50多年后,他向一群投資者和華爾街分析師回憶這段經(jīng)歷時(shí)說(shuō),,他特別希望能把這些領(lǐng)帶賣給布魯明戴爾百貨店,,這是“美國(guó)最熱門的百貨店”。布魯明戴爾百貨店的采購(gòu)員說(shuō)他很喜歡這些領(lǐng)帶,,只要?jiǎng)趥惔饝?yīng)兩個(gè)條件他就買下這些領(lǐng)帶:把領(lǐng)帶的寬度做窄一些,,并把領(lǐng)帶背面的商標(biāo)更換成布魯明戴爾百貨店的標(biāo)志。他說(shuō):“我真得很想賣給布魯明戴爾百貨店,?!钡鎸?duì)這次機(jī)會(huì),勞倫選擇了拒絕,。他說(shuō):“我不想改領(lǐng)帶的設(shè)計(jì),,于是在拒絕之后,我離開(kāi)了那里,。當(dāng)時(shí)我兩腿發(fā)軟,。”

六個(gè)月后,,布魯明戴爾百貨店打電話同意買下他的領(lǐng)帶,。

這成為了勞倫的人生轉(zhuǎn)折點(diǎn)。他告訴華爾街的分析師:“如果我改了領(lǐng)帶的設(shè)計(jì),,我今天就不會(huì)站在這里,?!彼麖倪@段經(jīng)歷中得到了重要的啟示:“相信自己?!?/font>

這個(gè)信念在這位白手起家的億萬(wàn)富翁的事業(yè)中發(fā)揮了巨大的作用,,讓他成為在世的最成功的時(shí)尚設(shè)計(jì)師。他的成功源自他自創(chuàng)的品牌,。這個(gè)品牌的歷史可以追溯到布魯明戴爾百貨店給他打電話的那一天,。除了Polo以外,他豐富了品牌組合,,包括以他自己的名字命名的品牌,,產(chǎn)品種類也從領(lǐng)帶增加到男裝、女裝,、童裝,、飾品、家具,、餐廳,、咖啡等。他一手締造的這個(gè)品牌,,其規(guī)模和業(yè)務(wù)范圍是業(yè)內(nèi)前所未有的,。

拉夫勞倫公司(Ralph Lauren)是《財(cái)富》美國(guó)500強(qiáng)公司中使用在世創(chuàng)始人的姓名作為名稱的兩家公司之一,另外一家是嘉信理財(cái)(Charles Schwab),。(為避免混淆,,我們以拉夫勞倫公司稱呼公司,以勞倫稱呼創(chuàng)始人,。)公司向美國(guó)證券交易委員會(huì)提交的年度申報(bào)文件,,以其執(zhí)行董事長(zhǎng)身穿舊牛仔上衣、戴著皮手套和一頂牛仔帽的照片作為封面,。它可能是唯一一家這樣做的公司,。但是,為什么不呢,?勞倫本人、拉夫勞倫這個(gè)品牌和公司三者是密不可分的,。

現(xiàn)年80歲的勞倫已經(jīng)有權(quán)利慶祝自己的勝利,,事實(shí)上,在今年2月,,他剛剛擺脫了一場(chǎng)由他自己造成的品牌價(jià)值危機(jī),,但新冠疫情又令公司的業(yè)務(wù)遭到重創(chuàng)。在短短三個(gè)月內(nèi),,由于實(shí)體店銷售全部停止,,公司股價(jià)從115美元下跌到70美元,。(公司拒絕高管接受采訪。該公司表示:“我們團(tuán)隊(duì)正專注于保護(hù)團(tuán)隊(duì)的安全和健康,,保證我們?cè)谶@場(chǎng)危機(jī)當(dāng)中和危機(jī)過(guò)后都能保持優(yōu)勢(shì)地位,。”)

現(xiàn)在,,勞倫在步入90歲高齡的過(guò)程中,,面臨著三重威脅:帶領(lǐng)他的夢(mèng)幻品牌度過(guò)這段可怕的疫情,證明電子商務(wù)對(duì)于該傳奇奢侈品牌而言是可行的,,并繼續(xù)發(fā)展該品牌,,吸引千禧一代和Z世代,而不只是吸引他們的父母,。

與公司的業(yè)務(wù)一樣,,應(yīng)對(duì)這場(chǎng)挑戰(zhàn)的擔(dān)子大都落在了勞倫肩上。他持有公司大部分股份,,所以擁有絕對(duì)控股權(quán),。雖然公司近幾年聘請(qǐng)了兩位外部CEO,但從來(lái)沒(méi)有人懷疑過(guò)誰(shuí)才是公司真正的主事人,。2015年,,公司宣布一位新高管上任之后,勞倫給全體員工發(fā)了封信,,里面寫到:“拉夫勞倫公司是我一手創(chuàng)辦,、發(fā)展和熱愛(ài)的公司?!苯裉?,我會(huì)像過(guò)去近50年一樣,繼續(xù)領(lǐng)導(dǎo)公司前進(jìn),。我不會(huì)下臺(tái),,也不會(huì)退縮。我要勇敢向前,?!?/font>

接下來(lái),無(wú)論成敗都將系于勞倫一身,。

一個(gè)成熟的品牌

要了解拉夫勞倫公司的現(xiàn)狀,,需要從該品牌如日中天的時(shí)候說(shuō)起。從2010年至2015年,,公司營(yíng)收激增53%,,達(dá)到76億美元。其他公司可能有過(guò)未達(dá)到營(yíng)收目標(biāo)或者嚴(yán)重庫(kù)存混亂等問(wèn)題,但拉夫勞倫公司從未出現(xiàn)過(guò)這樣的情況,。在公司盈利的情況下,,勞倫依舊在兜售一個(gè)不現(xiàn)實(shí)的理想化世界。2000年至2014年期間曾任公司二把手的羅杰?法拉赫說(shuō):“他的腦子里總是像在放電影一樣,,里面裝著各種各樣的創(chuàng)意,,從產(chǎn)品、門店到營(yíng)銷和展示廳,,應(yīng)有盡有,。”拉夫?勞倫不止設(shè)計(jì)服裝,。他還導(dǎo)演電影,,創(chuàng)建了一個(gè)令人難以抗拒的平行宇宙,讓人們可以逃離現(xiàn)實(shí),。他甚至就活在那個(gè)世界里,,或者似乎是這樣。他在科羅拉多州有一座占地19,000英畝的農(nóng)場(chǎng),;在紐約貝德福德有莊園,;在長(zhǎng)島有一座歷史悠久的海濱別墅;他還收藏有全世界最優(yōu)雅,、被完美修復(fù)的汽車,,過(guò)去幾十年,這些都曾經(jīng)是他營(yíng)銷宣傳的主題,。正如他曾經(jīng)說(shuō)過(guò):“我做的不是衣服,,而是不同的世界?!?/font>

零售顧問(wèn)史蒂芬?丹尼斯表示,,在2015年之前,公司面臨的問(wèn)題是:“作為一個(gè)成熟的品牌,,從哪里尋找新的增長(zhǎng)點(diǎn),?”拉夫勞倫公司的答案是找到那些正在增長(zhǎng)的銷售渠道。與此同時(shí),,曾在諾德斯特龍和電商公司任職的零售業(yè)資深人士凱西?格希表示,,“增長(zhǎng)主要來(lái)自折扣市場(chǎng)?!盩.J. Maxx和Marshalls等零售店以及梅西百貨和Dillard’s等中檔百貨公司都表現(xiàn)不錯(cuò),。于是,拉夫勞倫公司選擇與這些渠道合作,。

其中最重要的梅西百貨曾占到公司總銷售額的12%,。梅西百貨的時(shí)任CEO特里?蘭格倫說(shuō)道:“2010年至2014年是梅西百貨史上業(yè)績(jī)最好的一段時(shí)期。我記得在2010年還是2011年,,拉夫勞倫公司在梅西百貨的銷售額接近10億美元,。這對(duì)我們而言是一個(gè)重要的里程碑?!痹诿肺靼儇涗N售的所有品牌中,,拉夫勞倫是“最出類拔萃的?!?/font>

所以,,拉夫勞倫公司的策略在理論上是明智的,在實(shí)踐中至少在一段時(shí)間內(nèi)也是成功的,。拉夫勞倫公司在尼曼百貨和布魯明戴爾百貨店尤其是勞倫自己位于曼哈頓的旗艦店,,銷售旗下的高端品牌。該旗艦店是一座面積巨大,、富麗堂皇的豪宅,,勞倫在1986年對(duì)內(nèi)部進(jìn)行了翻新。當(dāng)時(shí)裝修人員訂購(gòu)了82,000平方英尺的洪都拉斯紅木,。梅西百貨和其他大眾百貨商店讓中產(chǎn)階級(jí)消費(fèi)者,,有機(jī)會(huì)進(jìn)入拉夫?勞倫創(chuàng)建的令人迷醉的世界里。

但這種策略很快出現(xiàn)了問(wèn)題,。

過(guò)度專注增長(zhǎng)的公司管理者擔(dān)心庫(kù)存太少不足以供應(yīng)零售商,,因此他們選擇了增加庫(kù)存。通常情況下,,商家會(huì)以原價(jià)或接近原價(jià)銷售商品,,但零售商包括公司自己的店鋪卻不會(huì)這樣做。結(jié)果,,百貨商店為了清倉(cāng)有時(shí)候會(huì)降價(jià)七成銷售,,有更多商品進(jìn)入了折扣店。凌亂的貨架和裝在箱子里被無(wú)數(shù)人摸來(lái)摸去的衣服,,這還是奢侈品牌嗎,?許多消費(fèi)者給出了否定答案。這種增長(zhǎng)策略在削弱品牌價(jià)值的同時(shí),,實(shí)際上是在破壞增長(zhǎng),。

公司的銷售額從小幅下滑演變成大幅減少,令人擔(dān)憂的是連續(xù)幾個(gè)季度保持下降趨勢(shì),。在拉夫勞倫公司的歷史上從未出現(xiàn)過(guò)這樣的情況,。過(guò)去20年,公司年收入曾有過(guò)一次下滑,,那是在2008年至2009年毀滅性的金融危機(jī)和經(jīng)濟(jì)衰退期間,,但當(dāng)時(shí)的下降幅度不足1%。如今,拉夫勞倫公司身上所獨(dú)有的那種魔力正在消退,。

Kate Spade,、Michael Kors、蔻馳(Coach)等奢侈品牌的領(lǐng)導(dǎo)者也曾犯過(guò)同樣的根本性錯(cuò)誤,。他們都發(fā)現(xiàn)了資深零售業(yè)者都知道的一個(gè)規(guī)律:一個(gè)高端品牌一旦按照他們所說(shuō)的“走下神壇”,,要恢復(fù)原有的定位幾乎無(wú)力回天。但規(guī)模龐大的拉夫勞倫公司必須這么做,。

2015年,,當(dāng)公司開(kāi)始走下坡路的時(shí)候,勞倫決定聘請(qǐng)新的管理人員,。他幾十年來(lái)一直沒(méi)有設(shè)置首席運(yùn)營(yíng)官,,而是把這份工作交給了經(jīng)驗(yàn)豐富的管理者,主要是法拉赫,。在法拉赫離開(kāi)公司一年以后,,勞倫做出了一個(gè)讓時(shí)尚界震驚的舉動(dòng),他從蓋璞集團(tuán)(Gap)的Old Navy連鎖品牌挖來(lái)了斯蒂芬?拉爾森,。拉爾森對(duì)Old Navy的改造令人印象深刻,,他此前曾在快速時(shí)尚連鎖品牌H&M工作了15年。為什么聘請(qǐng)一位41歲的快速時(shí)尚專家經(jīng)營(yíng)一個(gè)頂級(jí)品牌,?勞倫告訴媒體WWD:因?yàn)樗巴瑫r(shí)兼具了設(shè)計(jì)師的敏感性和建立與發(fā)展一家公司的能力,。這在業(yè)內(nèi)是極其罕見(jiàn)的。通常情況下,,人們只具備一種品質(zhì),。”

拉爾森很快就找到了公司銷量下滑的關(guān)鍵原因,。他向投資者和分析師解釋說(shuō),,公司的產(chǎn)品從訂購(gòu)到擺上貨架“有15個(gè)月前置時(shí)間?!睂?duì)一家季節(jié)性的公司來(lái)說(shuō),,這就是問(wèn)題所在。例如,,這意味著公司還沒(méi)有看到今年春季銷售季的業(yè)績(jī)結(jié)果,,也不知道零售商是否愿意訂購(gòu)下一季的商品,就必須要訂購(gòu)明年的春裝,。

所以公司的管理者通常會(huì)額外訂購(gòu),;因?yàn)樗麄儾恢懒闶凵淘诮衲甏杭镜匿N量,也不清楚他們明年春季想要什么樣的商品,,為了保險(xiǎn)起見(jiàn),,他們只能這樣做,。拉爾森說(shuō),這種“供需不匹配”意味著“我們的原價(jià)零售店在銷售季開(kāi)始之前就已經(jīng)出現(xiàn)了庫(kù)存過(guò)剩,?!睅?kù)存過(guò)剩“增加了促銷壓力,,更糟糕的是,庫(kù)存會(huì)進(jìn)入價(jià)值零售渠道,?!边@也讓購(gòu)物者知道了不要原價(jià)購(gòu)買拉夫勞倫的產(chǎn)品。

拉爾森的解決辦法是將前置時(shí)間縮短到九個(gè)月,,關(guān)閉50家門店(之前一年已經(jīng)關(guān)閉了43家),,并裁員約1,200人(之前一年已經(jīng)裁員約750人)。然而,,雖然公司向華爾街承諾終于要認(rèn)真對(duì)待庫(kù)存過(guò)剩問(wèn)題,,但他們的認(rèn)真態(tài)度還需要接受考驗(yàn)。公司高管們得回答一個(gè)重要的問(wèn)題:如何處理現(xiàn)有的過(guò)剩庫(kù)存,?

他們沒(méi)有降價(jià)銷售,,或者把過(guò)剩庫(kù)存送到折扣零售商銷售,而是將其付之一炬,。

銷毀剩余庫(kù)存是奢侈品牌的慣例,,盡管這會(huì)讓人覺(jué)得心痛,而且很少會(huì)有人提到這種做法,。一把火燒掉過(guò)剩庫(kù)存,,避免高價(jià)商品進(jìn)入折扣銷售渠道,可以維持品牌的專有性,。自從拉夫勞倫公司1997年上市以來(lái),,沒(méi)有證據(jù)證明公司曾經(jīng)這樣做過(guò)。過(guò)剩的庫(kù)存至少可以帶來(lái)一些收入,,顯然,,這種誘惑常常令人難以抗拒。但拉夫勞倫公司卻選擇了銷毀價(jià)值1.55億美元的商品,。這表明了一個(gè)頂級(jí)品牌的自律,。

拉爾森清楚,公司還有很多問(wèn)題急需要解決,,比如改造疲軟的電商業(yè)務(wù),、淘汰不暢銷的產(chǎn)品、繼續(xù)關(guān)店和裁員,,以及執(zhí)行其他削減成本的措施等,。但公司的情況正在好轉(zhuǎn),。Piper Sandler公司的分析師艾瑞恩?墨菲說(shuō):“斯蒂芬?拉爾森制定的策略是有效的??上肋h(yuǎn)沒(méi)有機(jī)會(huì)繼續(xù)推行下去,。”

2017年2月,,擔(dān)任CEO剛剛15個(gè)月后,,勞倫宣布他與拉爾森“同意分道揚(yáng)鑣?!彼f(shuō)的理由是“對(duì)于如何發(fā)展公司業(yè)務(wù)的創(chuàng)意部門和面向消費(fèi)者的部分,,兩人存在分歧”,但沒(méi)有提供詳細(xì)的解釋,。拉爾森后來(lái)前往服裝公司PVH任總裁,。PVH旗下有Calvin Klein和Tommy Hilfiger等品牌。他拒絕對(duì)《財(cái)富》雜志的置評(píng)請(qǐng)求做出回應(yīng),。法拉赫認(rèn)為,,有快速時(shí)尚行業(yè)背景的拉爾森,“并不適合”拉夫勞倫公司,。為了讓華爾街安心,,公司在宣布人事變動(dòng)時(shí)特別提到公司會(huì)繼續(xù)執(zhí)行拉爾森提出的策略。

改造這個(gè)重要的品牌必然會(huì)伴隨著痛苦和混亂,。除此之外,,還有另外一個(gè)原因讓勞倫對(duì)這些事件感到困擾。投資者對(duì)他的“賺錢能力”做出了評(píng)價(jià),,但結(jié)果并不理想,。在他宣布辭去CEO一職由拉爾森接任時(shí),公司股價(jià)暴漲,,但在他宣布拉爾森離職的消息后,,股價(jià)應(yīng)聲下跌。投資者傳達(dá)出來(lái)的信息很殘酷:他們已經(jīng)不再信任拉爾森的魔力,。

拉夫勞倫公司已聘請(qǐng)?jiān)趯殱嵢温?8年的高管帕特里斯?盧維出任CEO,。盧維雖然沒(méi)有服裝行業(yè)的從業(yè)經(jīng)驗(yàn),但他在被譽(yù)為“管理學(xué)院”的寶潔管理全球美容美妝業(yè)務(wù),,積累非常風(fēng)的經(jīng)驗(yàn),。低調(diào)的盧維目前一直在為拉夫勞倫公司推行基本的策略:繼續(xù)提升品牌;恢復(fù)可持續(xù)的,、贏利性增長(zhǎng),;吸引新一代消費(fèi)者;增強(qiáng)電商業(yè)務(wù),。

但他的任務(wù)并不輕松,。公司全年銷售額直到2019財(cái)年(截至2019年3月30日)才恢復(fù)增長(zhǎng),。但公司的管理者知道他們的策略取得了勝利,因?yàn)殡m然銷售額仍在下滑,,但利潤(rùn)卻恢復(fù)了增長(zhǎng),。品牌的自律帶來(lái)了回報(bào)。據(jù)零售業(yè)分析公司Edited的數(shù)據(jù)顯示,,公司的折扣率為五年最低,,這意味著消費(fèi)者支付的價(jià)格更高。在截至去年新年前夜的一個(gè)季度,,拉夫勞倫公司的季度利潤(rùn)打破了歷史記錄,。它又恢復(fù)了往日的魔力。巴克萊(Barclays)的分析師阿德里安娜?易驚嘆道:“這家公司的數(shù)據(jù)完全打破了零售業(yè)的趨勢(shì),。”她終于可以自信地說(shuō),,拉夫勞倫執(zhí)行了“成功的(但也很難實(shí)現(xiàn)的)品牌價(jià)值提升策略,。”在這個(gè)令人喜悅的時(shí)刻,,似乎可以放心地開(kāi)香檳慶祝了,。

拉夫?勞倫:從前與現(xiàn)在

拉夫勞倫公司的未來(lái)前景

現(xiàn)在預(yù)測(cè)新冠疫情對(duì)拉夫勞倫公司的影響是徒勞的,因?yàn)檫@取決于疫情的實(shí)際情況,,但目前世界各地的疫情仍不明朗,。今年被拿來(lái)與大蕭條相提并論,在這樣的背景下,,作為價(jià)格高昂且非必要商品的賣家,,拉夫勞倫公司可能要比多數(shù)公司的處境更加艱難。Cowen的分析師約翰?克南在最近的一篇報(bào)告中寫道:“拉夫勞倫依舊是一個(gè)強(qiáng)大的品牌,,它有服裝紡織品行業(yè)最優(yōu)秀的管理團(tuán)隊(duì)之一,。”盡管如此,,由于大環(huán)境疲軟,,他還是下調(diào)了對(duì)拉夫勞倫股票的評(píng)級(jí)。

有幾個(gè)因素可以緩解拉夫勞倫公司面臨的困境,。公司利潤(rùn)大部分來(lái)自多年來(lái)暢銷的核心產(chǎn)品,,如Polo衫、國(guó)旗圖案毛衣,、針織毛衣等,。這些產(chǎn)品即使今年滯銷,也可以等到明年繼續(xù)銷售,。凱西?格希表示:“拉夫勞倫并不是一個(gè)潮流品牌,。它不是普拉達(dá)(Prada),。這是它的優(yōu)勢(shì)?!蹦浦赋?,至少對(duì)拉夫勞倫公司同樣重要的是,它的“資產(chǎn)負(fù)債表狀況非常穩(wěn)健,,長(zhǎng)期負(fù)債幾乎可以忽略不計(jì),。”似乎沒(méi)有分析師懷疑拉夫勞倫公司能夠度過(guò)這次危機(jī),,并以比多數(shù)競(jìng)爭(zhēng)對(duì)手更強(qiáng)勁的勢(shì)頭走出困境,。

但眼前的危機(jī)不應(yīng)該掩蓋這個(gè)品牌面臨的更大、更長(zhǎng)遠(yuǎn)的挑戰(zhàn),。雖然它避免了被扔到T.J. Maxx的尾貨箱子里的命運(yùn),,但它已經(jīng)不再是以前的那個(gè)拉夫勞倫,這是不爭(zhēng)的事實(shí),。不妨看看Interbrand,、凱度(Kantar)和Brand Finance這三家市場(chǎng)營(yíng)銷公司的年度品牌價(jià)值評(píng)估排名。雖然三家公司使用的評(píng)估方法不同,,但評(píng)估結(jié)果顯示的拉夫勞倫在過(guò)去十年的趨勢(shì)完全一致:“拉夫勞倫”品牌的價(jià)值在2014年達(dá)到最高峰,,然后大幅下降;現(xiàn)在距離最高峰已相去甚遠(yuǎn),。

繼續(xù)向前追溯會(huì)發(fā)現(xiàn)更嚴(yán)重的品牌價(jià)值下降趨勢(shì),。廣告業(yè)巨頭WPP旗下的品牌研究與評(píng)價(jià)公司BAV集團(tuán)表示,今天美國(guó)成年人評(píng)價(jià)“拉夫勞倫”品牌“高質(zhì)量”,、“高價(jià)值”和“獨(dú)特性”的比例,,與2005年相比有所下降。該公司的調(diào)查顯示,,在消費(fèi)者眼中,,認(rèn)為該品牌有差異化特色的比例減少了28%,認(rèn)同該品牌的相關(guān)性的比例減少了43%,。

再向前追溯,,通過(guò)一個(gè)非正統(tǒng)的文化影響力指標(biāo)可以看出該品牌價(jià)值的起伏。據(jù)美國(guó)社會(huì)保障署的數(shù)據(jù)顯示,,在1967年勞倫創(chuàng)業(yè)之初,,“勞倫”在當(dāng)年出生的女孩使用的姓名中排在第242位。1989年,,勞倫登上了《時(shí)代》(Time)周刊封面,,并刊登了多條內(nèi)頁(yè)廣告,用奢華的照片描繪了他所創(chuàng)造的世界,當(dāng)年“勞倫”的排名上升到第9位,。2018年(有可用信息的最近一年),,其排名下降到171位。

公司的未來(lái)問(wèn)題也與勞倫有關(guān),。法拉赫說(shuō):“繼任者問(wèn)題已經(jīng)讓公司困擾了至少十年之久,。我想他只要身體健康就會(huì)繼續(xù)工作下去,而他的身體一直都很好,。我想他在很長(zhǎng)時(shí)間內(nèi)會(huì)繼續(xù)擔(dān)任公司領(lǐng)導(dǎo)人,。”其他了解勞倫的人也認(rèn)為,,他選擇離開(kāi)公司是難以想象的事情,。勞倫最近出版的個(gè)人自傳的作者艾倫?弗魯瑟說(shuō):“拉夫退休?那他還能有什么娛樂(lè)活動(dòng),?他肯定還會(huì)做目前在做的事情,。”弗魯瑟也是一位男裝設(shè)計(jì)師,,同時(shí)也是勞倫的老朋友,。

勞倫很早就學(xué)會(huì)了相信自己,他不會(huì)改變這種信念,。他在公司控股意味著只要他愿意就可以一直留在公司,。而這讓一些人感到擔(dān)憂,。格希說(shuō)道:“他會(huì)退休還是只是換個(gè)職位,,可能決定公司的成敗。如果在需要他放手的時(shí)候,,他還繼續(xù)抓住不放,,公司的未來(lái)就會(huì)面臨風(fēng)險(xiǎn)?!碧乩A大學(xué)的企業(yè)治理專家查爾斯?艾爾森說(shuō):“沒(méi)有人愿意承認(rèn)自己已經(jīng)垂垂老矣,,但有時(shí)候人要服老。你不能永遠(yuǎn)掌控著公司,。雖然根據(jù)公司股權(quán)結(jié)構(gòu)你可以這樣做,,但這會(huì)損害投資者的利益?!?/font>

這種擔(dān)憂可能為時(shí)尚早,。89歲的沃倫?巴菲特經(jīng)營(yíng)伯克希爾-哈撒韋(Berkshire Hathaway)依舊業(yè)績(jī)出色,他的合伙人查理?芒格已經(jīng)96歲了,,卻仍在為公司做著貢獻(xiàn),。馬上就要97歲的亨利?基辛格依舊筆耕不輟,他的文章還是觀點(diǎn)犀利?,F(xiàn)在人到80歲不見(jiàn)得像以前一樣年邁昏憒,。但人們有這種擔(dān)憂是難免的,。

創(chuàng)造世界與單純的設(shè)計(jì)服裝的區(qū)別在于,世界是可以永久存在的,。到目前為止,,拉夫?勞倫和他的公司一直關(guān)系緊密。但未來(lái),,他們必然要分開(kāi),,讓拉夫勞倫公司延續(xù)下去。(財(cái)富中文網(wǎng))

翻譯:劉進(jìn)龍

審校:汪皓

Ralph Lauren loves to tell a story about his earliest days in the clothing business. It was 1967. He had designed some ties, wider than most and made of unconventional fabrics, and was selling them to a few stores in Manhattan under the new brand name he had chosen, Polo. He especially wanted to sell them to Bloomingdale’s—“the hottest store in America,” he recalled as he told the story to a group of investors and Wall Street analysts more than 50 years later. The Bloomingdale’s buyer said he liked the ties and would buy them if Lauren did two things: make them slightly narrower and remove his own label from the back, replacing it with the Bloomingdale’s label. “I was really dying to sell Bloomingdale's,” he said. But faced with the opportunity, he refused. “I wasn't going to change the ties, and I didn't, and I walked out,” Lauren said. “I thought my legs would crumble.”

Six months later, Bloomingdale’s called and said yes.

That was a turning point in Lauren’s life. “Had I changed that tie, I would not be here today,” he told the Wall Street crowd. And he drew a profound lesson from the experience: “I believed in myself.”

Believing in himself has worked spectacularly well for Lauren, a self-made billionaire and arguably the most successful fashion designer who has ever lived. He built his success on the brand he created, a brand that began its ascent on the day Bloomingdale’s called back. He expanded it beyond the Polo name to include his own name, and beyond ties to embrace men’s, women’s, and children’s clothing, accessories, home furnishings, restaurants, even coffee—a brand of greater scale and scope than the industry had ever seen.

The company is one of only two in the Fortune 500 whose name is simply the first name and last name of a living founder; the other is Charles Schwab. (To avoid confusion, we’ll call the man Lauren, the company RL Corp.) It is quite likely the only company that sends the Securities and Exchange Commission a required annual filing that opens with a full-page photo of the executive chairman on a horse, wearing a beat-up canvas coat, leather gloves, and a cowboy hat. But then, why not? The man, the brand, and the company have always been intertwined.

At age 80 Lauren has earned every right to be enjoying a victory lap, and indeed this past February he had just emerged triumphantly from a self-inflicted crisis in the brand’s value—only for the business then to be hammered by the coronavirus. In three short months the stock has fallen from $115 to $70 as physical sales have ground to a halt. (The company declined to make executives available for interviews, saying, “Our entire team is fully focused on protecting the safety and well-being of our teams and ensuring we are in a position of strength throughout and following this crisis.”)

Now, as he enters his ninth decade, Lauren is facing a triple threat: navigating his dreamy brand through a nightmarish pandemic, proving that e-commerce is a viable path forward for this storied luxury brand, and continuing to develop a brand that is relevant to millennials and Gen Z, not just their parents.

As with everything about his business, this challenge is intensely personal for Lauren. He owns most of his company’s stock and thus holds total control. Though the company has had two outside CEOs in recent years, there has never been much doubt who is really in charge. After RL Corp. announced the arrival of one leader in 2015, Lauren sent all employees a memo that read in part: “The Ralph Lauren Corporation is the Company I founded, nurtured, and love. I will continue to lead it today as I have for almost 50 years. I am not stepping down, nor am I stepping back. I am stepping up.”

Win or lose, whatever happens next, it’s all on him.

****

A mature brand

To understand where RL Corp. is now, you need to go back a few years, to when the brand was riding high. From 2010 to 2015 revenue rocketed 53%, to $7.6 billion. Other companies would miss earnings targets or experience mysterious inventory snafus, but not RL Corp. And while the business churned out profits, Lauren continued to sell an impossibly idealized world. “He’s got a movie running in his head all the time,” explains Roger Farah, Lauren’s No. 2 executive from 2000 to 2014. “Everything emanates from that—the product, the stores, the marketing, the showrooms.” Ralph Lauren doesn’t just design clothes. He directs movies, creating an alternative cosmos that’s an irresistible escape from real life. He even lives there, or seems to. His 19,000-acre Colorado ranch; his manorial estate in Bedford, N.Y.; the weathered beach house on Long Island; his collection of the world’s most elegant, perfectly restored cars—they’ve been running themes in his marketing and publicity for decades. As he once said, “I don’t do shoulders. I do worlds.”

By 2015, says retail consultant Steven Dennis, the question the company was facing was this: “As a mature brand, where do you go for growth?” RL Corp.’s answer was, you go to the channels that are growing. At that time, “growth was largely at the discount end of the market,” says Kathy Gersch, a retail veteran with experience at Nordstrom and e-commerce companies. Stores such as T.J. Maxx and Marshalls were doing well, as were mid-tier department stores such as Macy’s and Dillard’s. So RL Corp. fed those channels.

Macy’s was most important, accounting for 12% of total sales at the time. “The years from 2010 to 2014 were the best years in Macy’s history,” says Terry Lundgren, the chain’s then-CEO. “I remember reaching the billion-dollar mark for Ralph Lauren at Macy’s in 2010 or 2011. It was a huge event for us.” Of all the brands sold at the store, Ralph Lauren was “the most prominent of them all.”

So RL Corp.’s strategy made sense in theory and also in practice, at least for a while. The brand proclaimed its upscale pedigree in Neiman Marcus and Bloomingdale’s, and most emphatically in Lauren’s own flagship store in Manhattan, a vast, old-money mansion that he gutted and renovated in 1986, and for which his decorators ordered 82,000 square feet of Honduran mahogany. Macy’s and other mass-market department stores then enabled middle-class consumers to participate in the heady Ralph Lauren world.

But the strategy soon ran into trouble.

The company’s growth-obsessed managers were afraid of producing too little inventory for those retailers, so, just to be sure, they produced too much. Often it was more merchandise than retailers, including the company’s own stores, could sell at full or near-full prices. As a result, department stores would sometimes have to slash prices 70% in order to clear out the goods, and more of them ended up in the off-price stores. Disheveled racks and bins of pawed-over clothing—this was a luxury brand? For many consumers, no, it was not. By devaluing the brand, the growth strategy was actually killing growth.

Sales fell, first a little, then a lot, and, alarmingly, they kept falling, quarter after quarter. This kind of thing just didn’t happen to Ralph Lauren Corp. Over the previous 20 years, annual revenue had declined only once, in the devastating financial crisis and recession of 2008 and 2009, and the decline was less than 1%. Those magical powers that others lacked were now faltering.

The leaders of Kate Spade, Michael Kors, Coach, and other luxury brands were making the same fundamental errors. All were finding what retail veterans already knew, that once an upscale brand gets “taken downstairs,” as they say, bringing it all the way back up is difficult and rare. Yet for RL Corp., a far larger business than those others, it had to be done.

As the trend lines started turning down in 2015, Lauren decided he needed new management. He hadn’t been the operating chief in decades, having delegated that job to experienced managers, most notably Farah. Now, a year after Farah had left, Lauren stunned the fashion world by bringing in Stefan Larsson from Gap’s Old Navy chain, which he had turned around impressively after 15 years at H&M, the fast-fashion chain. Why a 41-year-old fast-fashion expert to run a prestige brand? Because he “has the sensitivity of design and of building a business and growing companies,” Lauren told WWD. “That’s rare in our business. Usually it’s one or the other.”

Larsson quickly identified a key reason for RL Corp.’s decline. “We have 15 months’ lead time” from ordering merchandise to getting it into stores, he explained to a roomful of investors and analysts. In a seasonal business, that’s trouble. It meant, for example, that the company had to order next spring’s assortments before seeing the results of this spring’s selling season—and well before retailers were willing to order next season’s merchandise.

That’s why the company’s managers were always ordering too much; with no idea how much retailers would sell this season, let alone what they’d want next season, they had to play it safe. That “mismatch between demand and supply,” Larsson said, meant “our full-price channels have had an excess of inventory already starting out the season.” That excess “drives up the promotional pressure and, worse than that, it pushes inventory over to the value channels.” It also taught shoppers not to pay full price for Ralph Lauren.

Larsson’s fix included cutting lead time to nine months, closing 50 stores (after closing 43 the previous year), and laying off about 1,200 employees (after laying off about 750 the year before). Now, having promised Wall Street the company was finally getting religion about excess inventory, the top leaders faced a big question, the answer to which would be an acid test of their seriousness: What would they do with the excess inventory they still had?

They didn’t slash prices or send that inventory to off-price retailers. They burned it.

Among luxury brands that’s a routine though painful and rarely mentioned practice. Incinerating excess inventory keeps high-priced goods out of cut-price channels and maintains the brand’s exclusivity. There’s no evidence RL Corp. had ever done it since going public in 1997. The temptation to get at least a little revenue from the overage was apparently always too strong. Now the company chose instead to destroy $155 million of merchandise. It was showing the discipline of a top-tier brand.

Larsson knew that tons of work remained to be done—overhauling a weak e-commerce operation, discontinuing low-selling products, closing more stores, laying off more employees, and other cost cutting. But the corner was being turned. “Stefan Larsson’s strategy was a good one,” says Piper Sandler analyst Erinn Murphy. “It’s unfortunate that he never got to finish it.”

In February 2017, just 15 months after Larsson became CEO, Lauren announced that the two had “agreed to part ways.” The stated reason was “different views on how to evolve the creative and consumer-facing parts of the business,” which doesn’t explain much. Larsson went on to become president of PVH, the apparel firm that owns the Calvin Klein and Tommy Hilfiger brands; he declined Fortune’s request for comment. Farah believes Larsson was “not a good match” for RL Corp. in light of his fast-fashion background. As reassurance to Wall Street, the company’s announcement of the change pointedly noted that the strategy Larsson outlined would continue.

In addition to the pain and turmoil necessary for rehabbing the all-important brand, these events may have been distressing to Lauren for another reason. He was receiving an evaluation of his golden touch, and it wasn’t good. When he announced he was surrendering the CEO role and giving it to Larsson, the stock leaped, and when he announced Larsson’s departure, it dropped. The brutal message from investors was that they no longer trusted Lauren’s magical powers.

The company recruited a new CEO, Patrice Louvet, an executive with a 28-year tenure at Procter & Gamble. He had no experience with apparel but plenty of experience managing grooming and beauty businesses globally at P&G, a company famed as a management academy. Out of the spotlight, he has been advancing the fundamental imperatives for RL Corp. now: continued elevation of the brand; a return to sustainable, profitable growth; relevance to a new generation of customers; a better e-commerce presence.

It hasn’t been easy. Full-year sales didn’t resume growing until the company’s fiscal 2019 (which ended March 30, 2019). But managers knew they were winning because even as sales were falling, profits were rising. Brand discipline was paying off. With the company’s discounting at its lowest in five years, according to the Edited retail analytics firm, customers were paying higher prices. In the quarter that ended last New Year’s Eve, RL Corp. achieved the highest quarterly profit in its history. The magic was back. “The company’s metrics defy retail,” marveled Barclays analyst Adrienne Yih. At long last she could say with confidence that Ralph Lauren was executing “a successful (and very difficult to achieve) elevation of the brand.” For a gratifying moment, it seemed safe to pop the Champagne.

****

Ralph Lauren: Then and now

****

The future of Ralph Lauren’s world

Predicting how hard the coronavirus crisis will hit RL Corp. is futile, since that will depend on presently unknowable epidemiological realities around the world. As a seller of premium-price, very nonessential merchandise, it may struggle more than most companies in a year that’s being compared to the Great Depression. “Ralph Lauren remains a strong brand with one of the best management teams in the softlines industry,” writes Cowen analyst John Kernan in a recent note. Yet he downgraded the stock because the environment is so weak.

A couple of factors could ease the pain. Much of the company’s profit comes from core products that sell year after year—polo shirts, the flag sweater, cable sweaters. If they don’t sell this year, they can be packed up and sold next year. “It’s not a trend brand,” says Kathy Gersch. “It’s not Prada. That’s an advantage.” At least as important, RL Corp. has “a very strong balance sheet with negligible long-term debt,” notes Murphy. No analyst seems to doubt that it will weather this crisis and come out of it stronger than most competitors.

But the immediacy of the crisis shouldn’t obscure the larger, longer-term challenges to the brand. While it has been rescued from the remainder bins at T.J. Maxx, the hard fact is that it still isn’t what it once was. Consider the brand valuation rankings published annually by three marketing firms, Interbrand, Kantar, and Brand Finance. Using different methodologies, they all show exactly the same trend over the past decade: The value of “Ralph Lauren” peaked in 2014 and then plunged; it’s still nowhere near that peak.

A look further back shows greater deterioration. U.S. adults today see “Ralph Lauren” as less “high quality,” “worth more,” and “distinctive” than they did in 2005, says BAV Group, a brand research and evaluation firm that’s part of the advertising giant WPP. The firm’s surveys show that in the eyes of consumers, the brand is 28% less differentiated and 43% less relevant than it was then.

Looking back still further, an unorthodox measure of cultural influence shows the brand’s rise and decline. When Lauren started out in 1967, “Lauren” ranked No. 242 among names for girls born that year, according to the Social Security Administration. In 1989, after he had appeared on the cover of Time and was running multipage magazine ads filled with lavish photos portraying his alternative worlds, it ranked No. 9. In 2018, the most recent year for which information is available, the name ranked No. 171.

The issue of the company’s future raises the matter of Lauren himself. “The question of succession has been hovering over the company for at least a decade,” says Farah. “My guess is he will continue to work as long as he’s healthy, and he’s a very healthy man. I envision him being the leader for a very long time.” Others who know him agree that it’s inconceivable he would ever leave the business by choice. “Ralph, retire?” says Alan Flusser, a fellow menswear designer, longtime acquaintance, and author of a recent biography of Lauren. “What would he do for relaxation? He’d do exactly what he’s doing now.”

Lauren learned that believing in himself made him successful, and he isn’t going to stop. His controlling stake in the company means he can stay as long as he wants. He can stay too long if he wants, which worries some. “Whether he retires or just shifts his role could make or break the company,” says Gersch. “If he won’t let go when he should, then the future of the company is at risk.” Charles Elson, a corporate governance expert at the University of Delaware, says, “No one wants to feel that they’ve aged out, but at some point you do. You don’t go on forever, but with that stock structure you do go on forever, to the detriment of the investors.”

This concern could be considerably premature. Warren Buffett is running Berkshire Hathaway ably at 89, and his partner, Charlie Munger, is contributing at 96. Henry Kissinger, still writing perceptive articles, is about to turn 97. Eighty isn’t necessarily as old as it used to be. But the concern becomes inevitable, eventually.

The thing about creating worlds rather than merely designing clothes is that worlds can endure. RL Corp. and Ralph Lauren have been interchangeable thus far. But at some point, they'll have to part ways for RL Corp. to live on.