幣安事件的教訓(xùn):想不變成騙子窩,,加密貨幣行業(yè)需要加強(qiáng)監(jiān)督

|

撰寫(xiě)區(qū)塊鏈和加密貨幣報(bào)道至今已經(jīng)有五年多時(shí)間,我發(fā)現(xiàn)該行業(yè)最頑固也是最不幸的一件事情是,,它對(duì)記者有著無(wú)端的敵意,。11月末,這一幕在一個(gè)奇怪的口水戰(zhàn)中再次上演,,故事涉及加密貨幣行業(yè)兩家最為重要的公司:總部位于馬耳他的加密貨幣交易所巨頭幣安,,以及專(zhuān)注于加密貨幣交易的刊物《區(qū)塊》。 故事是這樣的,,當(dāng)《區(qū)塊》報(bào)道,,幣安上海辦事處遭到了當(dāng)局的突擊檢查,隨后關(guān)閉,。幣安不僅否認(rèn)他們?cè)獾搅恕巴粨魴z查”,,同時(shí)還稱自己在上海并沒(méi)有辦事處。幣安的創(chuàng)始人及首席執(zhí)行官趙長(zhǎng)鵬(業(yè)界又將其稱為“CZ”)甚至來(lái)了個(gè)特朗普式的發(fā)飆,,聲稱《區(qū)塊》是“假新聞”,,并威脅要起訴該雜志。 |

I’ve been writing about blockchain and cryptocurrency for more than half a decade now, and one of the most consistent and unfortunate things about the community is its irrational hostility to journalists. That was on display yet again at the end of November in a bizarre spat between two of the most important companies in crypto: giant Malta-based crypto exchange Binance, and crypto-focused trade publication The Block. The saga began when The Block reported that a Binance office in Shanghai had been “raided” by Chinese authorities, then shut down. Binance not only denied that they had been “raided,” but said that they had no office in Shanghai. Binance founder and CEO Changpeng Zhao (best known as simply ‘CZ’) even went Full Trump, declaring The Block to be “fake news” and threatening to sue. |

|

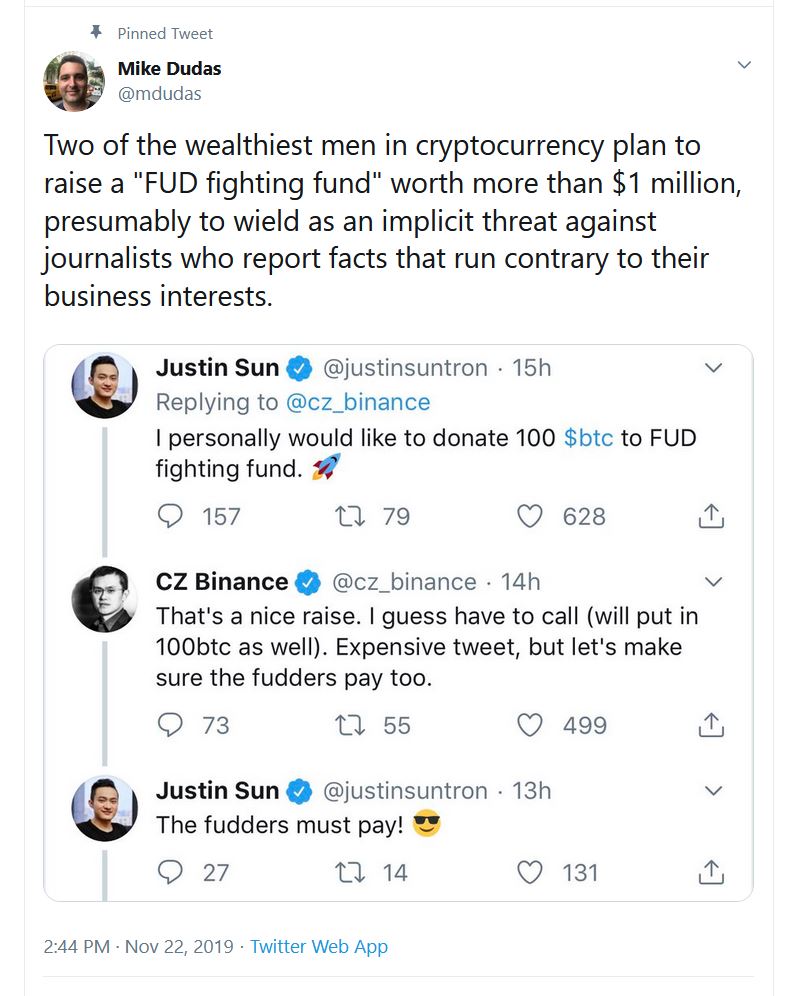

作為回應(yīng),,《區(qū)塊》刊登了其所稱的莫須有辦公室的照片,,而且還詳細(xì)說(shuō)明了他們?cè)谧畛鯃?bào)道中所援引的信息來(lái)自于親眼所見(jiàn)的證人,包括組建辦事處的管理層,。其中一個(gè)線人——一名供應(yīng)商——甚至宣稱趙長(zhǎng)鵬曾經(jīng)親自到訪過(guò)這個(gè)臆想的辦事處,。 事實(shí)最終證明,面對(duì)《區(qū)塊》的報(bào)道,,幣安拿不出什么有力的反駁證據(jù),。不過(guò),,該雜志倒是更改了標(biāo)題的措辭,將“突擊檢查”變成了如今的“到訪”,。但幣安最終扔下了這么一個(gè)論斷,,盡管有這么一個(gè)地方存在,而且那里的人也是在為公司工作,,但這并不意味著它就是公司的辦事處,。 好吧。 一位看似是幣安寫(xiě)手的評(píng)論員則信口開(kāi)河地說(shuō)道,,這個(gè)辦公室并非是辦事處,,因?yàn)椤皫虐部赡茉诓簧俚胤蕉加蓄?lèi)似的存在,只是一個(gè)個(gè)據(jù)點(diǎn)罷了,。它們采用的是一種中心輻射模式,。” 當(dāng)然,,這一點(diǎn)也是幾乎各類(lèi)規(guī)?,F(xiàn)代公司的真實(shí)寫(xiě)照?!敦?cái)富》雜志在紐約,、舊金山、倫敦設(shè)有辦事處,,也在北京設(shè)立了辦事處,,這一點(diǎn)我們承認(rèn)。 這種顧左右而言他的措辭顯得尤為空洞,,因?yàn)閾?jù)知情人士稱,,就在今年秋天,幣安曾經(jīng)就建立戰(zhàn)略合作伙伴關(guān)系與《區(qū)塊》進(jìn)行過(guò)探討,。(幣安并未回復(fù)《財(cái)富》雜志的置評(píng)請(qǐng)求,。) 考慮到來(lái)自于政府的壓力,幣安對(duì)事實(shí)的荒唐歪曲聽(tīng)起來(lái)還略為合理些,。幣安的官方總部位于馬耳他,,但趙長(zhǎng)鵬出生于中國(guó),而且公司似乎正在努力拓展其在中國(guó)的版圖,。但由于中國(guó)缺乏明確的法規(guī),,因此此類(lèi)業(yè)務(wù)擴(kuò)張取決于政府的態(tài)度,而且突擊/到訪發(fā)生數(shù)天之前,,中國(guó)人民銀行下令打擊加密貨幣詐騙和交易所,。幣安可能希望通過(guò)否認(rèn)《區(qū)塊》的報(bào)道,來(lái)博取政府的好感,。 至于威脅要起訴,,很有可能只是做做樣子罷了,。專(zhuān)注于加密貨幣行業(yè)的律師布雷斯頓·拜尼雖然自己也與《區(qū)塊》有過(guò)節(jié),但他也警告幣安,,訴訟會(huì)讓公司付出很大的代價(jià),。“在美國(guó)打誹謗官司是一項(xiàng)難以完成的任務(wù),。很明顯,,幣安有著大量的資源,完全可以在其他地方打這場(chǎng)官司,,但我想質(zhì)疑一下這種公開(kāi)自身信息邏輯的合理性,也就是說(shuō),,在取證過(guò)程中與一群按桶買(mǎi)墨水的人打交道,。” 換句話說(shuō),,這場(chǎng)官司會(huì)大大增加幣安的曝光度,,而且不僅僅限于法庭取證過(guò)程。Castle Island Ventures專(zhuān)注于加密貨幣的投資者尼克·卡特稱:“真正的故事在于,,這個(gè)昧著良心向散戶兜售無(wú)價(jià)值代幣的離岸交易所,,認(rèn)為自己可以通過(guò)上訴的威脅,逼迫一個(gè)自命不凡的媒體刊物三緘其口,。在他們?cè)噲D博取美國(guó)監(jiān)管方的歡心之際,,這種做法對(duì)于他們來(lái)說(shuō)沒(méi)有任何好處?!?/p> 不管有多少表演成分在里面,,打官司這種威脅確實(shí)能夠吸引社交媒體上加密貨幣粉絲的注意力。更有甚者,,趙長(zhǎng)鵬隨后還稱加密貨幣初創(chuàng)企業(yè)應(yīng)該“分配一些資金用于抵御FUD(恐懼,、不確定性和懷疑)”在加密貨幣界看來(lái),F(xiàn)UD幾乎等同于“虛假新聞”,?;蛘撸拖瘛秴^(qū)塊》的首席執(zhí)行官邁克·杜達(dá)斯說(shuō)的那樣:“它相當(dāng)于與其商業(yè)興趣相反的事實(shí),?!?/p> “FUD防范基金”這一理念迅速得到了孫宇晨這類(lèi)人的附和,后者是智能合約平臺(tái)波場(chǎng)的創(chuàng)始人,。然而孫宇晨的支持便很能說(shuō)明問(wèn)題,,因?yàn)橛腥瞬粩嗟赜么_鑿的證據(jù)指控孫宇晨開(kāi)展各種形式的欺詐活動(dòng),包括波場(chǎng)白皮書(shū)和代碼抄襲,,這些事件最終都被記者和研究人員曝光,。 盡管存在明顯的公開(kāi)證據(jù),,但孫宇晨一直在否認(rèn)這些報(bào)道。然而希望澄清自己的趙長(zhǎng)鵬對(duì)它的支持感到十分高興,。趙長(zhǎng)鵬自己此前似乎曾經(jīng)威脅過(guò)《區(qū)塊》,,同時(shí)也曾經(jīng)表示,在談到中國(guó)的加密貨幣行業(yè)時(shí),,“有些事情還是不說(shuō)為妙,。” |

The Block responded by publishing photos of the supposedly nonexistent office, and detailing that they had sourced information in the original report through firsthand witnesses, including building management. One source, a vendor, even claimed that CZ was personally present in the imaginary workspace. Ultimately Binance turned out to have little substantive objection to The Block’s reporting. The Block did rephrase its headline, which now describes a “visit” by authorities rather than a “raid.” But Binance was ultimately left arguing that just because it had a place where people worked for the company, that didn’t make it an “office.” Okay. One commentator, seeming to speak as a proxy for Binance, took a particularly wild swing, saying that the office wasn’t an office because “Binance may have this presence here and there as clusters. They’re in a hub-and-spoke model.” This, of course, describes nearly every modern company of any size. Fortune has offices in New York, San Francisco, London, and – yes, we admit it – Beijing. The evasions ring especially hollow because, according to sources familiar with the situation, Binance was in talks about a possible strategic partnership with 區(qū)塊 as recently as this Fall. (Binance did not respond to Fortune’s request for comment.) The absurd contortions by Binance make just slightly more sense in light of pressures from government. Binance is officially based in Malta, but Zhao was born in China and the company appears to be working to expand the business there. But the lack of clear rule of law in China makes such expansion subject to the whims of government, and the raid/visit came just days after the People’s Bank of China ordered a crackdown on crypto scams and exchanges. By pushing back on The Block’s reporting, Binance may somehow be hoping to curry favor with government. As for Binance’s threat to sue, it seems likely to have been posturing. Preston Byrne, a crypto-focused lawyer who has had his own conflicts with The Block, nonetheless warned that Binance had a lot to lose in litigation. “Proving a defamation case in the United States is a tall order. Binance obviously has considerable resources to bring litigation anywhere and against anyone it wishes, but [I] would query the wisdom of opening the kimono, so to speak, in a discovery process with a group of folks who buy ink by the barrel.” In other words, a lawsuit would mean big exposure for Binance – and not just in court discovery. “The real story here is that an offshore exchange which made its name hawking worthless tokens to retail investors with no compunction felt that they could bully an upstart media publication into silence through the threats of lawsuits,” says Nic Carter, a crypto-focused investor at Castle Island Ventures. “This can’t possibly be doing them any favors as they try and ingratiate themselves to US regulators.” However performative, the threat of a lawsuit did play well among crypto stans on social media. Zhao even followed it up by arguing that crypto startups should “allocate some funds for fighting FUD”. “FUD” – for Fear, Uncertainty, and Doubt – has come in crypto circles to be roughly synonymous with “fake news.” Or, as 區(qū)塊 CEO Mike Dudas put it, “facts that run contrary to their business interests.” The idea of a “FUD fighting fund” was quickly cosigned by none other than Justin Sun, founder of the smart-contract platform Tron. This is revealing because Sun has been repeatedly and credibly accused of various forms of deception, including plagiarizing Tron’s whitepaper and code, that were ultimately revealed by reporters and researchers. Sun continually denied those findings despite public, obvious evidence, but Zhao seemed happy to have his support in the quest for truth. And Zhao himself has previously appeared to threaten The Block while arguing that when it comes to crypto in China, “some things are better left unsaid.” |

|

加密貨幣領(lǐng)域?qū)γ襟w的不信任有很多原因,。確實(shí),,一些主流金融和商業(yè)新聞源未認(rèn)真對(duì)待過(guò)加密貨幣背后的理念。很多傳說(shuō)中的加密貨幣新聞網(wǎng)站實(shí)際上本身就是個(gè)騙子,,只要給錢(qián)就報(bào)道,。加密貨幣容易投資的事實(shí)意味著批判性的報(bào)道可能會(huì)引發(fā)眾多線上投資人的反感。事實(shí)上,,似乎很多人都認(rèn)為,,比特幣價(jià)格下跌的罪魁禍?zhǔn)资恰秴^(qū)塊》的報(bào)道。 但人們?cè)谶@場(chǎng)紛爭(zhēng)中忽視了一點(diǎn),,記者并非只是那種對(duì)一切事物持批判態(tài)度的人士,。他們是所有行業(yè)的免疫系統(tǒng),會(huì)對(duì)任何功能障礙和即將來(lái)臨的危險(xiǎn)狀況發(fā)出警告,,從而希望在這些危險(xiǎn)事物造成巨大傷害之前讓公司和投資者做好應(yīng)對(duì)的準(zhǔn)備,。2017/2018年的加密貨幣泡沫便缺乏可信任的嚴(yán)肅報(bào)道,這一現(xiàn)象或許讓加密貨幣市場(chǎng)因?yàn)樵p騙和歪點(diǎn)子而蒙受了數(shù)十億美元的損失,。 以當(dāng)前的這個(gè)例子為例:就算《區(qū)塊》不存在,,沒(méi)有去報(bào)道中國(guó)的監(jiān)管環(huán)境,但攻擊其報(bào)道的加密貨幣投資者將依然不得不面對(duì)未報(bào)道事實(shí)所帶來(lái)的后果,。政府依然有能力在任何時(shí)候取締加密貨幣交易,,只不過(guò)投資者無(wú)法獲得有關(guān)這一事實(shí)的深刻洞見(jiàn)。 卡特說(shuō):“如果這個(gè)行業(yè)拋棄了對(duì)事實(shí)真相的關(guān)注,,那么它將陷入一片混亂,。任何對(duì)不當(dāng)行為的報(bào)道對(duì)于該行業(yè)來(lái)說(shuō)都是純粹的利好消息,而且叫喊著‘FUD’的憤怒人群在意識(shí)到這一點(diǎn)后就不會(huì)那么驚慌失措,?!保ㄘ?cái)富中文網(wǎng)) 譯者:馮豐 審校:夏林 |

There are a lot of factors to the cryptosphere’s distrust of the media. It’s true that some mainstream financial and business news sources have never taken the ideas behind crypto seriously. Many purported crypto-news websites are effectively scams themselves, taking payment for coverage. And the ease of investing in cryptocurrency means critical reporting is likely to generate backlash from a lot of people with money on the line – in fact, many seemed to blame a subsequent drop in bitcoin’s price on The Block’s reporting. But what gets lost in that mess is that journalists aren’t just naysayers and scolds. They’re the immune system of any industry, warning of dysfunction and gathering storms, and hopefully giving companies and investors the ability to react before they become catastrophic. The lack of trusted, serious reporting during the 2017/2018 bubble arguably left the crypto market uniquely vulnerable to billions of dollars in scams and bad ideas. To spell this out in the current case: if?The Block didn’t exist to report on the regulatory environment in China, the crypto investors who attacked its reporting would still have faced consequences from the unreported facts. The government would still have the ability to clamp down on crypto trading at any time – investors just wouldn’t have any insight into that fact. “If this industry abandons the pursuit of truth, it will degenerate into chaos,” says Carter. “Anything that sheds light on malfeasance is a net good for the industry, and the baying crowds yelling ‘FUD’ would do well to recognize that.” |