業(yè)績持續(xù)不振,,寶潔走向拆分之路?

|

今年10月寶潔舉行歷史性的股東大會(huì),也經(jīng)歷了公司治理史上規(guī)模最大也最昂貴的一場代理權(quán)之爭,,最終雙方握手言和,。“我們會(huì)繼續(xù)談,,”首席執(zhí)行官戴懷德(David Tylor)表示,,他認(rèn)為自己稍勝一籌,雖然大概五星期之后詳細(xì)計(jì)票結(jié)果顯示其實(shí)他輸了,。對此激進(jìn)投資者納爾遜·佩爾茨回應(yīng)稱,,“‘我們’可以談,但‘我們’不會(huì)聽,!”(編者注:這里的“我們”指的是寶潔高層領(lǐng)導(dǎo)和董事,,佩爾茨用戴懷德的話反諷他)。戴懷德則回應(yīng)稱,,“不不不,,你說的不對?!? 表面上來看,,我們看的是一場勝負(fù)難分的董事會(huì)席位大戰(zhàn),但實(shí)際上關(guān)系著美國最大企業(yè)之一寶潔的命運(yùn)?,F(xiàn)在這場代理權(quán)大戰(zhàn)結(jié)果已揭曉,,但特利安基金管理公司的佩爾茨究竟能不能推動(dòng)寶潔走上巨大變革之路還是未知數(shù)。雖然佩爾茨手握35億美元的股票,,多少說話有些分量,,但從戴懷德“我們可以談”的口氣就能感覺到,,佩爾茨在11或12個(gè)人的董事會(huì)里必將單打獨(dú)斗。從兩人簡短交談情況也能看出,,哪怕只說幾句也會(huì)因?yàn)楦纠砟畈煌称饋?,也說明兩人對寶潔未來的看法存在巨大的沖突。佩爾茨為了進(jìn)董事會(huì)花了至少2500萬美元,,寶潔為了阻止他花了至少3500萬美元?,F(xiàn)在雙方終于擱置了爭議,但佩爾茨還是進(jìn)了董事會(huì),。 說實(shí)話,,戴懷德跟佩爾茨在很重要的一點(diǎn)上還是有共識的,就是寶潔需要改,。只是兩人屬意的方式不一樣,。佩爾茨一直在指責(zé)“寶潔持續(xù)十年表現(xiàn)不佳?!贝鲬训聞t更強(qiáng)調(diào)正面因素,,即“我們處于巨大轉(zhuǎn)型過程中?!钡澈蟮默F(xiàn)實(shí)是寶潔已持續(xù)低迷多年,。 |

At the end of Procter & Gamble’s historic annual shareholders’ meeting in October, the climax of the biggest, most expensive proxy fight in corporate history, the two antagonists shook hands. “We’ll talk,” said CEO David Taylor, who thought he had won by a slim margin, though a careful count of paper ballots showed some five weeks later that he’d lost. To which activist investor Nelson Peltz replied, “We’ll talk, but we don’t listen!” (the “we” referring to P&G’s top leaders and directors). Taylor responded, “No, no, no, that’s not true.” And there we have in microcosm the surprisingly inconclusive outcome of a bitter battle ostensibly over a single board seat, but in reality over the future of one of America’s greatest companies. We know who won the proxy fight, but we have no idea whether Trian Fund Management’s Peltz will succeed in his campaign for major change at P&G. Though his $3.5 billion of company stock gives his views extra heft, as Taylor’s “We’ll talk” indicates, Peltz will be only one director on a board of 11 or 12. The two men’s brief conversation suggests they can’t exchange even a few words without disagreeing fundamentally—reflecting the larger conflict between their sharply different views of P&G’s future. Peltz spent at least $25 million to get himself elected to the board, and P&G spent at least $35 million trying to keep him off. Now they’ll resume their dispute, but with Peltz in the boardroom. Truth be told, Taylor and Peltz agree on one big thing: P&G needs fixing. They spin it differently. Peltz rails about “P&G’s decade-long history of underperformance.” Taylor sells the upside—that “we’re in a major transformation.” But the underlying reality is that this company has been sputtering for years. |

|

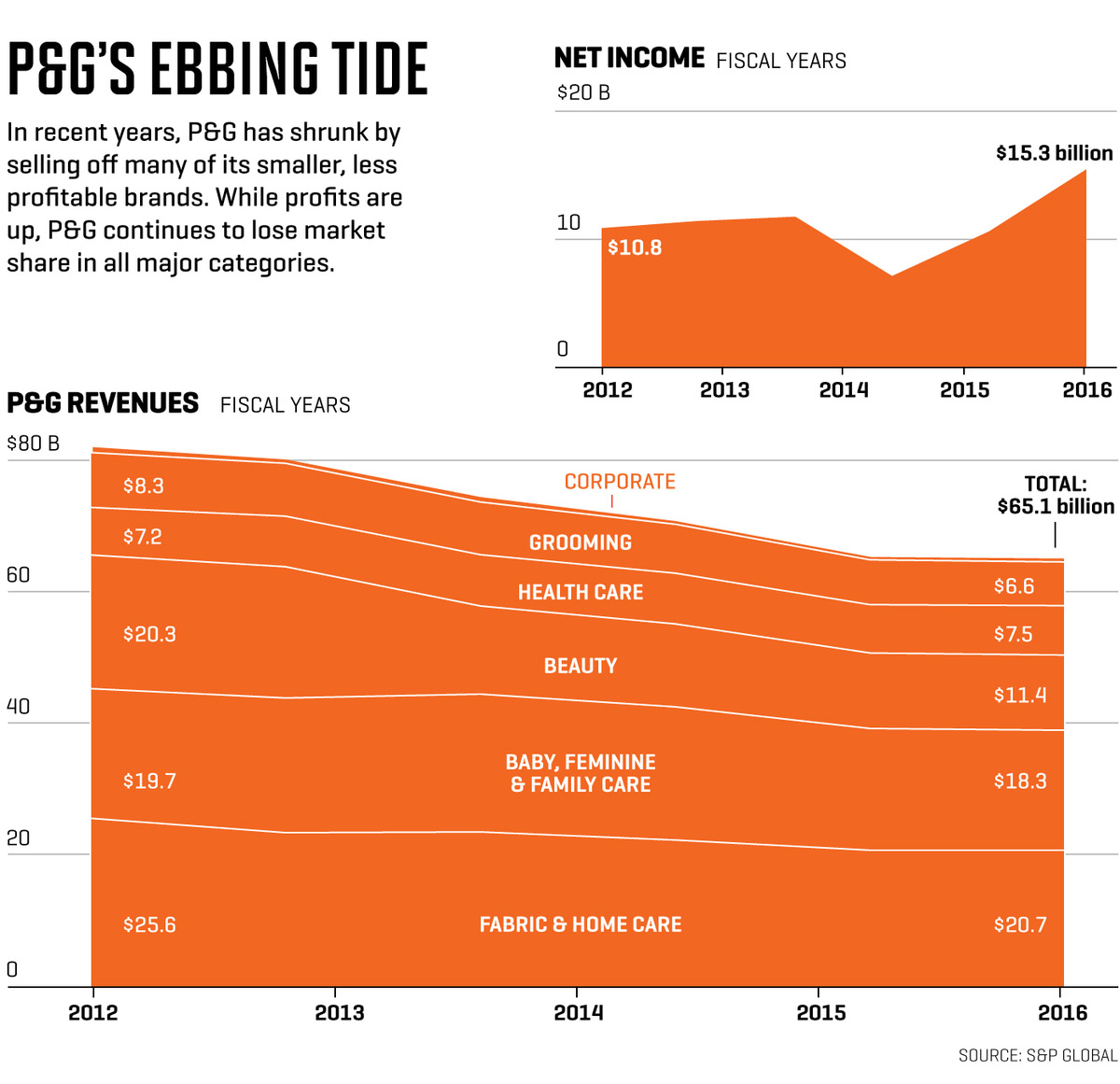

寶潔的問題不只是業(yè)務(wù)低迷,。之前我們也見過類似情況,即鼎盛的美國企業(yè)仿佛過了氣,,面臨著追回往日榮光還是步入長期衰退的問題,。大概25年前,IBM,、通用汽車,、希爾斯和柯達(dá)也面臨過類似的轉(zhuǎn)折點(diǎn)。重返高峰并非不可能,,IBM就做到了,,至少有段時(shí)間做到了,但歷史經(jīng)驗(yàn)證明機(jī)會(huì)真的很小,。戴懷德現(xiàn)在59歲,,納爾遜·佩爾茨75歲,兩人都很清楚自己在做什么,,雖然策略相差很大,。所有證據(jù)都表明,至少未來幾年里兩人都會(huì)堅(jiān)持自己的計(jì)劃,。所以就要看,,到底誰能拯救公司,? 首先分析下挑戰(zhàn)的難度。自從美國經(jīng)濟(jì)達(dá)到衰退前頂點(diǎn)以來,,寶潔的股價(jià)(也包括股利)表現(xiàn)一直比標(biāo)普500指數(shù)企業(yè)平均水平差,。隨著大眾消費(fèi)品整體增速放緩,行業(yè)內(nèi)最大的巨頭寶潔也漸漸落在競爭對手身后——包括聯(lián)合利華,、高露潔,、德國漢高等等。寶潔旗下很多大品牌,,包括吉列,、佳潔士和潘婷市場份額都在下跌,。過去一個(gè)財(cái)年里(截至6月30日)五大主要品類市場份額都出現(xiàn)大幅下降,。上個(gè)財(cái)年里自然增長率,即不考慮收購,、剝離資產(chǎn)和外匯兌換等因素的增長率僅為2%,,預(yù)計(jì)今年增長率為2%至3%。該數(shù)字低于大部分競爭對手,,如果算上通脹調(diào)整因素的話,,寶潔實(shí)際自然增長率幾乎為零。 數(shù)字看起來很差,,非財(cái)務(wù)指標(biāo)則更不妙?,F(xiàn)在的年輕人找工作時(shí),寶潔的吸引力遠(yuǎn)比不上過去,。一位寶潔出身的人士就對其如今的頹勢非常難過,,他回憶道,“我進(jìn)公司的時(shí)候,,寶潔就像現(xiàn)在的谷歌和亞馬遜,,是當(dāng)時(shí)最光鮮的地方。讓人感覺‘我們是全世界最強(qiáng)的企業(yè),,我們的產(chǎn)品是最好的,,我們改善人們的生活,而且培養(yǎng)出全世界最優(yōu)秀的領(lǐng)導(dǎo)者,?!脒M(jìn)寶潔非常難。面試的時(shí)候就會(huì)鎮(zhèn)住你,。當(dāng)時(shí)公司真的很強(qiáng)?,F(xiàn)在再也沒有那樣的氣勢了?!? 數(shù)據(jù)也能證明這點(diǎn),。1996年《財(cái)富》雜志調(diào)研企業(yè)領(lǐng)導(dǎo),、董事會(huì)成員和股票分析師排出年度榜單里,寶潔是美國最受尊重的企業(yè)(僅次于可口可樂),。2009年,,寶潔還能排第六,之后一路下滑,,如今已經(jīng)落到第19名,,就在佩爾茨發(fā)動(dòng)代理權(quán)大戰(zhàn)之前做的調(diào)研。 當(dāng)然了,,對很多企業(yè)來說,,能在全世界最受尊重的企業(yè)榜單上排名第19,市值2200億美元,,還能當(dāng)上道瓊斯成分股已經(jīng)很不錯(cuò),。這些都是成功的標(biāo)志,但也孕育著巨大的問題,,因?yàn)榭梢缘贸鲆韵陆Y(jié)論:寶潔沒有遇到危機(jī),。如果屈從慣性思維,寶潔完全可以像所有走下坡路的企業(yè)一樣安慰自己,,只想著維護(hù)現(xiàn)狀,,不用太考慮趨勢。寶潔可以列舉出在各個(gè)國家做得非常好的產(chǎn)品當(dāng)證據(jù),。然而事實(shí)擺在眼前,,剛剛結(jié)束的三年里,董事會(huì)給高管層定下的指標(biāo)都沒有完成,。接下來的三年,,董事會(huì)稱自然增長率要達(dá)到年均2.8%,雖然戴懷德表示市場增速可能為3%到3.5%,。感覺就是落水之人勉強(qiáng)掙扎而已,。正如一位寶潔前高管總結(jié)的,“按他們制定的目標(biāo),,市場份額只會(huì)越來越低,。” |

P&G (PG, +1.16%) isn’t just a business in the doldrums. It’s in a troubling situation we’ve seen before—an aristocrat of American enterprise seemingly past its prime, now facing the profound question of whether it can regain lost glory or continue into a long, slow decline. IBM, General Motors, Sears, and Kodak were at that same turning point about 25 years ago; some would put General Electric in that category today. A comeback isn’t impossible—IBM did it, for a while at least—but history says the odds are heavily against it. David Taylor, 59, and Nelson Peltz, 75, both think they know what needs doing, though their strategies are radically different. All evidence suggests they’ll both remain on this project for a long time to come, maybe several years. So who, if either, can save this company? Consider the magnitude of the challenge. Since the U.S. economy’s pre-recession peak, P&G stock (including dividends) has badly underperformed the S&P 500. As the whole consumer packaged goods business slows down, P&G, the industry’s biggest player, has been falling behind major competitors—Unilever, Colgate-Palmolive, Henkel, and others. Dozens of major P&G brands, including Gillette, Crest, and Pantene, have been losing market share; all five of its product categories lost significant share in the past fiscal year (ended June 30). Organic growth, a company-calculated measure that strips out the effects of acquisitions, divestitures, and foreign currency translation, was just 2% last fiscal year, and the company forecasts 2% to 3% this year. Those numbers are below most competitors’, and since they aren’t adjusted for inflation, they mean P&G’s actual organic growth is around zero. The numbers are damning, and nonfinancial indicators are even more ominous. Today’s best young people might never imagine that P&G was once as glamorous an employer as any company in the world. An alumnus, one of many distressed by its slide, recalls, “When I joined, it was the Google, the Amazon, the Goldman of its day. Its message was, ‘We’re the best company in the world. We create the best products, we improve people’s lives, we export great leaders to the whole world.’ It was hard to get into. They crushed you in the interviews. It was just great. They don’t have that edge anymore.” Data supports the assertion. Back in 1996, P&G was America’s second-most-admired company (after Coca-Cola) in Fortune’s annual survey of corporate leaders, board members, and stock analysts. As recently as 2009, it was the sixth-most-admired company in the world. It has been falling steadily since, today ranking 19th based on a survey conducted before Peltz launched his proxy fight. Of course most companies would be thrilled to rank 19th among the world’s most admired, to boast a market cap of $220 billion, to be a Dow component. These are the marks of a champion—and that’s a big problem, which can be summarized as follows: P&G is not in crisis. It can, if it succumbs to the temptation, console itself the way declining organizations have always consoled themselves, by focusing on its current state rather than on the trends. It can point to a hundred ways in which it’s doing well with various products in various countries. The fact remains, however, that the company missed most of the targets the board set for top executives in the just-ended three-year performance period. For the next three-year bonus period, the board declared an organic growth target of 2.8% a year, though Taylor has said he expects market growth of 3% to 3.5% a year. That’s barely treading water. As one former P&G executive sums up, “They set a goal to lose market share.” |

|

文化不再是加速器,,反而成了制動(dòng)閘,。 寶潔稱四年前就意識到挑戰(zhàn)存在,從那時(shí)起就開始轉(zhuǎn)型,。戴懷德發(fā)誓大力推動(dòng),,舉措之一就是引入更多外部人才加入高層。很有道理,但會(huì)陷入第22條軍規(guī)的困境:寶潔的企業(yè)文化向來拒絕外來者,,基本只招聘初級員工,,原因就是再往上級別的外人就沒法接受企業(yè)文化。近年來寶潔通過收購引入了部分外人,,但很少有管理層能留下,。“寶潔文化排斥他們,,”一位前高管稱,,他口中的“寶潔文化”是指完全同化的寶潔員工。實(shí)際上,,佩爾茨說戴懷德在去年春天一次會(huì)上告訴他,,“我們沒法請層級較高的外人,他們肯定待不下去,?!睂殱嵅⑽捶裾J(rèn)這句話,只是表示單獨(dú)看有些斷章取義,。一位發(fā)言人列舉了幾位外部請來的高管,,但外部人士還是極少,??傮w來看,寶潔稱去年從外部聘請了200位初級以上員工,,幾年前還只有50位,。 然而,聘請外部人士由內(nèi)部高層領(lǐng)導(dǎo)沒什么用,?!肮馐钦衅镐N售人員改變不了文化,”1998年至2008年曾擔(dān)任首席執(zhí)行官的克萊頓·達(dá)利表示,,他現(xiàn)在跟佩爾茨合作,。“寶潔得從外部聘請高管才行,。如果過去十年美妝業(yè)務(wù)沒起色,,為什么不從歐萊雅或者聯(lián)合利華挖人呢?” |

P&G claims it recognized the challenge four years ago and has been transforming its culture since then. Taylor vows to turbocharge the change, in part by bringing in more outsiders at high levels. Makes sense, except for a perfect catch-22: The culture has a long history of rejecting outsiders brought in much above entry level—because they don’t understand the culture. P&G has brought in hordes of outsiders over the years through acquisitions, especially its biggest one, Gillette, but few executives remain. “The Proctoids rejected them,” recalls a former exec, using the term for thoroughly acculturated employees. In fact, Peltz says Taylor told him at a meeting last spring that “we cannot bring in outside people at too senior a level or they will fail.” P&G doesn’t deny the quote but says it was taken out of context. A spokesman points to several senior staff executives who have been brought in from outside, though few high-level line managers are outsiders. Overall, P&G says it brought in 200 outsiders above entry level last year, up from 50 a few years ago. Yet bringing them in below senior levels achieves little. “You don’t change the culture by hiring salespeople,” says Clayton Daley, the company’s CFO from 1998 through 2008, who is now working with Peltz. “The company must hire senior line management from the outside. If your beauty line has been suffering for a decade, why wouldn’t you want to get someone from L’Oréal or Unilever?” |

|

還有一點(diǎn)很重要,,跟企業(yè)文化也差不多,,就是組織架構(gòu)。寶潔內(nèi)部一直像個(gè)大迷宮,,布滿各種枝枝蔓蔓,,如果畫出來可能就像東京地鐵圖一樣復(fù)雜。幾十年來,,寶潔首席執(zhí)行官以下沒有一個(gè)人全盤掌控過,,或者負(fù)責(zé)過盈虧,。既然沒有責(zé)任,業(yè)績也就沒有那么重要,,人們更愿意逃避,。佩爾茨稱現(xiàn)在仍是如此,但戴懷德表示在簡化“復(fù)雜架構(gòu)”,,就是內(nèi)部周知幾乎不可穿透的組織結(jié)構(gòu),。他讓業(yè)務(wù)部門負(fù)責(zé)人“全盤”負(fù)責(zé)盈虧,雖然相關(guān)負(fù)責(zé)人對支出和推廣決策并不能全面掌控,。在小一些的市場里,,團(tuán)隊(duì)可以“在一定框架內(nèi)自由決定”支出和定價(jià)。與此同時(shí),,戴懷德也將業(yè)績獎(jiǎng)金發(fā)放權(quán)下移,,鼓勵(lì)更多擔(dān)責(zé)。這是個(gè)過程,。至于夠不夠還有待觀察,。 如果戴懷德真能理順企業(yè)文化和架構(gòu),就有機(jī)會(huì)解決寶潔最頭疼的問題之一:創(chuàng)新文化衰退,。寶潔有全球聞名的兩板斧,,一是經(jīng)過多年研究發(fā)明新產(chǎn)品,二是打造強(qiáng)勢品牌并大力推廣,。最突出的例子就是汰漬,,這是世界上第一個(gè)合成洗衣粉,也是最暢銷的洗衣粉,,僅2017年預(yù)計(jì)銷售額就超過60億美元,。 但突破性創(chuàng)新和新的強(qiáng)勢品牌現(xiàn)在越來越少了。寶潔最近兩個(gè)大突破是速易潔產(chǎn)品線下的拖把,、清掃機(jī),、抹布等產(chǎn)品,另一個(gè)就是紡必適系列家庭除臭劑,,都是1998年研發(fā)的,。(2012年推出的汰漬洗衣丸是很成功的品牌延伸。)為了回應(yīng)質(zhì)疑,,戴懷德還引入了“精簡創(chuàng)新”系統(tǒng),,現(xiàn)在很多公司都在積極應(yīng)用。這也是個(gè)好主意,,只要企業(yè)文化能容下就行,。 更重要的是戴懷德承認(rèn)了寶潔存在問題,還表示正在積極解決。他引用了股價(jià)為證,,在圖A可以看到,。他擔(dān)任首席執(zhí)行官兩年來,寶潔股價(jià)加股利已經(jīng)回升20.4%,,還是比不上標(biāo)普500的23%漲幅,。業(yè)績平平可能沒什么好吹噓,但比起之前兩年表現(xiàn)已經(jīng)好多了,。 問題在于,,最近股價(jià)表現(xiàn)回升部分原因是佩爾茨的積極參與,還有他作為激進(jìn)投資者擅長提升公司業(yè)績的名聲,。2月佩爾茨宣布持股時(shí)股價(jià)上升,,6月傳出佩爾茨提名自己加入董事會(huì)時(shí)股價(jià)上揚(yáng)幅度更大。不管寶潔愿不愿意接受,,佩爾茨還是幫了忙,,然后寶潔又用股價(jià)上揚(yáng)為自己辯解。 此外,,寶潔為了支撐股價(jià)也使用了不少財(cái)技,。上次公布收益情況時(shí),寶潔驕傲地稱上一季度持續(xù)經(jīng)營每股收益增幅達(dá)5.8%,。但只要深挖一點(diǎn)就能發(fā)現(xiàn)實(shí)際上持續(xù)經(jīng)營每股收益沒有增長,。寶潔只是回購了不少股份,所以每股收益數(shù)字看上去漲了,。如果看過去四個(gè)季度也差不多: 持續(xù)經(jīng)營每股收益上升6%,,但根本原因是股份數(shù)降低,;實(shí)際持續(xù)經(jīng)營每股收益只上升了0.6%,。 用小招數(shù)提升每股收益并不能提升公司價(jià)值。最后還是要借來數(shù)十億美元還給股東,,公司資本結(jié)構(gòu)改變,,但對業(yè)績毫無影響。這種做法本身并無問題,。多年來寶潔一直在回購股票,。但十年前二十年前實(shí)際年增長率能達(dá)到10%甚至更多,回購只會(huì)小幅影響收益情況?,F(xiàn)在卻成了提升持續(xù)經(jīng)營每股收益唯一的手段,。 這種行為并不可持續(xù),寶潔自己也打算收手,,表示希望本財(cái)年通過“核心業(yè)務(wù)利潤增長”,,而不是通過股份回購,“推動(dòng)核心業(yè)務(wù)每股收益增長”。與此同時(shí),,寶潔還承諾以股利形式向股東發(fā)放更多現(xiàn)金,,很多股東都非常虔誠地多年追隨。127年來寶潔每年都派發(fā)股利,,而且61年來持續(xù)提升,。“我們現(xiàn)金的主要用途就是派發(fā)股利,,”寶潔在提交美國證券交易委員會(huì)的文件中稱,。此舉并無錯(cuò),但前提是不要影響將錢用在更有效率的地方,,比如收購創(chuàng)新型新品牌,,畢竟競爭對手都在這么做,佩爾茨就很支持收購,。過去四個(gè)季度里,,寶潔的現(xiàn)金流超過100%以股份回購和股利形式流回股東手中。 實(shí)際上,,戴懷德的轉(zhuǎn)型計(jì)劃是漸進(jìn)的,,雖然用的語言比較激進(jìn),說什么打造“面目全新的企業(yè),?!毕翊蠖鄶?shù)需要?jiǎng)?chuàng)新的優(yōu)秀老企業(yè)首席執(zhí)行官一樣,他似乎最擔(dān)心催得太緊導(dǎo)致崩潰,。這可以理解,,但像寶潔一樣文化根深蒂固的企業(yè)其實(shí)非常善于排斥根本性變化。佩爾茨的計(jì)劃顯然更激進(jìn),,但比起他對其他企業(yè)的手段還是比較克制,,對寶潔他比其他激進(jìn)投資者更注重長期發(fā)展。他都沒有建議換掉戴懷德,,也沒提削減研發(fā)計(jì)劃或發(fā)債,。 有些投資者稱,不管是戴懷德還是佩爾茨都沒搞清寶潔真正的問題,。他們認(rèn)為唯一的解決方案就是激進(jìn)投資者(包括佩爾茨)經(jīng)常提出的建議:拆分公司,。 桑福德·C·伯恩斯坦公司明星分析師阿里·迪巴迪最近被《機(jī)構(gòu)投資者》評為全美頂尖研究團(tuán)隊(duì),近兩年他一直呼吁拆分寶潔,?!拔艺J(rèn)為戴懷德為了寶潔已經(jīng)拼勁全力,”他表示,?!安恍业氖?,寶潔十年前就應(yīng)該大轉(zhuǎn)型。我相信對股東來說拆分仍然是最佳選擇,?!? 大企業(yè)總是稱通過結(jié)合多項(xiàng)業(yè)務(wù)可以實(shí)現(xiàn)價(jià)值協(xié)同和規(guī)模經(jīng)濟(jì),但迪巴迪表示所謂的優(yōu)勢“看來不過是幻覺,?!贝笃髽I(yè)拆分出來的品牌,例如寶潔賣給科蒂的美妝品牌(伊卡璐,、威娜,、封面女郎等等)在小集團(tuán)里活得一樣很好?!叭绻屑?xì)算算利潤和成本的話,,寶潔并不比規(guī)模小些的競爭對手更高效。反而更復(fù)雜,。對當(dāng)下的寶潔來說是并無協(xié)同效果的規(guī)模經(jīng)濟(jì),。” 寶潔內(nèi)部人士懷疑,,雖然佩爾茨沒有提到拆分,,但私下里可能也在考慮。他希望寶潔重整10項(xiàng)全球業(yè)務(wù)部門,,變成“一家簡潔高效控股公司”旗下三家“獨(dú)立”業(yè)務(wù),。從這種架構(gòu)走向拆分只是一步之遙??偛课挥谟睦麧崟r(shí)是寶潔競爭對手之一,,旗下有來蘇兒和護(hù)麗洗滌劑等品牌,最近宣布明年1月1日起將采用精簡架構(gòu)(分成兩個(gè)部門而不是三個(gè)),,分析師推測此舉是為全面拆分鋪路,。 分拆可能會(huì)推動(dòng)創(chuàng)新和提升效率。但現(xiàn)在來看除非業(yè)績進(jìn)一步下滑,,否則可能性并不大,。不管對寶潔來說最佳方案可能是什么,業(yè)績都是最大的問題,,因?yàn)闃I(yè)績下滑是緩慢衰退的根本原因。大型成功企業(yè)跟不上變化時(shí)很少會(huì)突然倒閉,,更常見的是停滯不前,。這些企業(yè)也會(huì)改,但力度不夠,。他們也會(huì)制定策略解決問題,,但效率不高,,要么就是沒法執(zhí)行?!拔易顡?dān)心的是他們把自然銷售增長率提升回3%的水平,,然后宣布轉(zhuǎn)型成功,”一位前寶潔員工表示,。不過寶潔堅(jiān)稱其雄心壯志不會(huì)這么小,。 兩年前的年度股東大會(huì)上,就在戴懷德出任首席執(zhí)行官幾個(gè)星期前,,一位名叫凱倫·梅耶爾的股東問當(dāng)時(shí)即將卸任的首席執(zhí)行官雷富禮,,“您如何向我這樣的股東保證,曾將企業(yè)帶入泥潭的主管和負(fù)責(zé)人能成功將企業(yè)拽出泥潭,?”今年的股東大會(huì)上,,凱倫的丈夫彼得提醒了戴懷德這個(gè)問題,還給出了自己的答案:“從當(dāng)前的數(shù)據(jù)看答案已經(jīng)很明顯,。他們做不到,。” 彼得這個(gè)答案也不一定對,。戴懷德再次肯定了近幾年全公司付出的艱苦努力,,向梅耶爾保證領(lǐng)導(dǎo)者和董事們都在努力追求優(yōu)秀的業(yè)績。即便寶潔無法重現(xiàn)往日榮光,,也可以說戴懷德獲得了成功,。“我認(rèn)為寶潔成不了未來的谷歌或亞馬遜,,”迪巴迪表示,,“但為了股東寶潔也得奮起?!? 然而,,凱倫·梅耶爾的問題到現(xiàn)在仍有意義,未來幾年就能得出分曉?,F(xiàn)在寶潔還在努力掙扎沒有徹底沒落,,對改變的需求雖然強(qiáng)大但還沒到生死關(guān)頭,也正是做出關(guān)鍵決策影響命運(yùn)的時(shí)刻,。寶潔并沒有出現(xiàn)危機(jī),。很快我們就會(huì)知道寶潔是不是真的需要來一場危機(jī)來推動(dòng)變革。但如果真到那一步,,恐怕為時(shí)已晚,。(財(cái)富中文網(wǎng)) 本文另一版本將發(fā)表于2017年12月1日出版的《財(cái)富》雜志,標(biāo)題是《寶潔是不是該拆分了,?》本文已根據(jù)最新消息更新,。 譯者:Pessy 審校:夏林 |

Closely related, and just as important, is the organizational structure, which at P&G has long been impossibly Byzantine, a sprawling matrix of dotted lines that would look like a map of the Tokyo subway if anyone charted the whole thing. For decades, virtually no one below the CEO held full control and responsibility for any profit-and-loss result. And without accountability, performance became less important than blame-shifting. Peltz says it’s still that way, but Taylor says he is thinning “the thicket,” as the near-?impenetrable structure is known internally. He has given business unit heads “end-to-end” responsibility for profit and loss, though they still lack full control over spending and marketing decisions. In small markets, teams have “freedom within a framework” to control spending and pricing. Accordingly, Taylor is extending performance bonuses further down into the organization to enforce accountability. That’s progress. Whether it’s enough remains to be seen. If Taylor can fix the culture and structure, he has a shot at reversing one of P&G’s most vexing problems: the decline of its vaunted innovation machine. The company was long the world’s greatest at the twin skills of creating new consumer products, often after years of scientific research, and then building superpowerful brands under which to market them. The outstanding example is Tide, the first synthetic detergent and the global bestselling detergent by a mile with estimated 2017 sales of over $6 billion. But breakthrough innovations and new blockbuster brands have been getting rarer. P&G’s last two major hits were the Swiffer line of mops, sweepers, dusters, and related products, and the Febreze brand of household odor eliminators, both introduced in 1998. (Tide Pods, introduced in 2012, have been a highly successful brand extension.) Taylor is responding in part by introducing the “l(fā)ean innovation” system, which many companies are using enthusiastically. It’s another good idea—if the culture doesn’t reject it. More broadly, Taylor acknowledges P&G’s problems and says the company is fixing them. Exhibit A in his argument is the stock price. In the two years since he became CEO, P&G stock including dividends has returned 20.4%, not quite matching the S&P 500’s 23%. Middling performance may not seem like much to crow about, but it’s a great deal better than the stock had been doing over the previous two years. The trouble with this argument is that at least some of the stock’s recent vim is a response to Peltz’s involvement and his reputation as an activist who spurs better performance. The stock price jumped in February when Peltz disclosed his stake, and it jumped even more in June when word leaked that Peltz had nominated himself for the P&G board. The company seems to be getting help from Peltz whether it wants it or not, then citing the stock’s rise in its own defense. In addition, P&G has been performing financial acrobatics to buoy the stock. The company reported proudly in its latest earnings release that earnings per share from continuing operations had risen a respectable 5.8% in the most recent quarter. But a bit of digging shows that actual earnings from continuing operations hadn’t risen at all. P&G simply bought back a large number of shares, so the per-share number increased. It’s a similar story over the past four quarters: Earnings per share from continuing operations rose 6%, but virtually all of that increase merely reflects a shrunken share count; actual earnings from continuing operations rose just 0.6%. Increasing EPS in this way does not make the company more valuable. It returns billions of dollars, much of it borrowed, to the shareholders, and the company’s capital structure changes, but that change has no effect on operating performance. There’s nothing improper about any of this. P&G has been buying back stock for many years. But a decade or two ago, when actual annual earnings growth reached 10% or more, buybacks added just a smidgen of extra EPS. Now they’re virtually the only source of increased EPS from continuing operations. That practice isn’t sustainable, and the company plans to scale it back, saying it expects “core operating profit growth”—not share buybacks—“to be the primary driver of core EPS” this fiscal year. At the same time, it has promised to send even more cash back to shareholders in the form of dividends, to which it is almost religiously devoted. The dividend has been paid annually for 127 years and increased annually for 61 years. “Our first discretionary use of cash is dividend payments,” P&G states in an SEC filing. That’s fine unless it interferes with more productive uses of money, such as the acquisition of innovative new brands, a move that competitors are making and that Peltz advocates. Over the past four quarters, P&G has sent more than 100% of its free cash flow back to shareholders via share buybacks and dividends. The truth is that Taylor’s transformation plan is incremental, despite the bold language about creating “a profoundly different company.” Like most insider CEOs of great, old companies in need of renovation, he seems concerned about breaking the organization by pushing too hard. That’s understandable, but cultures like P&G’s are astoundingly effective at repelling fundamental change. Peltz’s plan certainly pushes harder, yet it’s restrained, even by comparison with his own proposals at other companies, which have typically been more long-term-oriented than other activists’. He is not suggesting that Taylor be replaced or R&D be cut or debt be taken on. Some investors argue that neither Taylor nor Peltz understands how troubled P&G really is. They say the only solution is a remedy that activists (including Peltz) have often demanded elsewhere: breaking up the company. Ali Dibadj, a star analyst at Sanford C. Bernstein who was recently named to Institutional Investor’s All-America Research Team, has been advocating a breakup for over two years. “I think David Taylor is doing his best to change the company,” he says. “Unfortunately, he’s been given a company that should have been changed 10 years ago. I believe breaking up is still the best option for shareholders.” Big companies argue that they achieve valuable synergies and economies of scale by combining many businesses, but Dibadj says those advantages “appear to be illusory.” Brands that giant companies divest, such as the beauty brands (Clairol, Wella, Covergirl, and others) that P&G sold to Coty last year, do just as well in smaller organizations, he says. “If one does the math on their margins and costs, and compares with smaller competitors, P&G is not more lean. It’s more complex. There are dissynergies of scale for P&G at this point.” P&G insiders suspect that while Peltz hasn’t called for a breakup, he may secretly favor one. He wants P&G reorganized from 10 global business units into just three “stand-alone” businesses within “a lean holding company.” From that structure to a breakup would be only a small step. A P&G competitor, U.K.-based Reckitt Benckiser, marketer of Lysol, Woolite, and other brands, recently announced it will adopt just such a structure (with two parts rather than three) as of Jan. 1, and analysts speculate the move was a prelude to full separation. A breakup might well unleash waves of innovation and productivity. But for now, it looks unlikely to happen unless performance gets much worse. That’s a problem regardless of what the best solution for P&G may be, because it supports the slow-decline scenario. Big, successful incumbents rarely flame out when they fail to adapt. More often they stagnate. They change, but not enough. They usually have a strategy for addressing their issues, but it isn’t sufficient, or they can’t execute it. “My biggest fear is that they’ll get organic sales growth back to 3% and will declare victory,” says one alum. P&G insists its ambitions are far greater than that. At the annual shareholders’ meeting two years ago, a few weeks before Taylor took over as CEO, a shareholder named Karen Meyer asked outgoing P&G chief A.G. Lafley, “What assurance can you give me, the shareholder, that the officers and directors who drove the company bus into the ditch are the ones to get us out?” At this year’s meeting, her husband, Peter, reminded Taylor of that question and then gave his own response to it: “I think the answer has been made abundantly clear by the current data. They can’t.” That answer may not be correct. Taylor, repeatedly acknowledging the company’s travails of the past several years, assured Meyer that the leaders and directors are utterly committed to outstanding results. And Taylor can succeed even without returning P&G to its full former glory. “I don’t think it can be the Google or Amazon of tomorrow,” says Dibadj. “But it owes it to shareholders to get better.” Nonetheless, Karen Meyer’s question is undoubtedly the right one, and the answer will become clear in just the next couple of years. Now, when P&G is treading water but not sinking—when the need for change is powerful but not desperate—is when this great institution’s fate is being determined. Procter & Gamble is not in a crisis. We’ll know soon whether it requires one in order to make the needed changes. If it does, it will be too late. A version of this article appears in the Dec. 1, 2017 issue of Fortune under the headline “Is It Time for P&G to Break Up?” The story has been updated to reflect breaking news. |